ba ii plus future value multiple cash flows

|

HOW TO USE YOUR TI BA II P CALCULATOR

When a present value or future value problem calls for a number of payments per year that is different from 1 use the following rules These rules only work if P/Y is set to 1 |

How do I find the FV of multiple cash flows?

If the multiple cash flows are a part of an annuity, you're in luck; there is a simple way to find the FV. If the cash flows aren't uniform, don't occur at fixed intervals, or earn different interest rates, the only way to find the FV is do find the FV of each cash flow and then add them together.

What is the future value of multiple cash flows?

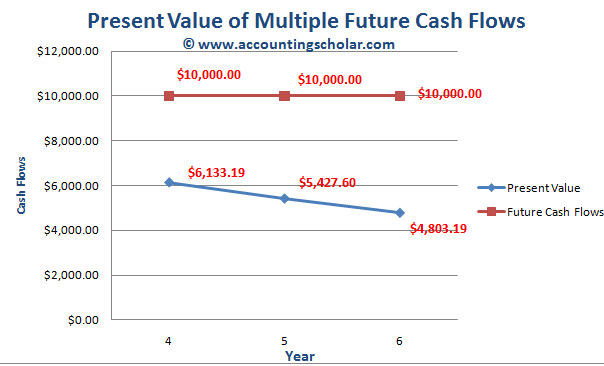

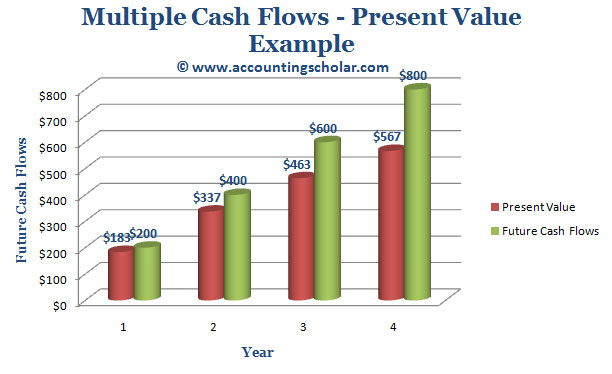

Finding the future value (FV) of multiple cash flows means that there are more than one payment/ investment, and a business wants to find the total FV at a certain point in time. These payments can have varying sizes, occur at varying times, and earn varying interest rates, but they all have a certain value at a specific time in the future.

What is a future value formula?

The future value formula is a financial calculation used to determine the value of an investment or asset at a future date based on the initial investment amount, the interest rate, and the period. It considers the compounding effect of interest, which allows the investment to grow exponentially over time.

What is the difference between future value and present value?

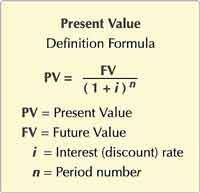

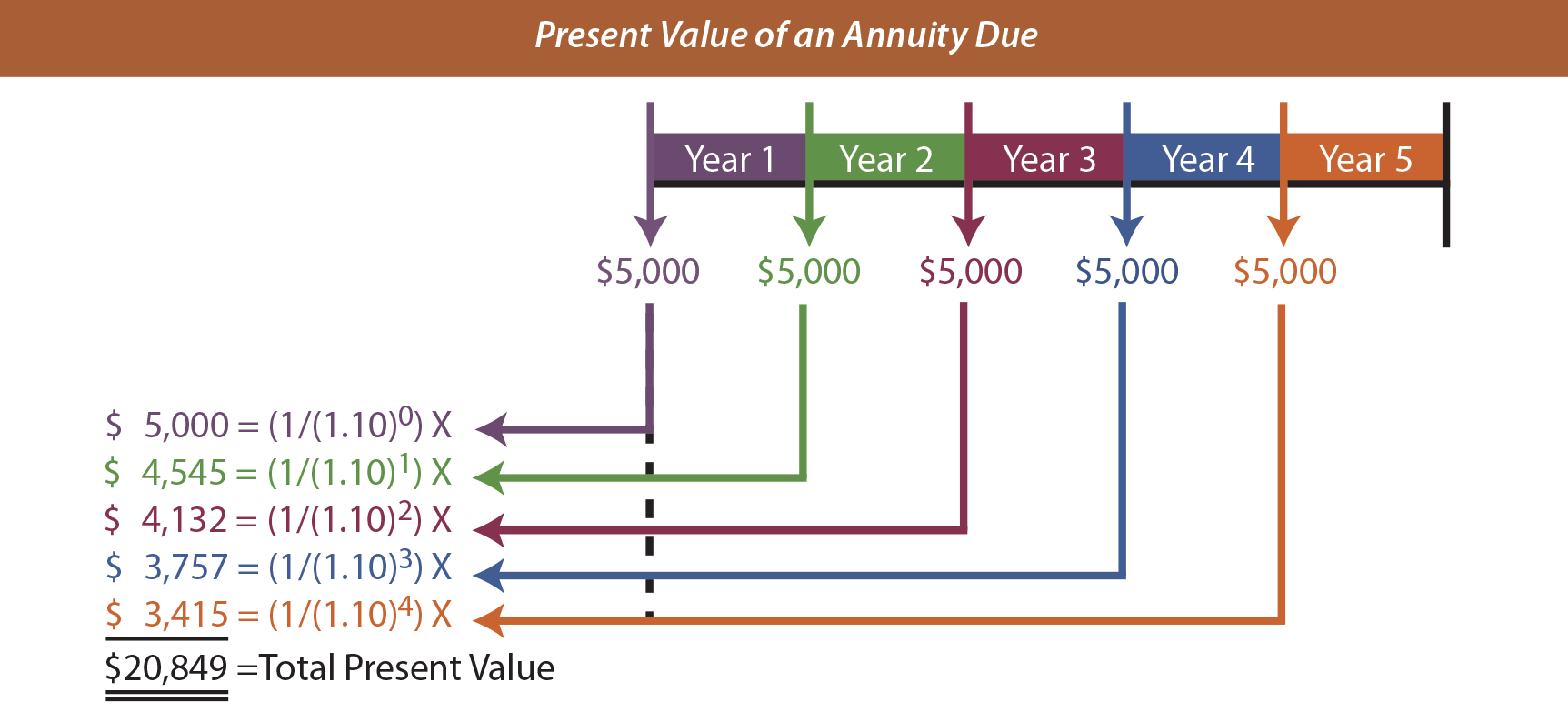

Future value refers to the value of an investment or cash flow at a future point in time, considering compounding interest. On the other hand, present value is the current value of an investment or cash flow, taking into account the time value of money and discounting future cash flows to their present worth.

Future Value of Multiple Cash Flows on the BAII Plus

How to Calculate the Future Value (FV) of Multiple Cash Flows

How to Calculate Future Value and Present Value with BA II Plus Calculator by Texas Instruments

|

Financial Calculations on the Texas Instruments BAII Plus

I set my BA II Plus to an artificially large number user to enter multiple occurrences of a value ... present value of the cash flows. |

|

Financial Calculations on the Texas Instruments BAII Plus

I set my BA II Plus to an artificially large number user to enter multiple occurrences of a value ... present value of the cash flows. |

|

HOW TO USE YOUR TI BA II PLUS CALCULATOR

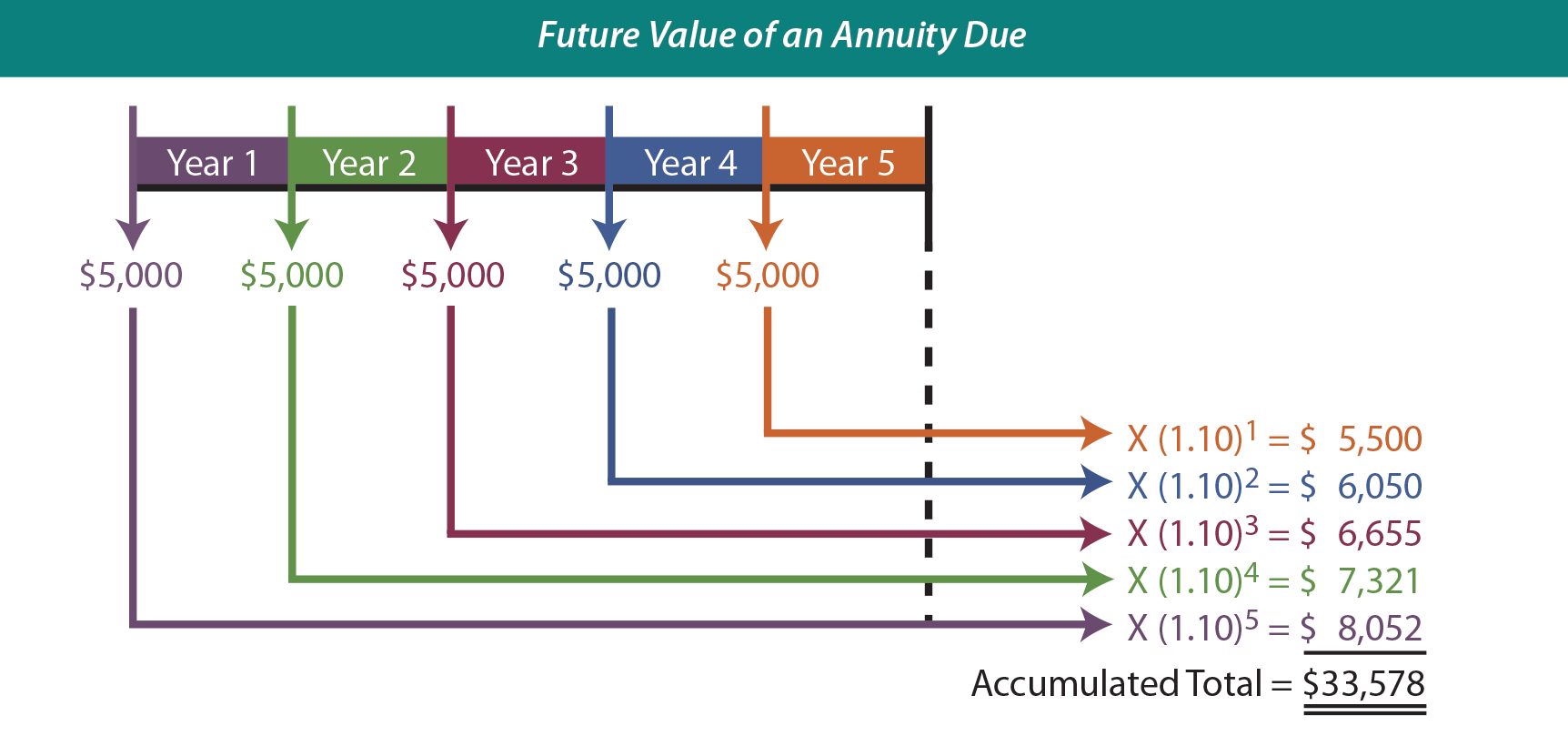

Notice that the future value is larger in this case because you receive each cash flow at the beginning of the period so each cash flow is exposed to one |

|

Financial Mathematics (FM) Exam Syllabus - April 2022

accumulated values for various streams of cash flows as a basis for Although several different calculators are allowed for this exam the BAII Plus or ... |

|

BA II PLUS™ PROFESSIONAL Calculator

calculations and generates an amortization schedule. & . Cash Flow worksheet. (Chapter 3). Analyzes unequal cash flows by calculating net present value. |

|

USING A TEXAS INSTRUMENTS FINANCIAL CALCULATOR FV or

When entering both present value and future value they must have opposite signs. Ordinary Annuity Calculations: 1) Press the 2nd button |

|

December 2022 Exam FM/2 Syllabus

accumulated values for various streams of cash flows as a basis for Although several different calculators are allowed for this exam the BAII Plus or ... |

|

BA II PLUS™ Calculator

Computing Cash Flows. 46. Example: Solving for UnequalCash Flows. 47. Example: Value of a Lease with Uneven Payments. 50. Bond Worksheet. |

|

June 2022 Exam FM/2 Syllabus

accumulated values for various streams of cash flows as a basis for Although several different calculators are allowed for this exam the BAII Plus or ... |

|

Texas Instruments BAII PLUS

To solve for the net present value (NPV) follow these steps: Press. This opens the cash flow register. Press. This clears any numbers that might be in the. |

|

Time Value of Money Part II

In cases in which you require a present value of uneven cash flows, you can use a program in your financial calculator, the NPV program 1 The NPV program |

|

THE TIME VALUE OF MONEY

o Annuity—multiple payments of the same amount that occur over equal time present value of the future cash flows plus the cash flow in the current period) |

|

Chapter 4 - AWS Simple Storage Service (Amazon S3)

future values are then summed up to get the future value of the multiple payment streams Example 1: Future Value of an Uneven Cash Flow Stream Using TVM Keys from a Texas Instrument BAII Plus Calculator and rounded to two |

|

MAF101 – FUNDAMENTALS OF FINANCE REVISION - StudentVIP

PV: the value today of a cash flow to be received at a specific date in the future ( known as principal of plus interest at maturity Define and calculate the present value and future value multiple cash flows, including ordinary annuities |

|

BA II Plus Tutorial

your interest rate and time period to accommodate the multiple compounding periods Your coupon payments and the maturity value (future value) are cash |

|

CHAPTER 2: FINANCIAL ANALYSIS - Faculty Washington

So, what are present and future values, and why are present values different cash flows using this formula only, in practice the present values of cash flows in annual costs include $2/ac in property taxes plus $1/ac for management, and |

|

Chapter 4: The Time Value of Money

Problem: can't directly compare or combine cash flows at different points in time since they Solution: convert all cash flows to equivalent values at a single point in time (so in the same units) today plus interest earned over the coming year |

|

Financial Calculations on the Texas Instruments BAII Plus

I set my BA II Plus to an artificially large number of decimals - usually user to enter multiple occurrences of a value us the net present value of the cash flows |