cares act 401k

How did the CARES Act affect 401ks and IRAs?

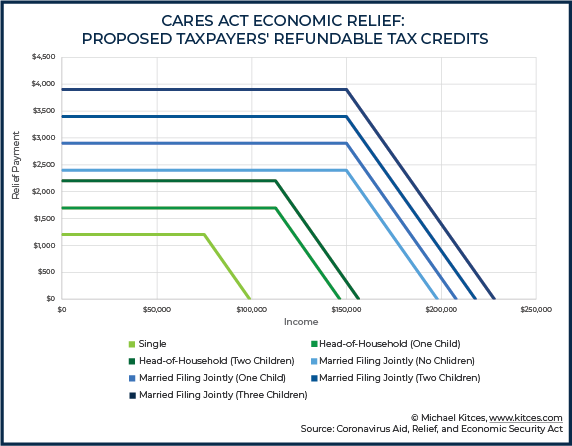

The Act provided specific aid and tax benefits for taxpayers who needed to withdraw more money than usual from their retirement and 401 (k) plans during the pandemic. Section 2202 of the CARES Act allows individuals to access up to $100,000 from their 401ks and IRAs with fewer consequences.

How does the CARES Act affect pre-retirement withdrawals?

One less-noticed part of the bill, though, changes the way that pre-retirement withdrawals from retirement plans work. Section 2022 of the CARES Act allows people to take up to $100,000 out of a retirement plan without incurring the 10% penalty. This includes both workplace plans, like a 401 (k) or 403 (b), and individual plans, like an IRA.

Is there a tax penalty for withdrawals from cares accounts?

There is good news though! When President Trump signed the Consolidated Appropriations Act on Dec 27, 2020, he expanded some of the benefits from the CARES Act into the new year for 180 days. This includes no tax penalty for up to $100,000 in withdrawals from these accounts.

|

Guidance for Coronavirus-Related Distributions and Loans from

Section 2202 of the CARES Act also increases the allowable plan loan amount Section 401(k)(2)(B)(i) generally provides that amounts attributable to. |

|

Recontribution of CARES Act Distribution(s) (Rollover Contribution

Recontribution of a CARES Act Distribution: If you received one or more (such as a 401(a) 401(k) plan |

|

Legally Brief: COVID-19 UPDATE THE CARES ACT: 401K LOAN

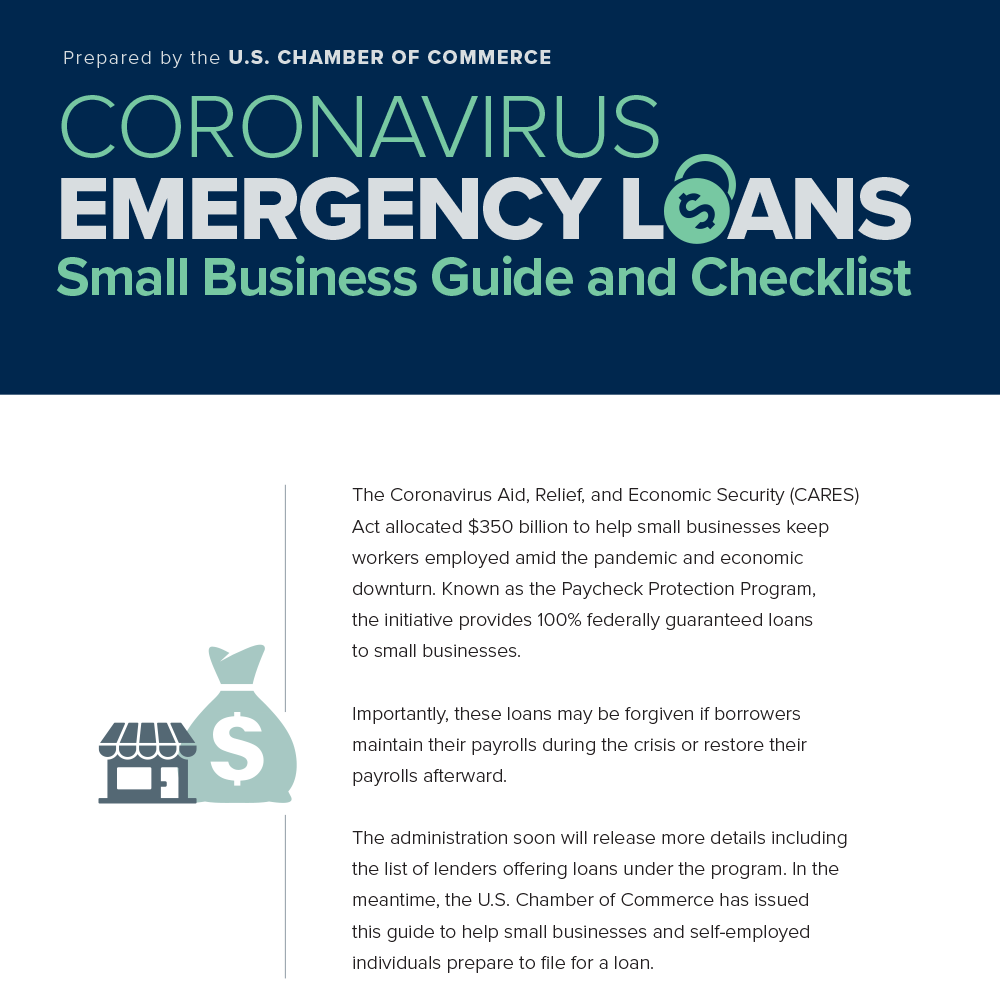

THE CARES ACT: 401K LOAN EXPANSION AND STUDENT LOAN RELIEF. The $2 trillion CARES Act the economic stimulus package recently signed into law |

|

CARES ACT 401(k) LOAN PAYMENT DEFERMENTS ATTN: Fidelity

ATTN: Fidelity 401(k) Participants that elected a CARES Act 401(k) loan deferment. In October 2020 Fidelity will be sending a reminder to applicable plan |

|

S. 3548

19 mars 2020 lief and Economic Security Act'' or the ''CARES Act''. 5. SEC. 2. TABLE OF CONTENTS. ... the requirements of sections 401(k)(2)(B)(i) |

|

Notice 2022-33 I. PURPOSE This notice extends the deadlines for

provisions of the SECURE Act Miners Act |

|

The CARES Act - ADP

The act also includes legislation that impacts employer-sponsored retirement plans. FOR PLAN SPONSOR USE ONLY — NOT FOR DISTRIBUTION TO THE PUBLIC. ADP |

|

Mass.gov

— Closing or scaling back your business due to COVID-19. The SMART Plan has elected to offer the Coronavirus-related CARES Act distribution provision to |

|

Guidance for Coronavirus-Related Distributions and Loans - Internal

Section 2203 of the CARES Act provides that, for eligible retirement plans other than defined benefit plans, no minimum distributions under § 401(a)(9) are required for 2020 |

|

The CARES Act - ADP

The act also includes legislation that impacts employer-sponsored retirement plans FOR PLAN SPONSOR USE ONLY — NOT FOR DISTRIBUTION TO THE |

|

Common Tax Questions on CARES Act Withdrawals - Fidelity

The CARES Act allows “qualified individuals” to withdraw money from an eligible workplace retirement plans [such as a 401(k) or 403(b)] Nonqualified and |

|

CARES Act impacts retirement plans - Lockton

ignore your 401(k)? CARES Act impacts retirement plans President Trump signed the Coronavirus, Aid, Relief and Economic Security (CARES) Act into law |

|

CARES ACT 401(k) LOAN PAYMENT DEFERMENTS ATTN: Fidelity

ATTN: Fidelity 401(k) Participants that elected a CARES Act 401(k) loan deferment In October 2020, Fidelity will be sending a reminder to applicable plan |

|

Understanding the CARES Act and what it means for you - NCPlans

26 mai 2020 · If you're feeling uncertain about what's next and how to manage your money, know that you're not alone As a participant in the NC 401(k) Plan, |

|

401(k)

How the CARES Act impacts retirement plan account access The Coronavirus Aid, Relief, and Economic Security (CARES) Act is a significant piece of |

|

Withdrawal – Coronavirus Related Distribution (CARES Act) - Varipro

Section 2202(a) of the CARES Act A Maximum of $100,000 may be distributed to you, counting all distributions from this plan and any other plans or IRAs in |

|

TIAA and CARES Act

those who seek access to their retirement plan savings through CARES Act relief TIAA supports this effort to assist Americans impacted by Coronavirus and is |