first time home buyer nj bad credit

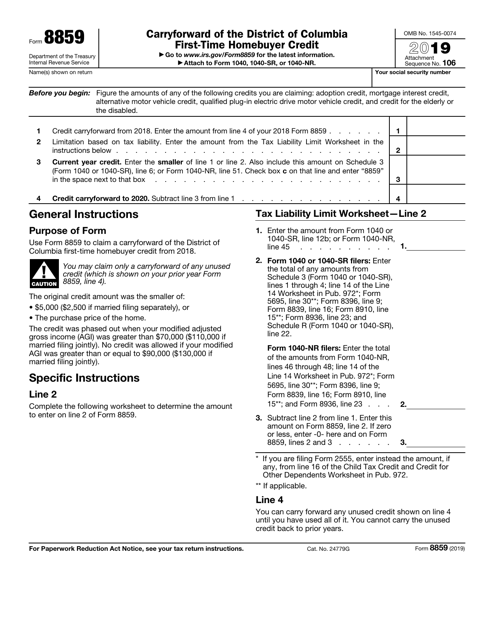

What are the requirements for a homebuyer tax credit?

You’d need to meet the following requirements: Must be a first-time homebuyer: You cannot have owned a home or co-signed on a mortgage within the past three years. This applies to primary residences and second homes. Cannot have used the tax credit previously: Homebuyers can only use this tax credit once.

What is the first-time homebuyer tax credit?

The First-Time Homebuyer Tax Credit is a tax refund from the U.S. Treasury. It’s paid to eligible first-time home buyers when their federal taxes are processed by the IRS. The refund is neither a loan, like some down payment assistance programs, nor a cash grant like the $25,000 Downpayment Toward Equity Act.

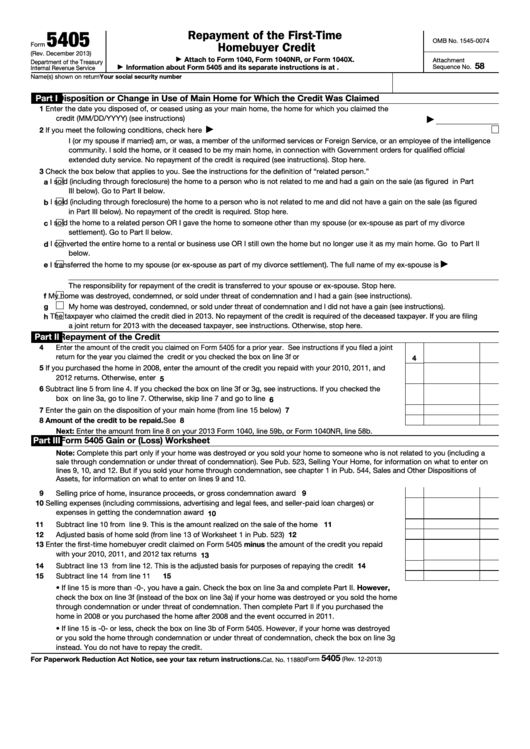

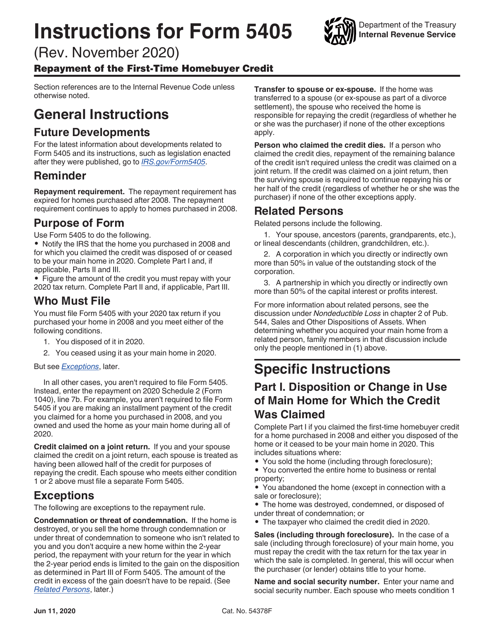

How do I report a first-time homebuyer credit?

Reporting the repayment. If required to repay the first-time homebuyer credit, you must file a federal income tax return, even if the gross income doesn't exceed the return filing threshold.

What is the Biden first-time homebuyer tax credit?

The bill is designed to provide a tax credit for first-time buyers worth up to $15,000 or 10% of a home’s purchase price, whichever is less. The bill, also known as the “Biden first-time homebuyer tax credit,” has yet to be signed into law. The bill also comes with certain requirements.

What Is The $15,000 First-Time Homebuyer Tax Credit?

The First-Time Homebuyer Tax Credit is a $15,000 refundable tax credit for first-time home buyers. It is not yet passed into law. Eligible home buyers must meet the following criteria, according to the bill’s most recent language: homebuyer.com

Did The First-Time Homebuyer Act Pass Yet?

As of February 7, 2024, the First-Time Homebuyer Act is not passed. President Biden first announced the $15,000 tax credit on his 2020 campaign trail, and the program became known as the Biden First-Time Home Buyer Tax Credit. The bill did not survive the last Congress and is also not dead. It’s common for the legislative process to span multiple C

How Does The First-Time Homebuyer Act Work?

The First-Time Homebuyer Tax Credit is a tax refund from the U.S. Treasury. It’s paid to eligible first-time home buyers when their federal taxes are processed by the IRS. The refund is neither a loan, like some down payment assistance programs, nor a cash grant like the $25,000 Downpayment Toward EquityAct. According to the bill’s original languag

If You Move Within 4 Years, You’Ll Pay Some Money Back

The First-Time Homebuyer Act builds long-term wealth for low- and middle-income households through real estate. It specifically legislates away from house flippers and real estate investors. Therefore, buyers claiming the credit who change their primary residence or sell their home within four years of purchase will realize a tax liability for movi

When Will The $15,000 First-Time Homebuyer Tax Credit Act Pass?

The $15,000 First-Time Home Buyer Tax Credit is among the more likely first-time buyer programs to pass into law because it has precedent. The program modifies tax code leftover from the 2009 Obama-era $8,000 First-Time Homebuyer Tax Credit, which more than 2.6 million renters used to buy their first home. The needs of today’s buyers are different

Common Questions About The First-Time Homebuyer Act

Is this program the same as the Biden First-Time Homebuyer Act? Yes, the First-Time Homebuyer Act is known by several names, including the Biden First-Time Homebuyer Tax Credit, the Biden Homebuyer Credit, and the $15,000 Homebuyer Tax Credit. They’re all the same thing. Is the $15,000 Home Buyer Tax Credit available yet? No, the $15,000 first-time homebuyer tax credit is not yet available. We expect the bill to pass into law in some form before the end of the year. Subscribe to our newsletterfor updates on this and other bills. How do I apply for the $15,000 Home Buyer Grant? Eligible first-time home buyers aren’t required to apply for the $15,000 first-time home buyer tax credit. When you meet the program’s eligibility requirements, the IRS credits your tax bill automatically. homebuyer.com

|

NJHMFA

Homebuyer Mortgage Program with Down Payment Assistance. 1-800-NJ-HOUSE • njhousing.gov. NJHMFA. PROGRAM DESCRIPTIONS. Homeward Bound. The New Jersey |

|

First-Time Home Buyer Savings Account Guidelines

7 Jan 2015 first-time home buyer savings accounts as required by Va. Code § 55-556. These guidelines are exempt from the provisions of the ... |

|

Monmouth County Division of Planning Office of Community

The Monmouth County Office of Community Development office has developed The First-Time. Homebuyers Program to provide financial assistance to low and |

|

Untitled

Submit most recent credit reports (six months of less). 2020 LOW INCOME LIMITES FOR THE CITY OF PATERSON'S FIRST TIME HOMEBUYER'S PROGRAM. |

|

NJJHMFA

New Jersey Housing and Mortgage Finance Agency's (NJHMFA) First-Time Homebuyer Mortgage Program provides a competitive 30-year fixed-rate government insured |

|

Phil Murphy Governor Sheila Oliver Lt. Governor Marlene Caride

Dear New Jersey Home Buyer. Homeownership is the fulfillment of the American dream. As with any major purchase |

|

What is the First-time Home Buyers Program?

First-Time. Home. Buyers. Program. Sponsored by the. Burlington County government to provide assistance to low ... HumanServices@co.burlington.nj.us. |

|

New Jersey Tax Guide

We do however |

|

FIRST TIME HOMEBUYERS PROGRAM

All interested applicant(s) must first register & successfully complete an 8 hour Homebuyer. Education Course with Neighborhood Housing Services (NHS). |

|

HUD # ______

The City of Passaic's First Time Homebuyer Program will provide qualified Low Income. Households or Very Low Income Households with Homebuyer Assistance in |

|

First Time Home Buyer Guide - PNC

All loans are provided by PNC Bank, National Association and are subject to credit approval For most of us, buying our first home is a dream come true Affordable loans for low- to moderate- for a mortgage, PNC Mortgage has programs |

|

Barriers to Accessing Homeownership - Urban Institute

GSE Low–Down Payment Programs 10 The first-time homebuyer share of GSE purchase loans has increased from about 25 percent during the early 2000s , |

|

Everything You Wanted to Know About Buying a Home - NJgov

work well for first-time home buyers who are reasonably confident of an income Negative amortization (when the principal balance of the loan increases |

|

Grants and Resources - NJgov

boarding house licenses, and the State's New Home Warranty program To: Local code officials, architects, engineers, builders, homeowners and any member of Description: Provides low interest loans to volunteer fire service and |

|

Helping YOU become a HOMEOWNER FLAGLER COUNTY SHIP

Prequalify for income and credit worthiness Eligible Households are first-time homebuyers that have household income is in the very low, low or moderate |

|

SECTION 8 HOUSING CHOICE VOUCHER (HCV

The basic premise of the housing choice voucher homeownership program is that instead of Meet the HUD definition of first-time homebuyer (i e , means the participant has not had ownership You cannot have bad credit Will purchasing a home make me ineligible for other assistance programs such as food stamps, |

|

NACA QUALIFICATION CRITERIA

Credit Score Not Considered (NACA Qualification based on Member's individual The NACA Mortgage is not limited to first-time homebuyers You may Purchase price limits allow NACA to focus its program on stabilizing low- to W- 2's, 1099, tax return (plus IRS transcripts for self-employed and special programs) for |

|

Good Neighbor Next Door - FDIC

as “revitalization areas” to full-time law enforcement officers, pre-kindergarten through of HUD-owned homes and qualified GNND buyers seeking an insured loans or various federal programs based on their special status base in low- and moderate- standing principal obligation of the first mortgage Debt-to- income |