ias 36 pdf

|

International Accounting Standard 36 Impairment of Assets

IAS 36 © IFRS Foundation 3 (d) paragraphs 126–133 specify the information to be disclosed about impairment losses and reversals of impairment losses for assets and cash‑generating units Paragraphs 134–137 specify additional disclosure requirements for cash‑generating units to which goodwill or intangible |

|

IAS 36 Impairment of Assets 2017

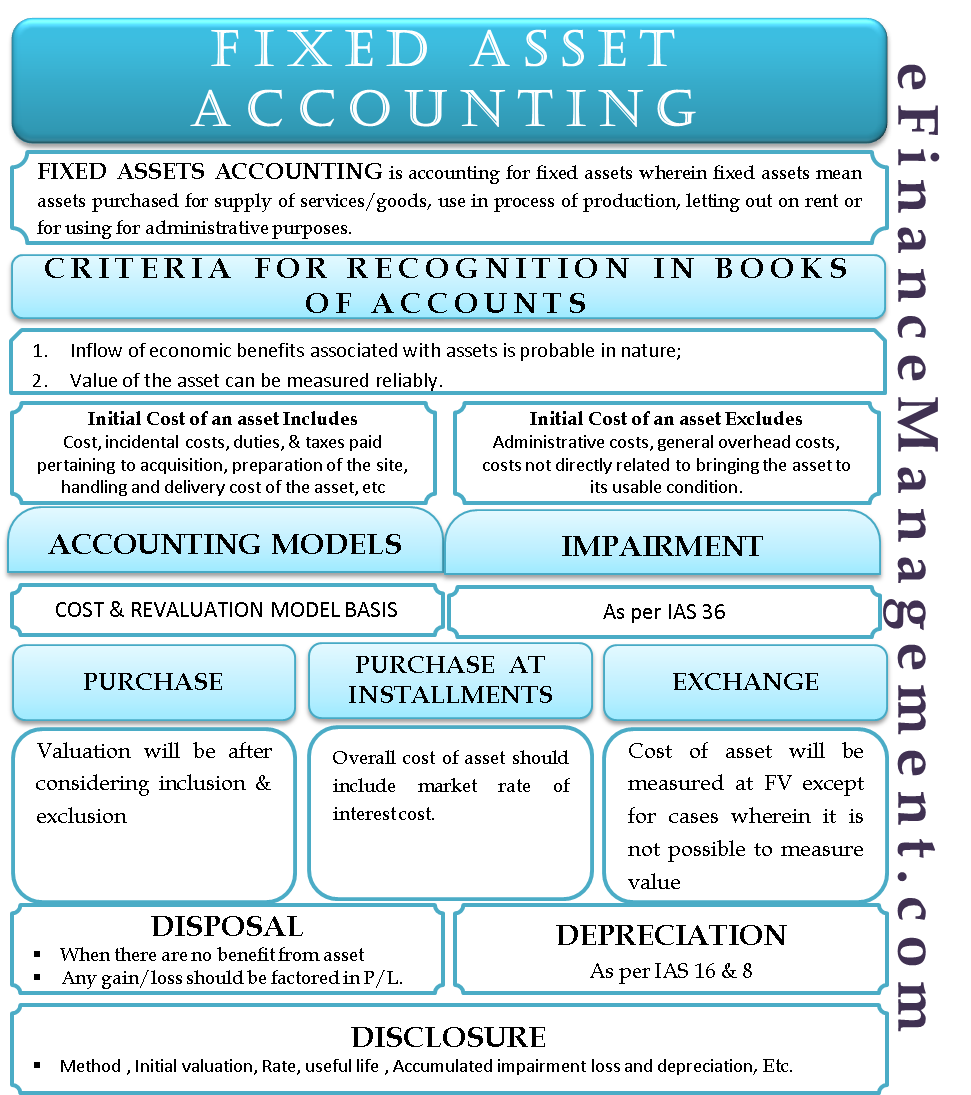

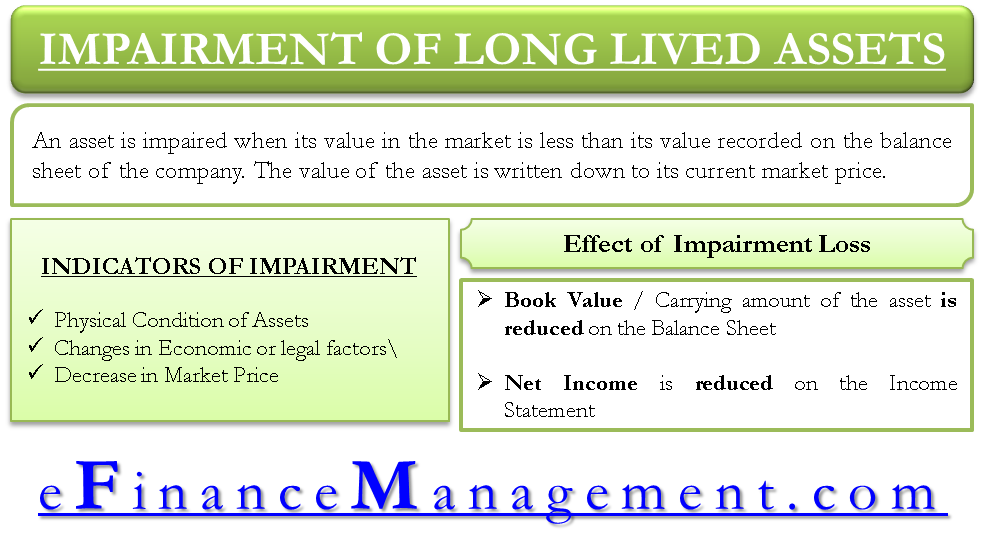

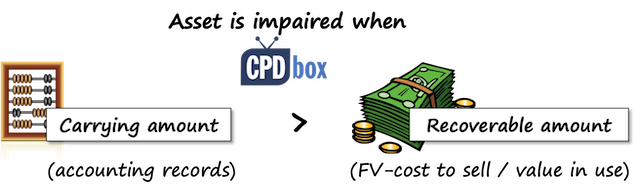

IAS 36 Impairment of Assets Objective To prescribe the procedures that an entity applies to ensure that its assets are carried at no more than its recoverable amount An asset is carried at more than their recoverable amount if its carrying amount exceeds the amount to be recovered through use or sale of the asset |

|

IAS 36 Impairment of Assets

Technical Summary This extract has been prepared by IASC Foundation staff and has not been approved by the IASB For the requirements reference must be made to International Financial Reporting Standards IAS 36 Impairment of Assets |

|

Impairment of Assets IAS 36

IAS 36 Impairment of Assets In April 2001 the International Accounting Standards Board (Board) adopted IAS 36 Impairment of Assets which had originally been issued by the International Accounting Standards Committee in June 1998 That standard consolidated all the requirements on how to assess for recoverability of an asset |

|

Impairment of Assets

OBJECTIVE SCOPE DEFINITIONS IDENTIFYING AN ASSET THAT MAY BE IMPAIRED |

Does IAS 36 apply to non-financial assets?

IAS 36 details the procedures that an entity must follow to ensure this principle is applied and is applicable for the majority of non-financial assets. The standard also specifies when an impairment loss must be reversed and prescribes disclosures related to impairment.

How should I read IAS 36?

All the paragraphs have equal authority but retain the IASC format of the Standard when it was adopted by the IASB. IAS 36 should be read in the context of its objective and the Basis for Conclusions, the Preface to IFRS Standards and the Conceptual Framework for Financial Reporting.

What is IAS 16 & IAS 31?

It replaced requirements for assessing the recoverability of an asset and recognising impairment losses that were included in IAS 16 Property, Plant and Equipment, IAS 22 Business Combinations, IAS 28 Accounting for Investments in Associates and IAS31 Financial Reporting of Interests in Joint Ventures.

IMPAIRMENT OF ASSETS

OBJECTIVE SCOPE DEFINITIONS IDENTIFYING AN ASSET THAT MAY BE IMPAIRED ifrs.skr.jp

MEASURING RECOVERABLE AMOUNT

Measuring the recoverable amount of an intangible asset with an indefinite useful life ifrs.skr.jp

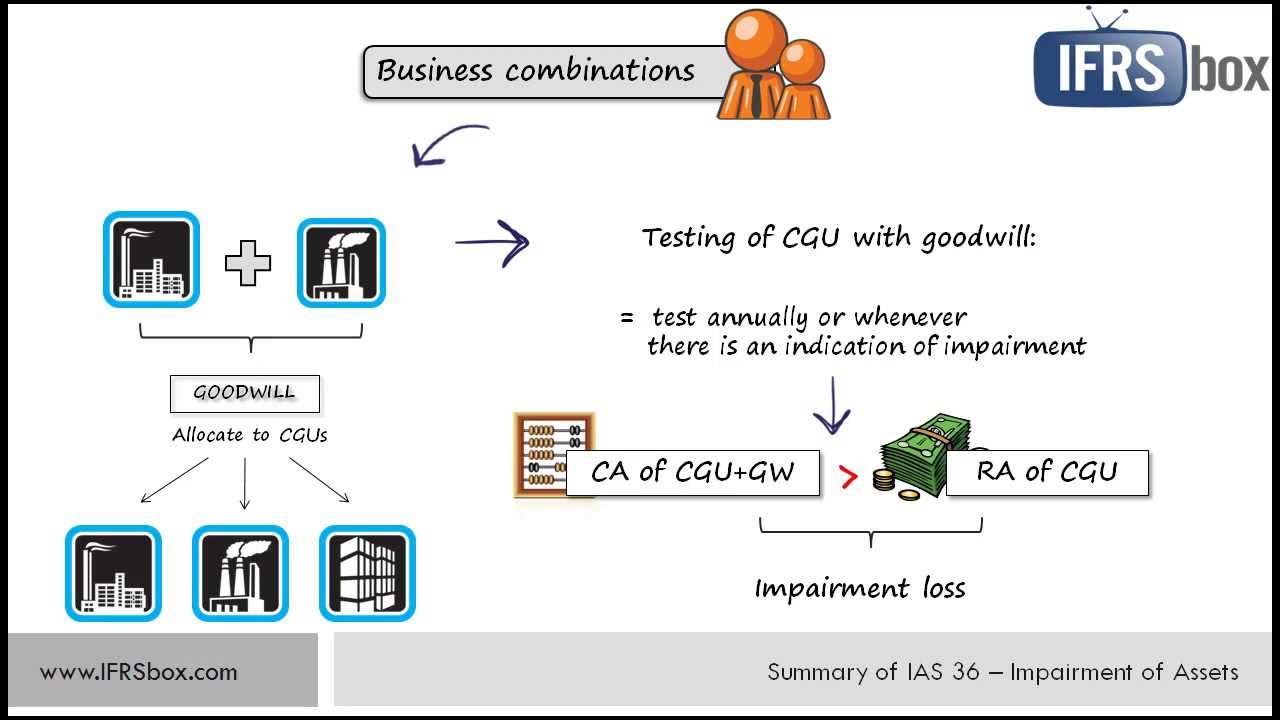

CASH-GENERATING UNITS AND GOODWILL

Identifying the cash-generating unit to which an asset belongs ifrs.skr.jp

Recoverable amount and carrying amount of a cash-generating unit

Goodwill Allocating goodwill to cash-generating units Testing cash-generating units with goodwill for impairment Timing of impairment tests Corporate assets Impairment loss for a cash-generating unit ifrs.skr.jp

REVERSING AN IMPAIRMENT LOSS

Reversing an impairment loss for an individual asset Reversing an impairment loss for a cash-generating unit Reversing an impairment loss for goodwill ifrs.skr.jp

Frequency of impairment testing

IN5 The previous version of IAS 36 required the recoverable amount of an asset to be measured whenever there is an indication that the asset may be impaired. This requirement is included in the Standard. However, the Standard also requires: the recoverable amount of an intangible asset with an indefinite useful life to be measured annually, irres

Measuring value in use

IN6 The Standard clarifies that the following elements should be reflected in the calculation of an asset’s value in use: an estimate of the future cash flows the entity expects to derive from the asset; expectations about possible variations in the amount or timing of those future cash flows; the time value of money, represented by the current mar

Disclosure

IN16 The Standard requires that if any portion of the goodwill acquired in a business combination during the period has not been allocated to a cash-generating unit at the end of the reporting period, an entity should disclose the amount of the unallocated goodwill together with the reasons why that amount remains unallocated. IN17 The Standard req

Objective

1 The objective of this Standard is to prescribe the procedures that an entity applies to ensure that its assets are carried at no more than their recoverable amount. Anasset is carried at more than its recoverable amount if its carrying amount exceeds the amount to be recovered through use or sale of the asset. If this is the case, the asset is d

Definitions

6 The following terms are used in this Standard with the meanings specified: An active market is a market in which all the following conditions exist: the items traded within the market are homogeneous; willing buyers and sellers can normally be found at any time; and prices are available to the public. Carrying amount is the amount at which an ass

12 In assessing whether there is any indication that an asset may be impaired, an entity shall consider, as a minimum, the following indications:

External sources of information during the period, an asset’s market value has declined significantly more than would be expected as a result of the passage of time or normal use. significant changes with an adverse effect on the entity have taken place during the period, or will take place in the near future, in the technological, market, economic

Basis for estimates of future cash flows

33 In measuring value in use an entity shall: base cash flow projections on reasonable and supportable assumptions that represent management’s best estimate of the range of economic conditions that will exist over the remaining useful life of the asset. Greater weight shall be given to external evidence. base cash flow projections on the most recen

Composition of estimates of future cash flows

39 Estimates of future cash flows shall include: projections of cash inflows from the continuing use of the asset; projections of cash outflows that are necessarily incurred to generate the cash inflows from continuing use of the asset (including cash outflows to prepare the asset for use) and can be directly attributed, or allocated on a reasonabl

Discount rate

55 The discount rate (rates) shall be a pre-tax rate (rates) that reflect(s) current market assessments of: the time value of money; and the risks specific to the asset for which the future cash flow estimates have not been adjusted. 56 A rate that reflects current market assessments of the time value of money and the risks specific to the asset is

Example

A mining entity owns a private railway to support its mining activities. The private railway could be sold only for scrap value and it does not generate cash inflows that are largely independent of the cash inflows from the other assets of the mine. It is not possible to estimate the recoverable amount of the private railway because its value in u

Timing of impairment tests

96 The annual impairment test for a cash-generating unit to which goodwill has been allocated may be performed at any time during an annual period, provided the test is performed at the same time every year. Different cash-generating units may be tested for impairment at different times. However, if some or all of the goodwill allocated to a cas

Example

A machine has suffered physical damage but is still working, although not as well as before it was damaged. The machine’s fair value less costs to sell is less than its carrying amount. The machine does not generate independent cash inflows. The smallest identifiable group of assets that includes the machine and generates cash inflows that are l

Estimates used to measure recoverable amounts of cash-generating units containing goodwill or intangibleassets with indefinite useful lives

134 An entity shall disclose the information required by (a)–(f) for each cash-generating unit (group of units) for which the carrying amount of goodwill or intangible assets with indefinite useful lives allocated to that unit (group of units) is significant in comparison with the entity’s total carrying amount of goodwill or intangible assets with

Appendix A Using present value techniques to measure value in use

This appendix is an integral part of the Standard. It provides guidance on the use of present value techniques in measuring value in use. Although the guidance uses the term ‘asset’, it equally applies toagroup of assets forming a cash-generating unit. ifrs.skr.jp

Traditional approach

A4 Accounting applications of present value have traditionally used a single set of estimated cash flows and a single discount rate, often described as ‘the rate commensurate with the risk’. In effect, the traditional approach assumes that a single discount rate convention can incorporate all the expectations about the future cash flows and the app

Testing for impairment

C3 Testing for impairment involves comparing the recoverable amount of a cash-generating unit with the carrying amount of the cash-generating unit. C4 If an entity measures non-controlling interests as its proportionate interest in the net identifiable assets of a subsidiary at the acquisition date, rather than at fair value, goodwill attributable

IAS 36 Impairment of Assets

IAS 36

IAS 36 Impairment of Assets

|

IAS 36 – 2021 Issued IFRS Standards (Part A)

IAS 36. © IFRS Foundation. A1417. Page 4. International Accounting Standard 36 Impairment of Assets (IAS 36) is set out in paragraphs 1–141 and Appendices A–C |

|

Norme comptable internationale 36 Dépréciation dactifs Objectif

En un tel cas après l'application des. Page 2. IAS 36. 2. © IFRS Foundation dispositions relatives à la réévaluation |

|

IAS 36

La Norme IAS 36 porte sur tous les actifs à l'exception : • des stocks (IAS 2) ;. • des actifs sur contrat et les actifs découlant des coûts engagés pour l |

|

IAS 36 Impairment of Assets 2017 - 07

The recoverable amount is the higher of an asset's or cash generating unit fair value less costs of disposal and its value in use. Page 2. IAS 36 Impairment of |

|

IAS 36 Impairment of Assets

1. In the case of an intangible asset the term 'amortisation' is generally used instead of. 'depreciation'. The two terms have the same meaning. IAS 36. © IFRS |

|

Les Cahiers de lAcadémie - N° 1 - Guide de lecture de IAS 36

1 fév. 2005 Le paragraphe 102 d'IAS 36 impose en premier que la valeur recouvrable de chaque UGT soit com- parée avec sa valeur nette comptable incluant la ... |

|

Insights into IAS 36 - Presentation and disclosure

IAS 36 also requires the disclosure of information used in estimating the recoverable amount where goodwill or indefinite- life intangible assets have been |

|

IAS 36 Impairment of Assets

19 IASC approved an International Accounting Standard on intangible assets in 1998. IAS 36 BC. C2088. © IFRS Foundation. Page 17. Value in |

|

Impairment of Assets - A guide to applying IAS 36 in practice

To accomplish this objective IAS 36 provides guidance on: • the level at which to review for impairment (eg individual asset level |

|

EVALUATION FINANCIERE_Mise en page 1

La norme IAS 36 impose de réaliser des tests annuels de dépréciation du goodwill dont elle encadre les modalités. Elle présente donc un enjeu stratégique pour |

|

Norme comptable internationale 36 Dépréciation dactifs Objectif

En un tel cas après l'application des Page 2 IAS 36 2 © IFRS Foundation dispositions relatives à la réévaluation il est improbable que l'actif réévalué se |

|

Norme IAS 36 - dépréciation dactifs

IAS 36 impose de constater une dépréciation lorsque la valeur comptable d'un actif est supérieure à sa valeur recouvrable Le processus d'évaluation doit |

|

IAS 36 - EAI International

La Norme IAS 36 porte sur tous les actifs à l'exception : • des stocks (IAS 2) ; des immeubles de placement évalués à juste valeur (IAS 40) ; |

|

IAS 36 - Impairment of Assets - IFRS Foundation

In May 2013 IAS 36 was amended by Recoverable Amount Disclosures for Non-Financial Assets (Amendments to IAS 36) The amendments required the disclosure of |

|

IFRS in Focus Projet de modification de lIAS 36 sur les informations

sur la valeur recouvrable des actifs non financiers (Projet de modification d'IAS 36) Cette procédure est maintenant terminée et l'IASB a publié des |

|

Mise en œuvre de la norme IAS 36 - IMA France

10 déc 2013 · actif en date de clôture l'application d'IAS 36 et IAS 1 conduit à indiquer la sensibilité de cette valeur y compris lorsqu'une perte de |

|

IAS 36 Dépréciation dactif - CPA Canada

1 jui 2013 · En mai 2013 l'IASB a publié Informations à fournir sur la valeur recouvrable des actifs non financiers (modifications d'IAS 36) Ces |

|

Etude-ias-36-1286987587pdf - Accuracy

La norme IAS 36 qui s'intéresse notamment à la valeur des goodwills est emblématique de cette révolution Accuracy et l'Université Paris-Dauphine ont créé un |

|

La communication financière sur lapplication dIAS 36* - Blogs

norme IAS 36 relative aux dépréciations d'actifs l'application d'IAS 36 Dépréciation d'actifs non financiers une des normes phares des |

|

IAS 36 Impairment of Assets 2017 - 07 - PKF International

The recoverable amount is the higher of an asset's or cash generating unit fair value less costs of disposal and its value in use Page 2 IAS 36 Impairment of |

|

IAS 36 - Tunisian-IFRS-Group

undation 1 Norme comptable internationale 36 Dépréciation d'actifs Objectif 1 L'objectif de la |

|

IAS 36 - AUNEGE

impose de constater une dépréciation lorsque la valeur comptable d'un actif est supérieure à sa |

|

IAS 36 - PwC France

tions dans le cadre des tests de dépréciation (IAS 36) Panorama 2012 des sociétés du CAC 40 |

|

Le test de perte de valeur avec lIAS 36 : difficultés - Focus IFRS

2014 — Or, en raison de l'impact parfois très important de l'IAS 36 sur le résultat et donc les capi- taux propres, il |

|

IAS 36 Impairment of Assets 2017 - 07 - PKF International

overable amount is the higher of an asset's or cash generating unit fair value less costs of disposal |

|

Mise en œuvre de la norme IAS 36 - IMA France

actif en date de clôture, l'application d'IAS 36 et IAS 1 conduit à indiquer la sensibilité |

|

IAS 36 Dépréciation dactif - CPA Canada

Lors de l'élaboration d'IFRS 13, l'IASB a décidé de modifier IAS 36 de façon à exiger que |

|

International Accounting Standard 36 Impairment of - ICAB

dealt with in paragraphs 58–64 Paragraphs 65–108 deal with the recognition and measurement |

![Ias 36 pdf 2018 [2020] Ias 36 pdf 2018 [2020]](https://demo.pdfslide.tips/img/742x1000/reader018/reader/2020012401/5b98319509d3f253748bdf93/r-2.jpg?t\u003d1613503819)

![Case Study- ias 36 - [PDF Document] Case Study- ias 36 - [PDF Document]](https://www.cpdbox.com/wp-content/uploads/IAS36ReversalImpairmentLoss.png)

![Impairment of Assets - IAS 36 - [PDF Document] Impairment of Assets - IAS 36 - [PDF Document]](https://www.pdffiller.com/preview/87/365/87365126.png)

![Impairment of Assets - IAS 36 - [PDF Document] Impairment of Assets - IAS 36 - [PDF Document]](https://i1.rgstatic.net/publication/253236657_Compliance_With_IFRS_3-_and_IAS_36-Required_Disclosures_Across_17_European_Countries_Company-_and_Country-Level_Determinants/links/0c96052700871efc16000000/largepreview.png)

![Insight IAS Prelims 2020 TEXTBOOK Test 36 PDF [Full Test-10] Insight IAS Prelims 2020 TEXTBOOK Test 36 PDF [Full Test-10]](https://docplayer.net/docs-images/40/61396/images/page_14.jpg)

![Manifest IAS Prelims 2020 Test 36 [Sectional] Download in PDF Manifest IAS Prelims 2020 Test 36 [Sectional] Download in PDF](https://media.cheggcdn.com/media/244/24426e9e-fedd-4bcc-b31c-b44e4a90686d/php1gCNLd)