global minimum variance portfolio

|

Portfolio Theory

Portfolio Theory. 35 / 54. Page 36. Strategy for Plotting Portfolio Frontier. 1. Set global minimum variance portfolio = first frontier portfolio min m σ2 pm |

|

Predicting the global minimum variance portfolio

Jul 5 2020 We propose a novel dynamic approach to forecast the weights of the global mini- mum variance portfolio (GMVP). The GMVP weights are the ... |

|

The Global Minimum Variance Portfolio and Efficient Frontier

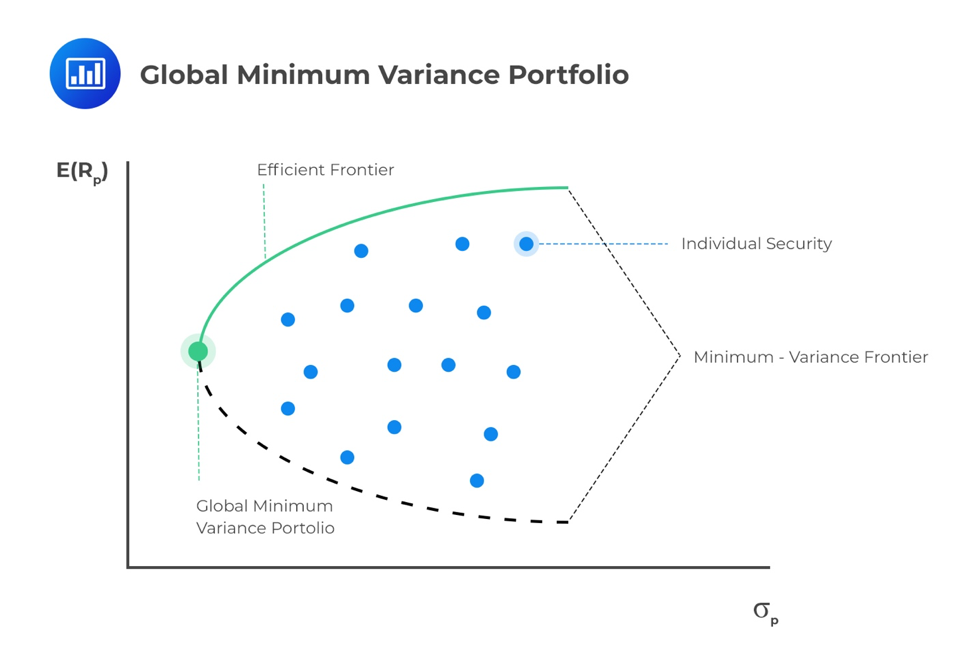

Global minimum variance portfolio (GMVP) is the portfolio with lowest variance among all other feasible portfolios. In addition efficient frontier is the |

|

On the estimation of the global minimum variance portfolio

Expected returns can hardly be estimated from time series data. There- fore many recent papers suggest investing in the global minimum variance portfolio. |

|

Global Minimum Variance Portfolio - Estimation of the Covariance

Jun 17 2021 However |

|

FTSE Global Minimum Variance Index Series: Ground Rules

Objective: Minimise portfolio volatility σ. 2= ∑ ∑ wiCijTwj. N j=1. N i=1. Where wi is the weight of the ith stock. Page 14. FTSE Global Minimum Variance |

|

Clustering Approaches for Global Minimum Variance Portfolio

Keywords: portfolio optimization global minimum variance portfolio |

|

Inverse covariance matrix estimation for the global minimum

The estimation of inverse covariance matrices plays a major role in portfolio opti- mization for the global minimum variance portfolio in mean-variance |

|

BUILDING MINIMUM VARIANCE PORTFOLIOS WITH LOW RISK

FIGURE 2: ANNUAL RETURNS OF THE STOXX GLOBAL MINIMUM VARIANCE INDICES. Source: STOXX data from Jan. 2 2003 to Jul. 29 |

|

Portfolio Theory with Matrix Algebra and No Short Sales

Aug 12 2014 No short sales constraint is not binding: unconstrained weights are all positive ! © Eric Zivot 2006. Page 5. Global Minimum Variance Portfolio ... |

|

On the estimation of the global minimum variance portfolio

Therefore the only efficient stock portfolios is the one with the smallest risk |

|

Predicting the global minimum variance portfolio

05 Jul 2020 The global minimum variance portfolio (GMVP) allocates a given budget among n financial assets such that the risk for the rate of expected ... |

|

Portfolio Theory

Finding the global minimum variance portfolio. Finding efficient portfolios. Computing the efficient frontier. Mutual fund separation theorem again. |

|

Inverse covariance matrix estimation for the global minimum

The estimation of inverse covariance matrices plays a major role in portfolio opti- mization for the global minimum variance portfolio in mean-variance |

|

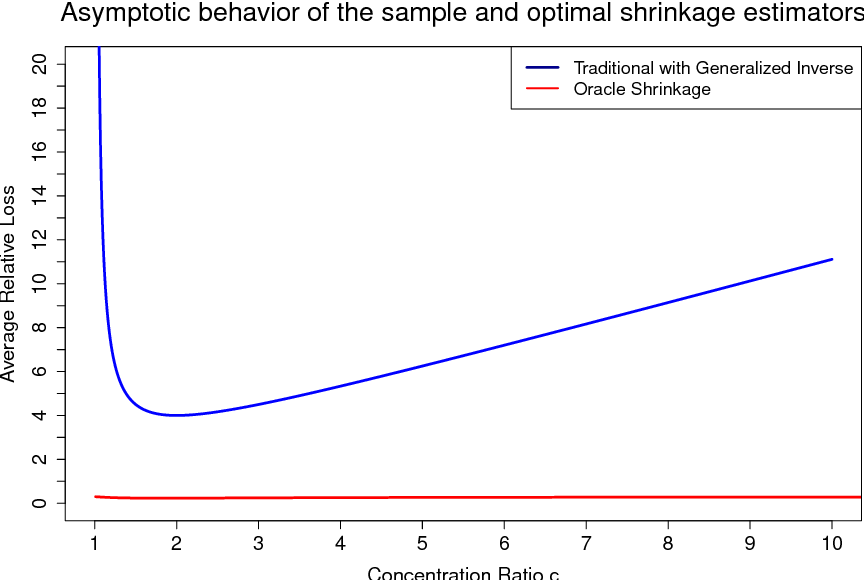

Tests for the weights of the global minimum variance portfolio in a

Index Terms—Finance; Portfolio analysis; Global minimum variance portfolio; Statistical test; Shrinkage estimator; Random matrix theory; Singular covariance |

|

Bayesian Estimation of the Global Minimum Variance Portfolio

17 Apr 2015 The global minimum variance (GMV) portfolio is a specific optimal portfolio which possesses the smallest variance among all portfolios on ... |

|

Global Minimum Variance Portfolio - Estimation of the Covariance

17 Jun 2021 However in this project the focus is on the Global Minimum Variance (GMV) portfolio derived from Markowitz theory which at the same time can ... |

|

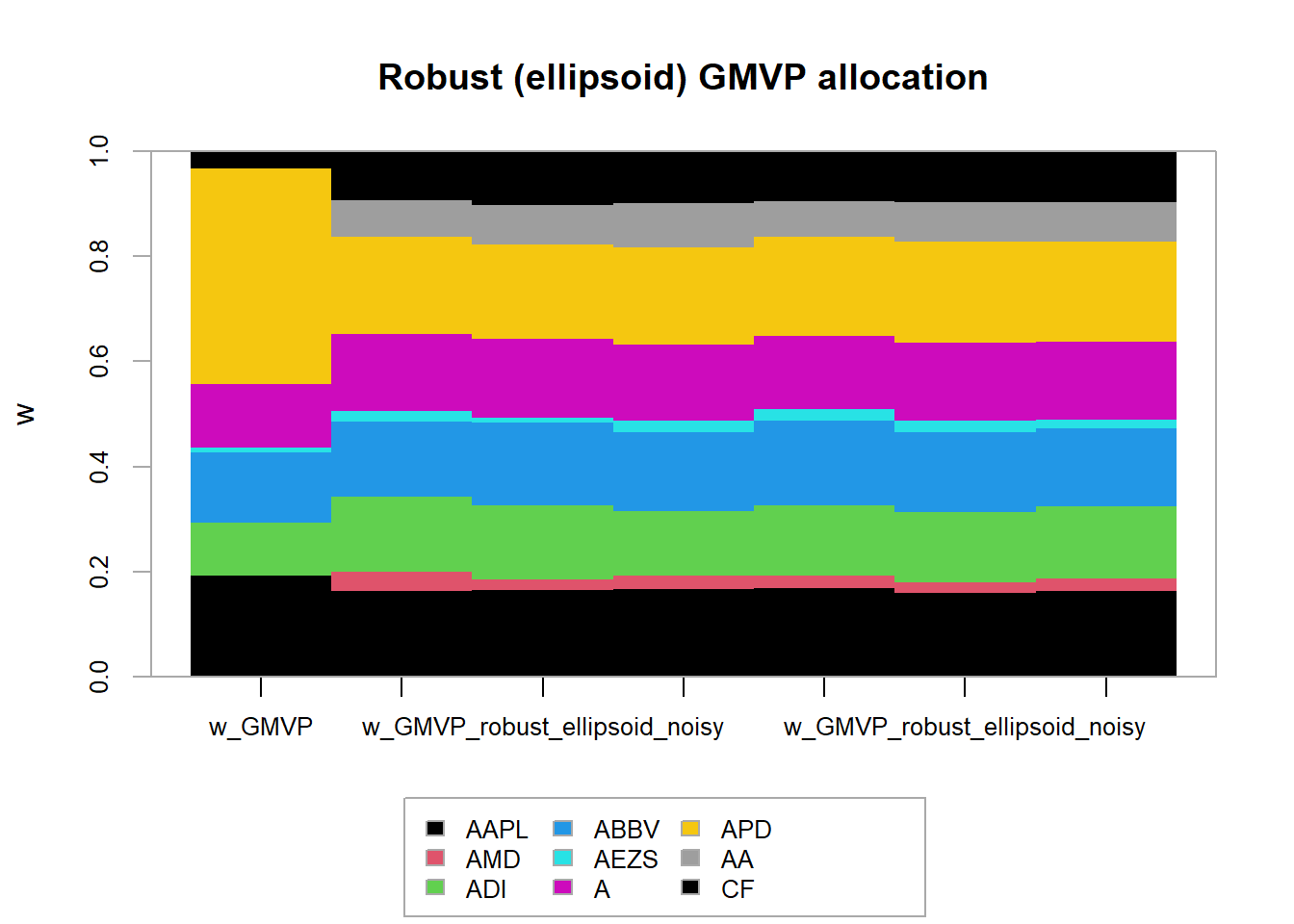

Global minimum variance portfolios under uncertainty: a robust

Keywords: Portfolio selection multi-objective |

|

Reconciling mean-variance portfolio theory with non-Gaussian returns

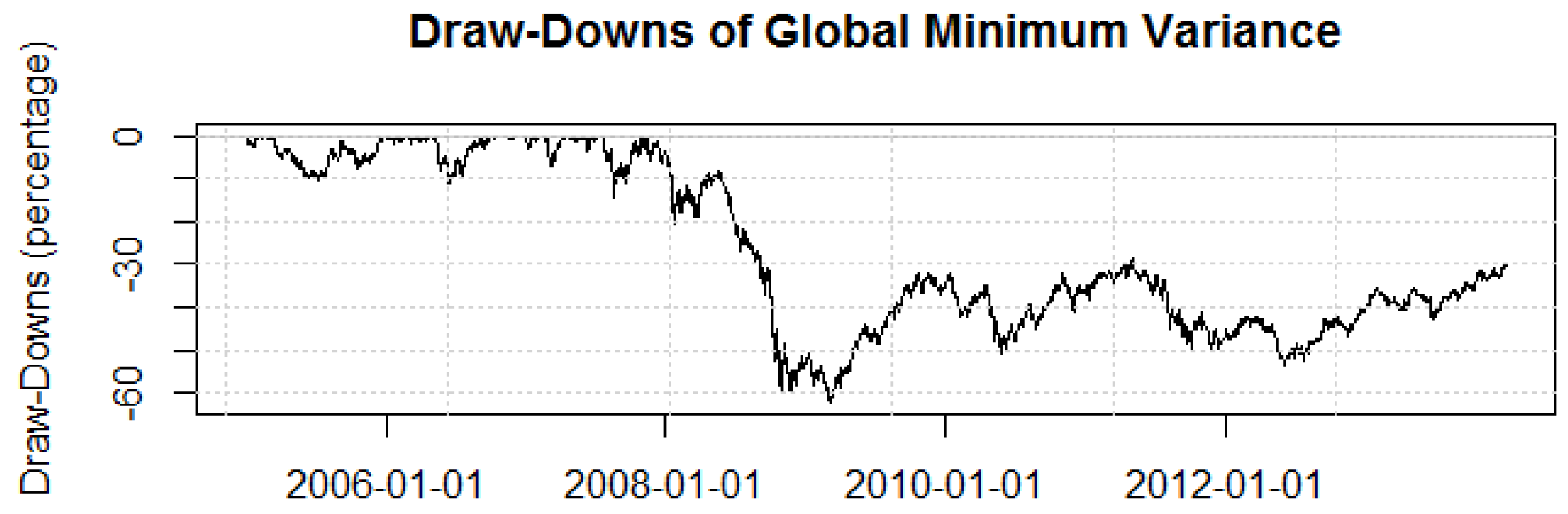

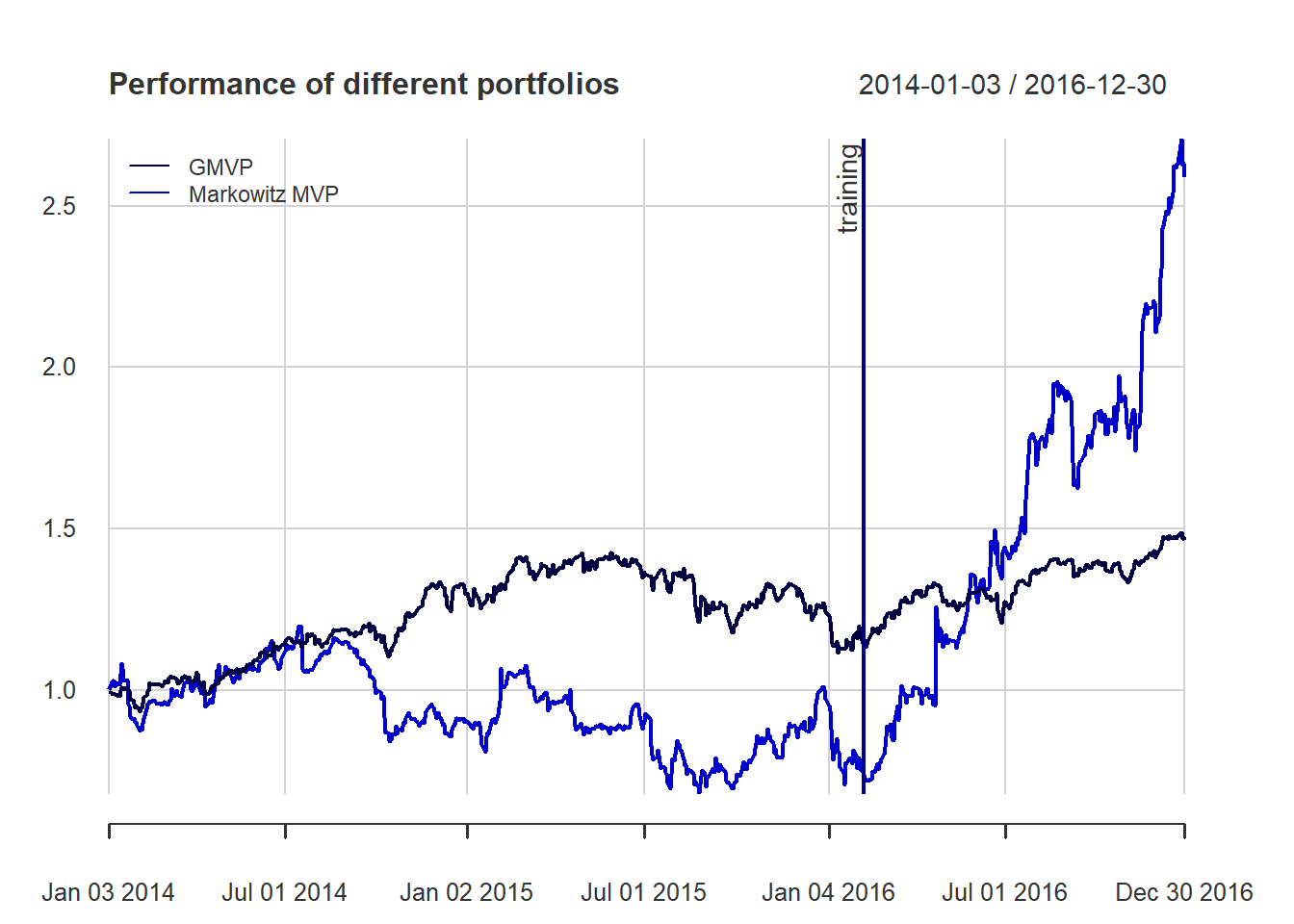

to compare the out-of-sample performance of the global minimum-variance (GMV) portfolio our portfolio strategy |

|

Chapter 1 Portfolio Theory with Matrix Algebra

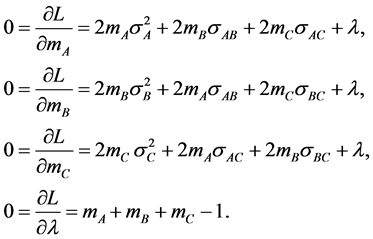

07 Aug 2013 solved to find the global minimum variance portfolio weights m m and m . Using matrix notation |

|

Global Minimum Variance Portfolio - Pompeu Fabra University

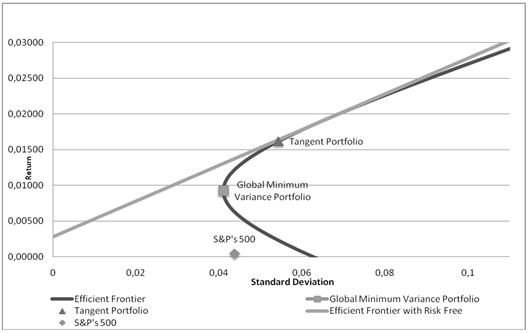

Global Minimum Variance Portfolio In this section we present the GMV portfolio derived from the Markowitz model as well as the optimization procedure to create it So the GMV portfolio is the portfolio with the lowest possible variance for a given universe of assets |

|

Chapter 1 Portfolio Theory with Matrix Algebra

Aug 7 2013 · The portfolio labeled GLOBAL MIN is the min-imum variance portfolio consisting of Microsoft Nordstrom and Starbucksrespectively 1 1 1 Portfolio Characteristics Using Matrix Notation De?ne the following 3 × column vectors containing the asset returns andportfolio weights ? ??? ? ? = x ?= ? |

|

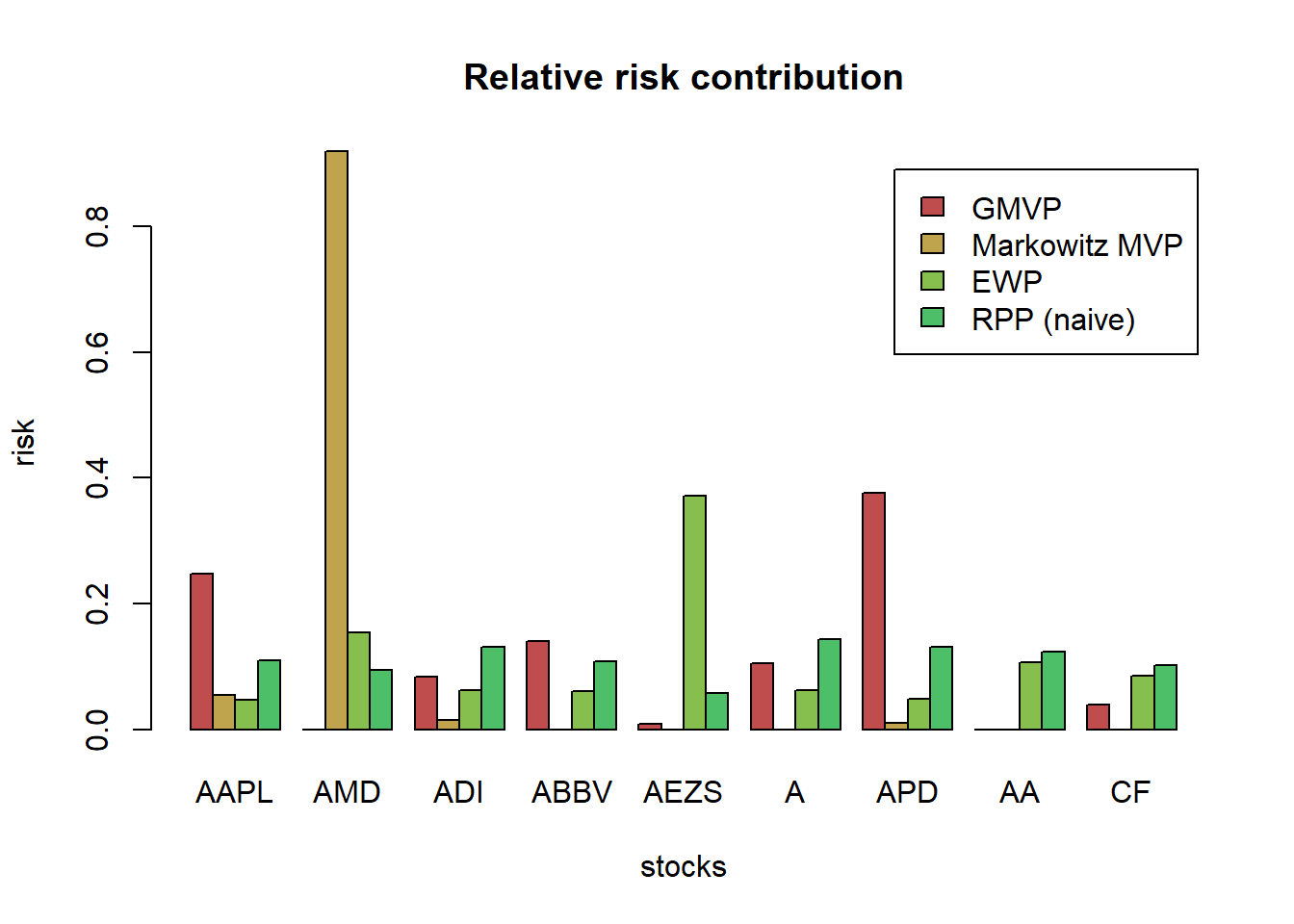

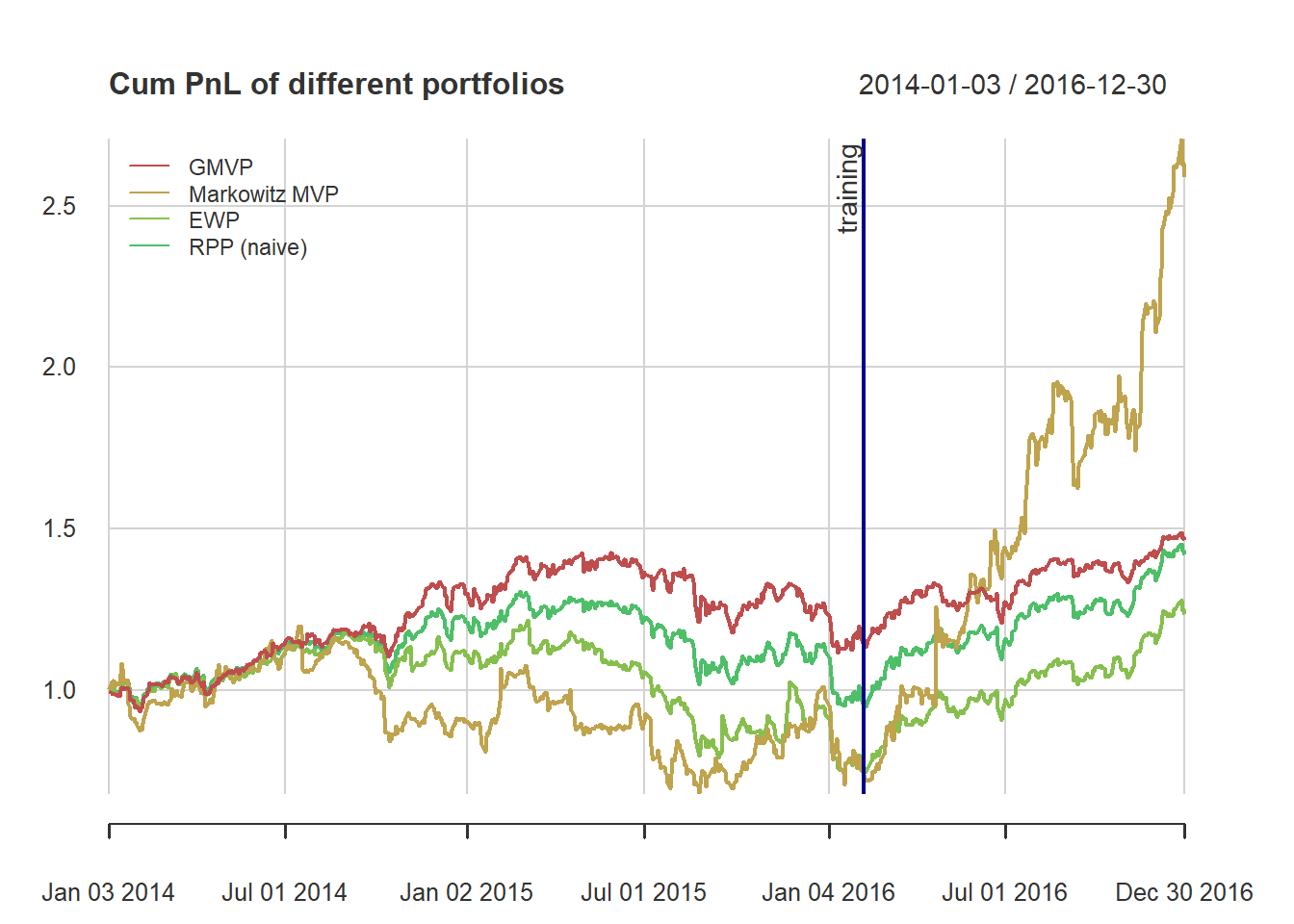

A critical review of the global minimum variance theory - Lu

4Heuristic Portfolios 5Markowitz’s Modern Portfolio Theory (MPT) Mean-variance portfolio (MVP) Global minimum variance portfolio (GMVP) Maximum Sharpe ratio portfolio (MSRP) Returns of the universe In practice we don’t just deal with one asset but with a whole universe of N assets |

|

Chapter 8 Markowitz Portfolio Theory - University of Utah

As it turns out this can be achieved with any two portfolios on the frontier so themore general mutual fund theorem states: Any minimum variance portfoliowcanbe expressed in terms of any two distinct minimum variance portfolios =s1wa+s2wb wherewa 6=wb ands1ands2satisfyings1+s2= 1can be calculated by certainformula similar to the formula fora |

What is global minimum variance portfolio?

- 3.3 Global minimum variance portfolio The core idea of the GMV theory is to find the asset weights that minimize the portfolio variance, given the assets covariance matrix. There are no

What is global minimum variance (GMV)?

- 3.3 Global minimum variance portfolio The core idea of the GMV theory is to find the asset weights that minimize the portfolio variance, given the assets covariance matrix. There are no constraints, therefore, negative weights might appear, i.e. short sales are allowed.

How to minimize portfolio variance?

- Given the estimated covariance matrix, this is approximately the optimal way to weight your portfolio to minimize the risk. By the usage of these weights and the sample covariance matrix, the minimized portfolio variance is calculated Twith formula (20), Y

How many covariance terms contribute to portfolio variance?

- Notice that variance of the portfolio return depends on three variance termsand six covariance terms. Hence, with three assets there are twice as manycovariance terms than variance terms contributing to portfolio variance. Evenwith three assets, the algebra representing the portfolio characteristics (1.1) (1.3) is cumbersome.

|

On the estimation of the global minimum variance portfolio - econstor

The weights of the global minimum variance portfolio are usually estimated by replacing the true return covariance matrix by its time series estimator However |

|

Portfolio Theory - Faculty Washington

1 Portfolios with Three Risky Assets Portfolio characteristics using matrix notation Finding the global minimum variance portfolio Finding efficient portfolios |

|

2 Mean-variance portfolio theory

we obtain λ1 =c − bµP ∆ and λ2 = aµP − b ∆ , and the optimal weight w∗ = Ω−1(λ11+ λ2 µ) To find the global minimum variance portfolio, we set dσ 2 P |

|

A critical review of the global minimum variance theory

The main purpose of this thesis is to give a basic understanding of the GMV portfolio theory and the problematics that arise when using the sample covariance |

|

Dominating estimators for the global minimum variance portfolio

In this paper, we derive two shrinkage estimators for the global minimum variance portfolio that dominate the traditional estimator with respect to the |

|

The Performance of Minimum Variance Portfolios in - Nasdaq Baltic

This paper applies minimum variance portfolio optimization to the Baltic equity State Street Global Advisors, Robeco, Invesco, AXA Rosenberg, and Vesco |

![PDF] Estimation of the global minimum variance portfolio in high PDF] Estimation of the global minimum variance portfolio in high](https://onlinelibrary.wiley.com/cms/asset/7ee6dcf8-ef2c-4a37-8a01-55e342c1d1bf/nfg004.jpg)