calculate the expected return and standard deviation of a portfolio

How is portfolio variance calculated?

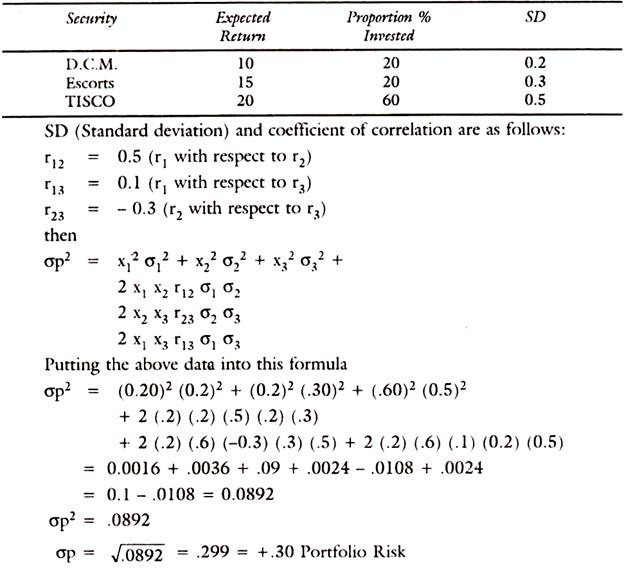

This portfolio variance statistic is calculated using the standard deviations of each security in the portfolio as well as the correlations of each security pair in the portfolio . Portfolio variance is a measure of a portfolio’s overall risk and is the portfolio’s standard deviation squared.

Calculate Risk And Return Of A Two-Asset Portfolio In Excel (Expected Return And Standard Deviation)

Calculate Risk And Return Of A 3-Asset Portfolio In Excel (Expected Return And Standard Deviation)

Calculating Expected Portfolio Returns and Portfolio Variances

|

Lecture 4 Example: 1 Calculate the expected return and variance of

Calculate the standard deviation of a portfolio weighted equally between the two securities in their correlation is – 0 9 Solution ?p 2 = x1 2 ?1 2 |

|

Risk and Return – Part 2

The formulas below are used to calculate the expected return and standard deviation of returns for a single security when |

|

Chapter 11 Expected Returns Variance and Standard Deviation

Compute the expected portfolio return using the same formula as for an individual asset • Compute the portfolio variance and standard deviation using the |

|

3 Basics of Portfolio Theory

Calculate the expected return and standard deviation of the portfolio of these two stocks in dollars The total investment in the portfolio is $500000 |

|

Solution to Problem Set 4

Suppose that stocks A and B are independent Then a 50/50 portfolio of A and B has expected return 0 5 × 10 + 0 5 × 12 = 11 and standard deviation |

|

Chapter08pdf

Calculate portfolio systematic risk (beta) Calculating a Portfolio's Expected Rate of Return Unlike expected return standard deviation is |

|

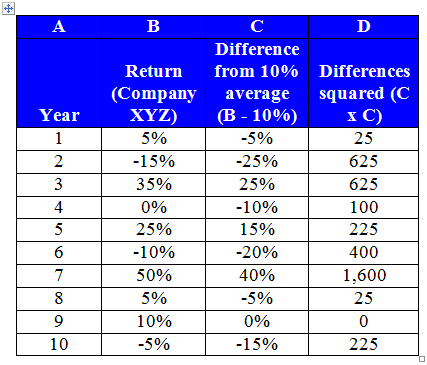

Illustration 1 Calculate the expected rate of return from the following

X is interested to build a portfolio of investment comprising of risk-free securities (Rf = 8 ) and the market portfolio (Rm = 18 and Standard deviation = 6 ) |

|

Section 111 The expected return of a portfolio - i i = 1n

Let Rp the realized return of the entire portfolio beg end end beg GROE Calculate the standard deviation of the portfolio return Op = ? |

|

Exercise Sheet 7 Exercise 1 Assume there are two stocks A and B

A which constitutes 40 of this portfolio has an expected return of 10 and a standard data calculate the market portfolio's standard deviation |

|

Chapter 11 – Return and Risk Unequal Probabilities

43 3237 13 0 433237(0 13) = Expected return = Can you find the portfolio standard deviation using a weighted average of the asset's standard deviations? |

|

Chapter 11 Expected Returns Variance and Standard Deviation

Deviation • Variance and standard deviation still measure the volatility of Weighted average of squared deviations ∑ Compute the expected portfolio return |

|

Outline Portfolio Expected Return and Standard Deviation - NYU Stern

Optimal portfolio choice with 2 risky assets Prof Lasse H Pedersen 3 Portfolio Expected Return and Standard Deviation The expected return on the portfolio |

|

Risk and Return – Part 2

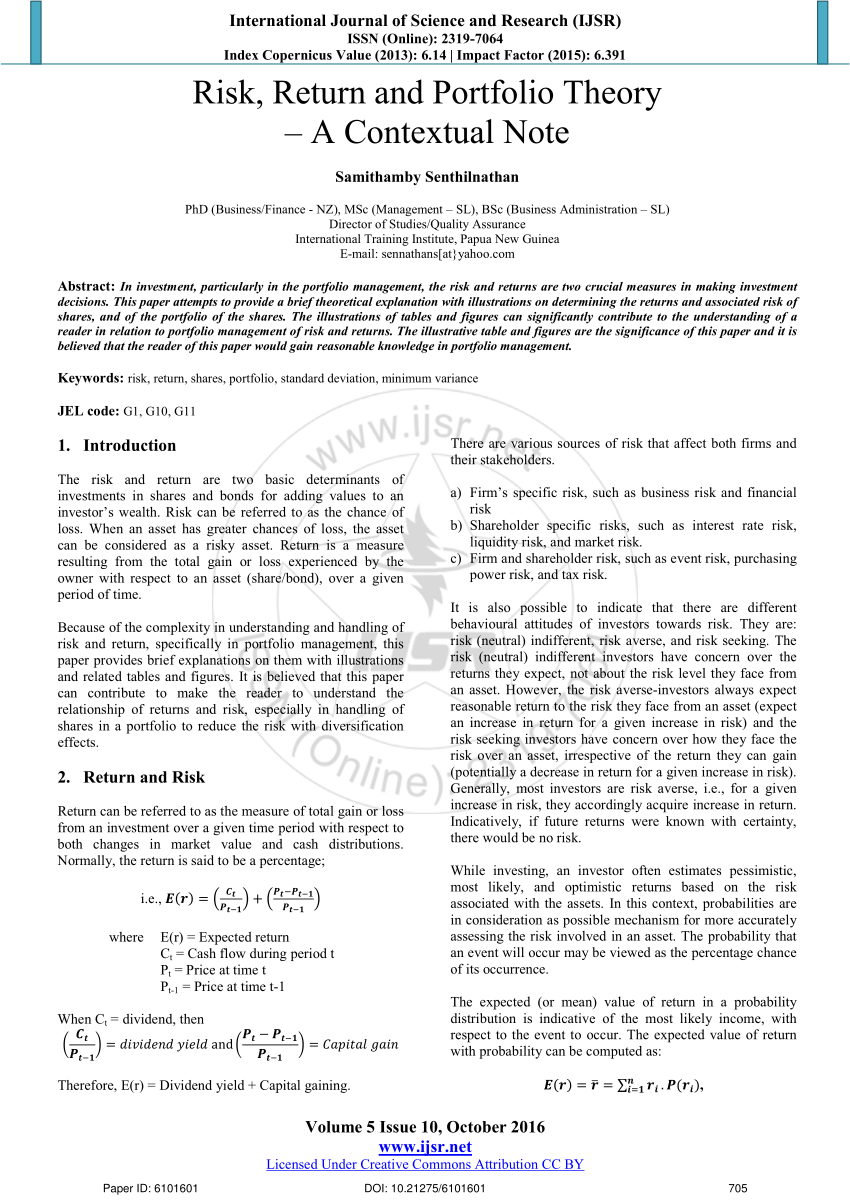

Portfolios Portfolio weights Short selling Expected returns Standard deviation of returns 4 Domination The formulas below are used to calculate the expected return and standard deviation of returns for a single security when you know the |

|

3 Basics of Portfolio Theory

Calculate the expected return and standard deviation of the portfolio of these two stocks in dollars The total investment in the portfolio is $500,000 The weights |

|

Portfolio Risk and Return - James Madison University - (educjmu

Expected return Standard Investment deviation ii) Measuring risk So how do we measure risk? One way to quantify risk is to calculate the standard deviation of |

|

Solution 7 - peopleexeteracuk

standard deviation of 28 If the correlation between the assets is 0 3 and the risk free rate 5 , calculate the capital market line Solution 2 The expected return |

|

Portfolio expected return - Chapter

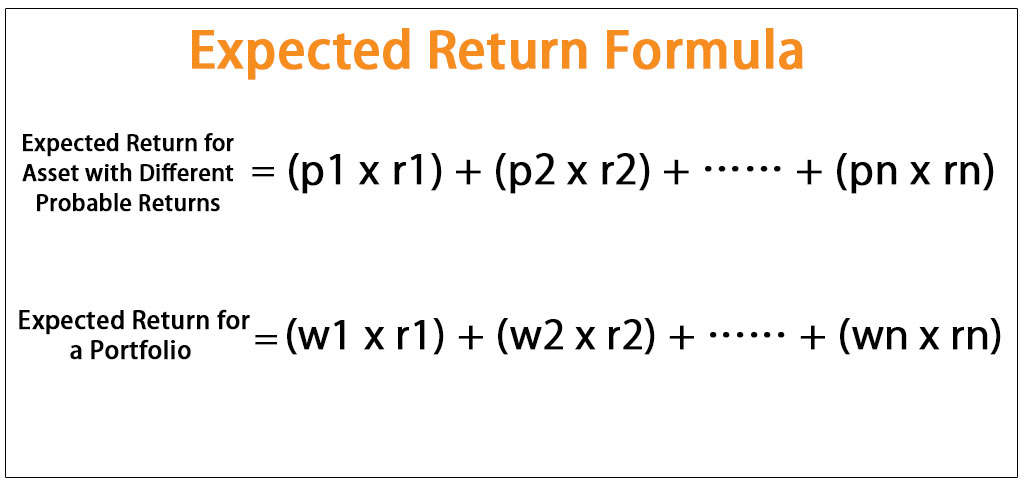

Expected Returns, I • Expected return is the “weighted average” return on a risky asset, from today to some future date The formula is: • To calculate an |

|

Chapter 7 Portfolio Theory

Expected return on a portfolio with two assets Expected What are the variance and StD of a portfolio with 1/3 invested in each stock In order to calculate return variance of a portfolio, we need Standard Deviation ( , per month) Return |

:max_bytes(150000):strip_icc()/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png)