bcbs 239 implementation date

|

Progress in adopting the Principles for effective risk data

of increasing the effectiveness of their implementation practices (see Section 4 1 1) Table 1 – Expected date of full compliance with BCBS 239 Year By 2019 |

|

BCBS 239 Compliance A catalyst for gaining competitive advantage

BCBS 239 was effective from 1st January 2016 for Global Systemically Important Banks (G-SIBs) while Other Systemically Important Banks (O-SIBs) are expected |

|

BCBS 239 Principles for effective risk data aggregation and risk

The Basel Committee on Banking Supervision issued the Principles for effective risk data aggregation and reporting (BCBS 239) in January 2013 BCBS 239 is a |

What is the BCBS 239 standard?

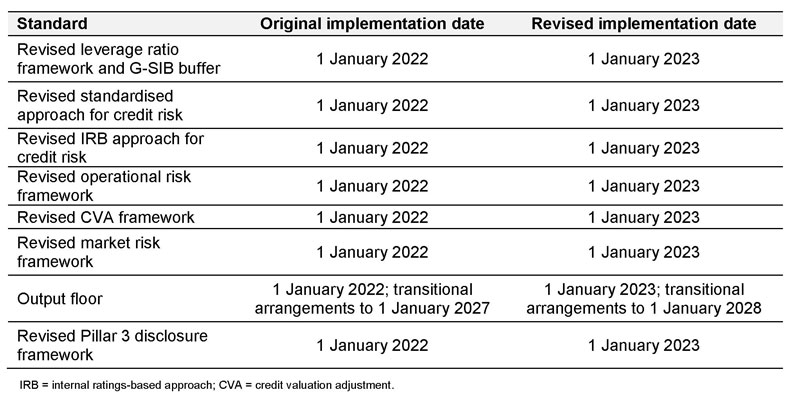

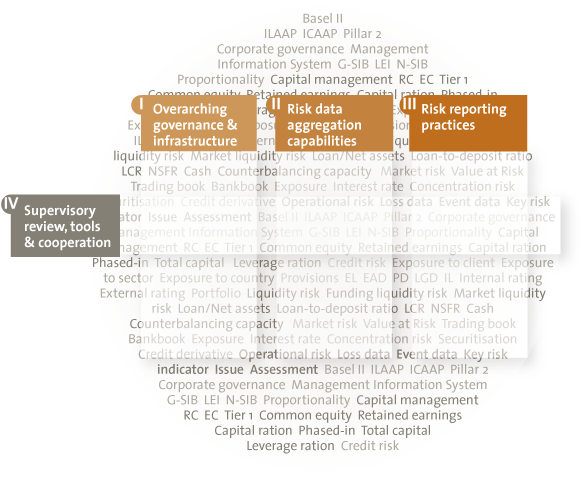

BCBS 239 presents a set of principles aimed at strengthening banks' governance frameworks, enterprise-wide risk data aggregation capabilities and internal risk reporting practices.

In turn, effective implementation of BCBS 239 is expected to enhance risk management and decision-making processes at banks.BCBS 239 is a set of 14 principles (11 for the banks and 3 for the supervisors) aimed at strengthening Banks' risk management and decision making.

Banks designated as Globally Systematically Important (G-SIBs) have been required to implement and meet these principles.

What are the challenges of BCBS 239?

Key challenges and components of BCBS 239 require financial institutions to strengthen their ability to identify, manage, and monitor their high-risk data; establish actionable governance and data management practices; and reduce risk.

What is BCBS 239 in the US?

BCBS 239 establishes a set of principles focused on improving risk data aggregation and reporting in banks.

Given the complexity of today's banking environment and the lessons learned from the 2007-2008 financial crisis, effective implementation of these principles is crucial.17 nov. 2023

Mike Butterworth

Principal Ernst & Young LLP mike.butterworth@ey.com assets.ey.com

Michail Tsibulevsky

Partner Ernst & Young — Russia michail.tsibulevsky@ru.ey.com assets.ey.com

Vadim Tovshteyn

Principal Ernst & Young LLP vadim.tovshteyn@ey.com assets.ey.com

Alissa McCaddin

Senior Manager Ernst & Young LLP alissa.mccaddin@ey.com assets.ey.com

EY Building a better working world

EY exists to build a better working world, helping to create long-term value for clients, people and society and build trust in the capital markets. Enabled by data and technology, diverse EY teams in over 150 countries provide trust through assurance and help clients grow, transform and operate. Working across assurance, consulting, law, strategy,

Revolutionizing Banks Data Governance Framework: BCBS 239 Guidelines Unleashed!

BCBS239 Overview

Bank Data Governance Unleashed: Decoding BCBS 239s 14 Basic Principles for Massive Impact!

|

Progress in adopting the Principles for effective risk data

Section 1 of this report summarises the background of BCBS 239 and work conducted by the Risk Data Network (RDN) 2 to date. Section 2 gives an overview of banks |

|

Basel Committee on Banking Supervision Principles for effective risk

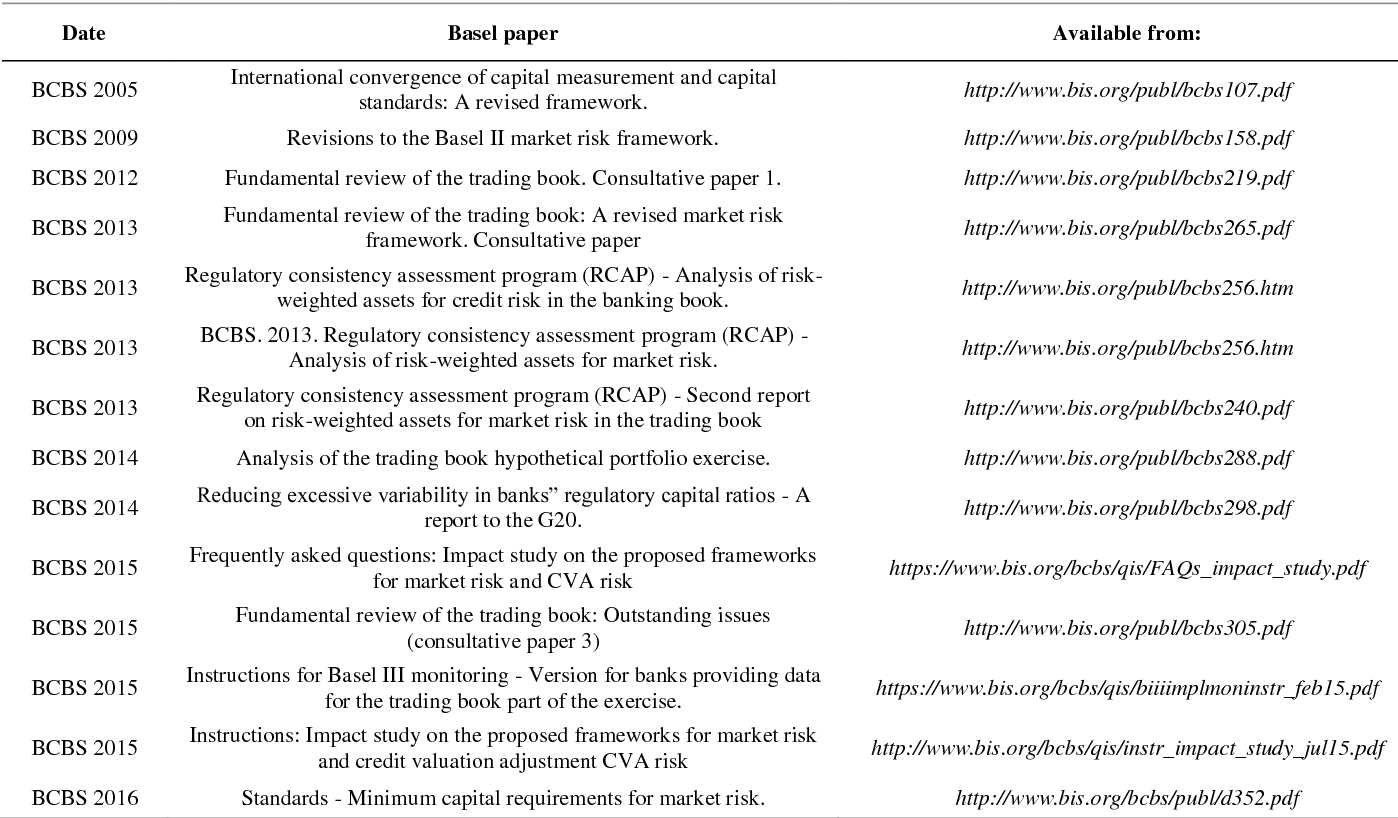

Implementation timeline and transitional arrangements . The Basel Committee also included references to data aggregation as part of its guidance on. |

|

Report on the Thematic Review on effective risk data aggregation

global systemically important banks – have fully implemented the BCBS 239 The deadline for global systemically important banks to meet these ... |

|

Progress in adopting the Principles for effective risk data

1. BCBS Principles for effective risk data aggregation and risk reporting |

|

BCBS 239 – Raising the standard - November 2017

Since it was issued in January 2013 |

|

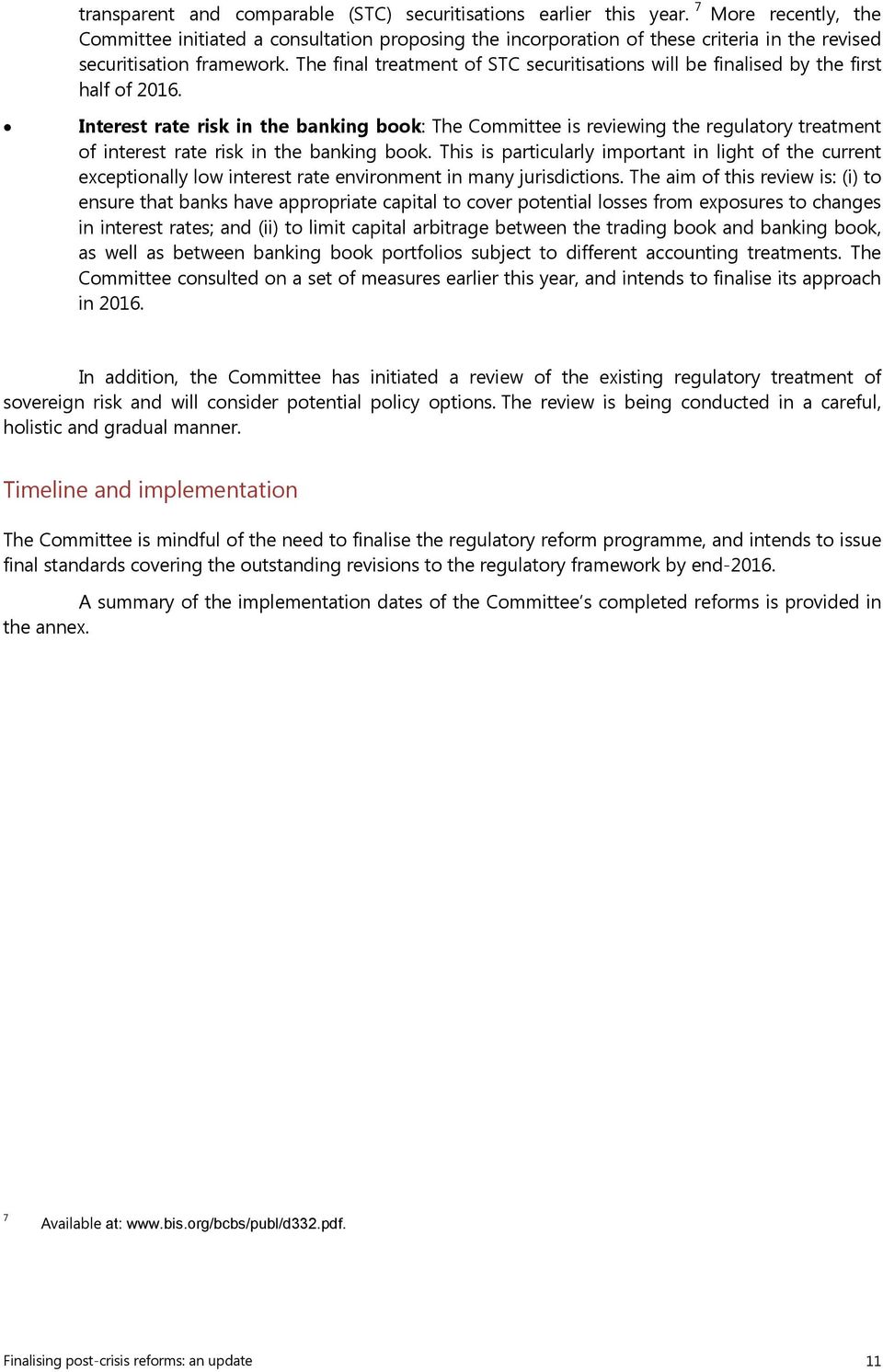

Progress report on adoption of the Basel regulatory framework

1 oct. 2021 The Basel Committee on Banking Supervision (BCBS) and its ... Applicable standards for which the agreed implementation deadline has passed ... |

|

Talking about compliance: BCBS 239 implementation in South Africa

Most banks expect to meet the deadline set by the South African Reserve Bank. (SARB)although there is no single definition of compliance. The shape and form of. |

|

BCBS 239 Compliance A catalyst for gaining competitive advantage

and Risk Reporting (BCBS 239) to enhance implementation of BCBS 239 is expected ... to be compliant three years after the date they become designated. |

|

Progress in adopting the principles for effective risk data

compliance by the 2016 deadline and to help identify and remedy any implementation issues. 1. The Principles can be found at www.bis.org/publ/bcbs239.htm. |

|

A report to G20 Leaders on implementation of the Basel III regulatory

The Basel Committee's agreed implementation dates in brackets. Source: Basel Committee monitoring reports on the adoption of Basel standards www.bis.org/bcbs/ |

|

Progress in adopting the Principles for effective risk data

of increasing the effectiveness of their implementation practices (see Section 4 1 1) Table 1 – Expected date of full compliance with BCBS 239 Year By 2019 |

|

BCBS 239 - PwC

The JFSA nominated 4 banks as D-SIBs in December 2015 and is requiring them to comply with BCBS 239 by December 2018 The compliance deadline for Hong Kong is 1 April 2018 However, we have noted that some of the 5 designated D-SIB banks have just started on their gaps assessment |

|

The Implementation of Basel Committee BCBS 239 - Sciendo

As the BCBS 239 for G-SIBs deadline was - at the time of writing – 10 months overdue, what approach towards compliance will prove to be more effective? |

|

BCBS 239 - KPMG International

The deadline for IT implementation falls within deadlines for other regulations, making significant demands on existing bank resources Implications of Compliance |

|

Report on the Thematic Review on effective risk data aggregation

global systemically important banks – have fully implemented the BCBS 239 The deadline for global systemically important banks to meet these expectations |

|

BCBS 239 Compliance: A Comprehensive Approach - Cognizant

Risk Data Aggregation BCBS 239 requires that regulatory reports be based on risk data that is complete, accurate and clear at all times, including during crises, |

|

BCBS239 Practical Implementation Issues - Reply

Complete and up-to date • Reporting to the right people at the right time • Flexibility and ad-hoc reporting, also in periods of stress or crisis BCBS 239: Context |

|

BCBS 239 progress update and industry trends (pdf) - EY

Cost and complexity of maintaining up-to-date documentation across functional banks regarding BCBS 239 compliance and RDAR practices EY Global Self- |

![PDF] Recent Issues in the Implementation of the New Basel Minimum PDF] Recent Issues in the Implementation of the New Basel Minimum](https://pbs.twimg.com/media/D0QKF6qWkAEmnNp.png:large)

![Intraday Liquidity Reporting - [PDF Document] Intraday Liquidity Reporting - [PDF Document]](https://docplayer.net/docs-images/42/8470290/images/page_13.jpg)