hqla level 1

|

Annex 1 Summary description of the LCR of press release Group

HQLA are comprised of Level 1 and Level 2 assets. Level 1 assets generally include cash central bank reserves |

|

US Liquidity Coverage Ratio

13 nov. 2020 The HQLA is comprised of Level 1 2A |

|

Occasional Paper Series - Availability of high-quality liquid assets

Table 1. Euro-denominated assets that qualify as HQLA in the EU. Asset class. Description. Level. Haircut. Exposures to central banks. Coins and banknotes. |

|

Liquidity Coverage Ratio (LCR) HQLA Amount (Numerator) HQLA

amount – max (Unadjusted excess HQLA amount ; Adjusted excess HQLA amount). Where. Level 1 liquid asset amount = Level 1 liquid assets that are eligible |

|

Basel Committee on Banking Supervision Basel III: The Liquidity

Annex 1: Calculation of the cap on Level 2 assets with regard to short-term more resilient banking sector: the Liquidity Coverage Ratio (LCR). |

|

LM-1 “Regulatory Framework for Supervision of Liquidity Risk”

28 août 2020 Application of LCR. 5.1 Structure of LCR. 5.2 High quality liquid assets (HQLA). 5.3 Level 1 assets. 5.4 Level 2A assets. |

|

1 Annex Basel III Framework on Liquidity Standards – Liquidity

Any excess of Level 2B assets over these limits must be deducted from the stock of. HQLA. 6.7 Calculation of Total net cash outflows. 6.7.1 The total net cash |

|

Frequently Asked Questions on Basel IIIs January 2013 Liquidity

(a). A bank has a reverse repurchase agreement receiving collateral that consists of a pool of assets including non-HQLA. Can the whole portion of Level 1 |

|

Final report

26 jan. 2022 1) Supply of liquid assets (size of the market). This is provided per type of liquid asset and level. For example the amount of outstanding ... |

|

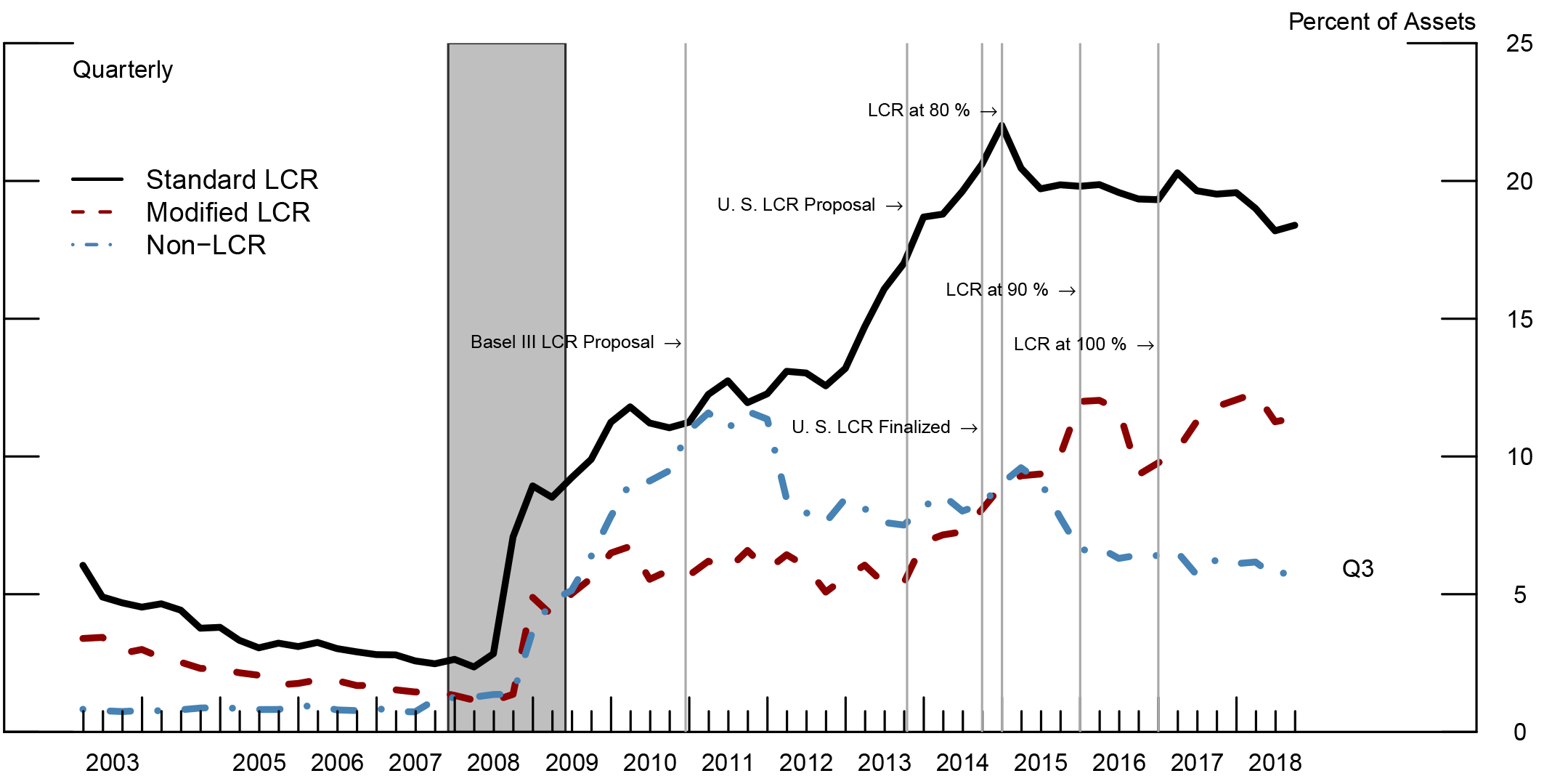

How have banks been managing the composition of high-quality

6 août 2017 The numerator of the ratio HQLA |

|

Basel Committee on Banking Supervision

These general guidelines were used to categorise broad asset classes into three levels of HQLA: Level 1 2A and 2B However individual assets within those broad categories and across different jurisdictions financial markets and currencies can exhibit very different liquidity characteristics |

|

Basel Committee on Banking Supervision

Our HQLA solution is scalable and can be customized to clients’ specific needs The full suite consists of 3 data sets: • HQLA Classification — Twenty one data points needed to assist in determining an appropriate level of HQLA for 8 jurisdictions These security-level data points include the level |

|

Liquidity Coverage Ratio - Goldman Sachs

The LCR Rule defines HQLA in three asset categories: Level 1 Level 2A and Level 2B and applies haircuts and limits to certain asset categories Level 1 assets are considered the most liquid under the LCR Rule and are eligible for inclusion in a firm’s HQLA amount without a haircut or limit |

|

UBS Americas Holdings LLC

The LCR rule classifies HQLA into three categories of assets: Level 1 liquid assets Level 2A liquid assets and Level 2B liquid assets Level 1 liquid assets are the highest quality and most liquid assets and include U S treasury securities and central bank reserves These assets are included in a Covered Company’s |

|

Liquidity Coverage Ratio (LCR) HQLA Amount (Numerator)

HQLA amount = Level 1 liquid asset amount + Level 2A liquid asset amount + Level 2B liquid asset amount – max (Unadjusted excess HQLA amount ; Adjusted excess HQLA amount) Where Level 1 liquid asset amount = Level 1 liquid assets that are eligible HQLA – Reserve balance requirement; |

|

Searches related to hqla level 1 filetype:pdf

The final rule establishes three categories of HQLA: level 1 liquid assets level 2A liquid assets and level 2B liquid assets Level 1 liquid assets which are the highest quality and most liquid assets are included in a Covered Company’s eligible HQLA without a limit and without haircuts Under the U S LCR the following assets are |

What are the three levels of HQLA?

- The current standard for the LCR relies on a combination of qualitative criteria, Basel risk weights and external credit ratings to determine asset class eligibility for the pool of HQLA. These general criteria were used to categorise broad asset classes into three levels of HQLA: Level 1, 2A, and 2B.

Can level 2B assets be included in HQLA?

- As described in the LCR standard, national authorities can choose whether to include an additional class of Level 2B assets. This gives scope for the potential inclusion in HQLA of a wide range of assets with very different liquidity profiles. This document provides suggestions that may assist supervisors when classifying such assets.

What does HQLA stand for?

- The LCR Rule requiresthat a firm subject to the LCR Rule maintain an amount of high-quality liquid assets ( HQLA) that % of the firm’stotal net cash outflows (NCOs) over a prospective 30 calendar -day period.

What metrics are required to qualify for HQLA?

- For example, qualifying Level 1 HQLA may only be required to pass the Fundamental and Basic Metrics, but qualifying Level 2 assets might need to pass the Fundamental, Basic, and Data-Dependent Metrics. This concept can be further extended by applying only certain metrics to a particular asset class within an HQLA level.

|

Annex 1 Summary description of the LCR of press release Group

HQLA are comprised of Level 1 and Level 2 assets Level 1 assets generally include cash, central bank reserves, and certain marketable securities backed by |

|

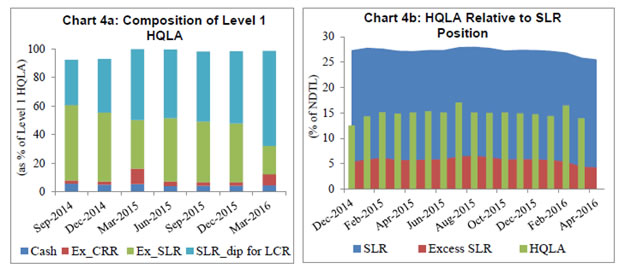

Availability of high-quality liquid assets and monetary policy

Table 1 provides an overview of euro-denominated assets that qualify as HQLA and the applicable LCR haircuts HQLA are classified as either Level 1 (L1) or |

|

Liquidity Coverage Ratio (LCR) HQLA Amount (Numerator) HQLA

Where Level 1 liquid asset amount = Level 1 liquid assets that are eligible HQLA – Reserve balance requirement; Level 2A liquid asset amount = 85 * Level 2A |

|

Deloitte proposals template

1 U S LCR final rule U S Basel III Liquidity Coverage Ratio (LCR) rule1 is finalized – key and inclusion limits (i e , Level 1, Level 2A, and Level 2B assets) |

|

CRR HQLA Level 1 Investors Focus - 3CIF

HQLA level 1 are the most liquid assets They may be used without limit in the liquidity buffer and are not subject to a discount (or haircut) to their market value |

|

Liquidity Coverage Ratio (LCR) - Reserve Bank of India

Any excess of Level 2B assets over these limits must be deducted from the stock of HQLA 6 7 Calculation of Total net cash outflows 6 7 1 The total net cash |

|

Liquidity Coverage Ratio - OSFI-BSIF

into account the impact on the stock of HQLA of the amounts of Level 1 and Level 2 assets involved in secured funding,10 secured lending11 and collateral |

|

Liquidity Coverage Ratio (“LCR”) Summary

Certain Municipal Securities as HQLAs Under the LCR Rule” on our website, www mofo com HQLAs Classification: Level 1 assets: • U S Government and U S |

|

Liquidity Coverage Ratio: - Morrison & Foerster

1 2 Securities issued or guaranteed by the U S Treasury; 1 Domestic reserve requirements are deducted from Level 1 assets in calculating the HQLA amount |

|

The Liquidity Coverage Ratio and Security Prices - Banque de France

The LCR requires banks to permanently hold an adequate stock of “high-quality liquid assets” (HQLA), consisting of so-called “Level 1” and “Level 2” assets, |