ba ii plus bond amortization

|

Bond Worksheet on BAII Plus Calculator

The bond worksheet on a BAII Plus calculator can compute the bond price the yield to maturity or call and accrued interest To access the bond worksheet press [2nd] [BOND] Use the [↓] or [↑] keys to access bond variables To reset the Bond worksheet to default values press [2nd] [CLR WORK] |

How do I use the bond worksheet on a BaII Plus calculator?

The bond worksheet on a BAII Plus calculator can compute the bond price, the yield to maturity or call, and accrued interest. To access the bond worksheet, press [2nd] [BOND]. Use the [↓] or [↑] keys to access bond variables. To reset the Bond worksheet to default values, press [2nd] [CLR WORK]. 2. 3.

How do I change the annuity mode on my TI BA II Plus?

Press the 2nd key and then the FV button. This selects the “CLR TVM” command and clears out any data you entered using the calculator’s TVM keys. The second step is to temporarily adjust your calculator’s annuity mode. By default your TI BA II Plus should be set to “end” mode, which means any annuity cash flows occur at the end of each period.

How do I calculate the bond price on BA II Plus?

When calculating the bond price on Ba II Plus, you will need to know the current market interest rate and the coupon rate of the bond. The coupon rate is the annual interest payment that the bondholder receives. To calculate the bond price, you will use a present value formula.

What Is Amortization?

An amortized loan is one with scheduled, periodic payments that are applied to a loan's principal amount as well as the interest accrued. Calculating amortization on a calculator allows you to compute the remaining balance and amounts paid to interest and principal for a range of payments. Good examples of where amortization occurs are with transac

Sample Problem

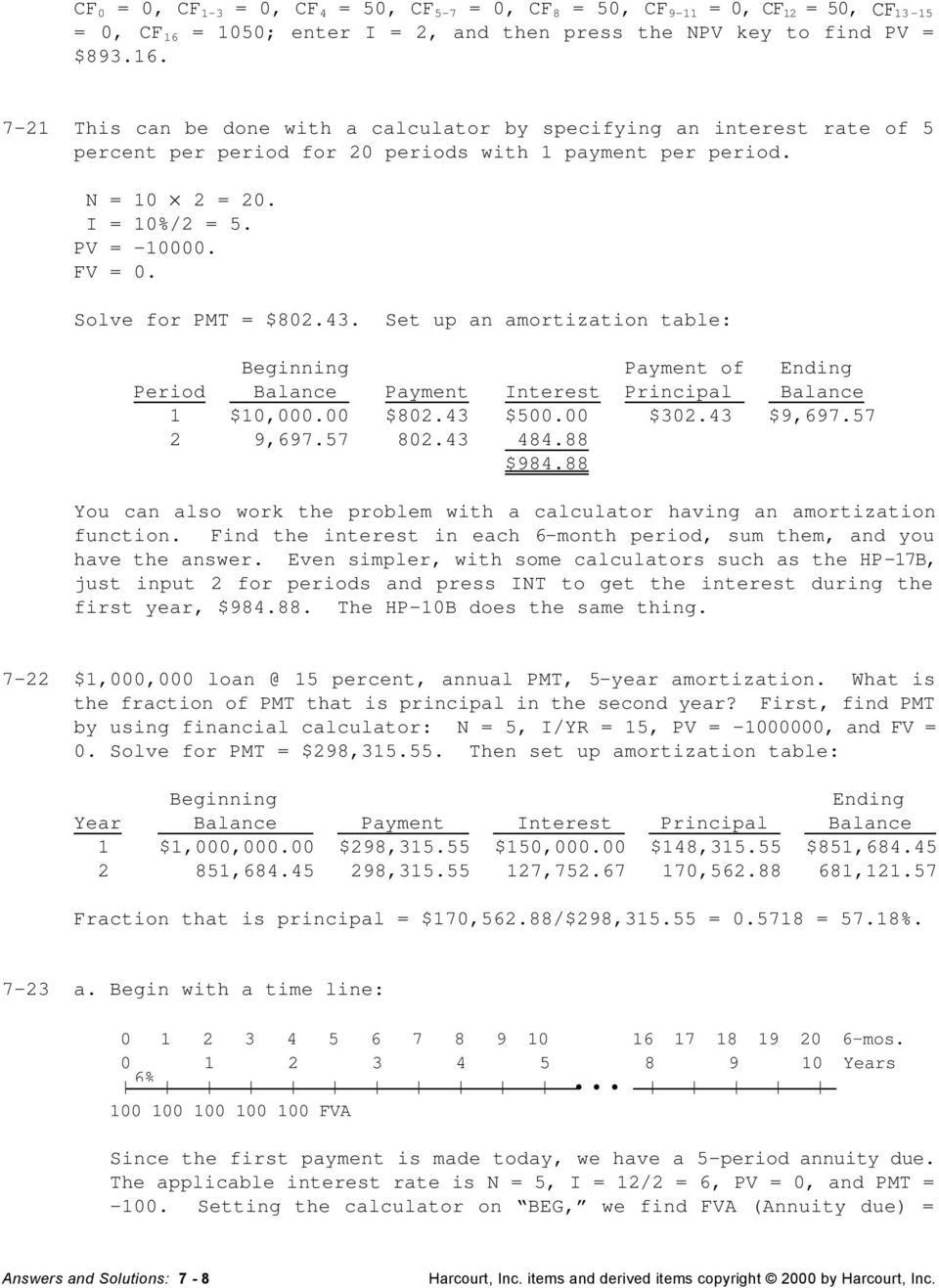

Let us say you borrow $100,000 and make annual payments for three years. If the interest rate is 7%, how much interest do you pay in year two? The first thing we want to do is clear the time value of money buttons on the calculator. Press the 2ND button, then press the CLR TVM (FV) button. toughnickel.com

Enter Your Data

Follow each step: 1. Type 3, then press the "N" button (There are three payment periods) 2. Type 7, then press the "I/YR" button (Do not input the symbol %) 3. Type 100,000, then press the "PV" button (This is positive because cash is received) 4. Type 0, then press the "FV" button (If you cleared your calculator when you started you can skip this

Display The Data

To display the fixed payment, press the CPT button, then press the "PMT" button. Your calculator should display a cash outflow of -38,105.17. This is the annual payment that you would have to pay to borrow this money. Now that we know the fixed payment, look at the other details. Press the 2ND button, then press the "AMORT" button. The calculator w

Monthly Payment Example

Annual payments were made in our example above. Try the same problem but change annual payments to monthly payments. In this example, you must find the number of periods and the periodic rate. This can be done by completing the calculation right before entering data into the "N" or "I/YR" buttons. If the problem states that monthly payments would b

Quarterly Payment Example

If the problem stated that quarterly payments would be made, then we would have to multiply 3 times 4 to give us 12 total payments. The periodic interest rate can be found by dividing the interest by the number of periods per year. When entering interest, type 7 / 4 = and then press the "I/YR" button. See below for data entry instructions. 1. Type

Amortization Schedule using BA II Plus

BA II Plus Tutorial

How to Construct an Amortization Schedule using the BA II Plus Financial Calculator

|

Bond Worksheet on BAII Plus Calculator

The bond worksheet on a BAII Plus calculator can compute the bond price the yield to maturity or call |

|

Review of Calculator Functions For The Texas Instruments BA II Plus

The bond amortization components can be found using the calculator's amortization worksheet in much the same way they are found for loan amortization. A bond |

|

Financial Calculations on the Texas Instruments BAII Plus

I set my BA II Plus to an artificially large number the payments that remain on the amortization ... The [BOND] worksheet requires starting. |

|

BA II PLUS™ Calculator

This example shows you how to use the TVM and Amortization worksheets to calculate the monthly payments on a 30-year loan and generate an amortization schedule |

|

BA II PLUS™ PROFESSIONAL Calculator

For cash-flow problems with unequal cash flows use the. Cash Flow worksheet. Page 26. 22. Time-Value-of-Money and Amortization Worksheets. |

|

Financial Calculations on the Texas Instruments BAII Plus

I set my BA II Plus to an artificially large number the payments that remain on the amortization ... The [BOND] worksheet requires starting. |

|

BA II PLUS PROFESSIONAL Calculator

This example shows you how to use the TVM and Amortization worksheets to calculate the monthly payments on a 30-year loan and generate an amortization schedule |

|

Broverman FM Study Guide 2017 - Sample Excerpt

9 Oca 2017 Section 12 - Bond Amortization Callable Bonds ... specifically for practice on the BA II PLUS calculator. This is followed by 6 practice ... |

|

Using the HP 10B and TI BA II Plus Financial Calculators

Prepare an amortization schedule for a three-year loan of $24000. The interest rate is 16 percent per year |

|

BA II PLUS™ Calculator

(See: Cash Flow. Worksheet.) After solving a TVM problem you can use the Amortization worksheet to generate an amortization schedule. •. To access a |

|

Bond Amortization Schedule

the issuer of the bond; the coupon payments and the redemption payment are The above analogy justifies the construction of amortization tables for bonds |

|

Amortizing bond and accreting bond tutorial FinPricing - PubPub

An amortizing bond is a bond whose principal (face value) decreases due to repaying part of the principal along with the coupon payments Each payment to the |

|

Bonds CR - Harper College

o Calculating and recording amortization of the discount or premium value of the bond is the face amount recorded in bonds payable plus the unamortized |

|

8 Bond Amortization - Labyrinth Learning

interest payment plus amortized discount or minus amortized premium Carrying Value The carrying value of a bond can be calculated as face value minus |

|

Amortizing Premium and Discount (from section 62)

Definition bond is said to sell at a premium if the price P is larger than the The total amount of interest is equal the sum of coupons plus the redemption value |

|

Book value and amortization scheduless - Manual for SOA Exam FM

Bonds Section 5 3 Book value and amortization schedules c 2009 Miguel A Arcones Notice that for each time k the interest paid plus the principal paid |

|

Premiums and Discounts in Trust Accounts - JSTOR

by paying out of the coupon into the fund, while the trust estate holds the bond, of Columbia disapproved in general terms of amortization 8 Slight evidence of a the coupons, but that amount minus the premium or plus the dis- count 22 |

|

Chapter 06 - Bonds and Other Securities

Coupon bonds - borrower makes periodic payments (coupons) to redemption payment includes original loan principal plus all amortization schedule |

|

Bond Worksheet on BAII Plus Calculator - George Brown College

The bond worksheet on a BAII Plus calculator can compute the bond price, the yield to maturity or call, and accrued interest To access the bond worksheet, press [ |