garch finance

|

Économétrie non-linéaire - Chapitre 4: Modèles GARCH

Modèles ARCH / GARCH sont apparus dans le contexte du débat sur Journal of Finance 48 |

|

An Introduction to the Use of ARCH/GARCH models in Applied

Robert Engle is the Michael Armellino Professor of Finance Stern School of ARCH and GARCH models have become important tools in the analysis of. |

|

Modélisation de la volatilité des rendements Bitcoin par les modèles

Journal of Academic Finance (J.o A.F.). Vol. 13 N° 1 Spring 2022. Modelling the volatility of Bitcoin returns using Nonparametric. GARCH models. Summary. |

|

Financial Econometrics: A Comparison of GARCH type Model

Financial Econometrics: A Comparison of GARCH type Model Performances when This essay investigates three different GARCH-models (GARCH EGARCH and. |

|

Modeling Volatility in the Stock Markets using GARCH Models

are considered as emerging markets in finance. We find that GARCH GJR-GARCH and. EGARCH effects are apparent for returns of PX and BUX |

|

Processus ARCH-GARCH Applications

10 juin 2013 Engle inventé la généralisation du «Modèle ARCH» pour résoudre des problèmes de prévision statistique dans le domaine de la finance. Abstract. |

|

LE CARACTÈRE PRÉVISIONNEL DU MODÈLE GARCH (11)

moyenne historique est couramment utilisée en finance. Fait surprenant ce modèle est le pire modèle de prévisions de la volatilité de l'indice TSE-300 |

|

FINANCE The relationship between GARCH and symmetric stable

finance many of the properties of stable models are shared by GARCH models |

|

Untitled

Le modèle GARCH (1 1) élémentaire a été proposé indépendemment par TAYLOR [1986]. LES MODÈLES ARCH EN FINANCE 5. Page 6. On écrit cette fois :. |

|

Modélisation de la volatilité des rendements Bitcoin par les modèles

Journal of Academic Finance (J.o A.F.) Résultats: Nous montrons que la prévision de volatilité du modèle GARCH non paramétrique donne. |

|

GARCH 101: An Introduction to the Use of ARCH/GARCH - NYU

The ARCH and GARCH models which stand for autoregressive conditional heteroskedasticity and generalized autoregressive conditional heteroskedasticity are designed to deal with just this set of issues They have become widespread tools for dealing with time series heteroskedastic models |

|

GARCH 101: An Introduction to the Use of ARCH/GARCH models

The GARCH-MIDAS model has been the most popular methodology for investigating the relationships between stock market volatility and economic variables of low frequency (Asgharian et al 2013;Conrad et al 2014;Conrad and Loch2015;Su et al |

|

ARCH/GARCH Models in Applied Financial Econometrics

ARCH/GARCH Models in AppliedFinancial Econometrics Abstract: Volatility is a key parameter used in many ?nancial applications from deriva-tives valuation to asset management and risk management Volatility measures the sizeof the errors made in modeling returns and other ?nancial variables |

|

Lecture 9 Volatility Modeling - MIT OpenCourseWare

GARCH Models De ning Volatility Basic De nition Annualized standard deviation of the change in price or value of a nancial security Estimation/Prediction Approaches Historical/sample volatility measures Geometric Brownian Motion Model Poisson Jump Di usion Model ARCH/GARCH Models Stochastic Volatility (SV) Models Implied volatility |

|

Markov-switching GARCH models in finance: a unifying

GARCH (EGARCH) speci?cation in the ?rst and a standard GARCH speci?cation in the second Markov-regime We derive a maximum likelihood estimation framework and apply our general Markov-switching GARCH model to daily excess returns of the German stock market index DAX Our empirical study has two major ?ndings First our estimation results |

|

Consumption Volatility Risk - financewhartonupennedu

uses a GARCH process for consumption volatility Other recent contributions testing the C-CAPM using realized consumption growth include Campbell (1996) A t-Sahalia Parker and Yogo (2004) Campbell and Vuolteenaho (2004) Bansal Dittmar and Lundblad (2005) Lustig and Nieuwerburgh (2005) and Jagannathan and Wang (2007) |

|

Garch Modelling in Finance: A Review of the Software Options

GARCH MODELLING IN FINANCE: A REVIEW OF THE SOFTWARE OPTIONS GAUSS Aptech Systems Inc 23804 S E Kent - Kangley Road Maple Valley WA 93038 USA (tel: 206 432-7855; fax: 206 432-7832) RATS Estima I8oo Sherman Avenue Suite 6I2 Evanston IL 6020I USA (tel: 708 864-8772; fax: 708 864-622I) |

|

GARCH Modelling in Finance: A Review of the Software Options

GARCH Modelling in Finance: A Review of the Software Options GAUSS Aptech Systems Inc 23804 S E Kent - Kangley Road Maple Valley WA 93038USA (tel: 206 432-7855; fax: 206 432-7832) RATS Estima 1800 Sherman Avenue Suite 612 Evanston IL 60201 USA (tel: 708 864-8772; fax: 708 864-6221) |

|

A GARCH Option Pricing Model in Incomplete Markets

1 A GARCH Option Pricing Model in Incomplete Markets Abstract We propose a new method for pricing options based on GARCH models with ?ltered histor- ical innovations In an incomplete market framework we allow for di?erent distributions of the historical and the pricing return dynamics enhancing the model °exibility to ?t market option prices |

|

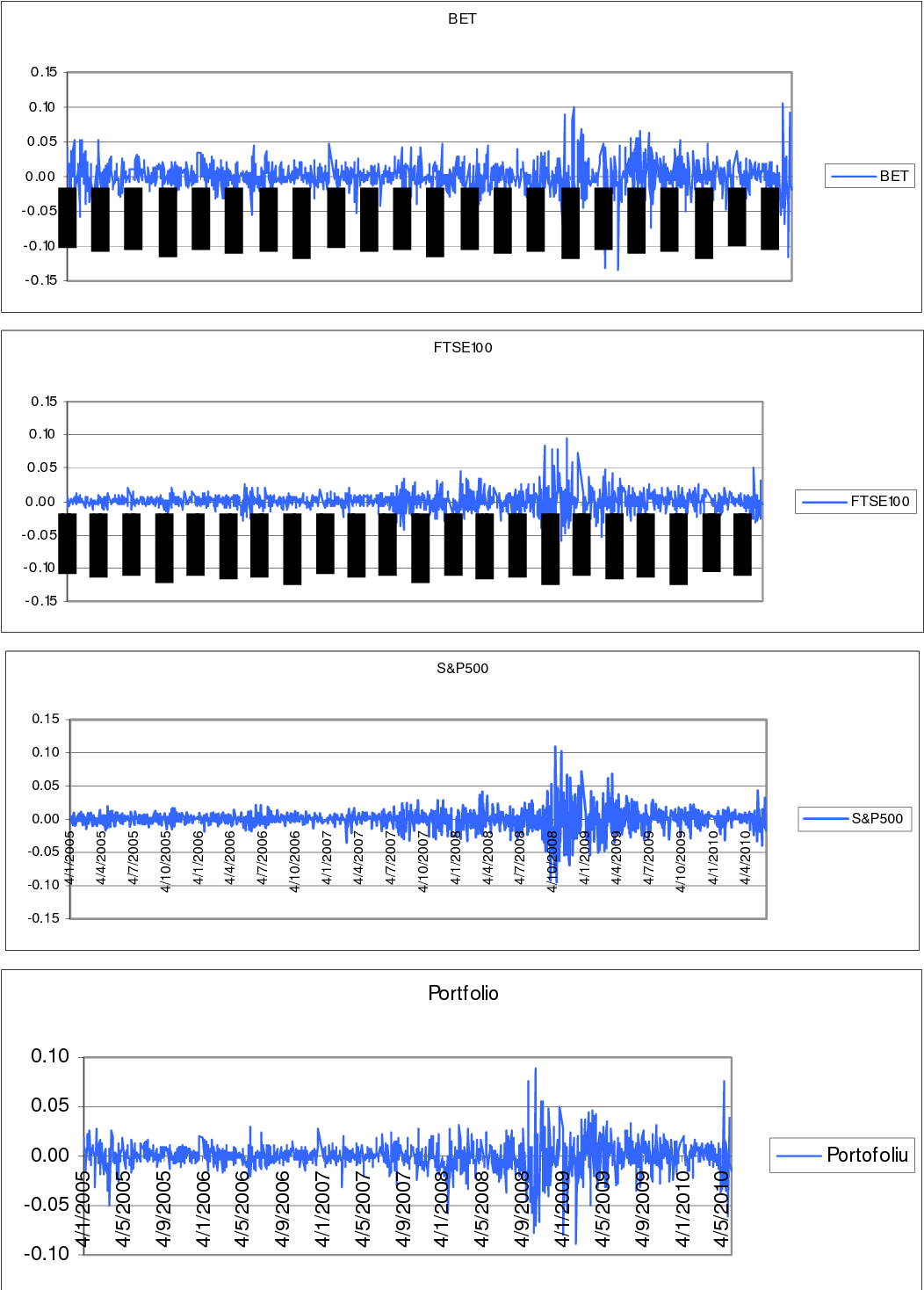

UDC: 33043 : 336 Applying MGARCH Models in Finance

The application of MGARCH models is very wide Some of typical applications are: portfolio optimization pricing of assets and derivatives computation of the value at risk (VaR) futures hedging volatility transmitting and asset allocation |

|

Finance and Economics Discussion Series Divisions of Research

The linear GARCH(1;1) model of Bollerslev (1986) is a workhorse of conditional volatility forecasting in ?nancial economics its applications spanning portfolio formation derivative pricing and risk manage-ment Despite its parsimony this model is shown to outperform (in terms of out-of-sample forecasting) |

|

Searches related to garch finance filetype:pdf

Ardia D 2008 Financial Risk Management with Bayesian Estimation of GARCH Models: Theory and Applications Springer doi:10 1007/978-3-540-78657-3 Bauwens L Preminger A Rombouts J V K 2010 Theory and inference for a Markov switching GARCH model EconometricsJournal 13 218-244 doi:10 1111/j 1368-423X 2009 00307 x Bollerslev T 1986 |

What is a GARCH(1) model?

- GARCH(1,1) model. The (1,1) in parentheses is a standard notation in which the first number refers to how many autoregressive lags or ARCH terms terms. Sometimes models with more than one lag are needed to find good

Why do we use arc and GARCH models?

- ARCH and GARCH models have become important tools in the analysis of time series data, particularly in financial applications. These models are especially useful when the goal of the study is to analyze and forecast volatility.

What is a useful generalization of GARCH model?

- useful generalization of this model is the GARCH parameterization introduced by Bollerslev(1986). This model is also a weighted average of past zero. It gives parsimonious models which are easy to estimate and even in its variances. The most widely used GARCH specification, asserts that the best

Why do we need a multivariate GARCH model?

- While modelling volatility of the returns has been the main centre of attention, understandingthe comovements of ?nancial returns is of great practical importance. It is therefore importantto extend the considerations to multivariate GARCH (MGARCH) models.

|

Modèles GARCH - Gilles de Truchis

Références Séries financières Modèles ARCH / GARCH sont apparus dans le contexte du débat sur Journal of Finance, 48, 1779-1801 Nelson, D , 1991 |

|

(ESA) Econométrie pour la Finance - Univ-Orléans

28 oct 2004 · MASTER ECONOMETRIE ET STATISTIQUE APPLIQUEE (ESA) Université d' Orléans Econométrie pour la Finance Modèles ARCH - GARCH |

|

Modélisation des Marchés Financiers et Krachs Boursiers

More precisely, the applications in econometrics of finance and the linéaire notamment les modèles ARCH GARCH et leurs extensions avec quelques |

|

Risque de modèle de volatilité

L'arbitrage rendement - risque étant la substance de la finance, la volatilité Keywords: Volatility, model risk, ARCH, GARCH, forecasting, structural model |

|

Application du modèle GARCH à lévaluation des options - Numdam

Evaluation des options, Modèle GARCH(1,1), Volatilité Stochastique 1 Je tiens à Framework for Volatility Modeling", Mathematical Finance, 4, pp 75- 102 |

|

FINANCE EMPIRIQUE - Faculté des HEC (HEC Lausanne) - HEC

La volatilité conditionnelle des rendements est très persistante, même si les modèles GARCH ne sont pas capables d'expliquer pourquoi 4 La forte persistance |

|

Estimation dun modele Arch-Garch avec primes d - Corpus UL

choix optimal de portefeuille dans son article paru au Journal of Finance en 1952 Ses travaux cherchent à minimiser la variance du rendement du portefeuille |

|

Processus ARCH-GARCH Applications - Depot institutionnel de l

10 jui 2013 · Engle inventé la généralisation du «Modèle ARCH» pour résoudre des problèmes de prévision statistique dans le domaine de la finance |

![E-BOOK_DOWNLOAD LIBRARY]~ GARCH Models Statistical Structure Infere E-BOOK_DOWNLOAD LIBRARY]~ GARCH Models Statistical Structure Infere](https://i1.rgstatic.net/publication/318984707_Determining_the_Best_ArchGarch_Model_and_Comparing_JKSE_with_Stock_Index_in_Developed_Countries/links/5989b0250f7e9b6c85430ba4/largepreview.png)