capital gain tax on sale of shares in singapore

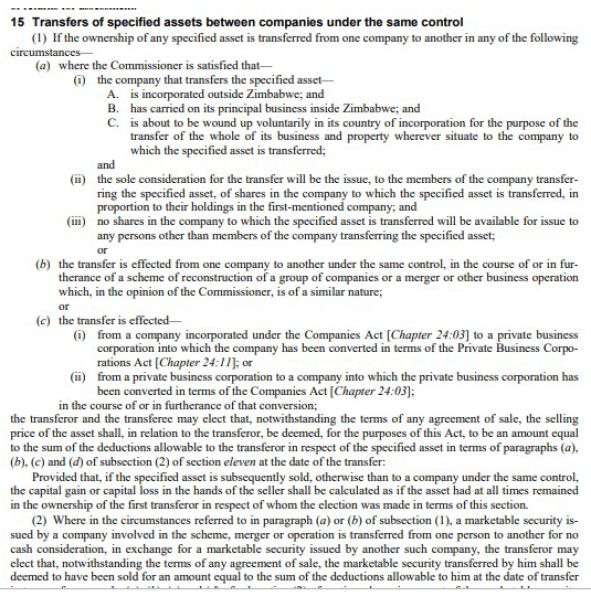

Do you pay capital gains tax if you sell shares in another company?

Never miss an important deadline with our detailed compliance calendar. Under the safe harbour role, companies selling shares in another company will not incur capital gains tax. However, the divesting company must: Any form of sale that does not meet the two conditions will be assessed by the IRAS against the six badges of trade criteria.

What is capital gains tax?

Capital gains tax is a levy imposed on the profits or gains realized from the sale of capital assets. This tax applies when an asset is sold at a higher price than its original purchase cost. Examples of capital assets include properties, shares, foreign exchange, and digital assets.

Are capital gains exempt from tax if a partnership sells a foreign asset?

For example, where the covered entity is a partnership and tax transparency treatment applies, the share of capital gains from the sale or disposal of a foreign asset will be exempt from tax in the hands of an individual partner of the partnership. 13.2 Tax exemption will not be given if the gains are business revenue gains.

Is buying a property a capital gain in Singapore?

Gains derived from the sale of a property in Singapore as it is a capital gain. Profits or losses derived from the buying and selling of shares or other financial instruments (including digital tokens) are generally viewed as personal investments. Payouts from insurance policies as they are capital receipts.

What Is A Capital Gains Tax?

A Singapore capital gains tax is applied to profits from sales of capital assets. This is derived by getting the difference between the asset’s higher selling price and its lower original purchase price. singapore.acclime.com

Singapore Has Zero Capital Gains Tax, But…

Yes, there is no income tax due on sales of shares, properties, and other intangible assets in Singapore, but they become taxable when your primary purpose in buying and selling is to make profits. This especially applies to traders or dealers whose income is generated simply from conducting one’s business. Therefore, the nature and source of your

When Do Companies Pay Capital Gains Tax in Singapore?

According to the IRAS, capital gains tax will apply to gains on the sale of assets based on the following criteria: singapore.acclime.com

The “Safe Harbour” Rule

Under the safe harbour role, companies selling shares in another company will not incur capital gains tax. However, the divesting company must: 1. Have held more than 20% of the ordinary shares 2. Have a holding period of more than 24 months Any form of sale that does not meet the two conditions will be assessed by the IRAS against the six badges o

Final Word

In conclusion, Singapore’s zero capital gains tax provides a huge strategic advantage. It allows for boosting the share prices, increases investment, and encourages entrepreneurship in the country. To ensure that you fully maximise the benefits of tax incentives but also maintain compliance, it is important to seek the assistance of a qualified tax

|

Certainty of Non-taxation of Companies Gains on Disposal of Equity

10 déc. 2020 4.1 Singapore does not tax capital gains. Therefore only gains or losses of an income nature derived by a company from disposal of equity ... |

|

Sg-tax-international-tax-singapore-highlights-2021.pdf

Residence: A company is resident in Singapore for income tax Singapore does not tax capital gains gains from the sale of shares or. |

|

Delivering clarity

5 mars 2021 Capital gains on sale of Indian company shares not taxable in India on satisfaction of conditions under India-Singapore tax treaty. |

|

Update on Indias Tax Treaty With Singapore

Capital gains arising from sale of shares/other capital assets situated in India are liable to be taxed according to the residence of the seller i.e. |

|

EY

4 févr. 2020 In particular the improved capital gains protections for disposal of non-listed Indonesian shares by a Singapore resident. |

|

At Long Last IND-SG Tax Treaty Tackles Capital Gains

3 août 2021 Indeed many companies in Indonesia have a Singapore holding company |

|

IRAS e-Tax Guide - Singapore

28 août 2020 exemption and corporate tax rebate. VCC. 5.14 – 5.16. Exemption of gains or profits from disposal of ordinary shares. Sub-fund. 5.17 – 5.21. |

|

Worldwide Real Estate Investment Trust (REIT) Regimes

8 oct. 2019 The disposal of REIT units will have CGT implications. ... shares with voting rights issued by affiliated real estate companies etc. |

|

Business Tax Alert_Revision of Singapore Thailand Tax Treaty

31 août 2015 wherein a 15% withholding tax is imposed on any capital gains derived from the sale of shares in a land-rich entity. |

|

The Investment Lawyer

ernment to tax income on the sale of Indian equity securities to investors that are domiciled in Mauritius and Singapore. The India short-term capital gains. |

|

Singapore personal taxation - PwC

Singapore taxes prior to you leaving Singapore /ceasing employment The taxation of stock option/stock award gains in Singapore is dependent sale proceeds are remitted to Singapore Stock Capital gains are tax exempt, unless an |

|

IRAS e-Tax Guide

15 juil 2016 · 3 1 Singapore does not tax capital gains Therefore, only disposal of ordinary shares in an investee company are not taxable if immediately |

|

Taxation of cross-border mergers and acquisitions - assetskpmg

of assets and business, or a purchase of shares of a company The choice is capital gains tax in Singapore), the likely recapture of capital allowances by the advisable to specify in the sale and purchase agreement an allocation that is |

|

PDF June 2019 answers - ACCA Global

Singapore does not impose tax on capital gains However There is no GST on the sale of shares, even if Sally Moo happens to be registered for GST There is |

|

Brief Guide to M&A in Southeast Asia - Mayer Brown

with offices in China, Hong Kong, Singapore, Vietnam and Japan In other to 20 capital gains tax unless this is sale of shares of a Thai company such gain |

|

Asia Tax Bulletin - Mayer Brown

15 avr 2020 · tax treaty with Singapore, which will, once it is capital gains tax of the sale of shares of of an equity interest, the capital gain from that |

|

Update on Indias Tax Treaty With Singapore - Squire Patton Boggs

Following the amendments and revisions to India's double tax avoidance agreements with Capital gains arising from sale of shares/other capital assets |

|

Of the tax treaty - KPMG India

6 juil 2018 · Singapore tax treaty do not apply to capital gain which is taxable in Singapore under Article capital gain on sale of shares, debt instruments, |