The FBAR - KPMG

|

KPMG report: 2020 FBAR update; revisit the rules while relief

KPMG report: 2020 FBAR update; revisit the rules while relief is available U S owners of certain foreign financial accounts (and U S individuals with authority over the accounts) are required to file annual reports—on FinCEN Form 114 Report of Foreign Ban“ k and Financial Accounts (FBAR) |

|

United States Updates to FBAR Exam Procedures

The U S Internal Revenue Service (“IRS”) recently issued interim guidance updating Report of Foreign Bank and Financial Accounts (“FBAR”) examination policy and procedures 1This interim guidance which was issued in response to a recent ruling from the Supreme Court of the United States2(“the Court”) updates the Internal Revenue Manual (“IRM”) |

|

FBAR Reporting: Changes Are in the Wind

Overview of FBAR Rules The Bank Secrecy Act which was enacted in 1970 imposes reporting requirements on profit and not-for-profit entities with respect to certain foreign bank and financial accounts which must be filed by June 30 of each year (at least until the due date changes next year) |

|

KPMG report: FBAR update for officers employees

FBAR enforcement activities is indisputably money laundering and tax evasion taxpayers who fully report income from foreign financial accounts but who inadvertently neglect to satisfy technical reporting requirements can potentially be ensnared Read a March 2019 report [PDF 171 KB] prepared by KPMG LLP: What’s News in Tax: FBAR Update: |

|

FBAR Update: No New Rules But Enforcement Threat Looms

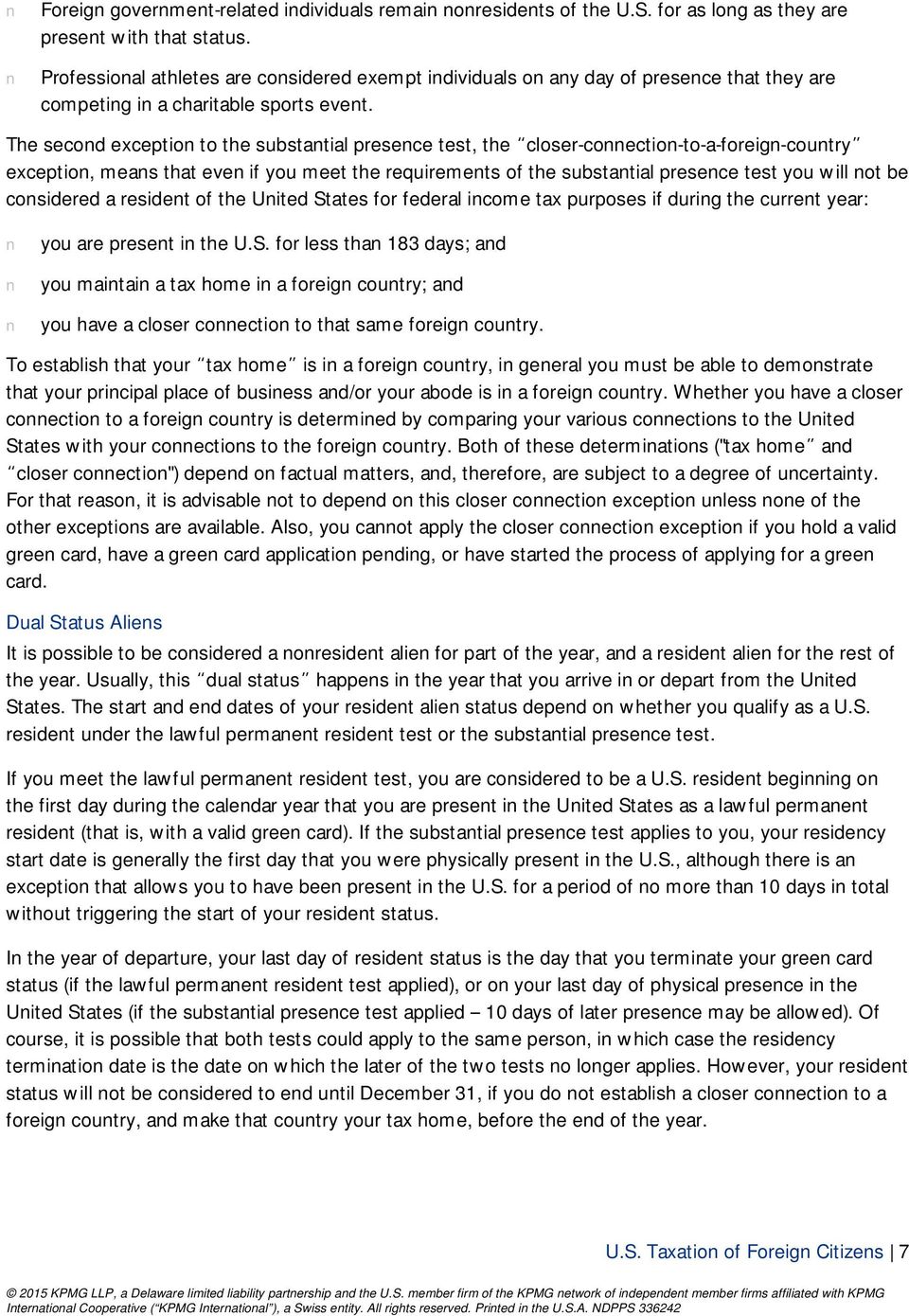

Generally FBAR reporting applies to each “United States person” (U S person) who has a financial interest in or signature or other authority over foreign financial accounts that have an aggregate value exceeding $10000 at any time during the calendar year |

|

What’s News in Tax

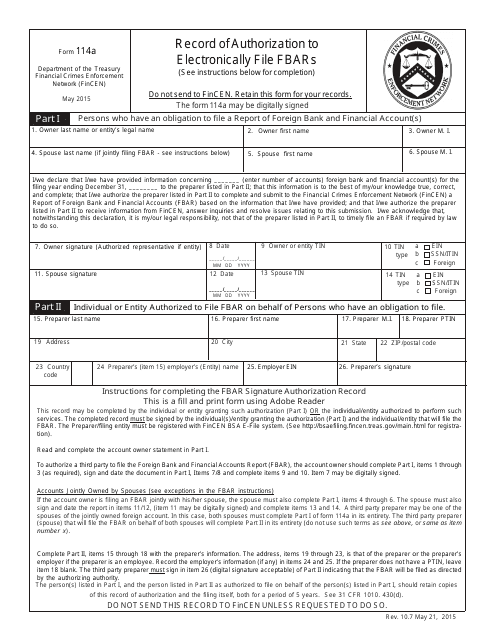

The due date for 2019 FBARs is April 15 2020 (the same as for federal individual income tax returns) but a six-month automatic extension of the filing deadline to October 15 is available without having to file a specific extension request FBARs must be filed electronically |

Do I need to file FBAR If I don't have a financial interest?

Certain U.S. persons may be required to file an FBAR even if they do not have a financial interest in a foreign financial account. FBAR reporting is required by a U.S. person who is an individual and who (alone or in conjunction with another) has signature or other authority over bank, securities, or other financial accounts in a foreign country.

Should a consolidated FBAR be reported in Part 2?

When a consolidated FBAR is filed, all reportable accounts are shown in Part V, even those directly owned by the filer. In other words, accounts should not be reported in Part II if a consolidated report is filed. Certain U.S. persons may be required to file an FBAR even if they do not have a financial interest in a foreign financial account.

Should foreign financial accounts be reported on the FBAR?

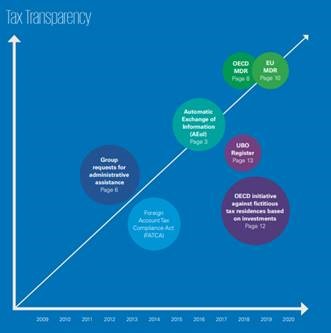

It has been six years since Congress enacted the Foreign Accounts Tax Compliance Act (“FATCA”), which focused renewed attention on the independent and longstanding requirement to annually report foreign financial accounts on the FBAR.

What changes have been made to the FBAR rules?

Finally, it reviews proposed changes to the FBAR rules issued last month. The Bank Secrecy Act, which was enacted in 1970, imposes reporting requirements on profit and not-for-profit entities with respect to certain foreign bank and financial accounts, which must be filed by June 30 of each year (at least until the due date changes next year).

|

2020 FBAR Update: Revisit the Rules While Relief Is Available

23 mar. 2020 The KPMG name and logo are registered trademarks or trademarks of KPMG International. Indeed in light of potential penalties for FBAR ... |

|

FBAR Reporting: Changes Are in the Wind

4 avr. 2016 FBAR reports with special focus on the current limited exceptions to ... The KPMG name |

|

FBAR filings: Deadline extended once again—to April 15 2023—for

9 déc. 2021 2021 KPMG LLP a Delaware limited liability partnership and a member firm ... This further extension of the FBAR deadline is being granted ... |

|

FBAR Update: Officers and Employees Should Remain Vigilant

18 mar. 2019 The KPMG name and logo are registered trademarks or trademarks of KPMG International. Snapshot: Requirements for 2018 FBAR Filing. |

|

Update Regarding FBAR Filing Requirements for Foreign Securities

You have received this message from KPMG LLP. If you wish to unsubscribe from Alternative Investment. Tax Matters please click here. If you wish to unsubscribe |

|

IES Flash Alert 2013-092 Egypt – Law Ushers in New Tax

26 jui. 2013 2013 KPMG Hazem Hassan Public Accountants & Consultants an Egyptian partnership and a member firm of the KPMG. |

|

Flash Alert

1 sept. 2017 Tax Filing and FBAR Due Date Relief for ... The FBAR for calendar year 2016 ... United States In this recent TaxWatch video KPMG's Jill. |

|

US / Swiss Taxation of Novartis Pension Plans October 11 2016

11 oct. 2016 2016 KPMG AG is a subsidiary of KPMG Holding AG ... KPMG. Kathy Stanley. US Tax Director ... Pensions -reporting on FBAR and Form 8938. |

|

GMS Flash Alert 2018-044 South Korea – Changes in Income Tax

2 mar. 2018 2018 KPMG Samjong Accounting Corp. the Korea member firm of the KPMG network of independent member firms ... (“FBAR”) by 30 June. |

|

2020 FBAR Update: Revisit the Rules While Relief Is - assetskpmg

23 mar 2020 · 2020 KPMG LLP, a Delaware limited liability partnership and the U S This article reviews the filing deadline for FBAR reports, current |

|

FBAR Update - KPMG International

12 mar 2018 · Form 114, Report of Foreign Bank and Financial Accounts (“FBAR”) This article alerts taxpayers to the filing deadline for FBAR reports, |

|

FBAR Reporting: Changes Are in the Wind - KPMG International

4 avr 2016 · FinCEN Form 114, Report of Foreign Bank and Financial Accounts (the “FBAR”), has become an area of increased focus Electronic filing is |

|

Production de FBAR par des personnes des États-Unis - KPMG

17 avr 2018 · FBAR – Citoyens américains résidant au Canada : conformez-vous afin d'éviter les pénalités Un nouvel article de KPMG aux États-Unis clarifie |

|

Update Regarding FBAR Filing Requirements for Foreign Securities

Generally, FBAR reporting (FinCEN Form 114) applies to each “United States As you evaluate the issue of whether foreign securities accounts create FBAR filing If you wish to unsubscribe from all KPMG communications, please click |

|

Fbar reporting deadline

The PDF file of the FBAR Financial Crimes Network (FinCEN) has issued a notice KPMG International and its member firms are legally separate and separate |

|

Fbar reporting deadline - Weebly

For more detailed information on the structure of the KPMG global organisation, see Flash Alert is a global mobility services publication of KPMG LLPs |

|

SILVER - SIFMA

At KPMG LLP (KPMG), we come to work every day because we are passionate about helping our clients address Foreign Bank Account Reporting (FBAR) |