401k withdrawal covid qualifications

|

COVID-19 Related Early Withdrawals from Retirement Accounts

You will not owe income tax on the amount borrowed from the 401(k) if you pay it back within five years In addition qualified individuals with an outstanding |

|

Guidance for Coronavirus-Related Distributions and Loans from

BACKGROUND A Distributions Under § 402(c)(8) an eligible retirement plan includes an individual retirement arrangement (IRA) under § 408(a) or (b) a qualified plan under 401(a) an annuity plan under § 403(a) a § 403(b) plan and a governmental deferred compensation plan under § 457(b) |

Age 59½ and over: No Traditional IRA withdrawal restrictions

Once you reach age 59½, you can withdraw funds from your Traditional IRA without restrictions or penalties.

What are the terms of withdrawal from 401K?

401(k) withdrawals

Pros: You're not required to pay back withdrawals and 401(k) assets.

Cons: Hardship withdrawals from 401(k) accounts are generally taxed as ordinary income.

Also, a 10% early withdrawal penalty applies on withdrawals before age 59½, unless you meet one of the IRS exceptions.

How do I withdraw money from my 401K?

By age 59.5 (and in some cases, age 55), you will be eligible to begin withdrawing money from your 401(k) without having to pay a penalty tax.

You'll simply need to contact your plan administrator or log into your account online and request a withdrawal.

- You have been diagnosed with COVID-19.

- Your spouse or a dependent has been diagnosed with COVID-19.

- You have financial issues because of being quarantined, furloughed or laid off due to COVID-19.

|

Guidance for Coronavirus-Related Distributions and Loans from

to distributions from eligible retirement plans that are coronavirus-related distributions. A section 401(k) plan distributes $35000 to a qualified. |

|

2021 Instructions for Form 5329

1 sept 2021 apply to qualified disaster distributions including 2020 coronavirus-related distributions. ... stock bonus plan (including a 401(k) plan);. |

|

Instructions for Form 8915-F (Rev. February 2022)

15 feb 2022 Qualified Disaster Retirement Plan Distributions and Repayments. Department of the Treasury ... in 2021 (coronavirus-related distributions. |

|

2020 Instructions for Form 8915-E

11 feb 2021 Qualified 2020 Disaster Retirement Plan Distributions and Repayments. (Use for Coronavirus-Related and Other Qualified 2020 Disaster ... |

|

DISB Consumer Alert: COVID-19 Related Early Withdrawals from

considerations for investors thinking of using 401(k) withdrawals or The CARES Act allows qualified individuals impacted by the coronavirus pandemic to. |

|

Form 8915-F (January 2022)

Did you claim coronavirus-related distributions on 2020 Form 8915-E? Did you claim qualified disaster distributions on a prior year's Form 8915-F (or on ... |

|

COVID-19 and Non-Qualified Deferred Compensation Plans

Before 2020 participants taking a safe harbor hardship withdrawal from a 401(k) plan were required to suspend all deferrals for six months |

|

2021 Instructions for Form 8915-D

14 feb 2022 We have retired Form 8915-E Qualified. 2020 Disaster Retirement Plan Distributions and Repayments |

|

Mass.gov

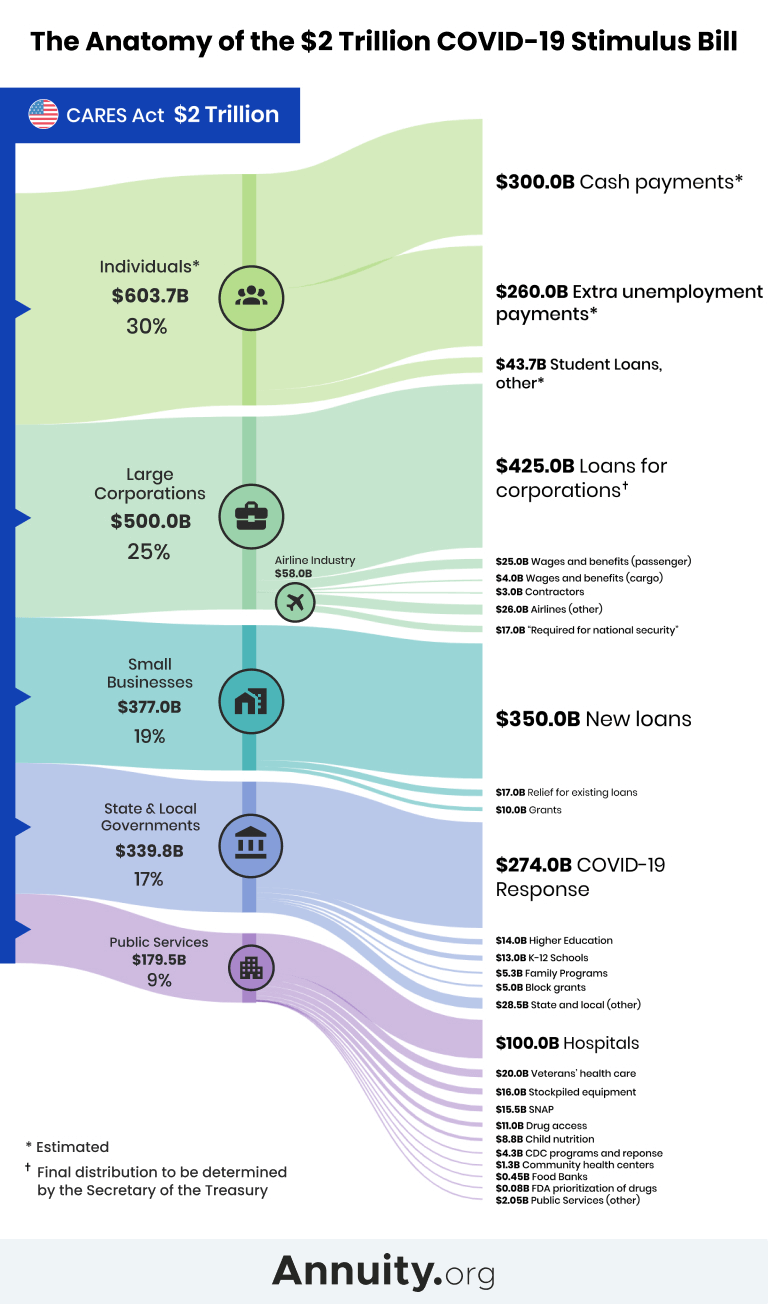

The Coronavirus Aid Relief |

|

Notice 2020-50 PDF - Internal Revenue Service

Thus, periodic payments and distributions that would have been required minimum distributions but for section 2203 of the CARES Act, received by a qualified individual from an eligible retirement plan on or after January 1, 2020, and before December 31, 2020, are permitted to be treated as coronavirus-related |

|

2020 Instructions for Form 8915-E - Internal Revenue Service

11 fév 2021 · Qualified 2020 Disaster Retirement Plan Distributions and Repayments (Use for Coronavirus-Related and Other Qualified 2020 Disaster Distributions) Department more than one type of plan, such as a 401(k) plan and an |

|

Coronavirus-Related Distributions

The “eligible retirement plans” from which CRDs can be taken are IRAs, individual retirement annuities, qualified retirement plans such as 401(k) plans, 403(a) and |

|

COVID-19 401k withdrawal option (also known as coronavirus

31, 2020 401k Loan provision What does the new loan provision in the CARES Act allow? The same eligibility qualifications for |

|

Common Tax Questions on CARES Act Withdrawals - Fidelity

On March 27, 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security Act ( The CARES Act allows “qualified individuals” to withdraw money from an eligible workplace retirement plans [such as a 401(k) or 403(b)] |

|

401(k) - Robert Half

4132-4563-6900 1 401(k) COVID-19 DISTRIBUTION OPTIONS 1 “qualified” participants the ability to take qualified coronavirus-related withdrawals (QCDs) |

|

CORONAVIRUS-RELATED DISTRIBUTIONS (CRDS)

(CARES) Act allows qualified employees to withdraw up to $100,000 total from their 457(b), 401(a), 401(k), and 403(b) plans, as well as any IRA accounts they |

|

Wells Fargo & Company 401(k) Plan - Wells Fargo - Teamworks

22 sept 2020 · In 2020, if you are a Qualified Individual, you may take one or more coronavirus- related distributions from the vested portion of your 401(k) Plan |

|

COVID-19 Distribution Request Form - UA Local 342

1 oct 2020 · S:\Supplemental 401(k) Retirement\Forms\Distributions\Participant I have read the Plan requirements to the Northern California Pipe Trades |

|

How to Tap Your Retirement Savings Penalty-Free Under the - Finivi

The CARES Act (Coronavirus Aid, Relief, and Economic Security) changed and withdraw money from your IRA, 401(k), or another covered qualified retirement plan taxes applied to the withdrawal can be avoided by redepositing the funds |