first time buyer mortgage calculator help to buy

How does Bankrate's mortgage calculator work?

As you shop for a purchase loan or a refinance, Bankrate's Mortgage Calculator allows you to estimate your mortgage payment. To study various scenarios, just change the details you enter into the calculator. The calculator can help you decide: The loan length that's right for you.

How do you calculate a monthly mortgage rate?

So, if your rate is 5%, then the monthly rate will look like this: 0.05/12 = 0.004167.n = the number of payments over the life of the loan. If you take out a 30-year fixed rate mortgage, this means: n = 30 years x 12 months per year, or 360 payments. Free mortgage calculator to estimate monthly house payment and annual amortization.

How do I get a first-time buyer loan?

To qualify for many first-time buyer loan programs, you’ll need to take a course. If you’re obtaining a conventional loan, you might be able to take the Fannie Mae HomeView online class to satisfy this requirement. Check with your loan officer to learn your options. Andrew Dehan writes about real estate and personal finance.

How do I find a comfortable mortgage amount?

Use Zillow's affordability calculator to estimate a comfortable mortgage amount based on your current budget. Enter details about your income, down payment and monthly debts to determine how much to spend on a house. should fit comfortably within your budget.

Usage

Use SmartAssets mortgage calculator to estimate your monthly mortgage payment, including the principal and interest, taxes, homeowners insurance and private mortgage insurance (PMI). You can adjust the home price, down payment and mortgage terms to see how your monthly payment will change. smartasset.com

Service

For a more detailed monthly payment calculation, click the dropdown for Taxes, Insurance & HOA Fees. Here, you can fill out the home location, annual property taxes, annual homeowners insurance and monthly HOA or condo fees, if applicable. smartasset.com

Example

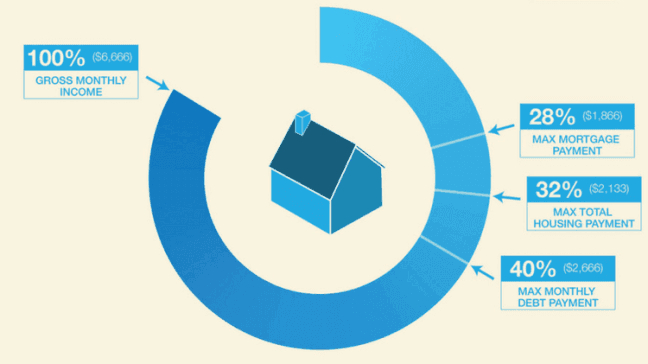

Lets break it down further. Home price, the first input, is based on your income, monthly debt payment, credit score and down payment savings. A percentage you may hear when buying a home is the 36% rule. The rule states that you should aim to for a debt-to-income (DTI) ratio of roughly 36% or less (or 43% maximum for a FHA loan) when applying for

Statistics

To calculate your DTI, add all your monthly debt payments, such as credit card debt, student loans, alimony or child support, auto loans and projected mortgage payments. Next, divide by your monthly, pre-tax income. To get a percentage, multiple by 100. The number youre left with is your DTI. smartasset.com

Benefits

In general, a 20% down payment is what most mortgage lenders expect for a conventional loan with no private mortgage insurance (PMI). Of course, there are exceptions. For example, VA loans dont require down payments and FHA loans often allow as low as a 3% down payment (but do come with a version of mortgage insurance). Additionally, some lenders h

Results

In general, most homebuyers should aim to have 20% of their desired home price saved before applying for a mortgage. Being able to make a sizeable down payment improves your chances of qualifying for the best mortgage rates. Your credit score and income are two additional factors that will play a role in determining your mortgage rate. smartasset.com

Variations

In the drop down area, you have the option of selecting a 30-year fixed-rate mortgage, 15-year fixed-rate mortgage or 5/1 ARM. The first two options, as their name indicates, are fixed-rate loans. This means your interest rate and monthly payments stay the same over the course of the entire loan. An ARM, or adjustable rate mortgage, has an interest

Causes

The lump sum due each month to your mortgage lender breaks down into several different items. Most homebuyers have an escrow account, which is the account your lender uses to pay your property tax bill and homeowners insurance. That means the bill you receive each month for your mortgage includes not only the principal and interest payment (the mon

Overview

Homeowners insurance is a policy you purchase from an insurance provider that covers you in case of theft, fire or storm damage (hail, wind and lightning) to your home. Flood or earthquake insurance is generally a separate policy. Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and loc

Risks

When you borrow money to buy a home, your lender requires you to have homeowners insurance. This type of insurance policy protects the lenders collateral (your home) in case of fire or other damage-causing events. smartasset.com

Cost

PMI is calculated as a percentage of your original loan amount and can range from 0.3% to 1.5% depending on your down payment and credit score. Once you reach at least 20% equity, you can request to stop paying PMI. smartasset.com

Effects

You can expect a smaller bill if you increase the number of years youre paying the mortgage. That means extending the loan term. For example, a 15-year mortgage will have higher monthly payments than a 30-year mortgage loan, because youre paying the loan off in a compressed amount of time. smartasset.com

Home Mortgages 101 (For First Time Home Buyers)

How to Buy Your First House // The Complete First Time Buyers Guide

How To Choose The Best Mortgage Lender (First Time Home Buyers)

|

Help to Buy: Equity Loan – Sustainability Calculator - Govuk

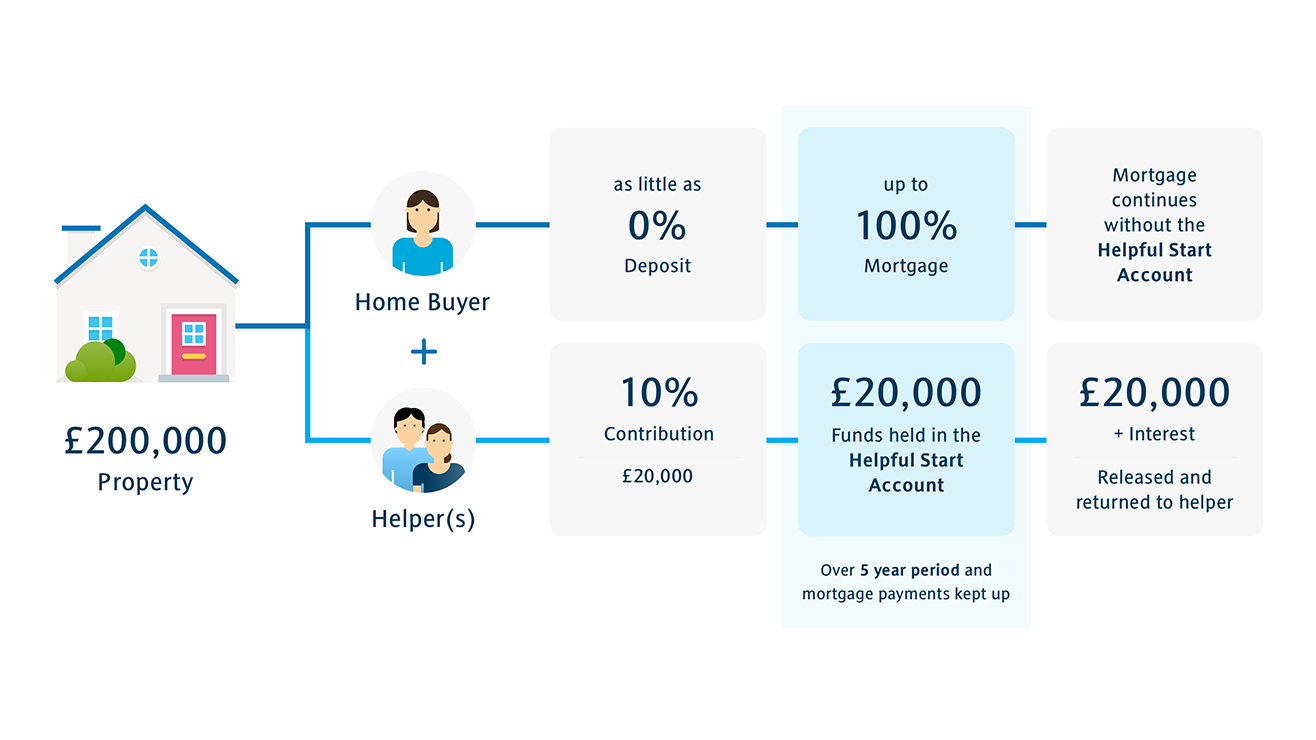

Help to Buy aims to help first-time buyers to get on the property ladder It is an equity loan calculator For a homebuyer to be eligible for an equity loan they must: • have a be working and 75 years or under at the end of the mortgage term |

|

Help to Buy: Equity Loan Sustainability Calculator - Govuk

Help to Buy scheme 2021-2023 Sustainability calculator information guide With a Help to Buy: Equity Loan the government lends first-time homebuyers up Only people named on the repayment mortgage can submit their income on the |

|

The Help to Buy Equity Loan Scheme What you need to - Santander

Available to both First Time Buyers and Home Movers ✓ □ Available on both Help to Buy capital and interest repayment mortgage provided by Santander |

|

Guide to Shared Ownership and Help to Buy - Share to Buy

home, Share to Buy helps first time buyers take those initial steps towards home ownership and get a foot on the property ladder A one stop shop for available, including a Mortgage Calculator to work out if mortgage lenders are likely to |

|

First time home buyer guide - Home Group

Buy p 14 Your first mortgage p 08 What's in this guide 04 The cost of buying and owning a home Use our Home Group Mortgage Calculator to work out how |

|

First Time Buyers Mortgage Guide 2020 - Money Saving Expert

Here's your copy of the MoneySavingExpert com Guide to Mortgages, If you're buying with someone who is also a first-time buyer you can both use Use our special overpayment calculator at www moneysavingexpert com/mortgagecalc to |

|

HELP TO BUY FACT SHEET

Please note: Bluestone Mortgages HTB products are equity loan to the borrower to help support the purchase of Help to Buy is available to first time buyers |

|

Buying for the first time - MJP Conveyancing

people make is to give up on the hope of buying a property improving-your- home/mortgage-calculator/ Attractive option with Government Help to Buy |

|

Help to Buy - Wales Buyers Guide - GOVWALES

home buyers (not just first time buyers) who wish to the new home which HtBW has helped to buy Amount of buyers' deposit, a repayment mortgage and |

|

First Time Buyers Guide - AIB

First Time Home Buyers Guide Page 2 1 AIB – Mortgages – First Time Buyers There's a quick, handy calculator (AIB eMortgage Calculator) on our website that will The Government Help to Buy incentive may be availed of by first time |