capital gains tax in france 2019

How much is capital gains tax?

The basic rate of capital gains tax is 19%. Tapered relief against the tax is granted over 22 years of ownership, commencing from the 6th year of ownership, as follows: No allowance for the first 5 years of ownership. Between 6 and 21 years of ownership: 6% allowance per year. For the final 22nd year of ownership: 4% allowance.

How long will my property sale be subject to capital gains tax?

After 22 years, your property sale will no longer be subject to capital gains tax. Up to five years: there is no allowance, and you will be subject to the full 19% capital gains tax rate

Can a former French resident be exempt from capital gains tax?

Since January 2019, former residents of France have been put in much the same position as residents, with the right to obtain exemption from capital gains tax on the sale of their former principal home.

What is capital gain tax in France?

on the sale or transfer for valuable consideration of a property located in France or on the sale or transfer for consideration of shares in a company whose assets consist mainly of real estate located in France. In these cases, your capital gain will be subject to 19% tax, regardless of your country of residence.

|

Worldwide Real Estate Investment Trust (REIT) Regimes

8 Oct 2019 Distributions from an Australian REIT may also include a tax deferred component capital gains tax. (CGT) concession component |

|

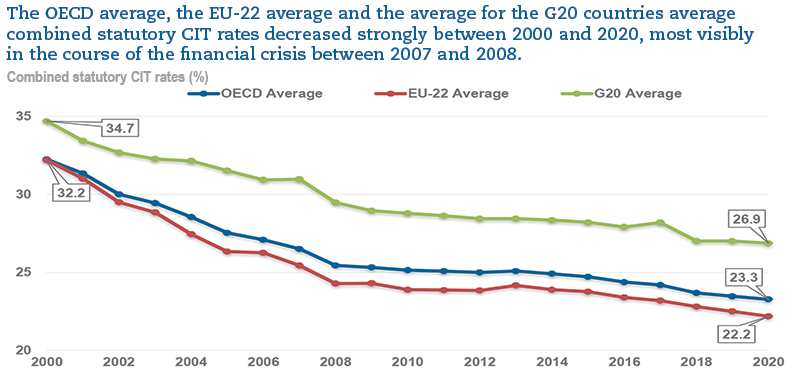

Revenue Statistics: Key findings for France

Between 2019 and 2020 the OECD average slightly increased from 33.4% to. 33.5%. The tax-to-GDP ratio in France has increased from 43.4% in 2000 to 45.4% in |

|

SHAREHOLDERS GUIDE

22 Mar 2019 Taxation on capital gains for shares not in a PEA. Shares held in an equity savings ... Your bank or broker sends you the French tax form. |

|

OECD Economic Surveys: France© OECD 2019

immobilière) and the taxation of capital was set to a flat rate of 30%. The headline corporate income tax rate will decrease to 25% in 2022. |

|

Brochure: Revenue Statistics 2021

to 2019. The small increase in the OECD average tax-to-GDP ratio in 2020 occurred against 1100 Taxes on income profits and capital gains of individuals. |

|

The European Tax Gap

amounts the biggest tax gaps are in Italy France and Germany. corporate income taxes; social security and capital gains taxes) and four aspects of tax ... |

|

Country Profile France 2020

The surcharge of 3.3 percent is levied on the part of the corporate income tax that exceeds EUR 763000. As from January 1 |

|

Taxand

Adjustment of the tax consolidation regime: For fiscal years beginning on or after 1 January 2019 several adjustments apply: •. Capital gains derived from |

|

Key Tax Issues at Year End for Real Estate Investors 2019/2020

As a reminder French interest |

|

PwC

11 Jan 2019 2019 French budget introduces ATAD ... It also amends the French tax consolidation rules ... capital gains realized on disposals of. |

|

Taxation and Investment in France 2017 - Deloitte

France Taxation and Investment 2017 3 4 Capital gains taxation income, and in 2019 will be extended to apply to small and medium-sized enterprises |

|

France - Deloitte

French tax (and foreign-source losses may not be deducted) Taxable Capital gains generally are subject to corporate tax at the standard 1 January 2019 |

|

DOCUMENTATION CAPITAL GAIN IN FRANCE - Accrediteco

29 mar 2019 · vered b the French Tax Administration → Our mission: • to draw up and sign the capital gains tax return, • to guarantee an tax ad ustment for |

|

Taxation of capital gains realized on the sale of a property located in

13 jan 2017 · Article 13 of the French-US tax treaty states that capital gain on the of a property in France will be subject to a withholding tax in France threshold will be brought down each year so that by 2019, every taxpayer will have |

|

SHAREHOLDERS GUIDE - Totalcom

22 mar 2019 · Taxation on capital gains for shares not Tentative schedule of 2019 ex- dividend dates(3) : You receive a French tax form (IFU) to declare |

|

Overview of the french tax system - Impotsgouv

31 déc 2016 · For tax years beginning on or after 1 January 2019, this reduced rate of 15 for long-term capital gains resulting from the disposal of units in |

|

Country Profile France 2020 - assetskpmg

Tax rate The French corporate income tax rate is progressively reduced from 33 33 percent As from January 1, 2019, a 10 percent tax rate applies to the net income derived Capital gains obtained from resident/non-resident subsidiaries |

|

FRANCE - Taxand

It should be noted that capital gains are booked as non-available reserves and trigger taxation at the normal corporate income tax rate (of 34 43 globally in 2019) |

|

Taxation of corporate and capital income - OECDorg

The standard corporate income tax rate for 2019 is 31 [2][3] decision of the French Constitutional Court that held the 3 tax on dividend distributions was |

|

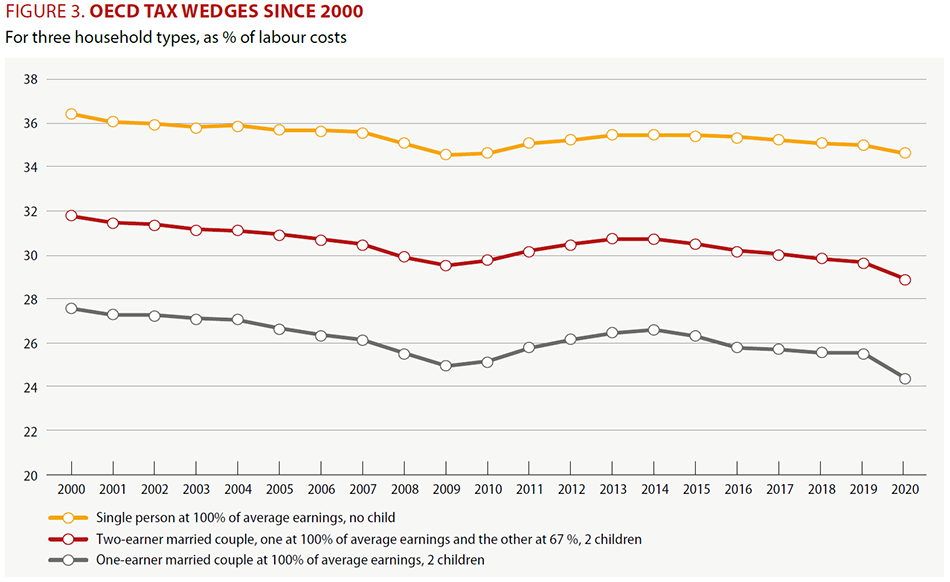

French tax system - Business France

being gradually reduced to 25 by 2022, and capital gains tax and labor costs both falling, France's Mazars and Business France are convinced of France's growing attractiveness and are keen to in 2018 and €1 million in 2019 In 2020 |

![Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download Income Tax Calculator For FY 2020-21 [AY 2021-22] - Excel Download](https://www.airliquide.com/sites/airliquide.com/files/styles/938w/public/2020/03/23/taxation-dividends-2020.png?itok\u003dyO2yYu_q)