earning codes / codes des gains deduction codes / codes de

|

Basic Earning & Deduction Codes Overview

Basic Earning & Deduction Codes Overview This document is meant to serve as an overview to some of the more common earning and deduction codes you might see on your paystub Not all earning/deduction codes were included |

|

Earnings and Deductions Quick Reference

* This guide includes any default earnings and deductions literals (codes for example AUTO for the Automobile Fringe earning) that are displayed in Box 14 If a code isn\'t listed for an earning or deduction the code is defined as a literal for the company on the Company Earnings and Deductions pages For more information search for |

|

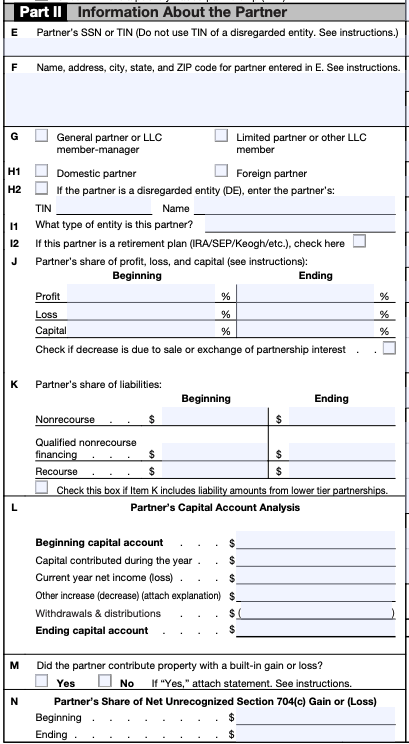

2021 Shareholders Instructions for Schedule K-1 (Form 1120-S)

Capital Gain (Loss) 7 Box 8a Net Long-Term Capital Gain (Loss) 7 Box 9 Net Section 1231 Gain (Loss) 7 Box 10 Other Income (Loss) 8 Box 11 Section 179 Deduction 9 Box 12 Other Deductions 9 Box 13 Credits 11 Box 14 International Transactions 13 Box 15 AMT Items 13 Box 16 |

What is the earnings and deductions quick reference?

The Earnings and Deductions Quick Reference includes a complete list of the earnings and deductions that are provided in the payroll application. For details on setting up earnings and deductions for your company, see “How Do I Add a Company Earning” and “How Do I Add a Company Deduction” in the online help.

What are default earnings and deductions literals?

* This guide includes any default earnings and deductions literals (codes, for example AUTO for the Automobile Fringe earning) that are displayed in Box 14. If a code isn't listed for an earning or deduction, the code is defined as a literal for the company on the Company Earnings and Deductions pages.

What if a code is not listed for an earning or deduction?

If a code isn't listed for an earning or deduction, the code is defined as a literal for the company on the Company Earnings and Deductions pages. For more information, search for Box 14 in the online help. In this section, earnings are listed by earnings category.

How does code B affect a shareholder's taxable income?

This directly impacts the shareholder's taxable income. Code B - Indicates rental real estate income which also flows to Schedule E and affects taxable income. Code J - Stands for Section 179 expense deduction which provides a deduction that can reduce the shareholder's tax liability.

|

Guide for Codes Applicable to Employees Tax Certificates - SARS

14 sept 2020 · Employees' Income Tax certificate to an employee 2 SCOPE • This guide explains each code relevant to remuneration, deductions, Any amount in terms of a qualifying equity share disposed or gain made under a |

|

Alphabetical Earn Code Index

Code Description Time Entry Earn Code Additional Pay Earn Code System Generated Time PGP Productivity Gain Payment ✓ A PIC Inconvenience |

|

Form 1120-S - Internal Revenue Service

3 fév 2021 · Shareholder's Share of Income, Deductions, Credits, etc Revenue Code unless otherwise noted Gain or loss from the disposition of |

|

Schedule C - Internal Revenue Service

ty, not-for-profit activity, or a hobby does not qualify as a business ployee, (b) income and deductions of certain qualified joint ventures, and (c) certain Code Instead, reduce the amount you would otherwise enter on Form 1040 or |

|

Comprehensive Guide to the ITR12 Return for Individuals

for a deduction in a previous year of assessment, and was carried forward as a (code 4102), it is possible that you are not registered for Income Tax purposes ▫ All information relating to capital gain transactions (local and foreign) ▫ |

|

THE DIRECT TAXES CODE, 2010 - Income Tax Department

Deduction of contribution or donations to certain funds or non-profit Section 360 of the Code of Criminal Procedure, 1973, and the Probation of Offenders |

|

SC1040 INSTRUCTIONS 2020 (Rev 12/22/2020) - SC Department

22 déc 2020 · South Carolina conforms with the Internal Revenue Code as amended through If you itemized your deductions on your federal Income Tax return and Adjust the federal gain or loss to reflect any difference in the South |

|

INTERNAL REVENUE CODE OF 1954 - GovInfo

nal Revenue Title" may be cited as the "Internal Revenue Code of 1954" of taxable income for individuals electing standard deduction) (f) CROSS (4) For alternative tax in case of capital gains, see section 1201 (a) (5) For rate of |

|

North Dakota Century Code t57c38 - North Dakota Legislative Branch

the provisions of law formerly known as the Internal Revenue Code of 1954, as amended deductions, or exemptions or the paying of North Dakota income tax, has the same Taxation of the gain or loss resulting from the sale of a principal |

|

FYI Income 15 - Coloradogov

1 the capital gain must be included in the taxpayer's federal taxable income for the year of the subtraction; Revenue Code applicable to capital gain |

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)