401k withdrawal covid fidelity

|

Cares Act Distributions Income tax

The Coronavirus Aid Relief and Economic Security Act (“CARES Act”) provides special tax treatment for up to $100000 in distributions from all 401(a) 401(k) 403(a) 403(b) and governmental 457(b) plans and individual retirement accounts (IRAs) made to qualified individuals on and after January 1 2020 and before December 31 2020 |

|

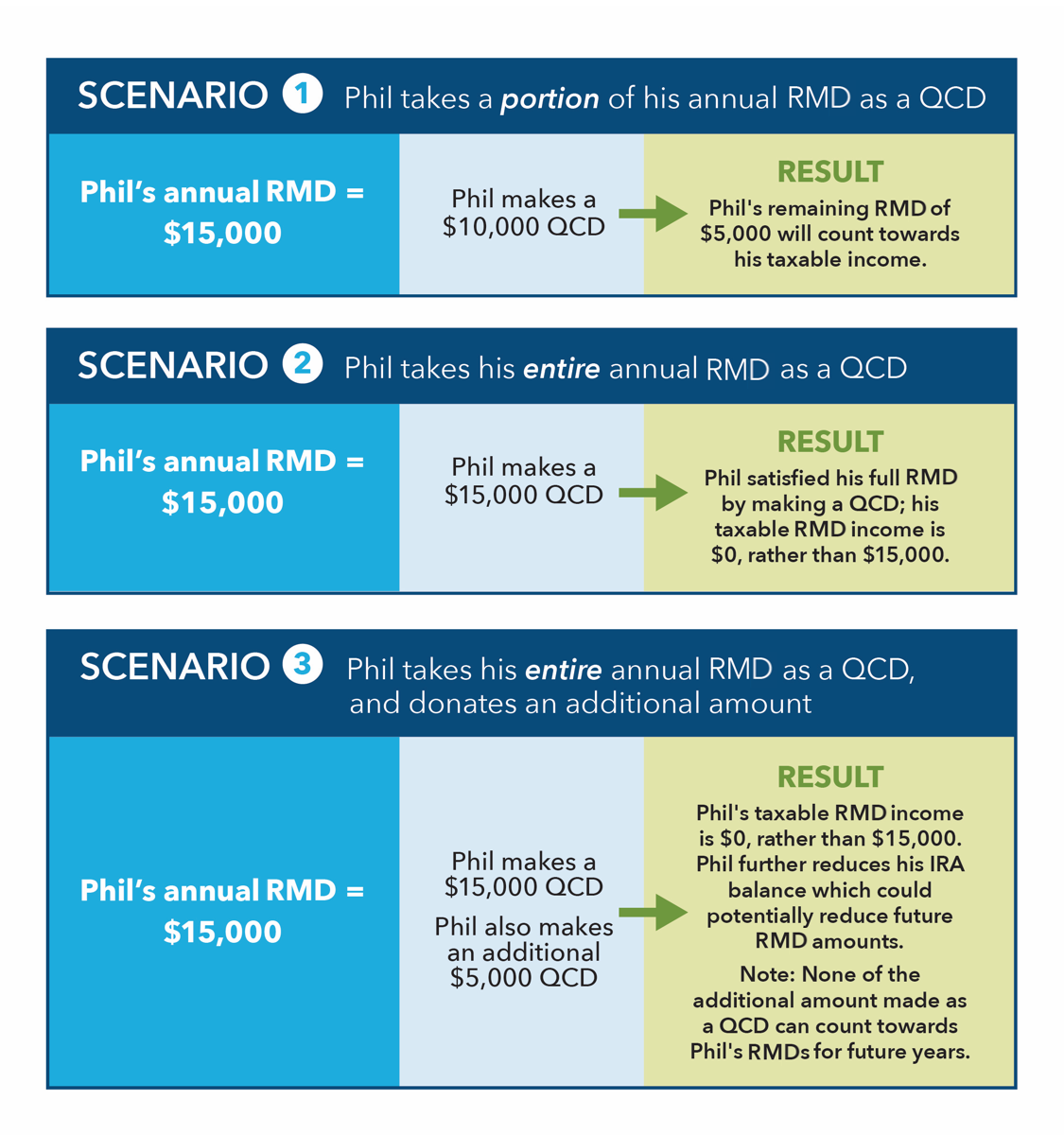

Impact of the CARES Act on 2020 Minimum Required Distributions

The Coronavirus Aid Relief and Economic Security (CARES) Act waives the MRD requirement for the 2020 distribution calendar year for defined contribution |

|

Distribution — Financial Hardship

Use this form to request a one-time cash distribution for hardship reasons from your 401(a) 401(k) 403(b) or 457(b) governmental employer plan |

Can I pull money out of my 401k?

Yes, you can withdraw money from your 401(k) before age 59½.

However, early withdrawals often come with hefty penalties and tax consequences.

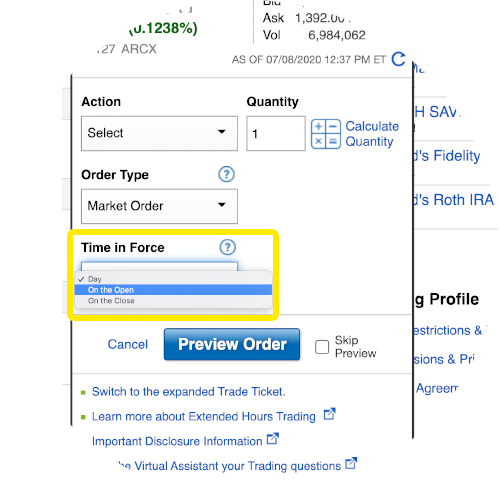

If you find yourself needing to tap into your retirement funds early, here are rules to be aware of and options to consider.Can I withdraw my 401k from Fidelity?

For a withdrawal from your Employer-Sponsored Retirement Plan (such as a 401k or 403b) Single Withdrawal Request (You will be directed to NetBenefits.

Once you log into NetBenefits, choose the account from which you want to withdraw.

Then click on Loans, Rollovers, and Withdrawals.)What qualifies as hardship for 401k withdrawal Fidelity?

The IRS considers immediate and heavy financial need for hardship withdrawal: medical expenses, the prevention of foreclosure or eviction, tuition payments, funeral expenses, costs (excluding mortgage payments) related to purchase and repair of primary residence, and expenses and losses resulting from a federal

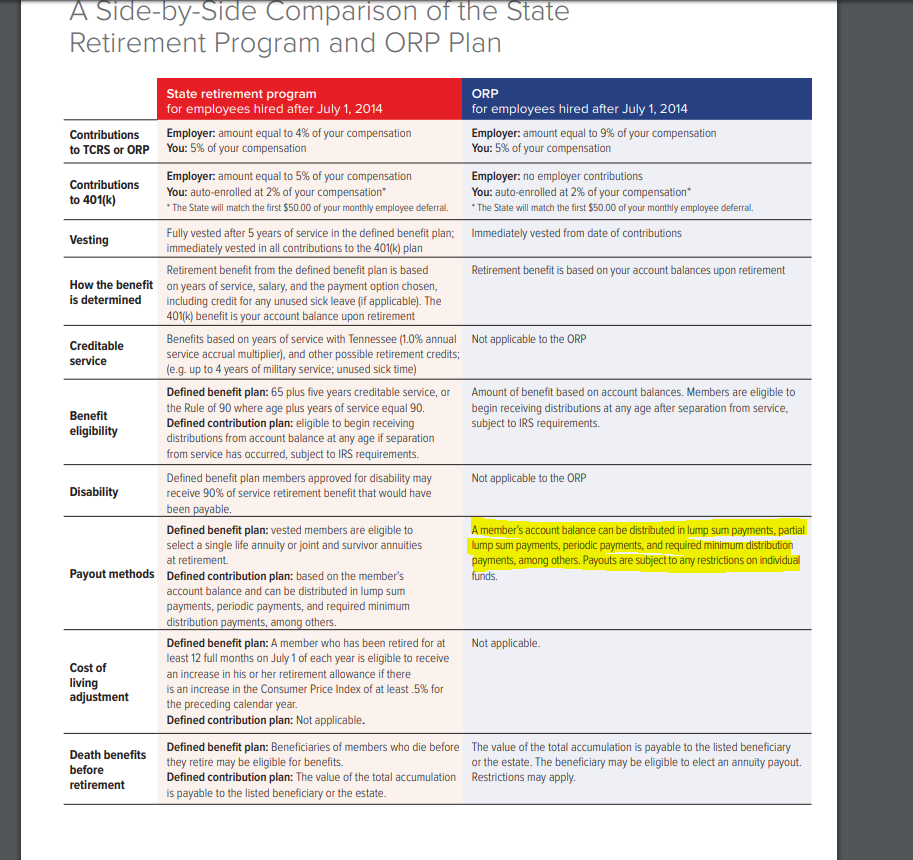

Generally, you have 4 options for what to do with your savings: keep it with your previous employer, roll it into an IRA, roll it into a new employer's plan, or cash it out.

How much money you have vested in your retirement account may impact what decision you make.

|

Recontribution of CARES Act Distribution(s) - Communications

or contact a Fidelity Phone Representative at 800-835-5097 ) (such as a 401(a ), 401(k) plan, 403(b) plan, 457(b) governmental plan), if it accepts such ( Guidance for Coronavirus-Related Distributions and Loans from Retirement Plans |

|

Consolidated Appropriations Act, 2021 - Fidelity Investments

31 déc 2020 · The CAA did not extend the Coronavirus, Aid, Relief, and Economic Security Act ( “CARES Act”) retirement The CARES Act did not allow the in-service withdrawal available to qualified individuals2 in 401(k), 403(b), or |

|

CARES Act - Fidelity Investments

1 avr 2020 · The Coronavirus Aid, Relief, and Economic Security Act (CARES Act) treatment for up to $100,000 in distributions from all 401(a), 401(k), |

|

CORONAVIRUS AID, RELIEF, AND ECONOMIC SECURITY ACT

Act), the third COVID-19 relief bill, into law The more than $2 trillion highlighted below impact Fidelity and Fidelity customers withdrawal penalty for distributions up to $100,000 from qualified (including 401(k), 403(b), and governmental |

|

CORONAVIRUS DISEASE 2019 - Trinity Health

30 déc 2020 · CARES Act Loans and Withdrawals Important Dates and Deadlines Fidelity, our retirement plans partner, is taking several steps to support Trinity 401(k) and 403(b) Retirement Savings Plans before December 31, 2020 |

|

Call Fidelity Investments at 1-800-835-5095 Visit the Fidelity COVID

of the HMSHost 401(k) Retirement Savings plan that can assist participants in managing the financial impact of the COVID-19 crisis Hardship Withdrawals |

|

CARES Act Distribution Form - UA Local 50

401(a) plan, 401(k) plan, 403(b) plan, or governmental 457(b) plan) within three years Use this form to obtain a coronavirus-related distribution under the CARES Act (a distributions, please call a Fidelity Retirement Service Specialist at |

|

3-30-2020 Advance Notice to the Union re: 401(k) Coronavirus

30 mar 2020 · CARES Act Distributions will be implemented for Eligible Plans and processed by Fidelity as described below after the CARES Act is fully |