revenue procedure 2017-44

|

HIGHLIGHTS Bulletin No 2017–44 OF THIS ISSUE October 30 2017

revenue procedure sets forth the procedure for obtaining ap-proval of the Internal Revenue Service (IRS) for a change in the funding method used for a defined benefit plan as provided by § 412(d)(1) of the Internal Revenue Code and section 302(d)(1) of the Employee Retirement Income Security Act of 1974 as amended (ERISA) |

A revenue ruling is an official interpretation by the IRS of the Internal Revenue Code, related statutes, tax treaties and regulations.

It is the conclusion of the IRS on how the law is applied to a specific set of facts.

January 2023 – Present

Rev. Proc. 2023-4, 2023-01 I.R.B. 162 Updates Rev. Proc. 2022-4, 2022-1 IRB 161, relating to the types of advice the IRS provides to taxpayers on issues under the jurisdiction of the Commissioner, Tax Exempt and Government Entities Division, Employee Plans Rulings and Agreements, and the procedures that apply to requests for determination letters and private letter rulings. irs.gov

January 2022 - December 2022

Rev. Proc. 2022-4, 2022-1 I.R.B. 161 Updates Rev. Proc. 2021-4, 2021-1 IRB 157, relating to the types of advice the IRS provides to taxpayers on issues under the jurisdiction of the Commissioner, Tax Exempt and Government Entities Division, Employee Plans Rulings and Agreements. Specifically, this revenue procedure updates the procedures that apply to requests for determination letters and private letter rulings, and the user fees applicable to submissions made for letter ruling requests and opinion letters on pre-approved plans. Rev. Proc. 2022-28, 2022-27 I.R.B. 65 Amplifies Rev. Proc. 2022-3, 2022-1 IRB 144, which sets forth areas of the Code relating to issues on which the IRS will not issue letter rulings or determination letters. This revenue procedure announces that the IRS will not issue letter rulings on whether certain transactions result in an employer reversion within the meaning of IRC Section 4980(c)(2). Rev. Proc. 2022-40, 2022-47 I.R.B. 487 Rev. Proc. 2022-40 provides the circumstances under which a plan sponsor may submit a determination letter application to the IRS with respect to a qualified individually designed plan, to permit the submission of determination letter applications for section 403(b) individually designed plans. irs.gov

January 2021 - December 2021

Rev. Proc. 2021-4, 2021-01 I.R.B. 157 Updates Rev. Proc. 2020-4, 2020-1 I.R.B. 148, relating to the types of advice the IRS provides to taxpayers on issues under the jurisdiction of the Commissioner, Tax Exempt and Government Entities Division, Employee Plans Rulings and Agreements, and the procedures that apply to requests for determination letters and private letter rulings. Rev. Proc. 2021-30, 2021-31 Updates the comprehensive system of correction programs for sponsors of retirement plans that are intended to satisfy the requirements of IRC Sections 401(a), 403(a), 403(b), 408(k), or 408(p), but that have not met these requirements for a period of time. This system, the Employee Plans Compliance Resolution System (“EPCRS”), permits Plan Sponsors to correct these failures and thereby continue to provide their employees with retirement benefits on a tax-favored basis. The components of EPCRS

January 2020 – December 2020

Rev. Proc. 2020-4, 2020-01 I.RB. 148 Contains information on the types of advice provided by the Commissioner, Tax Exempt and Government Entities Division, Employee Plans Rulings and Agreements Office, including procedures for issuing determination letters and letter rulings. Rev. Proc. 2019-4 is superseded. Rev. Proc. 2020-9, 2020-02 I.R.B. 294 Clarifies which amendments are treated as integral to a plan provision that fails to satisfy the qualification requirements of the Code by reason of a change to those requirements made by the recently published regulations under Sections 401(k) and 401(m) relating to hardship distributions of elective deferrals. This revenue procedure also extends the deadline, applicable to pre-approved plans, for adopting an interim amendment relating to those regulations. Rev. Proc. 2020-10, 2020-02 I.R.B. 295 Rev. Proc. 2017-41 sets forth procedures for providers of pre-approved plans to obtain opinion letters, once every six years, for qualified pre-approved plans submitted with respect to the third (and subsequent) six-year remedial amendment cycles. Defined benefit and defined contribution pre-approved plans are under different six-year remedial amendment cycles. This revenue procedure provides that the third six-year remedial amendment cycle for pre-approved defined benefit plans begins on May

January 2019 - December 2019

Rev. Proc. 2019–4, 2019-1 I.R.B. 146 Contains revised procedures for determination letters and letter rulings issued by the Commissioner, Tax Exempt Agreements Office. Rev. Proc. 2018–4 is superseded. Rev. Proc. 2019-19, 2019-19 I.R.B. 1086 Modifies and supersedes Rev. Proc. 2018-52, the most recent prior consolidated statement of the correction programs under EPCRS. This update is a limited update and is published primarily to expand SCP eligibility to permit correction of certain Plan Document Failures and certain plan loan failures, and to provide an additional method of correcting Operational Failures by plan amendment under SCP. Rev. Proc. 2019-20, 2019-20 I.R.B. 1182 Provides for a limited expansion of the determination letter program with respect to individually designed plans. It also provides for a limited extension of the remedial amendment period under IRC Section 401(b) and Rev. Proc. 2016-37 under specified circumstances, and for special sanction structures that apply to certain plan document failures discovered by the IRS during the review of a plan submitted for a determination letter pursuant to this revenue procedure. irs.gov

January 2018 - December 2018

Rev. Proc. 2018–4, 2018-1 I.R.B. 146 Contains revised procedures for determination letters and letter rulings issued by the Commissioner, Tax Exempt and Government Entities Division, Employee Plans Rulings and Agreements Office. Rev. Proc. 2017–4 is superseded. Rev. Proc. 2018–19, 2018-14 I.R.B. 466 Modifies Rev. Proc. 2018–4, 2018–1 I.R.B. 146. Specifically, this revenue procedure changes one user fee set forth in Appendix A of Rev. Proc. 2018–4, Schedule of User Fees, with respect to applications on Form 5310, Application for Determination for Terminating Plan. That user fee is reduced from $3,000 to $2,300, effective January 2, 2018. Applicants who paid the $3,000 user fee listed in Rev. Proc. 2018–4 will receive a refund of $700. Rev. Proc. 2018–21, 2018-14 I.R.B. 467 Modifies the procedures of the IRS for issuing opinion and advisory letters for pre-approved master and prototype and volume submitter plans as provided in Rev. Proc. 2015–36. In particular, this revenue procedure modifies sections 6.03(7)(c) and 16.03(7)(c) of Rev. Proc. 2015–36 to allow pre-approved defined benefit plans containing a cash balance formula to provide for the actual rate of return on plan assets as the rate used to determine interest credits. irs.gov

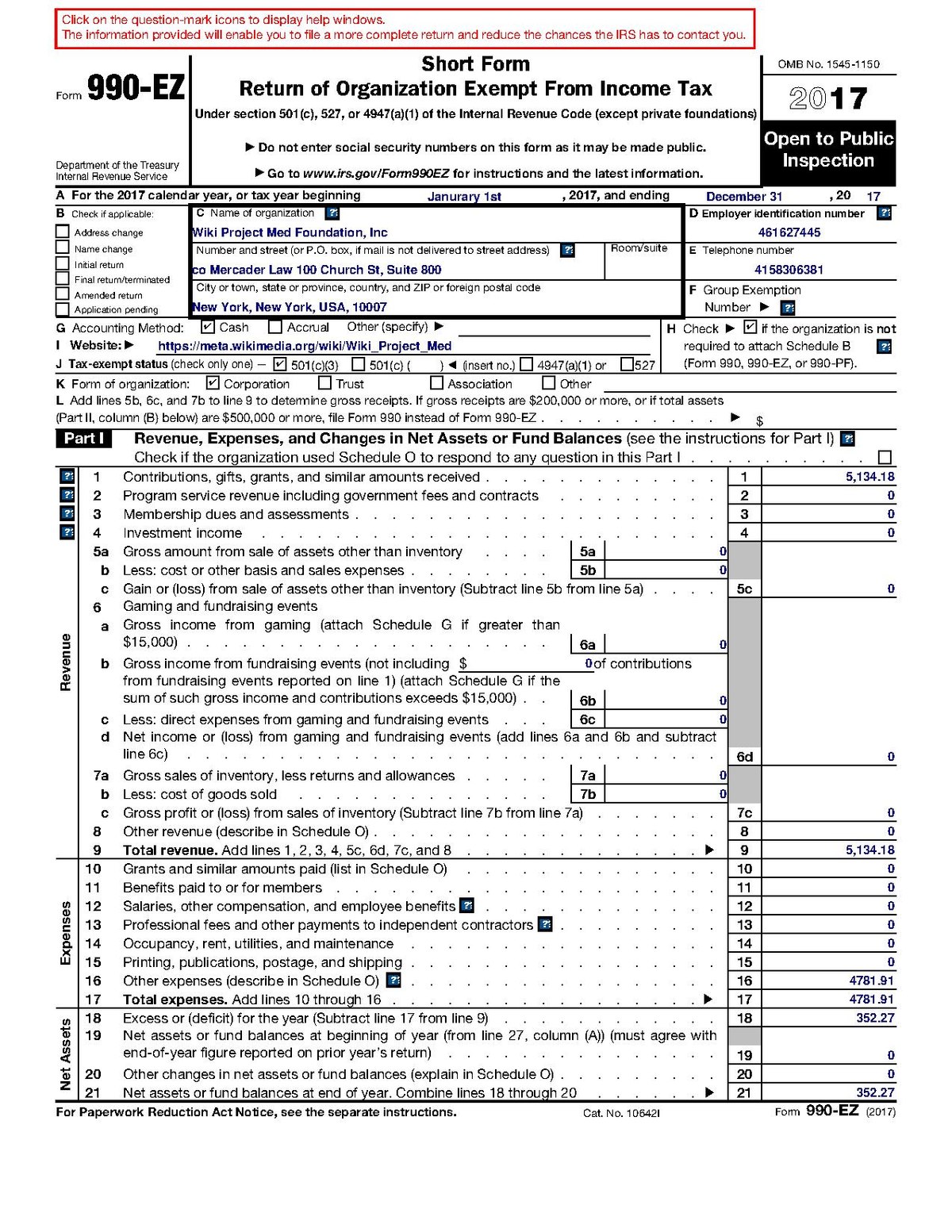

January 2017 - December 2017

Rev. Proc. 2017–2, 2017-1 I.R.B.106 These procedures explain when and how an Associate office within the Office of Chief Counsel provides technical advice, conveyed in technical advice memoranda (TAMs). It also explains the rights that a taxpayer has when a field office requests a TAM regarding a tax matter. Rev. Proc. 2016–2 superseded. Rev. Proc. 2017–4, 2017-1 I.R.B. 146 This procedure contains consolidated and revised procedures for determination letters and letter rulings issued by the Commissioner, Tax Exempt and Government Entities Division, Employee Plans Rulings and Agreements Office. Rev. Proc. 2016–4, Rev. Proc. 2016–6, and Rev. Proc. 2016–8 are superseded. Rev. Proc. 2017-18, 2017-5 I.R.B. 743 Provides that the last day of the remedial amendment period for IRC Section 403(b) plans, for purposes of section 21 of Rev. Proc. 2013–22, 2013–18 I.R.B. 985, is March 31, 2020. irs.gov

January 2016 - December 2016

Rev. Proc. 2016-2, 2016-1 I.R.B. 105 This is the basic, annual EP/EO revenue procedure on technical advice. Rev. Proc. 2016-4, 2016-1 I.R.B. 142 This is the basic, annual EP/EO revenue procedure on letter rulings. Rev. Proc. 2016-6, 2016-1 I.R.B. 200 This is the annual EP determination letter revenue procedure. irs.gov

January 2014 - December 31, 2014

Rev. Proc. 2014-4, 2014-1 I.R.B. 125 This is the basic, annual EP/EO revenue procedure on letter rulings. Rev. Proc. 2014-5, 2014-1 I.R.B. 169 This is the basic, annual EP/EO revenue procedure on technical advice. Rev. Proc. 2014-6, 2014-1 I.R.B. 198 This is the annual EP determination letter revenue procedure. irs.gov

January 2007 - December 2007

Rev. Proc. 2007-4, 2007-1 I.R.B. 118PDF This revenue procedure is the basic EP and EO letter ruling procedure. Rev. Proc. 2007-5, 2007-1 I.R.B. 161PDF This revenue procedure is the basic EP and EO technical advice procedure. Rev. Proc. 2007-6, 2007-1 I.R.B. 189PDF This revenue procedure is the basic EP and EO determination letter procedure. irs.gov

|

Rev. Proc. 2017-57 Procedures for Requesting Approval for a

05 Rev. Proc. 2017-56 2017-44 I.R.B. xx |

|

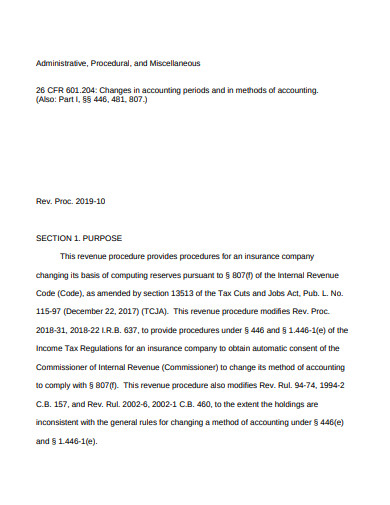

1 26 CFR § 601.201 Rulings and determination letters. Automatic

revenue procedure provides automatic approval for certain changes in funding method used for single-employer defined benefit Proc. 2017-57 2017-44. |

|

26 CFR 601.105: Examination of returns and claims for refund credit

Rev. Proc. 2018-45. SECTION 1. PURPOSE. This revenue procedure provides the domestic asset/liability percentages and Proc. 2017-44 2017-35. I.R.B. 216. |

|

2017-2018 PGP 4th Quarter Update

17 août 2018 Revenue procedures relating to approval for funding method changes. • PUBLISHED 10/30/17 in IRB 2017-44 as REV. PROC. 2017-56. |

|

Rapport pour le conseil régional MARS 2017

9 mars 2017 Un peu plus du quart de ce montant est revenu aux TPE-PME. ... à procédures adaptées (MAPA) d'un montant supérieur à 25 000 euros HT2 et en ... |

|

COMMISSION EUROPÉENNE Bruxelles le 3.2.2017 SWD(2017) 44

3 févr. 2017 SWD(2017) 44 final ... Commission européenne au moyen de procédures ... employeurs de 1 685 millions d'euros/an (revenus. |

|

IRB 2017-43 (Rev. October 23 2017)

23 oct. 2017 This revenue procedure sets forth the procedure by which the sponsor of a defined benefit plan that is subject to the funding. |

|

2017-2018 Priority Guidance Plan

20 oct. 2017 regulations; (2) notices revenue rulings |

|

No ICC-01/12-01/15 1/68 17 août 2017 Traduction officielle de la

17 août 2017 Le 2 décembre 2016 ont déposé leurs observations générales sur la procédure en réparation : i) le Fonds au profit des victimes (« le Fonds ... |

|

IRB 2017-44 (Rev October 30, 2017) - Internal Revenue Service

30 oct 2017 · amended Finding Lists begin on page ii Bulletin No 2017–44 October 30 procedure for obtaining approval of the IRS to revoke an election |

|

Determination of correct tax liability - Internal Revenue Service

Rev Proc 2017-44 SECTION 1 PURPOSE This revenue procedure provides the domestic asset/liability percentages and domestic investment yields needed |

|

Internal Revenue Bulletin: 2019-44 - NCSHA

28 oct 2019 · https://www irs gov/irb/2019-44_IRB#REV-PROC-2019-41 2017), which directed the Secretary to review all significant tax regulations issued |

|

Comment Request for Rev Proc 2018-31 AGE - Federal Register

21 oct 2019 · The IRS is soliciting comments concerning Revenue Procedure 2018-44, 2018 -37 I R B 426, Rev Proc 2017-59, 2017-48 I R B 543, |

|

Rev Proc 2018-58

Also, taxpayers may recommend that additional acts be considered for postponement under sections 7508 and 7508A See section 18 of this revenue procedure |

|

Second Quarter Update to the 2017-2018 Priority Guidance Plan

7 fév 2018 · Revenue procedures relating to approval for funding method changes • PUBLISHED 10/30/17 in IRB 2017-44 as REV PROC 2017-56 |

|

Rev Proc 2016-55

44 Property Exempt from Levy 6334 45 Interest on a Certain This revenue procedure sets forth inflation-adjusted items for 2017 SECTION 2 CHANGES |

|

Rev Proc 2019-44: Inflation adjustments for 2020 - assetskpmg

6 nov 2019 · The IRS today released an advance version of Rev Proc 2019-44 providing the annual inflation adjustments for more than 60 tax provisions to |