france corporate income tax rate 2018

|

France alert: Finance bill for 2018 published

28 sept 2017 · The corporate income tax rate would be gradually reduced to 25 by for 2018: a 28 rate would apply to the first EUR 500000 of profits |

|

Country Profile France

- In 2018 a 28 percent tax rate applies for taxable profit up to EUR 500000 Profits exceeding EUR 500000 remain subject to a corporate income tax rate |

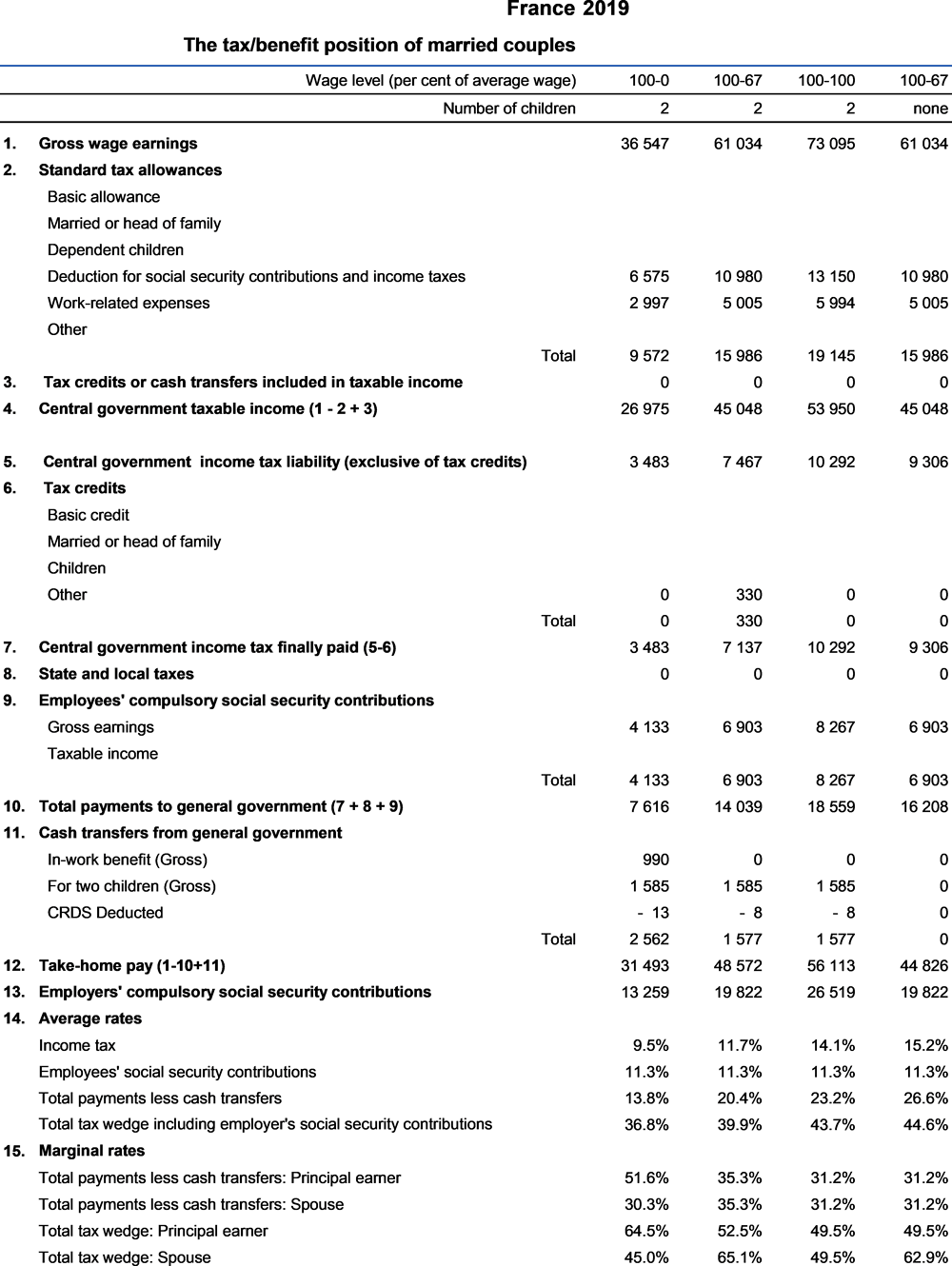

Individuals pay in 2022 income taxes at progressive rates between 0 and 45%.

Additional 3% tax is imposed on personal income between EUR 250,000- EUR 500,000 and 4% for income exceeding EUR 500,000 for singles.

The taxable revenue is divided in 2 or more shares, in relation with the size of the family.

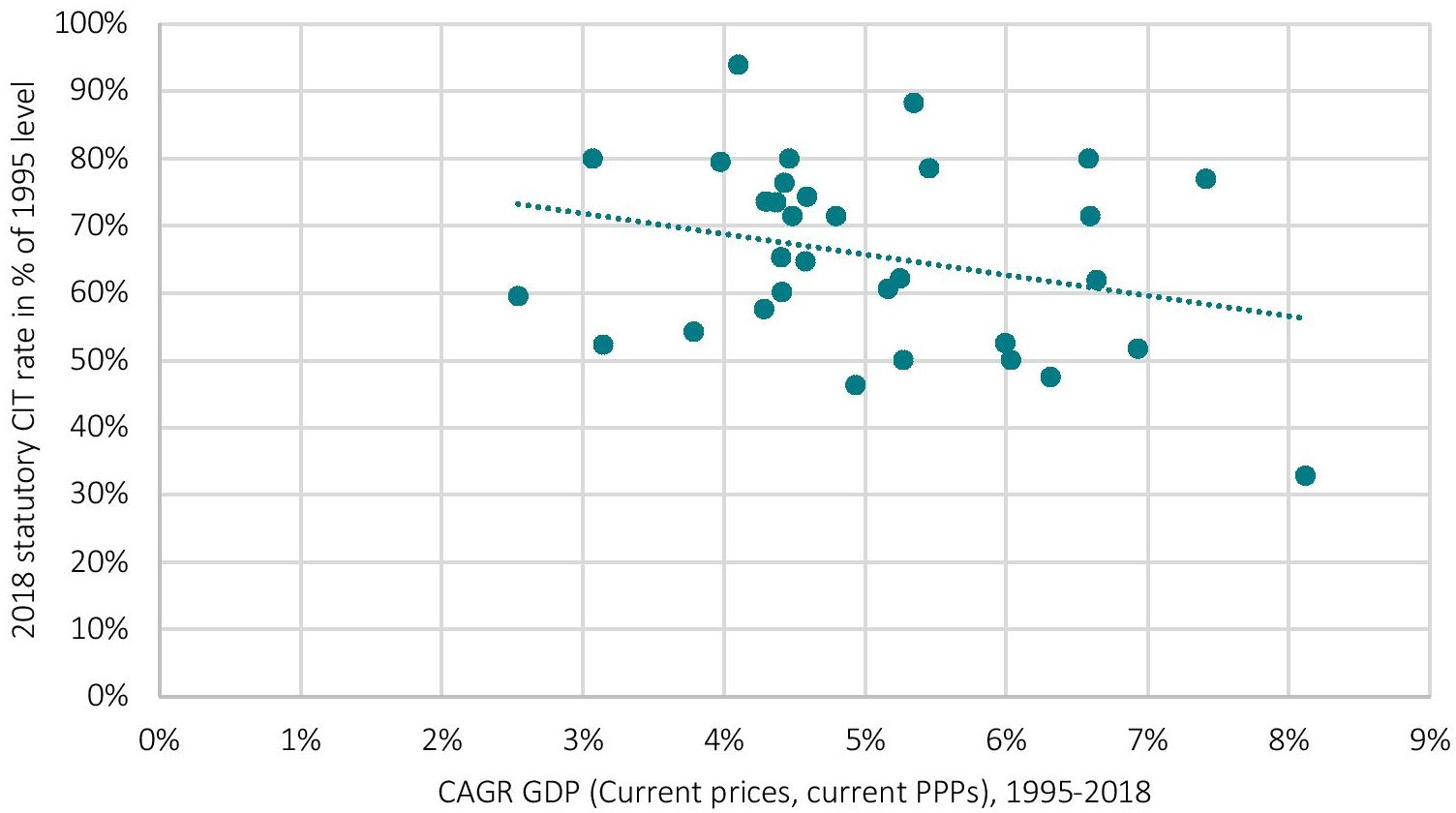

What is the Corporate Tax Rate around the world 2018?

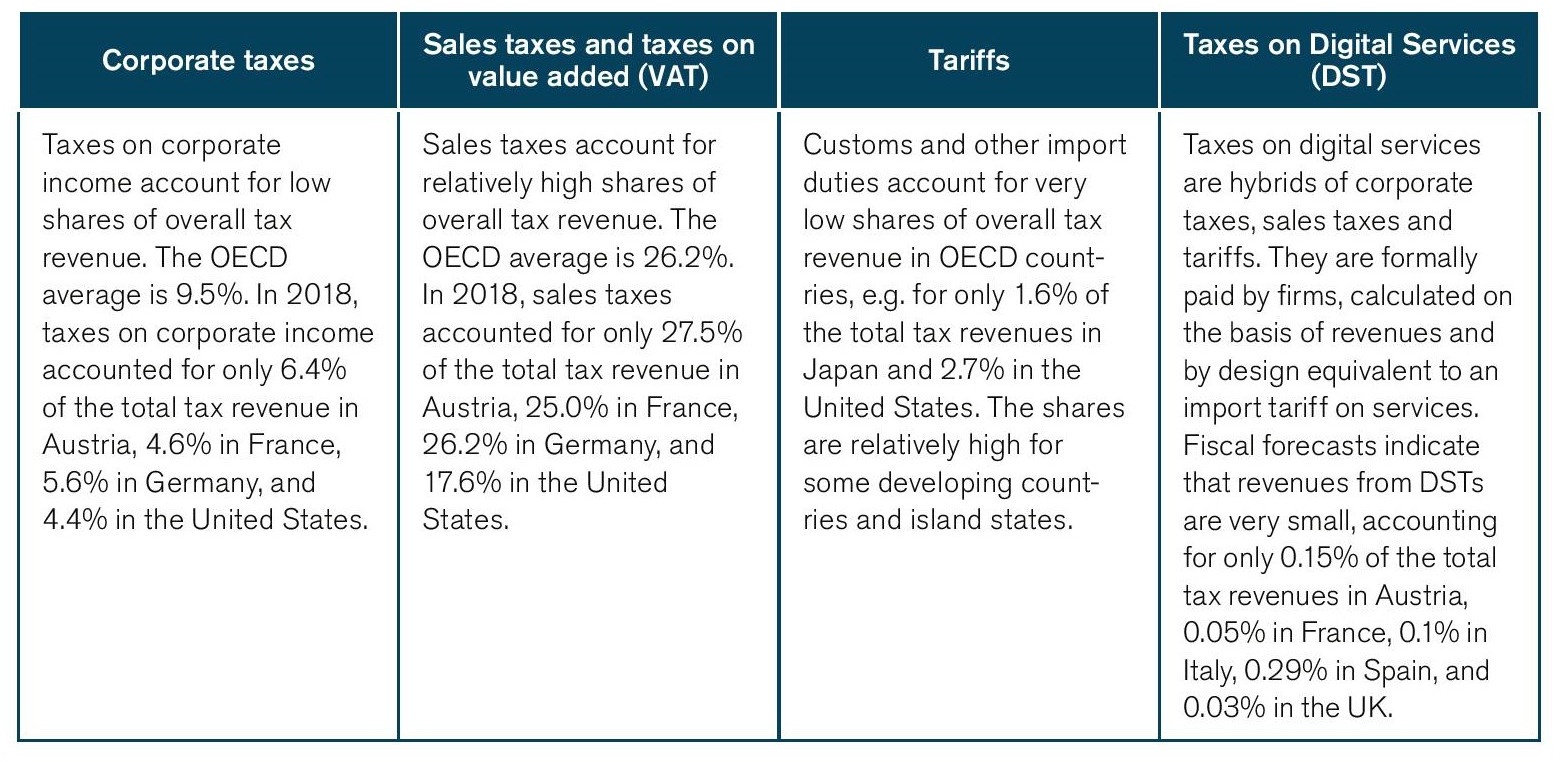

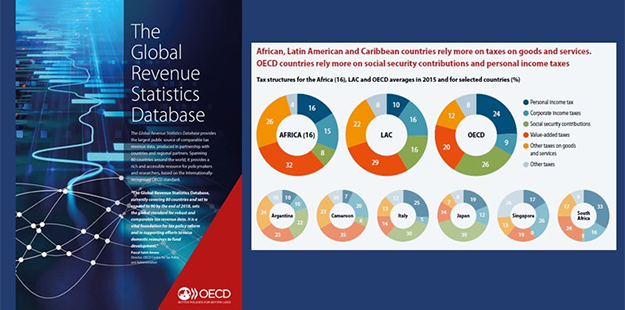

The worldwide average statutory corporate income tax. rate, measured across 208 jurisdictions, is 23.03 percent.

When weighted by GDP, the average statutory rate is 26.47 percent.

The average top corporate rate among EU countries is 21.68 percent, 23.69 percent in OECD countries, and 27.63 percent in the G7.

What is the Corporate Tax Rate in France 2017?

Rate.

The 2017 French corporate tax rate was 15% of the taxable income up to and including €38,120, 28% up to €75,000 and above which the rate is 33.3%.

By 2020, the whole taxable income of all companies will be taxed at 28%.

What is the tax rate for a business in France?

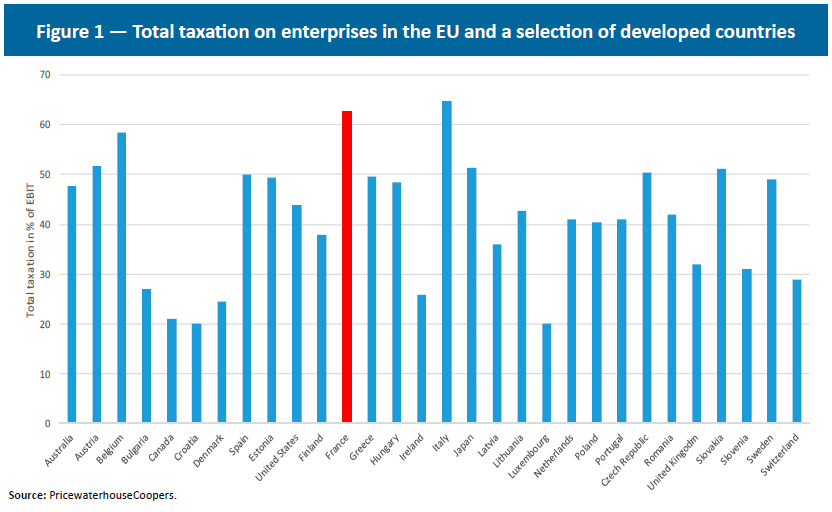

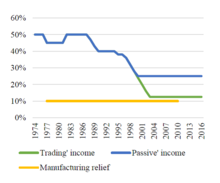

Corporate tax rates in France have been gradually reducing.

In 2021, the standard rate was 26.5%, with companies with profits of more than €500,000 paying a higher rate of 27.5%.

Since 2022, however, companies have paid a standard corporate tax rate of 25% regardless of their profits.

|

France alert: Finance bill for 2018 published

28 Sept 2017 The French finance bill for 2018 released on 27 September 2017 ... The corporate income tax rate would be gradually reduced to 25% by 2022. |

|

Corporate Tax Statistics First Edition

analysis of corporate taxation in general |

|

CBO

3 Mar 2017 See Appendix A for further discussion of CBO's analytical methods. 3. The G20 consists of Argentina Australia |

|

EUROPEAN COMMISSION Brussels 7.3.2018 SWD(2018) 208 final

7 Mar 2018 MIP Assessment Matrix (*) – France 2018. 20. Table 4.3.1: Stock of ... statutory corporate income tax rate and reducing the cost of labour. |

|

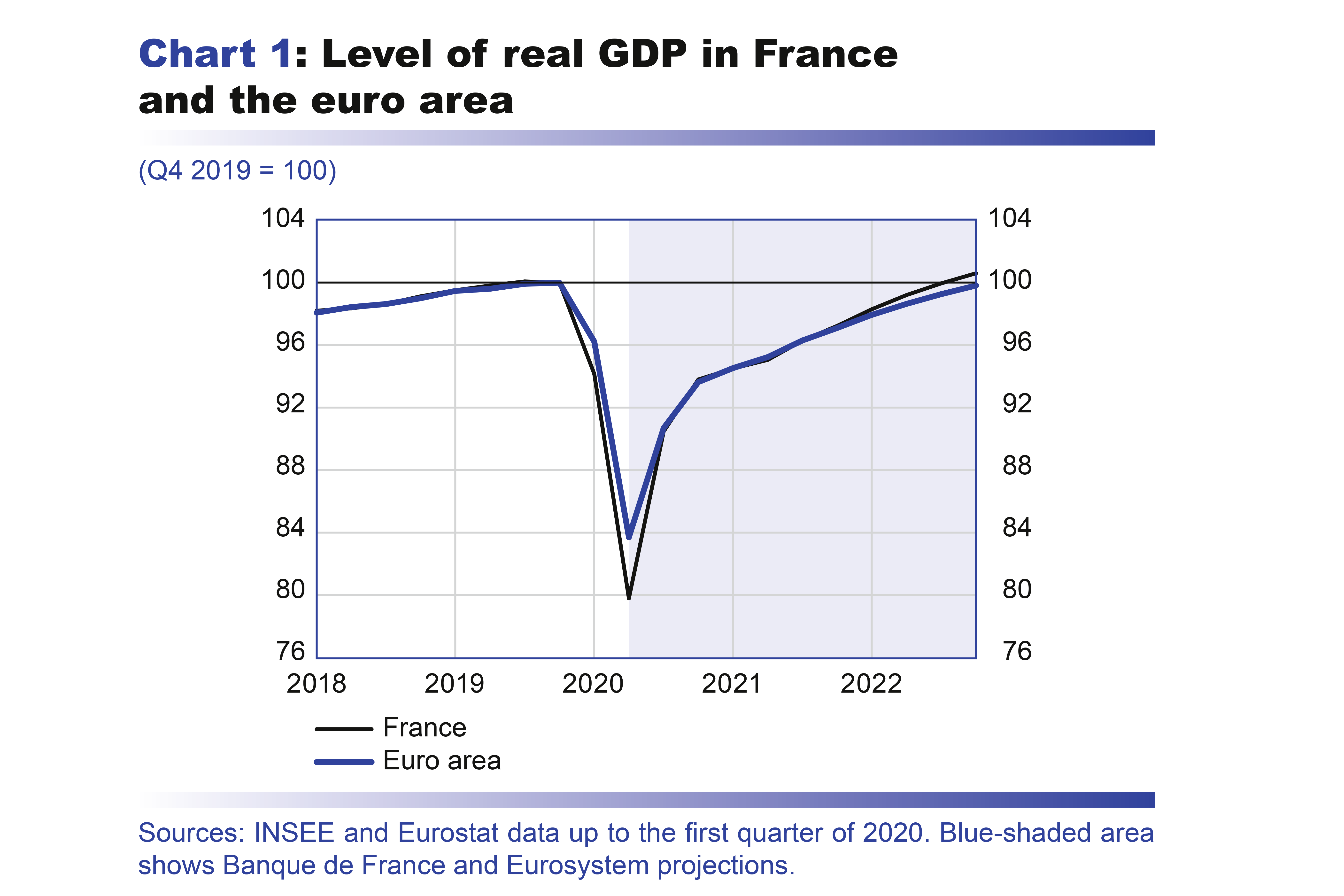

Brochure: Revenue Statistics 2021

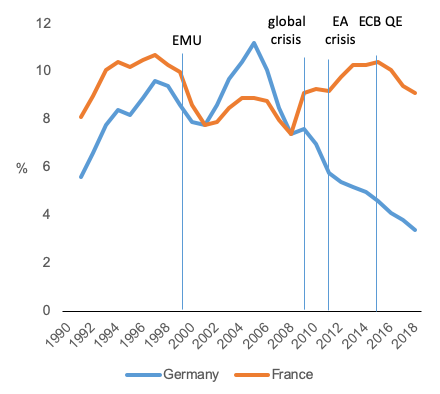

France was higher has had the highest tax-to-GDP ratio of OECD countries since due to a sharp decrease in corporate income tax revenues (3.5 p.p.) |

|

Taxand

FRANCE. 1. GLOBAL GUIDE TO M&A TAX: 2018 EDITION Progressive reduction of the Corporate income tax (CIT) rate. The French CIT rate should decrease ... |

|

Revenue Statistics: Key findings for France

Over the same period the. OECD average in 2020 was slightly above that in 2000 (33.5% compared with 32.9%). During that period the highest tax- to-GDP ratio in |

|

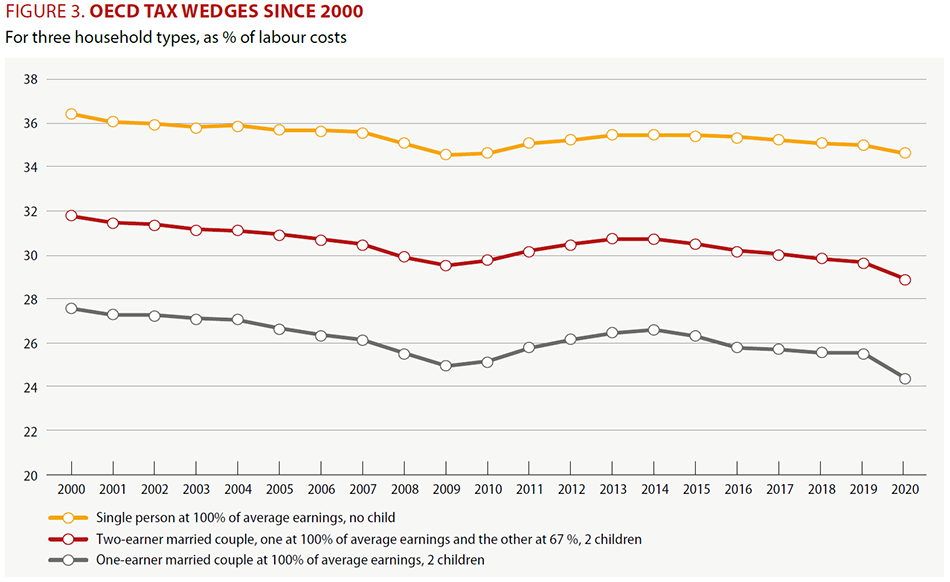

Taxing Wages: Key findings for France

The employee net average tax rate is a measure of the net tax on labour income paid directly by the employee. Employee net average tax rate. Average tax wedge |

|

France: Financial Sector Assessment Program-Technical Note

1 Oct 2019 France was prepared by a staff team of the International Monetary Fund as ... After the 2018 reform the corporate income tax rate in France ... |

|

ECONOMIC SOCIAL AND FINANCIAL REPORT

headline corporate income tax rate will gradually be lowered to 25% by 2022 with an initial reduc- tion in 2018. This rate cut will bring France's cor-. |

|

France alert: Finance bill for 2018 published - Deloitte

28 sept 2017 · However, keeping in line with company expectations, the rate reduction adopted under the 2017 finance law would be maintained for 2018: a 28 rate would apply to the first EUR 500,000 of profits for all companies (with the remaining profits subject to the 33 33 standard rate) |

|

Corporate Income Tax Rates 2014-2018 - Deloitte

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited (“DTTL”), its global network of member firms, and their related entities DTTL (also referred to |

|

France - European Commission

DG Taxation and Customs Union Taxation Trends in Europe 2020 France Table FR 1: Tax Revenue 2018 (billion euros) A Structure by type of tax as of GDP Indirect taxes 15 2 15 0 Corporate income taxes 3 0 3 0 3 0 1 8 2 3 |

|

Revenue Statistics 2019 - France - OECDorg

The OECD's annual Revenue Statistics report found that the tax-to-GDP ratio in France did not change between 2017 and 2018 The tax-to-GDP ratio remained |

|

Taxation of corporate and capital income - OECDorg

A federal surtax increased the general federal corporate income tax rate by 1 12 From 2018 the credit institutions pay advance income tax with rate of 14 subtracted from next year`s CIT on distributed profits II 1 FRANCE The rates in |

|

Doing business in France 2018 - Moore Global

it includes relevant information on business operations and taxation matters Income tax (including capital gains taxes) 30 reforms in France, for example the competitiveness and employment corporate tax credit (crédit d'impôt pour la |

|

Worldwide Corporate Tax Guide - EY

20 mai 2020 · France (European Union member state) 531 The corporate income tax rate is 5 for software production and development October 2018, the Albanian Council of Ministers approved for Albania to |

|

FRANCE - Taxand

FRANCE 1 GLOBAL GUIDE TO M&A TAX: 2018 EDITION Progressive reduction of the Corporate income tax (CIT) rate The French CIT rate should decrease |

|

World Tax Advisor - Deloitte Österreich Tax & Legal News

12 jan 2018 · France: Amended finance bill for 2017 and finance bill for 2018 The corporate income tax rate (before applying the surtax) is reduced from |