cares act 2

|

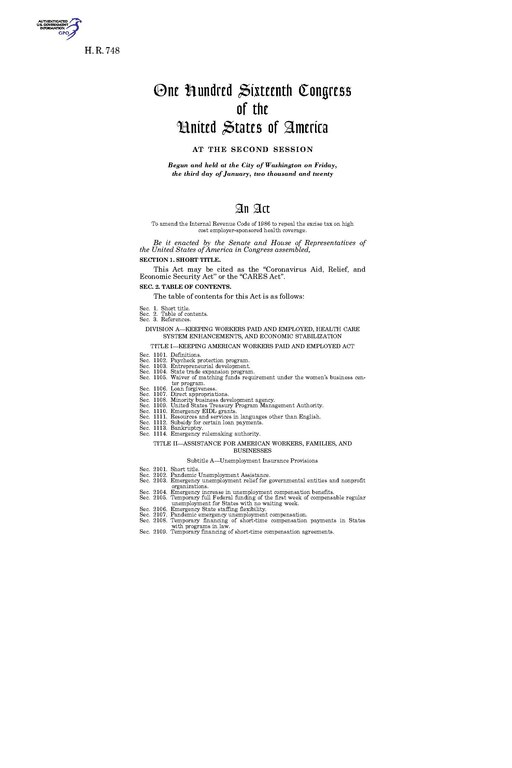

Public Law 116–136 116th Congress An Act

This Act may be cited as the ‘‘Coronavirus Aid Relief and Economic Security Act’’ or the ‘‘CARES Act’’ SEC 2 TABLE OF CONTENTS The table of contents for this Act is as follows: Sec 1 Short title Sec 2 Table of contents Sec 3 References DIVISION A—KEEPING WORKERS PAID AND EMPLOYED HEALTH CARE |

What is the CARES Act vs ARPA?

The CARES Act was the first of three major pieces of COVID-19 relief legislation. The Consolidated Appropriations Act (CAA) followed the CARES Act and the American Rescue Plan Act (ARPA) came last. The table below compares base funding in several key areas for each law. What Is the CARES Act vs. the CAA vs. ARPA?

When did the CARES Act become law?

The CARES Act was passed by Congress on March 25, 2020 and signed into law on March 27, 2020. The Consolidated Appropriations Act (2021) was passed by Congress on December 21, 2020 and signed into law on December 27, 2020.

What's in the CARES Act 2?

While the Biden administration has begun pushing for the next recovery package, educators are still sorting out the details of the Consolidated Appropriations Act of 2021, also known as "CARES Act 2." The $900 billion relief package passed by Congress on Dec. 21, 2020 and signed into law on Dec. 27, dedicated $82 billion for education.

What is the difference between the CARES Act & the CRF?

The Consolidated Appropriations Act, 2021 (Division N of P.L. 116-260) set aside $25 billion, while Section 3201 of the American Rescue Plan Act (P.L. 117-2) set aside an additional $21.5 billion. These were to be funded by the Coronavirus Relief Fund (CRF) established by the CARES Act.

What Is The Cares Act?

The U.S. Congress passed a $2.2 trillion stimulus bill called the Coronavirus Aid, Relief, and Economic Security Act (CARES) in March 2020 to blunt the economic damage set in motion by the global coronavirus pandemic. With most forecasters at the time predicting that the U.S. economy was either already in a recession or heading into one, policymake

Understanding The Cares Act

At over $2 trillion, the CARES Act stands as the largest financial rescue package in U.S. history. The 2009 Recovery Act was $832 billion, the Consolidated Appropriations Act (CAA) contained $900 billion in pandemic relief, and the American Rescue Plan Act (ARPA)comes closest at $1.9 trillion. The law allocated $175 billion to states and localities

Cares Act Benefits For Individuals

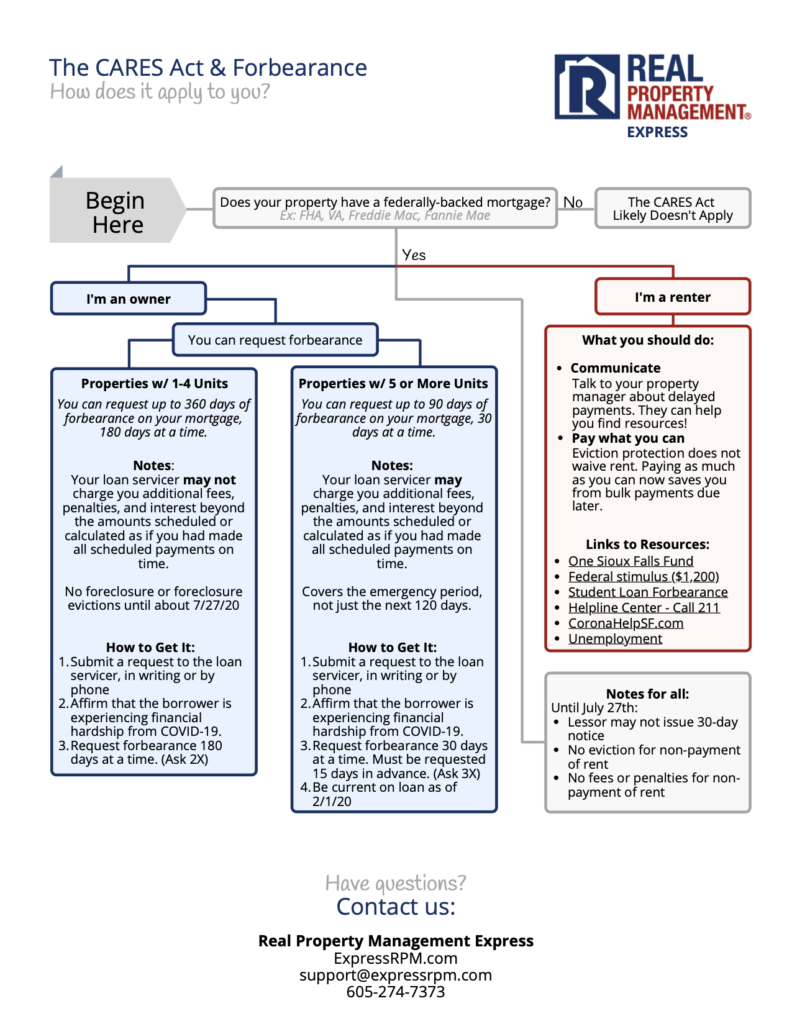

Direct Payment to Taxpayers The act authorized direct payments to families of $1,200 per adult plus $500 per child for individuals making up to $75,000, heads of households making up to $112,500, and couples filing jointly making up to $150,000. Mortgage and Rent Relief The CARES Act was the first piece of coronavirus legislation to place a moratorium on foreclosures and evictions. The expiration date was extended numerous times. However, on Aug. 26, 2021, the Supreme Court rejected the latest extension requested by the CDC. There is still help available, however, through the Treasury Emergency Rental Assistance Program. For those seeking assistance on their mortgage or rent payments, the National Low Income Housing Coalition provides a searchable listof suc

Small Business Relief

Paycheck Protection Program The law appropriated $349 billion to support small businesses' efforts to maintain their payrolls and some overhead expenses through the emergency. The stated goal was to keep workers paid and employed. The Paycheck Protection Program (PPP)applied to any business, nonprofit organization, veterans organization, or tribal business that had fewer than 500 employees—or, under the Small Business Administration standard, had under 500 employees per physical location for all food service and accommo

Big and Mid-Sized Business Relief

Economic Stabilization Loans In order to provide liquidity to the hardest-hit businesses and industries, the CARES Act allocated $500 billion for economic stabilization loans and guarantees. This included $25 billion for passenger airlines, $4 billion for air cargo carriers, and $17 billion for businesses deemed critical to national security. The remaining $454 billion was allocated toward programs and lending facilities operated by the Federal Reserve to support other businesses, states, and municipalities. Unlike the S

Tax Breaks and Credits

For Individual Taxpayers If taxpayers did not receive their direct stimulus payments of $1,200 per adult and $500 per child, they could claim the amount they were due as a tax credit. The CARES Act also allowed taxpayers to take an above-the-line deduction from adjusted gross income of up to $300 for charitable contributions and relaxed other limits on charitable contributions. Retirement Plan Withdrawals The plan allowed people to take special disbursements and loans from tax-advantaged retirement funds of up to $100,000 without facing a tax penalty. It waived the required minimum distribution (RMD) rules for 401(k) plans and individual retirement accounts (IRAs)and the 10% penalty on early 401(k) withdrawals up to $100,000. Account-holders would be able to repay the distributions over the next three years and could make extra contributions for this purpose. These measures applied to anyone d

Hospital and Health Care Providers Assistance

The stimulus plan addressed both emergency health care and financing for treatment and prevention of COVID. The plan boosted payments to health care providers and suppliers by $100 billion through various programs, including Medicare reimbursements, grants, and other direct federal payments. It also directed $27 billion in spending on tests, vaccin

State and Local Government Relief

State and local governments received up to $150 billion in assistance through the new Coronavirus Relief Fund. Of that, $3 billion was reserved for federally administered territories and $8 billion for tribal governments. Payments to states and local governments were divided proportionally according to population. These were large, open-ended block

Earmarked Spending

As can be expected, numerous industries, agencies, and special interest groups lined up for a piece of the funding pie. The CARES Act also included legal changes designed to benefit specific industries or businesses in key congressional districts that might not seem directly connected to the COVID-19 crisis. These included: 1. $25 million for opera

Comparison to The Consolidated Appropriations Act and The American Rescue Plan

The CARES Act was the first of three major pieces of COVID-19 relief legislation. The Consolidated Appropriations Act (CAA) followed the CARES Act and the American Rescue Plan Act (ARPA) came last. The table below compares base funding in several key areas for each law. investopedia.com

|

One Hundred Sixteenth Congress of the United States of America

This Act may be cited as the ''Coronavirus Aid Relief |

| COVID-19 Pandemic Response Laboratory Data Reporting |

|

Frequently Asked Questions about the Emergency Financial Aid

The CARES Act which establishes and funds the Higher Education Emergency Relief Section 2 of the Funding Certification and Agreement for the Emergency ... |

|

The Small Business Owners Guide to the CARES Act Table of

(CARES) Act that was just passed by Congress are intended to assist business Paycheck Protection Program Loans. 2. Small Business Debt Relief Program. |

|

ESG CARES Act Round 2 Allocation Methodology rev

CARES Act Emergency Solutions Grant (ESG) Round 2 Funding under COVID-19. Supplemental Appropriations. June 2020. This paper provides an explanation for the |

|

PublicFacingFAQ - Cares Act2.0.docx

Aug 27 2021 CARES Act - Frequently Asked Questions. What is the CARES Act 2.0? Maryland has been allocated an additional $3.4 million dollars in ... |

|

Consumer Reporting FAQs Related to the CARES Act and COVID

Jun 16 2020 CARES Act amendments to the Fair Credit Reporting Act (FCRA)? ... amounts |

|

Public Law 116–136 116th Congress An Act

Mar 27 2020 This Act may be cited as the ''Coronavirus Aid |

|

CARES Act Provider Relief Fund Frequently Asked Questions

Aug 30 2021 There is no direct ban under the CARES Act on accepting a payment ... and the specific payment amount that was received; and (2) agree to ... |

|

CARES Act - Congressgov

SECTION 1 SHORT TITLE This Act may be cited as the ''Coronavirus Aid, Relief, and Economic Security Act'' or the ''CARES Act'' SEC 2 TABLE OF |

|

CARES Act - Congressgov

19 mar 2020 · This Act may be cited as the ''Coronavirus Aid, Re- 4 lief, and Economic Security Act'' or the ''CARES Act'' 5 SEC 2 TABLE OF CONTENTS |

|

Guidance - Treasury

15 jan 2021 · CARES Act; FAQ A 59 has been updated to correct the cross-reference to Treasury OIG's FAQs; and the application of FAQ B 6 has been |

|

The Small Business Owners Guide to the CARES Act Table of

(CARES) Act that was just passed by Congress are intended to assist business owners with whatever needs they have right now When implemented, there will |

|

HR 133 - House Appropriations Committee

Subchapter I – Extension of CARES Act Unemployment Provisions Section 201 Extension and Benefit Phaseout Rule for Pandemic Unemployment Assistance |

|

CARES Act - US Department of Education

Coronavirus Aid, Relief, and Economic Security (CARES) Act Section 18004(a)( 2) of the CARES Act, Pub L No 116-136 (March 27, 2020), authorizes |

|

HEERF Emergency Financial Aid Grants - US Department of

The CARES Act, which establishes and funds the Higher Education Emergency Relief Fund (HEERF), directs institutions of higher education (“institutions”) to |

|

1 Implementation of the CARES Act Extended January 1, 2021 Due

Implementation of the CARES Act Extended January 1, 2021 Due Date for Contributions to Defined Benefit Plans Notice 2020-82 Purpose This notice |

|

CARES Act Airport Grants - Federal Aviation Administration

3 déc 2020 · CARES Act Airport Grants – Frequently Asked Questions This document answers frequently asked questions (FAQs) stakeholders may have |