asset securitization pdf

|

Asset Securitization and Optimal Asset Structure of the Firm

The process of asset securitization is a new and innovative financing method used for funding and risk management purposes Evolved over the last few decades securitization represents a substantial and established part of US and global capital markets In addition to its importance as a financial and asset restructuring tool securitization origin |

|

Asset Securitization

Definition Asset securitization is the structured process whereby interests in loans and other receivables are packaged underwritten and sold in the form of “asset- backed” securities From the perspective of credit originators this market enables them to transfer some of the risks of ownership to parties more willing or able to manage them |

|

The Role of Banks in Asset Securitization

asset-backed-securitization activity from 1978 to 2008 For each asset-backed security (ABS) we focus on the primary roles in securitization: issuer underwriter trustee and servicer These four roles are critical in the life of an asset-backed security extending from issuance through maturity and |

|

What Is Securitization?

Securitization is the process in which certain types of assets are pooled so that they can be repackaged into interest-bearing securities The interest and principal payments from the assets are passed through to the purchasers of the securities |

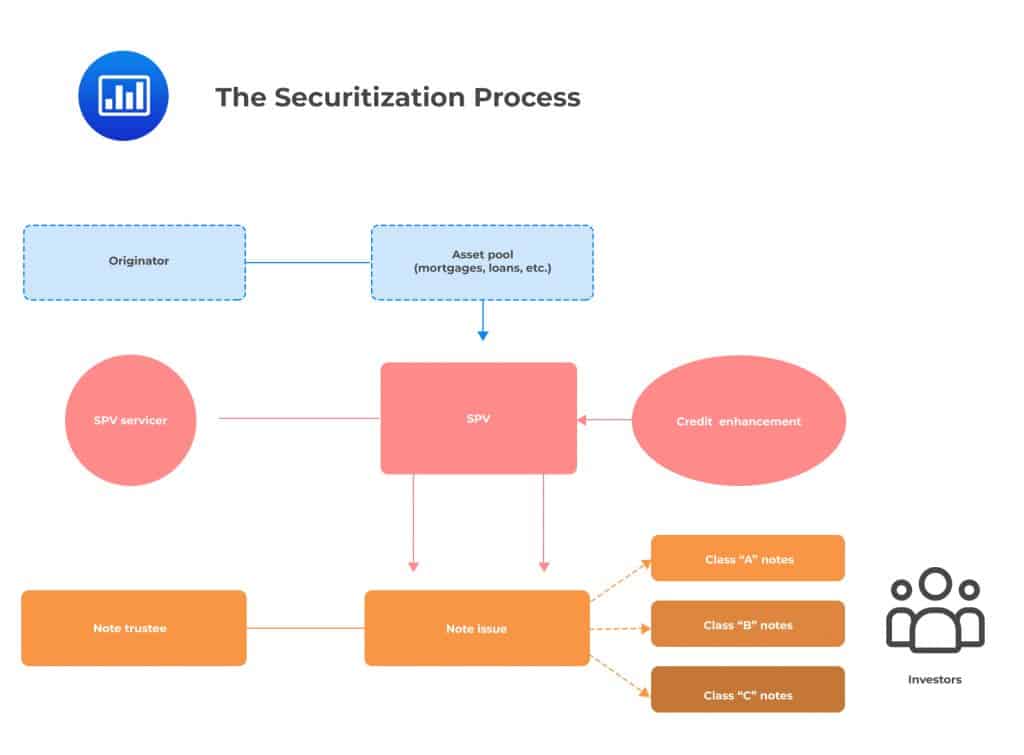

What are the key roles in the securitization process?

The exhibit highlights the key roles in the securitization process: issuer, underwriter, rating agency, servicer, and trustee.2 The issuer (sometimes referred to as sponsor or originator) brings together the collateral assets for the asset-backed security.

Should asset securitization be considered a risk based capital decision?

Asset Securitization 40 Comptroller’s Handbook balance sheet and additional risk-based capital. Although such a decision is for management to make, examiners should ensure appropriate risk-based capital levels are maintained for the risks assumed.

Are banks relying on securitization markets to absorb new asset-backed security issues?

A second concern is unmitigated dependence on securitization markets to absorb new asset-backed security issues — a mistake that banks originating assets specifically for securitization are more likely to make. Such a bank may allocate only enough capital to support a “flow” of assets to the securitization market.

What is asset securitization?

Definition Asset securitization is the structured process whereby interests in loans and other receivables are packaged, underwritten, and sold in the form of “asset- backed” securities. From the perspective of credit originators, this market enables them to transfer some of the risks of ownership to parties more willing or able to manage them.

Abstract

The process of asset securitization is a new and innovative financing method used for funding and risk management purposes. Evolved over the last few decades, securitization represents a substantial and established part of US and global capital markets. In addition to its importance as a financial and asset restructuring tool, securitization origin

1 Introduction

Firms own multiple assets and the nature of the assets varies across the firms. For a specific multi-asset firm, the assets can be similar to each other, indicating that the firm is focused and it has minimized the potential conflicts which are caused by holding widely diverse assets. Alternatively, the assets can be different from each other, sugg

2 V1V2

The value of equity is equal to the total value of the firm minus the value of debt haas.berkeley.edu

4 Comparative analysis of different models

Our research continues with a comparative analysis of the models developed in the previous sections. There are two main goals which we want to achieve. First we want to focus on the multi-asset firm. Using the closed-form solutions for the total value of the multi-asset firm, the value of its contingent claims, and the optimal leverage, we can prov

5 Conclusions

The main goal of our project is to provide an answer to the question why firms securitize their assets. In order to clarify this issue we developed a valuation models for the multi-asset firm, the single-asset firm and the securitization vehicle. Each of these business entities issues its own debt and equity securities. We also determined the optim

|

Asset Securitization and Structured Financing: Future Prospects and

Asset securitization was initially practiced by financial institutions who securitized home mortgage loans transforming them to mortgage backed securities. |

|

Asset Securitization Comptrollers Handbook

Although purchasing asset-backed securities as investments clearly helps to diversify assets and manage credit quality these benefits are discussed in other |

|

World Bank Document

In order to finance the purchase of the assets the SPV issues bonds into the capital markets. The bonds are referred to as “asset-backed securities” because |

|

Asset securitisation

developing a comprehensive capital framework for asset securitisation third party that issues asset-backed securities (ABS) that are claims against ... |

|

Understanding Securitisation

Securitisation is a financing technique by which homogeneous income-generating assets ? which on their own may be difficult to trade ? are pooled and sold to |

|

Revisions to the securitisation framework - Basel III document

assets requires a lower capital surcharge than a securitisation with to the Basel II framework July 2009 |

|

The Role of Banks in Asset Securitization

The Role of Banks in Asset Securitization mechanisms such as issuance of commercial paper backed by the securitized assets. And the creation of these new |

|

Climate Risk Measurement of Assets Eligible as Collateral for

6 janv. 2022 Keywords: Collateral Framework Asset-Backed Securities (ABS) |

|

THE SECURITISATION AND RECONSTRUCTION OF FINANCIAL

Exemption from registration of security receipt. 9. Measures for assets reconstruction. 10. Other functions of asset reconstruction company. 11. Resolution of |

|

Guideline B-5: Asset Securitization

This guideline sets out OSFI's general expectations with respect to asset securitization transactions. The guideline supplements the Life Insurance Capital |

|

Asset Securitization - Office of the Comptroller of the Currency (OCC)

The discussion of risk focuses on banks' roles as financial intermediaries, that is, as loan originators and servicers rather than as investors in asset-backed |

|

Asset securitisation - Bank for International Settlements

Synthetic securitisation refers to structured transactions in which banks use credit derivatives to transfer the credit risk of a specified pool of assets to third parties |

|

Asset Securitization and Structed Financing - International Monetary

Asset securitization was initially practiced by financial institutions who securitized home mortgage loans, transforming them to mortgage backed securities |

|

Asset Securitization in Asia - NYU Stern

The term asset-backed security (ABS) is generally applied to issues backed by non-mortgage assets Asset securitization techniques are being embraced by a |

|

ASSET SECURITISATION AS A RISK MANAGEMENT AND - CORE

The following paper acknowledges the topical nature of asset securitisation and probes (available at http://www securitization net/ pdf /gerling_new_0302 pdf ) |

|

Securitization Structured finance solutions - Deloitte

2 1 Benefits of securitization 9 2 2 The process 10 2 3 Types of asset-backed securities 10 2 4 Risk and return profiles of tranche notes 11 2 5 The cash flow |

|

Securitization - World Bank Document

In order to finance the purchase of the assets, the SPV issues bonds into the capital markets The bonds are referred to as “asset-backed securities” because the |

|

Wealth effects from asset securitization - DiVA

Asset securitization is a process in which one company (originator) pools and transfers (sells) its assets, which can be mortgage loans, credit card receivables, |

|

The Actual Problems of Assets Securitization in - Revista ESPACIOS

Asset Securitization is the structured process whereby interests in loans and other receivables are packaged, underwritten, and sold in the form of “asset- backed” |

|

Securitization;

Securitization is the pooling of cash flows and the securities backed by underlying assets ▫ The repayment of securities is Asset backed securities ( ABS) |

![PDF] Contemporary Phase of Securitization in the Russian PDF] Contemporary Phase of Securitization in the Russian](https://imgv2-2-f.scribdassets.com/img/document/344350991/298x396/15e49a2b4d/1491549711?v\u003d1)

![PDF] The effects of asset securitization on sustainability PDF] The effects of asset securitization on sustainability](https://pressroom-en.natixis.com/media/cache/natixis-groupe_asset_card_grid_fs/5d25b54a1e57656c8a75628d)

![PDF] The effects of asset securitization on sustainability PDF] The effects of asset securitization on sustainability](http://ws-na.amazon-adsystem.com/widgets/q?_encoding\u003dUTF8\u0026Format\u003d_SL_300_\u0026ASIN\u003d1888215062\u0026MarketPlace\u003dUS\u0026ID\u003dAsinImage\u0026WS\u003d1\u0026ServiceVersion\u003d20070822)