market correction 2017

What is a stock market correction?

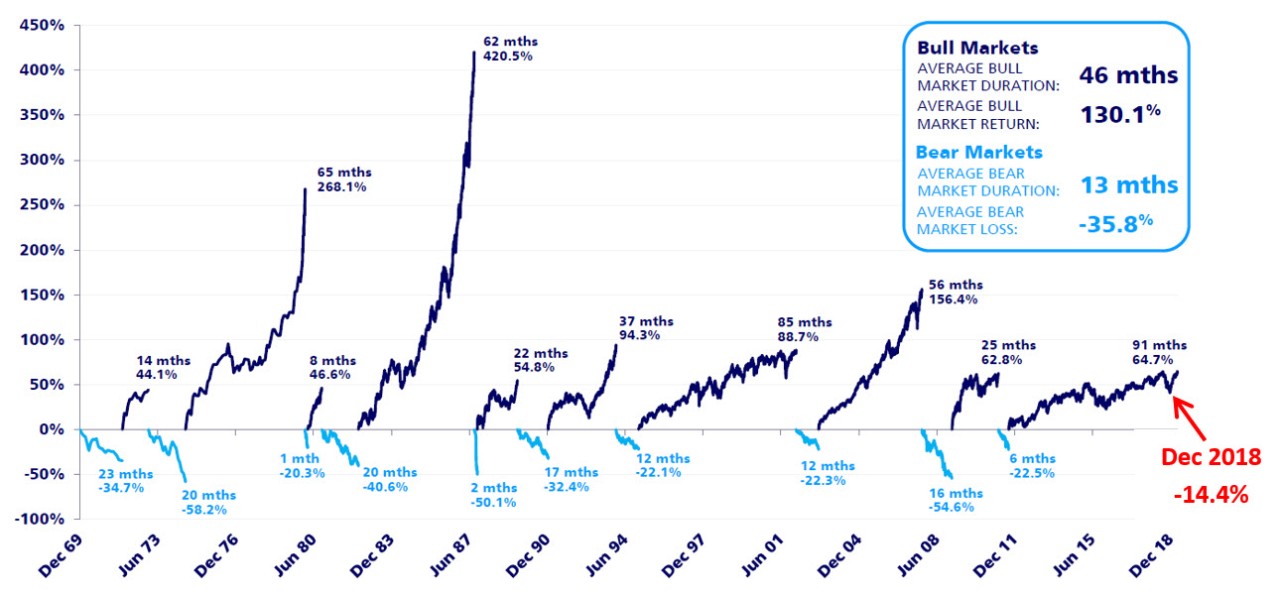

The definition of a stock market correction is a pullback of up to 20% of broad market value. Stock market corrections differ from stock market crashes in two key ways. First, a correction and crash differ in severity. While both a correction and a crash cause a loss of stock market value, a stock market crash is far worse.

How often do market corrections occur?

Even a 5% decline over a short period can feel unsettling, but they occur on average three times per year. Market corrections of 10% or more are also surprisingly common and have happened on average once per year. The volatility of early 2018 may have felt more jarring than usual because it followed a year that didn’t have a single 5% decline.

How long does it take to recover from a stock market correction?

This analysis shows that it takes approximately nine months on average for a status quo, long-only equity investor to recover their losses following a correction. Surprisingly, an investor who has a five-year time horizon and invests two-and-a-half years before and after a correction will see annualized price returns of 10.26%.

Market Corrections Are Fairly Common.

Market pullbacks are more common than some may think. Even a 5% decline over a short period can feel unsettling, but they occur on average three times per year. Market corrections of 10% or more are also surprisingly common and have happened on average once per year. The volatility of early 2018 may have felt more jarring than usual because it foll

Markets Typically Have Recovered quickly.

While markets may seem pessimistic during periods of heightened volatility, they often bounce back quickly. Despite averaging a double-digit correction per year, 31 of the last 41 calendar years have finished with positive returns. Equity returns are often strongest after a decline when investors believe that the market has overreacted to the downt

Bear Markets Have Been Rare Outside of A Recession.

Over the last 50 years, only eight of 36 market corrections have been classified as bear markets. Most bear markets coincide with recessions, which are also relatively infrequent. In the absence of a recession, a growing economy can still spur positive corporate earnings growth, which supports equity prices. Market declines outside of a recession h

Even Bear Markets Have Been Relatively short-lived.

A long-term focus can help investors put bear markets into perspective. Since 1949 there have been nine periods of 20%-or-greater declines in the S&P 500. And while the average 33% decline of these cycles can be painful to endure, missing out on part of the average bull market’s 263% return could be even worse. Bear markets have averaged 14 months,

Volatility Can Compound Investor mistakes.

Buy low and sell high — it’s one of the most commonly quoted investment phrases, but all too often it’s the exact opposite of how most investors actually behave. Looking at U.S. equity asset flows since the start of the 2008-09 bear market illustrates this. In 2009, as markets bottomed to levels not seen in more than a decade, investors were net se

Market Correction

How To Make The Most Of Stock Market Corrections ET Money

What is a stock market correction?

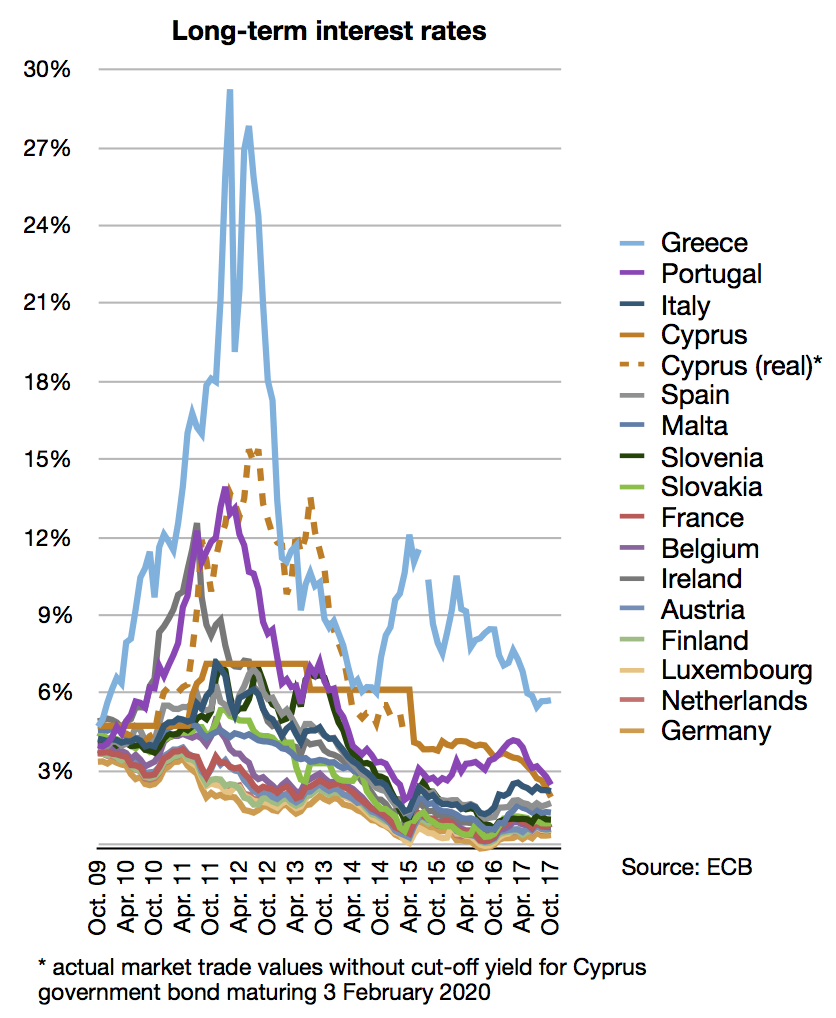

| EUROPEAN COMMISSION Brussels 22.2.2017 SWD(2017) 71 final |

|

Updated Summary Report of 2017 Benefit Year Risk Adjustment

15 jan. 2021 Table 2a: Updated Issuer-Specific 2017 HHS-RADV Adjustments to 2018 Risk Adjustment Transfers for Non-Merged Market. |

|

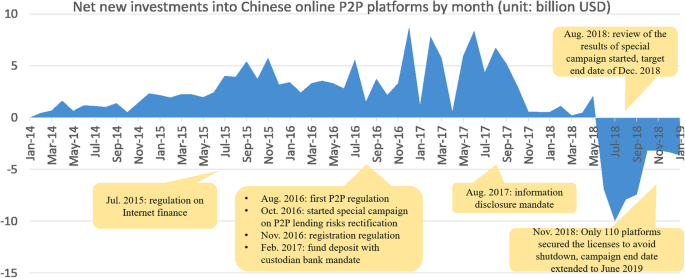

Assessing Chinas Residential Real Estate Market WP/17/248

percent y/y in 2016 and 16 percent in the first half of 2017. In fact the majority of the Risks of a Housing Market Correction and the Potential Impact. |

|

Recommended practices for DR market design

15 sept. 2017 Update September 2017: Includes residential customer segment ... Finally it must be market based |

|

Three Risks for the German Residential Property Market IW-Report

1 août 2017 speculative bubble in the German housing market has been gaining ... Thomschke (2017) stress the danger of a market correction in the German ... |

|

REGULATION (EU) 2017/ 1131 OF THE EUROPEAN PARLIAMENT

30 jui. 2017 (1). Money market funds (MMFs) provide short-term finance to financial institutions corporations and governments. By providing finance to those ... |

|

Management et sciences de gestion

Vendredi 14 avril 2017 de 14h00 à 16h00. Durée : 2 heures Étudier le mix marketing (ou plan de marchéage) de Naïo Technologies. |

|

Price Correction Report

24 nov. 2017 2017. 2017. Overview. This document is intended to meet the requirements of ISO Tariff section 35.6 |

|

Price Correction Report

15 déc. 2017 2017. 2017. Overview. This document is intended to meet the requirements of ISO Tariff section 35.6 |

|

Price Correction Report

15 avr. 2017 Week of Apr 17-21 2017. Overview. This document is intended to meet the requirements of ISO Tariff section 35.6 |

|

Stock Market Corrections - Oakwood Financial

All stock market corrections in our lifetime - and long economic recessions, as have all the bear markets in stocks S&P 500 – 2008 to 2017 Market Dip |

|

The market and the economy in 2017 - Pareto

Whereas the preceding year had started with a major downturn, 2017 was mercifully free of substantial corrections By the end of the year, the MSCI World index |

|

Market correction trend in 2017 - VIETDATA

Market correction trend in 2017 1 Stock market developments After reaching a peak of 970 points on December 4 th and increased by 46 from the beginning |

|

Japan – Reflections on 2017 and Market Outlook - Nomura

1 déc 2017 · Reported Earnings The Japanese equity market spent much of 2017 in a slow upward trajectory, punctuated by sharp corrections, most |

|

Quarterly Market Review Third Quarter 2017

The first is that, despite market corrections that have come along with such frequency, the S&P 500 (still excluding dividends, just measuring by price) provided a |

|

Expectations vs Reality Market Wrap - First Quarter 2017

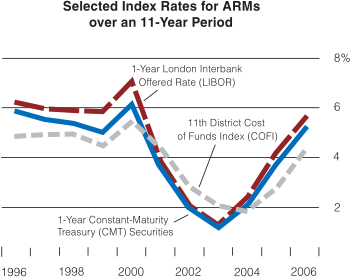

Will there be a correction soon? Based on nothing other than recent history, it's fair to say there will be a 5 or 10 pullback soon Since 1990, we have averaged |

|

Quarterly Update - Lokken Investment Group, LLC

Correction warning flags are out Remember, we haven't had a significant stock market correction in quite some time 2017 has been essentially correction-free, |

|

Med Jones 2016-2017 Successful Forecasts - International Institute

There will be market correction either in 2016 or 2017 • This year investors have worried about China, oil prices, terrorism, Brexit, and the outcome of the U S |

|

Mitch on the Markets Why Im Rooting for a Market Correction

April 16, 2017 Mitch on the Markets Why I'm Rooting for a Market Correction By Mitch Zacks \ Portfolio Manager Many readers likely did a double-take |

|

Insights - Webster Bank

After rallying in July and August, the bond market saw some in 2017 1 ——— MARKETS Q3 2017 YTD 2017 Blue Chip Large Stocks correction or worse |