france corporate income tax rate 2019

|

Country Profile France

Profits exceeding EUR 500000 remain subject to a corporate income tax rate of 33 33 percent - For financial years commencing as of January 1 2019 a 28 |

What is the corporate income tax of France?

Key takeaways.

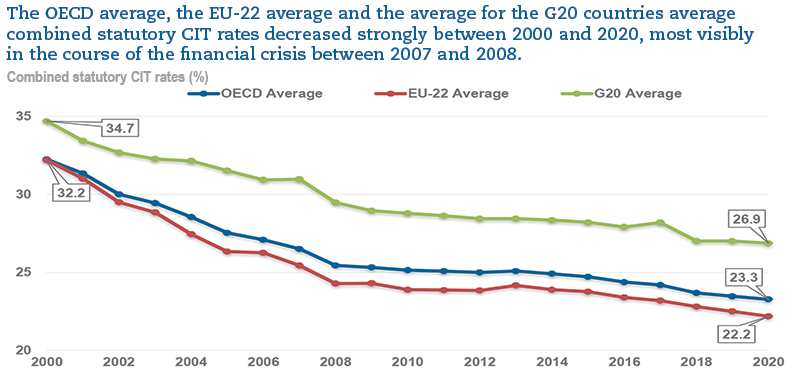

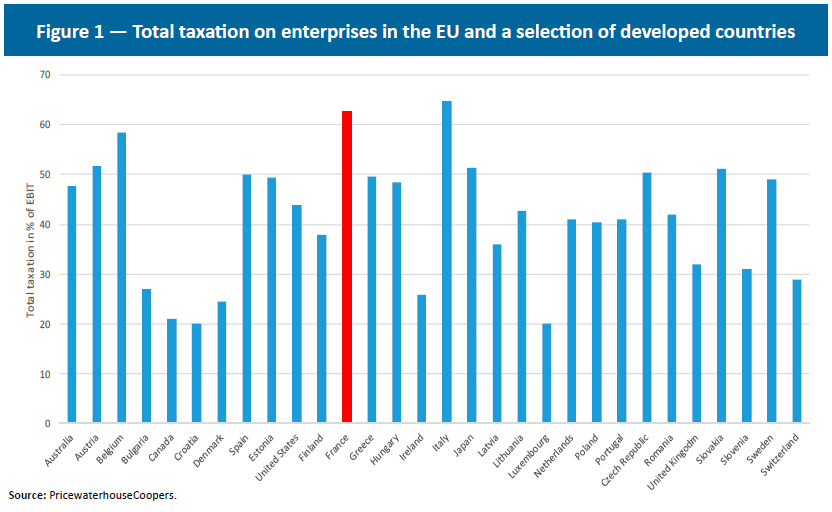

The French corporate income tax rate for 2022 has been lowered to 25%.

Calculating deferred taxes for French companies has been simplified.

French corporate income tax rate now more in line with the rest of Europe and OECD countries.9 mar. 2023What is the corporate tax rate in France 2019?

Profits exceeding EUR 500,000 remain subject to a corporate income tax rate of 33.33 percent. - For financial years commencing as of January 1, 2019, a 28 percent tax rate applies for taxable profit up to EUR 500,000.

Profits exceeding EUR 500,000 will be taxed at a rate of 31 percent.What are the corporate tax rates around the world 2019?

Generally, a French resident is liable to French income tax on interest income, whether from French or foreign sources.

Taxable interests are subject to a flat rate tax (PFU, sometimes referred to as the 'flat tax') set at 30%, including income tax at 12.8% and social surtaxes at 17.2%.

|

Country Profile France - assetskpmg

Profits exceeding EUR 500000 remain subject to a corporate income tax rate of 33 33 percent - For financial years commencing as of January 1 2019 |

|

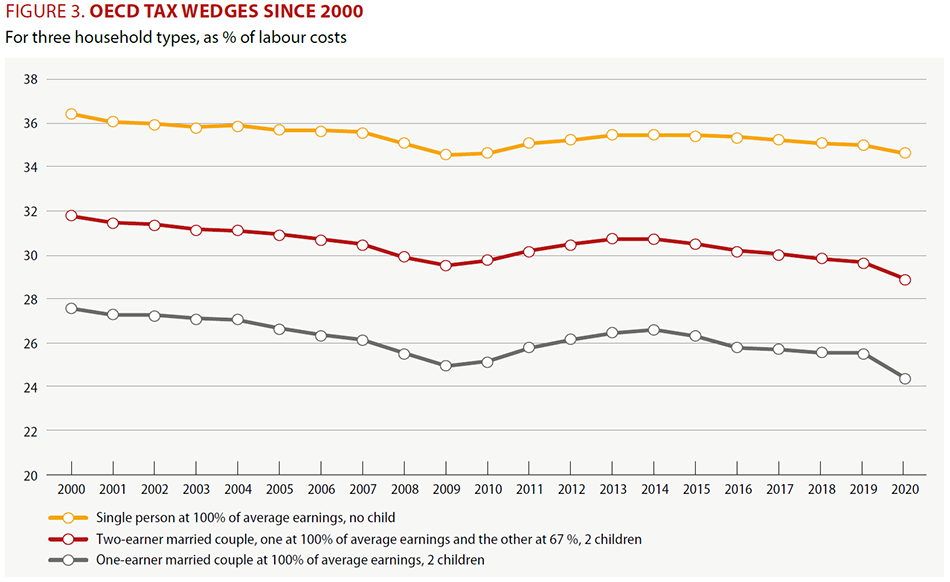

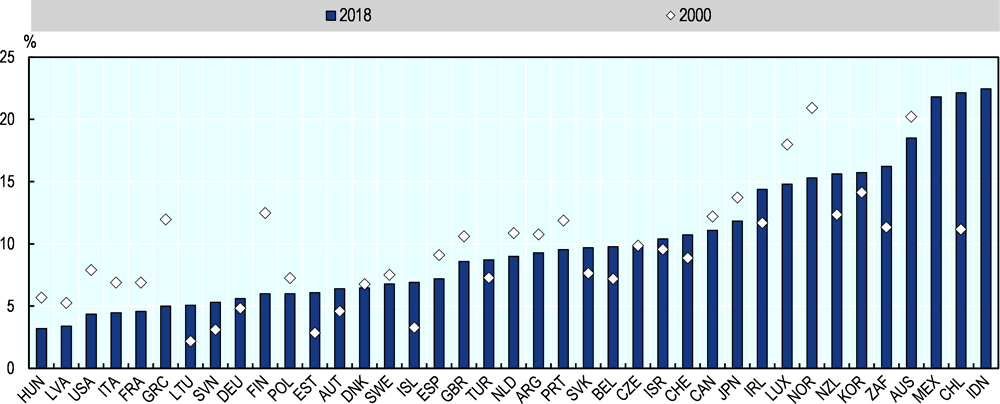

Revenue Statistics: Key findings for France - OECD

The OECD's annual Revenue Statistics report found that the tax-to-GDP ratio in France increased by 0 5 percentage points from 44 9 in 2019 to 45 4 in 2020 |

|

FRANCE Taxand

These companies are subject to corporate income tax (“CIT”) The top French rate for personal income tax amounts to 45 France does not assess local |

|

France Taxand

Progressive reduction of the Corporate income tax (CIT) rate The French CIT rate should decrease progressively from 33 33 to 25 by 2022 (Finance Law for |

|

Corporate Tax Rates around the World 2020

8 déc 2020 · (d) Colombia's 2018/2019 tax reform introduced measures to reduce the In France the standard statutory corporate income tax rate was |

|

Overview of the french tax system - Impotsgouvfr

31 déc 2016 · VIII – SOCIAL CONTRIBUTION ON CORPORATE INCOME TAX For tax years beginning on or after 1 January 2019 this reduced rate of 15 will be |

|

Danone-tax-policy-2019pdf

The Effective Tax Rate2 (“ETR”) of Danone is below the corporate income tax rate in France where the Danone Company is headquartered |

|

France alert: Finance bill for 2018 published - Deloitte

28 sept 2017 · The corporate income tax rate would be gradually reduced to 25 by 2022 The rate reduction would be spread over the period from |

|

ICEbreakers: Unlocking France - Deloitte

Progressive reduction of corporate income tax rate from 33 1/3 to 28 2019: The 28 rate will be extended to apply to all profits of |

|

Country Profile France 2020 - assetskpmg

The French corporate income tax rate is progressively reduced from 33 33 percent to 25 percent |

|

France - European Commission

DG Taxation and Customs Union Taxation Trends in Europe 2020 France Table FR 1: Tax Revenue Corporate income taxes In force from: 01-01-2019 |

|

France - EY

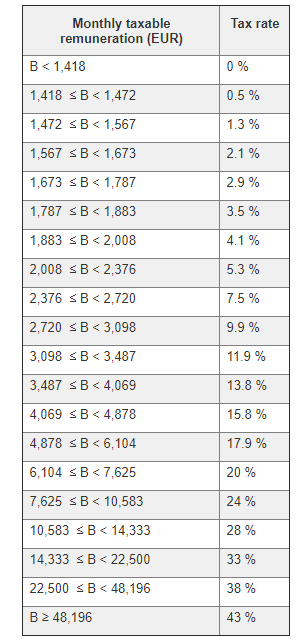

Signed in December 2019 the new laws are effective from 1 January 2020 Taxable income per unit (EUR) Tax rate up to 10,064 0 10,064 to 25,659 11 or realized as from 1 January 2020, and for corporate income tax, to financial |

|

Worldwide Corporate Tax Guide - EY

20 mai 2020 · France (European Union member state) 531 The corporate income tax rate is 5 for software production and development period while the effects for 2019 and 2020 must be deducted or taxed over a |

|

Revenue Statistics 2019 - France - OECDorg

The OECD's annual Revenue Statistics report found that the tax-to-GDP ratio in France did Since the year 2000, the tax-to-GDP ratio in France has increased from Includes income taxes not allocable to either personal or corporate income |

|

Taxation of corporate and capital income - OECDorg

subtracted from next year`s CIT on distributed profits II 1 FRANCE The rates in Table II 1 The standard corporate income tax rate for 2019 is 31 [2][3] |

|

TAX NEWS: 2018 FRENCH GOVERNMENT - Business France

corporate tax rate of 15 on their first €38,120 of earnings 2019, all businesses will be taxed at 31 above Withholding tax rates on income paid out to non- |

|

French tax system - Business France

the corporate tax rate from 33 to 25 in 2022 has been approved by parliament, while capital income is now taxed at a flat rate of 30 Now that France has created a in 2018 and €1 million in 2019 In 2020, the higher rate of 33 33 will |