401k withdrawal cares act

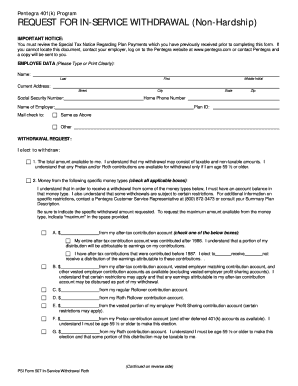

What is the CARES Act?

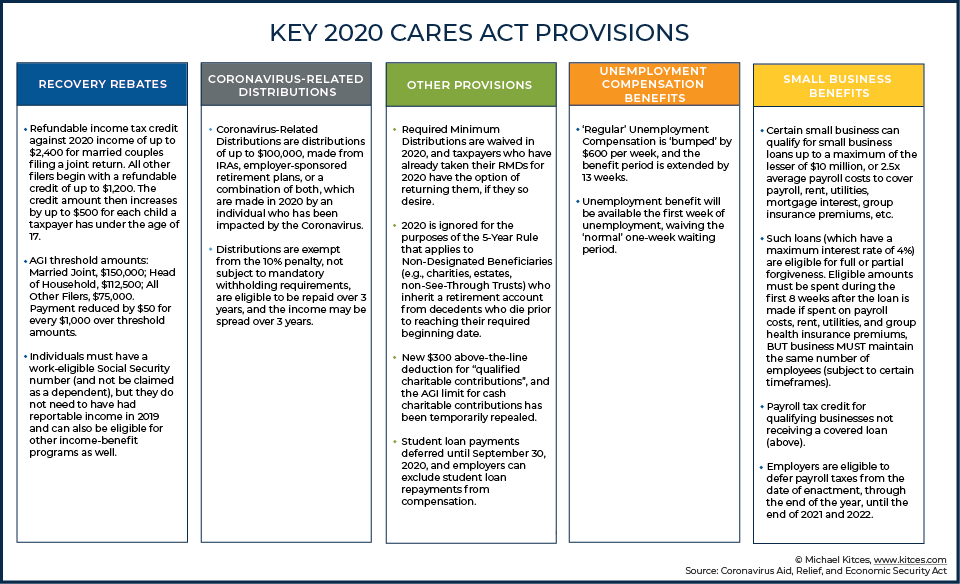

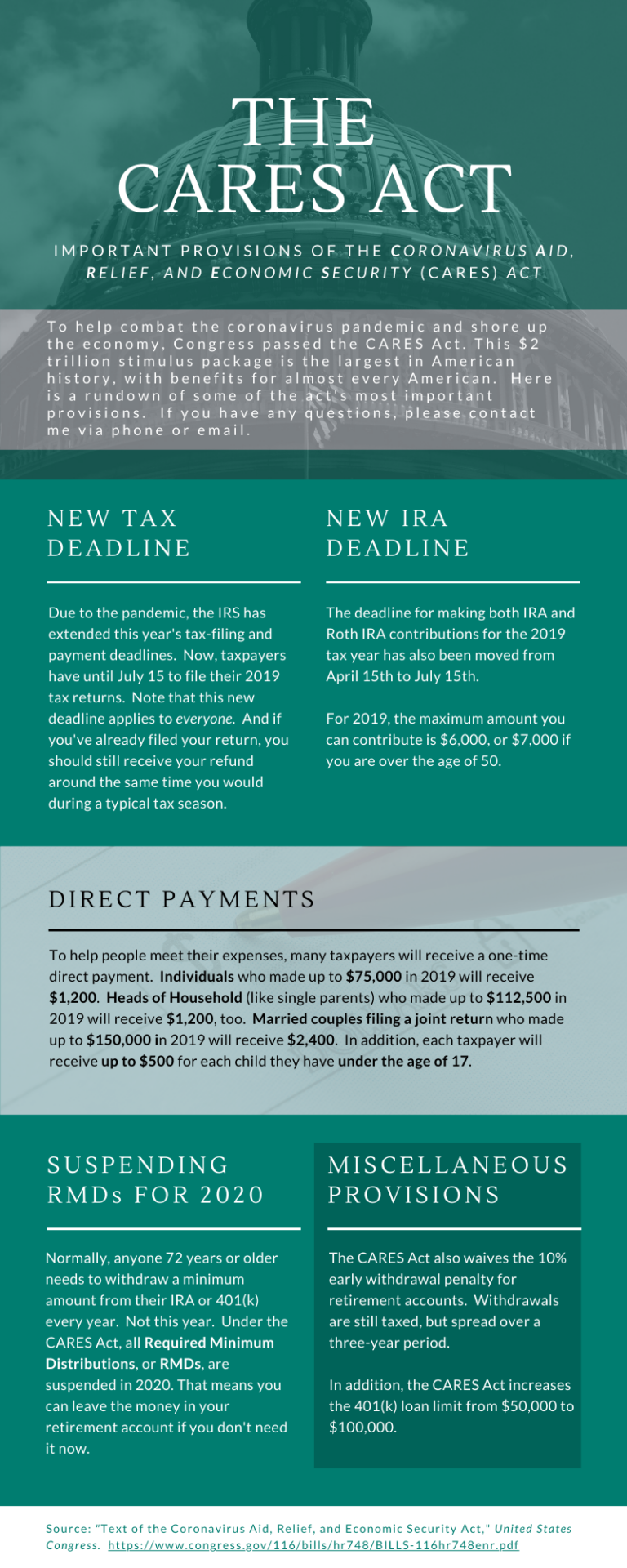

This relief provides favorable tax treatment for certain withdrawals from retirement plans and IRAs, including expanded loan options. The CARES Act waives required minimum distributions (RMDs) during 2020 for IRAs and retirement plans, including for beneficiaries with inherited IRAs and accounts inherited in a retirement plan.

Are 401(k) withdrawals taxable?

Normally, any withdrawals from a 401 (k), IRA or another retirement plan have to be approved by the plan sponsor, and they carry a hefty 10% penalty. Any COVID-related withdrawals made in 2020, though, are penalty-free. You will have to pay taxes on those funds, though the income can be spread over three tax years.

What happens if you withdraw from a 401(k) in 2020?

It also brought major changes for many people financially, including their retirement savings and taxes. Normally, any withdrawals from a 401 (k), IRA or another retirement plan have to be approved by the plan sponsor, and they carry a hefty 10% penalty. Any COVID-related withdrawals made in 2020, though, are penalty-free.

What is the CARES Act 401(k) withdrawal?

The act provides access to retirement funds from 401 (k) plans. The CARES Act 401 (k) Withdrawal allows those with a 401 (k) plan to withdraw their funds for financial hardship reasons relative to the COVID-19 pandemic without being penalized. The bill was signed into law on March 27, 2020 by President Donald Trump.

|

Guidance for Coronavirus-Related Distributions and Loans from

Section 2202 of the CARES Act also increases the allowable plan loan amount Section 401(k)(2)(B)(i) generally provides that amounts attributable to. |

|

Recontribution of CARES Act Distribution(s) (Rollover Contribution

(such as a 401(a) 401(k) plan |

|

Mass.gov

A CARES Act withdrawal is a special distribution option that a retirement plan participant can take through December 30 2020. The early withdrawal penalty is |

|

Voya Updates on the CARES Act

RMD Waivers: Required minimum distributions (RMDs) for 2020 are waived for 401(a) plans (including 401(k) plans 403(b) plans |

|

DISB Consumer Alert: COVID-19 Related Early Withdrawals from

amounts they withdraw. Unfortunately unscrupulous promoters have used these CARES Act benefits to encourage investors to take money from their 401(k)s or |

|

ADP

The Act allows affected retirement plan participants to take distributions in 2020 of up to $100000 from a retirement plan or IRA and these withdrawals are not |

|

Voya Updates on the CARES Act

The Coronavirus Aid Relief |

|

CARES ACT 401(k) LOAN PAYMENT DEFERMENTS ATTN: Fidelity

ATTN: Fidelity 401(k) Participants that elected a CARES Act 401(k) loan deferment. In October 2020 Fidelity will be sending a reminder to applicable plan |

|

Notice 2020-50 PDF - Internal Revenue Service

The CARES Act was enacted on March 27, 2020 Under section 2202 of the CARES Act, qualified individuals receive favorable tax treatment with respect to distributions from eligible retirement plans that are coronavirus-related distributions |

|

Common Tax Questions on CARES Act Withdrawals - Fidelity

The CARES Act allows “qualified individuals” to withdraw money from an eligible workplace retirement plans [such as a 401(k) or 403(b)] Nonqualified and |

|

Understanding the CARES Act and what it means for you - NCPlans

26 mai 2020 · The NC 401(k) and NC 457 Plans allow for hardship withdrawals for economic reasons not covered by the CARES Act or directly tied to the |

|

The CARES Act - ADP

The Act allows affected retirement plan participants to take distributions in 2020 of up to $100,000 from a retirement plan or IRA and these withdrawals are not |

|

Withdrawal – Coronavirus Related Distribution (CARES Act) - Varipro

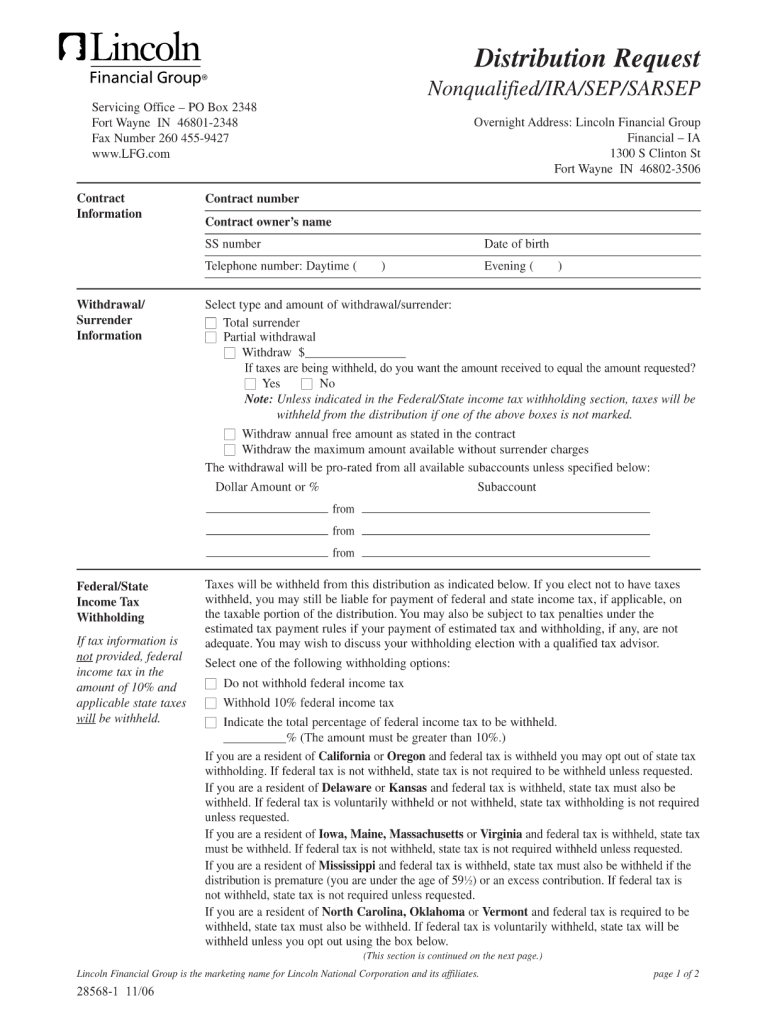

Unless you elect otherwise, you will be subject to 10 withholding for federal income taxes, plus any applicable state tax withholding • The CRD may be repaid to |

|

COVID-19 Related Early Withdrawals from Retirement Accounts

amounts they withdraw Unfortunately, unscrupulous promoters have used these CARES Act benefits to encourage investors to take money from their 401(k)s or |

|

How to Tap Your Retirement Savings Penalty-Free Under the - Finivi

If you are under age 59 ½, qualify under the CARES ACT, and withdraw money from your IRA, 401(k), or another covered qualified retirement plan during 2020, |

|

Understanding the provisions of the CARES Act and other

31 août 2020 · all types of defined contribution plans (including 401(k), 403(b), ••Have an The CARES Act creates a new distribution type available from |

|

CARES Act Offers Economic Relief to Employees - Twenty Over Ten

If allowed by your plan, greater access to retirement funds through a new withdrawal provision from 401(a), 401(k), 403(b), and governmental 457(b) plans , and |