attijari wafa bank pdf

|

ATTIJARIWAFA BANK GROUP IN AFRICA

With operations in 15 African countries and more than 4300 branches we have the most extensive branch network in Africa Our recent acquisition in Egypt is a welcome addition to our coverage and has bolstered our presence in the region |

|

ATTIJARIWAFA BANK’S SYSTEM IN AFRICA

Attijariwafa bank «Best investment bank in Morocco for the year 2022» In its ranking Global Finance named Attijariwafa bank as the «Safest bank in Africa» and «Best Private Bank in Africa» Attijariwafa bank was elected «Best Bank in Morocco in 2022» awarded by the prestigious English magazine Euromoney for the 12th year |

What Accounting Standards does Attijariwafa use?

In its consolidated financial statements as of 31 December 2022, the Attijariwafa bank Group has applied the mandatory principles and standards set out by the International Accounting Standards Board (IASB).

Who is Attijariwafa Bank?

About Attijariwafa bank Created in 2004 with the merger of Banque Commerciale du Maroc (founded in 1911) and Wafabank (founded in 1904), Attijariwafa bank is the undisputed leader in Morocco and the sixth-largest bank in Africa.

What is the Attijariwafa bank risk management framework?

The Attijariwafa bank risk management framework is an integral part of the decision-making procedures of Management and the Board of Directors, and is designed to help them reach these objectives. Attijariwafa bank endeavors to include risk-based decision making in its strategic planning, and in its operating and financial procedures.

How did Attijariwafa Bank assess the cost of fixed assets?

Attijariwafa bank opted for an assessment of the cost of all fixed assets. Depreciation in linear and spread out over the following useful life: The Attijariwafa bank group did not internally generate any intangible fixed assets. The useful life thereof is as follows:

AN INTERNATIONAL BANKING AND FINANCIAL GROUP

Europe Afrique Europe North Afrique Africa du Nord du Nord CEMAC UEMOA EMCCA CEMAC WAEMU UEMOA FINANCIAL ir.attijariwafabank.com

North Africa

Attijariwafa bank Group operates in North Africa through its subsidiaries Attijari bank Tunisie (ABT), Attijari bank Mauritanie (ABM) and Attijariwafa bank Egypt. (MAD millions) (*) Including direct office (*) Contribution to Group (IFRS) ir.attijariwafabank.com

WAEMU zone

Attijariwafa bank Group does business in Senegal through Compagnie Bancaire de l’Afrique de l’Ouest and Crédit du Sénégal. Attijariwafa bank Group is present in Ivory Coast, Mali and Togo through, respectively, Société Ivoirienne de Banque, Banque Internationale pour le Mali and Banque Internationale pour l’Afrique au Togo. (MAD millions) (*) Inclu

HIGHLIGHTS OF 2022

With SOTUGAR and in partnership with USAID (U.S. Agency for International Development), Attijari bank signed the Dhamen Express agreement, whose purpose is to replace the Support for Business Resilience (SARE) mechanism for businesses. With this partnership, Attijari bank aims to support post-crisis business recovery of very small and medium-sized

HIGHLIGHTS OF 2022

• Implementation of a support system to finance small and medium-sized companies and industries, under the guidance of the Central Bank of West African States. • Creation of a solution that simplifies access to mortgage loans, called Crédit Am sa Kër. This helps functionaries to complete their projects for a tenancy-at-will properties. ir.attijariwafabank.com

Morocco, Europe and International Retail Specialized Offshore Banking Finance Insurance Subsidiaries Banking Zone

Attijariwafa bank Attijariwafa bank Europe Attijari International Bank Attijari Finances Corp. Wafa Gestion Attijari Intermédiation Wafa Assurance Attijari Assurance Tunisie Wafa IMA Assistance Wafa Assurance Cameroun Wafa Assurance Sénégal Wafa Assurance Côte d’Ivoire Compagnie Bancaire - Wafasalaf de l’Afrique de l’Ouest - Wafabail

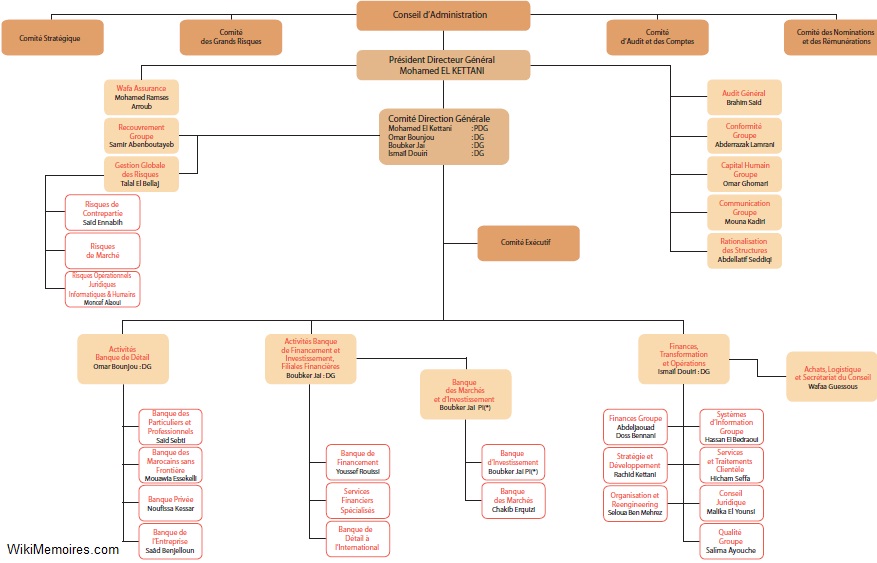

MISSION AND ORGANISATION OF GLOBAL RISK MANAGEMENT

Attijariwafa bank’s approach to risk management is based on professional and regulatory standards, international rules and recommendations made by supervisory authorities. Risks are managed centrally by Global Risk Management (GRM), which operates independently of the bank’s divisions and business lines and reports directly to the Chairman and CEO

Upstream

Make recommendations for credit policy; Analyse and assess risk-taking applications submitted by the bank’s various sales teams in relation to counterparty/ transaction criteria; Assess the consistency and validity of guarantees; Assess the importance of a customer relationship in terms of potential business volume and whether the requested finan

Downstream

Review all loan commitments regularly in order to compartmentalise the portfolio by risk category; Check for early signs of difficulty and identify loan-repayment-related incidents; Work closely with the branch network to recover these loans; Make provisions for non-performing loans. ir.attijariwafabank.com

Operational risk

The operational risk management policy is managed by the Operational, Legal, Information Systems, and Human Risk unit created by Global Risk Management; The ROJIH unit has established a risk map for each business line based on the bank’s standard processes. Each risk is mapped on the basis of frequency and potential impact. ir.attijariwafabank.com

Country risk

Diagnosis of the current system and its compliance with existing regulatory requirements, and identification of changes necessary with respect to an international benchmark; Preparation of a conceptual model for optimizing the management of country risk (functional blocks and dedicated information systems), and planning for the implementation of i

Market risk

The role of this unit is to detect, analyse and monitor the bank’s various interest rate and foreign currency positions, rationalise these positions by formal authorisations and remain alert to any departure from these positions. ir.attijariwafabank.com

ALM risk

ALM provides indicators for monitoring the risk and expected return of various balance sheet items. ALM outlines management rules for reducing the bank’s balance sheet risk exposure and for optimizing management of the bank’s positions. ALM policy involves a process of identifying, assessing, and managing the bank’s risky positions. One of the fund

1- Governance and organisation

The management principles established by the bank’s decision-making bodies are applied unconditionally to the way in which risk management is governed and organised. In order to coordinate joint action more effectively, the various responsibilities of the main decision-making entities have been clearly defined. ir.attijariwafabank.com

These entities include:

The Board of Directors General Management Decision-making Committees Global Risk Management. ir.attijariwafabank.com

Board of Directors’ role:

Regarding the bank’s market activities, the Board of Directors’ responsibilities include: Determine and review the bank’ commercial strategy and risk management policy periodically; Assess the main risks to which the Bank is exposed in its business activities; Validate overall risk limits and ensure that General Management and the Decision-makin

General Management’s role:

General Management is the Group’s executive body and its responsibilities include: Implement the strategy and policies approved by the Board of Directors; Implement the processes and resources required to identify, measure, monitor and control risks related to the bank’s commercial activities; Establish and maintain the organisation responsible

Major Risks Committee

This committee, which is chaired by the CEO, analyses and authorises the major commitments (loans, recovery, investments, purchases etc.) entered into by the bank above a certain level. This committee also monitors risk indicators and determines short-term risk management objectives. ir.attijariwafabank.com

Audit and Accounts Committee

Within the board of directors, the audit and accounts committee plays a vital role in assessing the quality of risk management and internal control. It is responsible for: Examining the consistency between internal risk monitoring and the procedures, laws and regulations in force; Issuing an opinion on the Group’s global provisioning policy; Fol

Market Risks Committee

The Market Risks Committee is an internal body which assesses and monitors all types of market risk. Its responsibilities include: Monitor and analyse market risks and any changes; Ensure compliance with monitoring indicators, specific management rules and pre-determined limits; Determine limits for the bank’s various product lines consistent wit

Global Risk Management’s role:

Its role is to supervise counterparty, market and operational risks and corresponding methodologies. Its main responsibilities include: Make recommendations regarding risk policies; Examine applications for credit and trading limits before submitting them to the appropriate committee; Monitor counterparty, market and operational risks in the con

2- Risk Management Process

The risk management process comprises four main stages: Risk Identification Risk Control Risk Measurement Risk Monitoring ir.attijariwafabank.com

Risk identification:

Risk identification consists of drawing up a comprehensive and detailed risk inventory and the factors inherent in each risk. This inventory needs to be regularly updated to account for any change in risk-generating factors as well as any change in the bank’s strategy or management policies. The Control and Methods unit is responsible for identifyi

Risk measurement

Risk measurement consists of assessing the probability of risks occurring and their impact in financial terms on the bank’s positions or assets. The risk measurement methods adopted are largely inspired by “sound practices” as decreed by the Basel Committee and comply with prudential rules. These methods come under the supervision of the Risk Commi

Risk Monitoring

This consists of measures taken by the bank to limit risk to an acceptable level. ir.attijariwafabank.com

Risk Control

This final stage involves risk management surveillance and supervision so that new types of risk may be identified and limits adjusted as circumstances change. ir.attijariwafabank.com

1.1 Risk management strategy

The Foundation promotes constructive debate through a platform of exchange open to all, especially young people. Topics include current economic, social and societal themes. In addition, the platform is designed to support and promote intellectual initiatives and research carried out inside Attijariwafa bank Group, as well as proceedings of confere

|

BankTrack

PAN-AFRICAN BANK. Attijariwafa bank is a Moroccan banking and financial group with a presence in 25 countries. It is the leading bank in Morocco. |

|

RESPONSIBILITY REPORT

31 дек. 2017 г. Attijariwafa bank Group is one of Africa's leading banking and financial services institutions. The Group has adopted. |

|

Believing in the creation of shared value

Attijariwafa bank is a Moroccan banking and financial group present in 25 countries. It is the leading bank in Morocco and the 4th largest bank in Africa. LOCAL |

|

IN AFRICA

Attijariwafa bank Group is now one of the leading pan-. African banking groups. With operations in 15 African countries and more than 4300 branches |

|

And corporate

It also tops the rankings in investment banking and financial market activities in Morocco. Attijariwafa bank is also the leading banking group in North Africa |

|

Financial report - 2021

2 февр. 2023 г. Created in 2004 with the merger of Banque Commerciale du Maroc (founded in 1911) and Wafabank (founded in 1904). Attijariwafa bank is the ... |

|

Tarification en vigueur des produits et servicesde la banque à partir

• Attijarinet et Attijari Mobile pour les personnes physiques. Produits et services facturés. Attijariwafa bank société anonyme au capital de 2 151 408 390 DH. |

|

RESULTS

11 сент. 2019 г. A liability adequacy test has already been carried out by Wafa ... Attijariwafa bank Europe Attijari international bank and holding companies. |

|

RAPPORT DACTIVITÉ

groupe Attijariwafa bank à travers sa filiale Wafa Gestion a lancé une nouvelle solution patrimoniale « Attijari. Dividend Fund » un fonds d'investissement |

|

Believing in the creation of shared value

Attijariwafa bank is a Moroccan banking and financial group present in 25 countries. It is the leading bank in Morocco and the 4th largest bank in Africa. LOCAL |

|

ATTIJARIWAFA BANK EUROPE

8 janv. 2021 Décision de la Commission des sanctions – procédure no 2020-01. Autorité de contrôle prudentiel et de résolution. 1. ATTIJARIWAFA BANK. |

|

RAPPORT DACTIVITÉ

Le groupe Attijariwafa bank accompagne depuis plus d'un siècle le développement économique du Maroc en jouant un rôle déterminant dans la modernisation du. |

|

AWBRapport-Annuel-2020.pdf

Bank Assafa filiale du groupe Attijariwafa bank a remporté le prix de la « Meilleure banque participative au Maroc en 2020 » |

|

DISPOSITIF EN AFRIQUE

Le groupe Attijariwafa bank figure aujourd'hui au tout premier plan parmi les groupes bancaires panafricains. Nous sommes présents dans 14 pays africains et |

|

Présentation Présence monde

Le groupe Attijariwafa bank accompagne depuis plus d'un siècle le développement économique du Maroc en jouant un rôle déterminant. |

|

La Banque Postale et Attijariwafa bank lancent leur partenariat pour

10 juin 2011 Attijariwafa bank et La Banque Postale proposeront tout d'abord une offre de double bancarisation des migrants en France et au Maroc en matière ... |

|

Tarification en vigueur des produits et servicesde la banque à partir

Attijariwafa bank société anonyme au capital de 2 131 729 870 DH. Siège social : 2 boulevard Moulay Youssef |

|

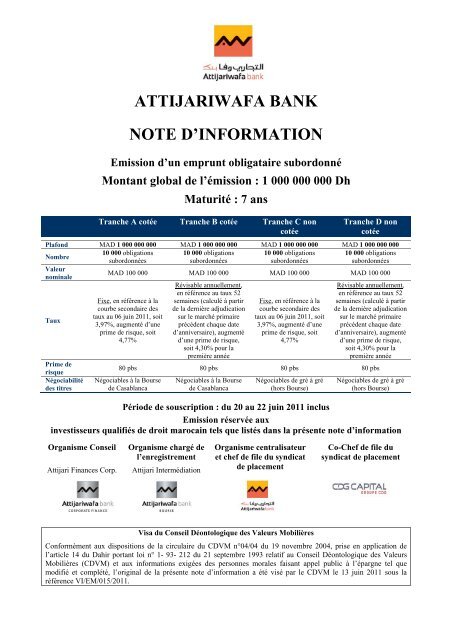

NOTE DINFORMATION

24 juin 2019 Prospectus Attijariwafa bank – Emission d'obligations subordonnées perpétuelles. 2. AVERTISSEMENT. Le visa de l'Autorité Marocaine du Marché ... |

|

RÉSULTATS au 31 mars 2021 PUBLICATION DES COMPTES

31 mars 2021 Au titre du premier trimestre 2021 Attijariwafa bank poursuit l'accompagnement et le soutien de ses clients dans les différents. |

|

SERVICE E-ATTIJARI CONTRAT DE SOUSCRIPTION

Attijariwafa bank Europe Société anonyme au capital de 46 640 180 euros Siège social Édition de RIB liste des mouvements et extrait de compte en PDF |

|

RAPPORT DACTIVITÉ 2019 - Attijariwafa bank

Sur l'opération Maroc Telecom, le groupe Attijariwafa bank composé du Réseau, Wafa Bourse et Attijari Intermédiation a placé 716 millions de dirhams sur les 2, |

|

RAPPORT FINANCIER 2019 - Attijariwafa bank

16 avr 2020 · La présente section décrit les principales évolutions des environnements économiques des pays de présence d'Attijariwafa bank en 2019 |

|

Présentation Présence monde - Attijariwafa bank

Le groupe Attijariwafa bank accompagne depuis plus d'un siècle le développement économique du Maroc en jouant un rôle déterminant dans la modernisation |

|

Sociétale dentreprise - Attijariwafa bank

Attijari Finances Corp Attijariwafa bank Grande entreprise Financement de projet Attijari Global Research International Europe Maroc Bureaux |

|

Télécharger rapport_annuel_2019pdf - Attijariwafa bank

11 mar 2019 · Le groupe Attijariwafa bank accompagne depuis plus d'un siècle le développement économique du Maroc en jouant un rôle déterminant dans |

|

Dactivité - Attijariwafa bank

Il s'agit d'Attijari bank Tunisie, la Société Ivoirienne de banque (SIB), et la Société Commerciale de banque Cameroun (SCB) Ainsi, le groupe Attijariwafa bank |

|

En premier lieu, je tiens à remercier les responsables dAttijariwafa

Attijariwafa Bank, en tant que filiale de l'ONA, est né de la fusion de deux banques marocaines en 2003, Wafabank et la Banque Commerciale du Maroc ( BCM) |

|

N OT ED IN FO RM AT ION - AMMC

AWB Attijariwafa bank BAM Bank Al-Maghrib BCM Banque Commerciale du Maroc BCP Banque Centrale Populaire BMCE BANK Banque Marocaine du |

|

Attijariwafa bank Dispositif dAccompagnement des Exportateurs

Evènements périodiques organisés par Attijariwafa bank à destination de sa clientèle exportatrice • Débats sur les tendances export avec intervention d' experts |

|

Guide utilisateur - E-Attijari

e-Attijari est le service de banque à distance d'Attijariwafa bank Europe N B : Pour l'édition des mouvements des comptes, le format PDF est disponible pour |