calculate the expected return and standard deviation for the following portfolios

What is the expected return of the overall portfolio?

The expected return of the overall portfolio would be 7.85%. We arrive at this result by using the formula above: An investor uses an expected return to forecast, and standard deviation to discover what is performing well and what is not.

How do investors calculate the expected value of a portfolio?

Investors and portfolio managers can calculate the anticipated values of their portfolios by using the expected return and standard deviation. Expected return uses historical returns and calculates the mean of an anticipated return based on the weighting of assets in a portfolio.

What is the difference between expected return and standard deviation?

The expected return is the anticipated amount of returns that a portfolio may generate, whereas the standard deviation of a portfolio measures the amount that the returns deviate from its mean. Investors and portfolio managers can calculate the anticipated values of their portfolios by using the expected return and standard deviation.

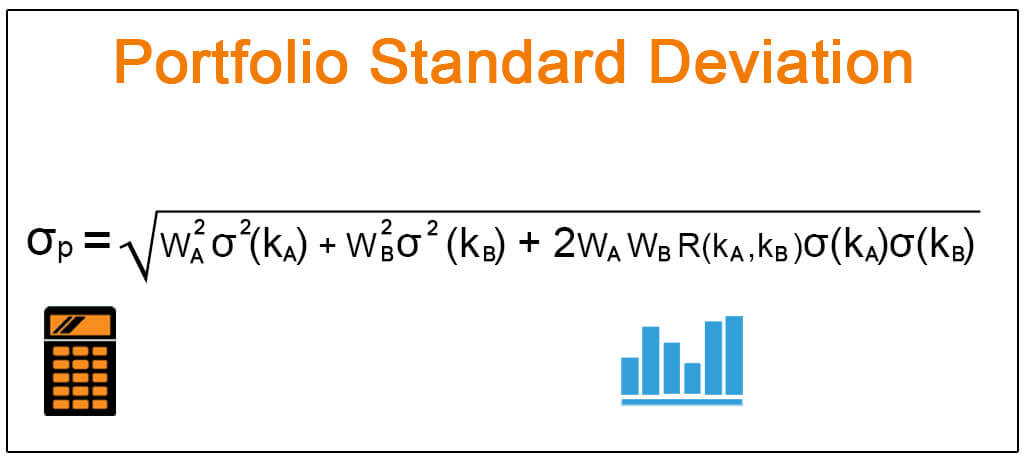

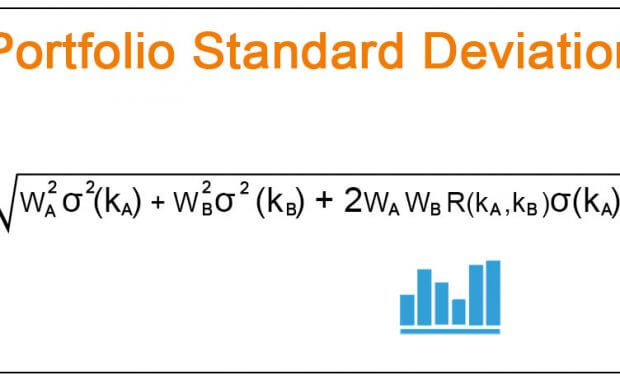

How is portfolio standard deviation calculated?

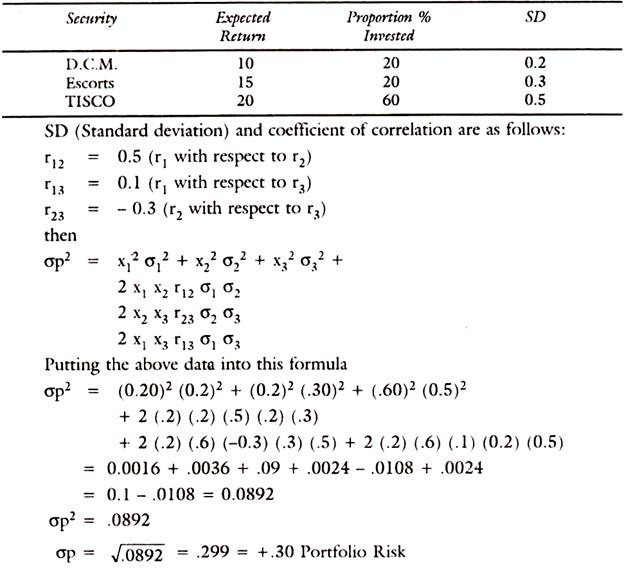

Portfolio Standard Deviation is calculated based on the standard deviation of returns of each asset in the portfolio, the proportion of each asset in the overall portfolio, i.e., their respective weights in the total portfolio, and also the correlation between each pair of assets in the portfolio.

How to Calculate Expected Return

To calculate the expected return of a portfolio, the investor needs to know the expected return of each of the securities in their portfolio as well as the overall weight of each security in the portfolio. That means the investor needs to add up the weighted averages of each security's anticipated rates of return (RoR). An investor bases the estima

Formula For Expected Return

Let's say your portfoliocontains three securities. The equation for its expected return is as follows: where: wn refers to the portfolio weight of each asset and En its expected return. investopedia.com

Limitations of Expected Return

Since the market is volatileand unpredictable, calculating the expected return of a security is more guesswork than definite. So it could cause inaccuracy in the resultant expected return of the overall portfolio. Expected returns do not paint a complete picture, so making investment decisions based on them alone can be dangerous. For instance, exp

Calculate Risk And Return Of A Two-Asset Portfolio In Excel (Expected Return And Standard Deviation)

Calculate Risk And Return Of A 3-Asset Portfolio In Excel (Expected Return And Standard Deviation)

Expected Return and Standard Deviation

|

Suggested Answer_Syl12_Jun2014_Paper_14

portfolio with a standard deviation of 24% what is the return of such portfolio? (iii) Co-efficient of variation = Standard deviation / Expected NPV. In case ... |

|

Economics 362 — Practice 3

Here are returns and standard deviations for four investments. Return Standard Deviation Calculate the standard deviations of the following portfolios. 1 ... |

|

Answer to MTP_Final_ Syllabus 2012_Jun 2017_Set 2

4 (a) A Ltd has an expected return of 22% and standard deviation of 40%. B (b) Compute Return under CAPM and the Average Return of the Portfolio from the ... |

|

MIT Sloan Finance Problems and Solutions Collection Finance

Calculate the expected return and standard deviation of a portfolio of following table: Portfolio weight w. 0. 1/2. 1. Expected return. Standard deviation. (c) ... |

|

FOI question paper 2016

(i) For Y and Z determine expected rate of return |

|

GROUP - III Paper-11 : CAPITAL MARKET ANALYSIS

31-Mar-2012 (ii) Calculate the total risk (variance and standard deviation) for stock A and for stock B. (iii) Calculate the expected return on a portfolio ... |

|

Answer to MTP_Final_Syllabus 2012_Dec2013_Set 1

Expected Return and its standard Deviation. [4]. Price. 135. 140. 145. 150. 155 The Beta of a security is a measure of return for the systematic risk of that ... |

|

Revisionary Test Paper_Paper-14_December 2018

Standard Deviation of Return. I. 23. 8.00. II. 20. 9.50. III. 18. 5.00. Which (i) The expected rate of return on his portfolio using Capital Asset Pricing ( ... |

|

How to Value Bonds

The correlation coefficient between the returns is 0.2. a) Compute the expected return and standard deviation of the following portfolios: Portfolio Percentage |

|

MTP_Final_Syllabus 2016_December 2017_Paper 14_Set 1

4(b) Calculate the market sensitivity index and the expected return on the Portfolio from the following data;. Standard deviation of an asset. 4.5%. Market |

|

Economics 362 — Practice 3

(a) Using CAPM find the expected rate of return of a security having a ? = 1.5. Calculate the standard deviations of the following portfolios. |

|

Risk and Return – Part 2

See the handout to convince yourself. Calculating the Standard Deviation of a Portfolio's Returns. The following formula is used. n is the number |

|

Exam IFM Sample Questions and Solutions Finance and Investment

You are given the following information about a portfolio with four assets. Calculate the standard deviation of the portfolio return. (A) 4.50%. |

|

University of Pennsylvania The Wharton School

(a) What is the expected return and standard deviation on each security? (f) Assuming that M is the market portfolio calculate the beta coefficient for ... |

|

MIT Sloan Finance Problems and Solutions Collection Finance

Calculate the expected return and standard deviation of a portfolio of stocks A B and C. Assume an equal investment in each stock. Expected Return Standard |

|

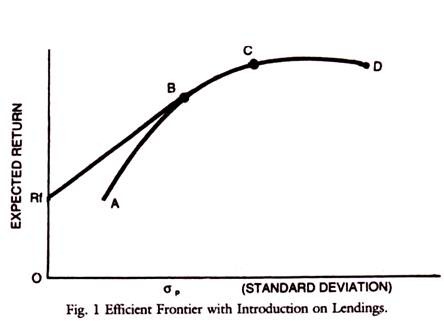

Optimal Risky Portfolios

(2.5 points) Calculate the expected return and standard deviation for the optimal risky portfolio P. b. (0.50 points) Find the slope of the capital allocation |

|

Suggested Answer_Syl12_Jun2014_Paper_14

portfolio with a standard deviation of 24% what is the return of such portfolio? Required: Calculate Annual rate of return for each of the investors. |

|

Section A

A and B is 0.2. a) Compute the expected return and standard deviation of the following portfolios: Portfolio. Percentage in A. Percentage in B. |

|

Econ 422 Summer 2006 Final Exam Solutions

If the average annual rate of return for common stocks is 11.7% diversified portfolio is 1.5 |

|

IAPM: Illustration 1 Calculate the expected rate of return from the

What is the standard deviation of portfolio returns? Illustration 23. The following information is available. Stock A. Stock B. Expected return. Standard |

|

Risk and Return – Part 2

Portfolios Portfolio weights Short selling Expected returns Standard deviation of The formulas below are used to calculate the expected return and standard deviation of returns for a single security when that consists of the following: |

|

Solution 7 - peopleexeteracuk

A, which constitutes 40 of this portfolio, has an expected return of 10 and Given the following data, calculate the market portfolio's standard deviation |

|

Economics 362 — Practice 3 - Stony Brook Mathematics

(a) Using CAPM, find the expected rate of return of a security having a β = 1 5 0 21 0 26 Calculate the standard deviations of the following portfolios 1 |

|

Outline Portfolio Expected Return and Standard Deviation - NYU Stern

Optimal portfolio choice with 2 risky assets Prof Lasse H Pedersen 3 Portfolio Expected Return and Standard Deviation The expected return on the portfolio |

|

Chapter 11 Expected Returns Variance and Standard Deviation

Deviation • Variance and standard deviation still measure the volatility of Weighted average of squared deviations ∑ Compute the expected portfolio return |

|

3 Basics of Portfolio Theory

The following table gives the price of Andover Company stock, along with the Calculate the expected return and standard deviation of the portfolio of these two |

|

Portfolio Risk and Return - James Madison University - (educjmu

In an efficient market, stock prices are not predictable – they don't follow any Calculate the expected return and standard deviation associated with the |

|

Risk and return practice problems

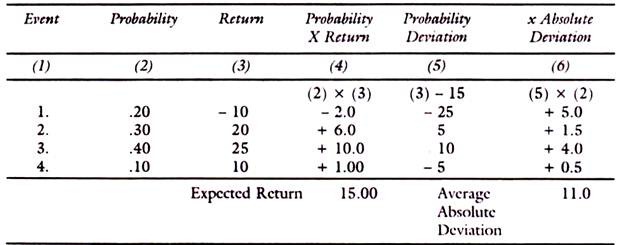

1 For each of the following probability distributions, calculate the expected value and standard deviation: a Outcome Probability |

|

Risk and return

Calculate variance and standard deviation of this rate of return Probability Payoff Calculate the return and beta of portfolios with following weights: WA WT |