ba ii plus future value of uneven cash flows

How do you calculate the future value of a cash flow series?

If our total number of periods is N, the equation for the future value of the cash flow series is the summation of individual cash flows: When cash flows are at the beginning of each period there is an additional period required to bring the value forward to a future value.

What is the future value of uneven cash flows?

The future value of uneven cash flows is the sum of future values of each cash flow. It can also be called “terminal value.” Unlike annuities where the amount of payment is constant, many financial instruments and assets generate cash flows that can vary from period to period.

How to calculate the present value of a series of unequal cash flows?

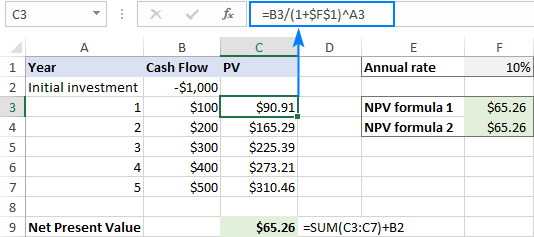

First, we need to find the PV of the perpetuity at the 5 th time (because a regular annuity payment occurs at the end of a period) and then discount it to time 0. That is: Just like calculating future values, the present value of a series of unequal cash flows is calculated by summing individual present values of cash flows.

What is future value factor of CF0 & CFN?

Please note that CF0 is compounded for the whole n periods and CFn is compounded for 0 periods, hence it has future value factor of 1. When a cash flow stream is uneven, the present value (PV) and/or future value (FV) of the stream are calculated by finding the PV or FV of each individual cash flow and adding them up.

Future Values

The Future Value (FV) of a Single Sum of Cash Flow The Future Value (FV) of a single sum of money is the amount that money invested today at a given interest rate (r) for a specified period will translate into in future. Denoted by FVNFVN, the future value of a single sum of money is given by: FVN=PV(1+r)NFVN=PV(1+r)N Where: PVPV = Present value of the investment. FVNFVN= Future value of the investment N periods from today. rr = Rate of interest per period. NN= Number of periods (Years). Note that the formula above is based on the time value

Annuity Due

Annuity due is a type of annuity where payments start immediately at the beginning of time, at time t = 0. In other words, payments are made at the beginning of each period. The formula for the future value of an annuity due is derived by: FVN=A[(1+r)N+(1+r)N–1+(1+r)N−2+…+(1+r)1] Which reduces to: FVN=A[(1+r)N–1d] Where: d=r1+r analystprep.com

Present Values

Present Values of Single Cashflow The present value (PV) is the current value of a future sum of money (Future value, FV) or series of cashflows given a specified rate of return. Note that the future value of a single sum of money is given by: FVN=PV(1+r)N If we make the present value (PV) the subject of the formula by dividing both sides of the above equation by FVN(1+r)N=PV(1+r)N(1+r)N ⇒PV=FVN(1+r)−N Where: PV = Present value of the investment. FVN = Future value of the investment N periods from today. r = Rate of interest

Present Value of A Series of Cashflows

Many investments offer a series of uneven, relatively even, or unequal payments over a given period. Therefore, different methodologies are employed in the valuation of their present values. analystprep.com

|

Texas Instrument BAII PLUS Tutorial

The effective rate of 10.47 percent is displayed on the screen. Cash Flow Operations. Example 1: We can also find the PV FV |

|

BA II PLUS™ PROFESSIONAL Calculator

Compute present value of 2nd cash flow. % . PV= 5785.12 . Sum to memory As the time line shows |

|

Texas Instruments BAII PLUS

This represents an uneven cash flow stream. To solve for the present value of this cash flow pattern follow these steps: Press. This opens the cash flow |

|

Financial Calculations on the Texas Instruments BAII Plus

Example Uneven Cash Flows. ➡ Valued at 6%. 0. 1. 2. 3. 4. 5. 0. $20 |

|

Set 2: Lesson 7 notes

Texas Instruments TI BA II Plus. Any calculator that has these keys noted The present or future value of multiple cash flows is simply the sum of the ... |

|

BA II PLUS™ Calculator

The present value of variable cash flows is the value of cash flows As the time line shows the cash flows are a combination of equal and unequal values. |

|

Texas Instruments BAII Plus Tutorial for Use with Fundamentals 11/e

Example 12: Uneven cash flows: annuity plus a lump sum NPV 12 ENTER ↓ CPT . 2 NPV stands for Net Present Value. Our stream has no negative cash flows but if ... |

|

THE TIME VALUE OF MONEY

See the explanation of how to compute the FV of an uneven cash flow stream using your calculator that was given in an earlier section. To find the PV of the |

|

THE TIME VALUE OF MONEY

o Future value of an uneven cash flow stream—consider the following situation: present value of the future cash flows plus the cash flow in the current period ... |

|

BA II PLUS PROFESSIONAL Calculator

Net future value (NFV) is the total future value of all cash flows. A As the time line shows the cash flows are a combination of equal and unequal values. |

|

BA II PLUS™ Calculator

Cash Flow worksheet. Analyzes unequal cash flows by calculating net present value and internal rate of return. & '. Bond worksheet. Computes bond price and. |

|

Financial Calculations on the Texas Instruments BAII Plus

present value of the cash flows. Page 5. 5. © Copyright 2002 Alan Marshall. 25. |

|

Read Book Texas Instruments Baii Plus Tutorial

6 days ago BA II Plus Calculator: Cash Flow - Net Present Value Finance: How to calculate Annuity Present Value |

|

BA II PLUS™ PROFESSIONAL Calculator

Cash Flow worksheet. (Chapter 3). Analyzes unequal cash flows by calculating net present value and internal rate of return. & '. Bond worksheet. (Chapter 4). |

|

BA II PLUS™ Calculator

Cash Flow worksheet. Analyzes unequal cash flows by calculating net present value and internal rate of return. & '. Bond worksheet. Computes bond price and. |

|

BA II PLUS PROFESSIONAL Calculator

Cash Flow worksheet. Analyzes unequal cash flows by calculating net present value and internal rate of return. & '. Bond worksheet. Computes bond price and. |

|

Texas Instrument BAII PLUS Tutorial

The BAII PLUS is programmed so that if the PV is + then the Fv is displayed as – FV an IRR (internal rate of return) of a series of unequal cash flows. |

|

Set 2: Lesson 7 notes

uneven cash flows and will probably get the job done. both the HP (10bii) and the TI (BA II Plus) keystrokes. N. I. PV. PMT. FV. |

|

Texas Instruments BAII Plus Tutorial for Use with Fundamentals 11/e

Here are the keystrokes: NPV 12 ENTER ? CPT . 2 NPV stands for Net Present Value. Our stream has no negative cash flows but if |

|

THE TIME VALUE OF MONEY

calculator to determine exactly how uneven cash flows must be entered. If you have a. Texas Instruments BAII PLUS solve for the present value for the |

|

THE TIME VALUE OF MONEY

Future Value of Uneven Cash Flow Streams, FVCFn—unlike an annuity, present value of the future cash flows plus the cash flow in the current period) Then, |

|

Chapter 4 - AWS Simple Storage Service (Amazon S3)

Apply the time value of money concepts to evaluate the lottery cash flow choice 9 Summarize Example 1: Future Value of an Uneven Cash Flow Stream Using TVM Keys from a Texas Instrument BAII Plus Calculator and rounded to two |

|

Time Value of Money Part II

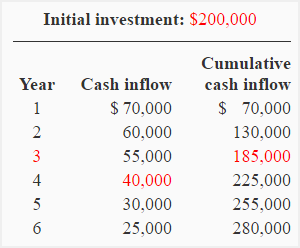

To calculate the future value of an uneven series of cash flows, you need to calculate the future value of each of the individual cash flows and then sum these future values to arrive at the future value of the series |

|

Chapter 4: Time Value of Money - KFUPM

At what time do these the cash flows occur and at what time do you need to evaluate back the $500 dollars plus interest after 2 years How much In general, the future value of an initial lump sum is: FVn = PV × (1+i)n 0 1 2 3 4 To calculate the future value of uneven cash flows, it is much easier to start by calculating |

|

Details - Topic Overview

uneven cash flows; 2 Calculate the future value of a series of uneven cash flows; principal plus interest amounts, teacher may show these tools to the class |

|

Using Financial and Business Calculators - Kees van der Sanden

J Calculating the net present value of a series of uneven cash flows: The TI BAII PLUS can store 24 cash flow groups besides the initial cash investment A cash |

|

Time Value of Money - WordPresscom

PV the cash flow at Time 0, whereas CF3 would be the value is equal to the principal plus the interest: FV PV PV(I)(N) 28 12 UNEVEN CASH FLOWS |

|

Set 2: Lesson 7 notes

uneven cash flows and will probably get the job done In this lesson, all of both the HP (10bii) and the TI (BA II Plus) keystrokes N I PV PMT FV CFj How much A Determine the present value of a single future cash flow of $10,000, due |

|

Hewlett-Packard 10BII Tutorial This tutorial has been - CSUN

with Chapter 2: The Time Value of Money and Chapter 8: Risk and Return Today , most Example 11: Annuity plus a lump sum Assume a Similarly, if we are interested in solving for the FV of this uneven cash flow stream, we just have to |