2019 standard deduction over 65

|

2019 Publication 554

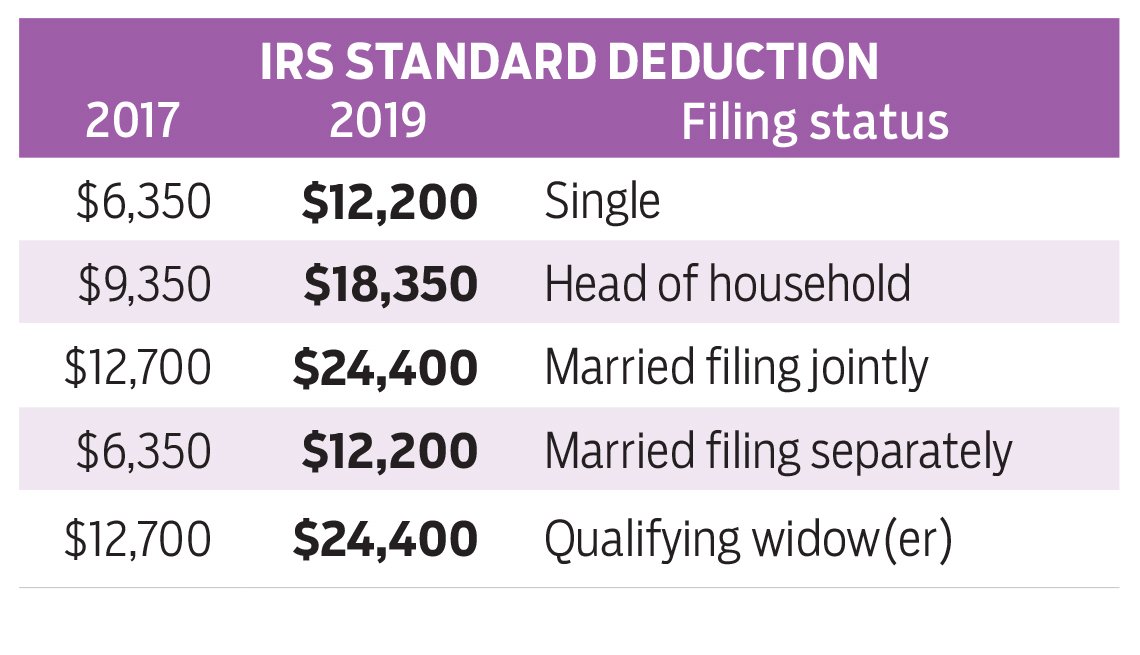

27 déc 2019 · For 2019 the standard deduction amount has been increased for all fil- ers The amounts are: • Single or Married filing separately — $12200 • |

What was the 2019 standard deduction?

The 2019 standard deduction is increased to $24,400 for married individuals filing a joint return; $18,350 for head-of-household filers; and $12,200 for all other taxpayers.

What is the personal exemption for 2019?

The deduction for personal exemptions is suspended (reduced to $0) for tax years 2018 through 2025 by the Tax Cuts and Jobs Act.

Although the exemption amount is zero, the ability to claim an exemption may make taxpayers eligible for other tax benefits.When should you itemize instead of claiming the standard deduction?

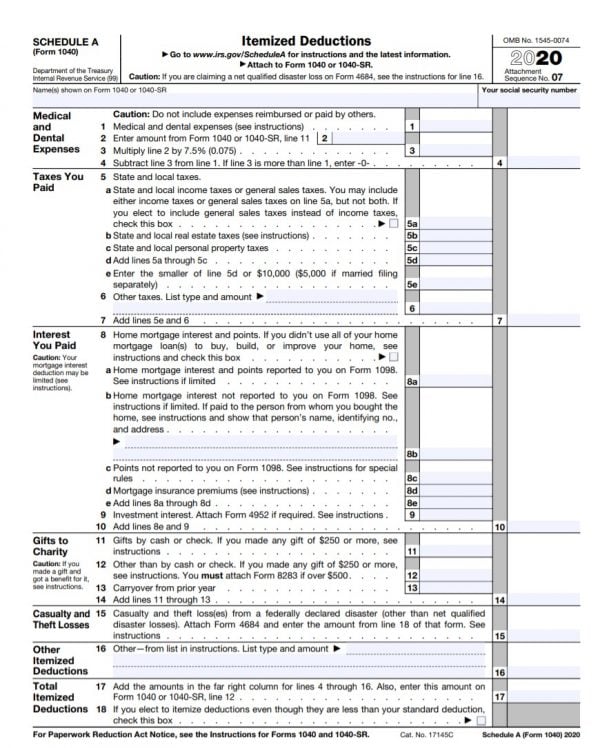

You should itemize deductions on Schedule A (Form 1040), Itemized Deductions if the total amount of your allowable itemized deductions is greater than your standard deduction or if you must itemize deductions because you can't use the standard deduction.

You can determine your AGI by calculating your annual income from wages and other income sources (gross income), then subtracting certain types of payments, such as student loan interest, alimony, retirement contributions, or health savings account contributions, you've made during the year.

|

2021 Publication 501

28 Jan 2022 can use the 2021 Standard Deduction Tables ... deduction for taxpayers who are blind or age 65 ... For 2019 he was entitled to. |

|

2019 Publication 501

13 Jan 2020 standard deduction. Form 1040-SR. You can file the new Form. 1040-SR U.S Tax Return for Seniors |

|

Hawaii Standard Deduction and Personal Exemptions

28 Jul 2021 2019. 2020. 2013. 2014. 2015. Federal Standard Deduction ... are 65 or older may claim an additional personal exemption (the age exemption). |

|

Form 4711 - 2019 Missouri Income Tax Reference Guide

31 Dec 2019 A. 65 years of age or older - You must be a full year resident. ... standard deduction is the greater of $1100 or the earned income for the ... |

|

2021 Form 1040-SR

Standard. Deduction. Someone can claim: You as a dependent. Your spouse as a dependent Check here if you were born after January 1 1998 |

|

2019 Instruction 1040

8 Jan 2020 available for use by taxpayers age 65 ... Schedules 1 through 3 and. 1040-SR. 2019. TAX YEAR ... so can't take the standard deduction if. |

|

2019 Publication 929

20 Mar 2020 For married taxpayers who are age 65 or over or blind the standard ... 501 Dependents |

|

Publication 1494 (Rev. 2019)

If the taxpayer in number 1 is over 65 and writes 1 in the ADDITIONAL STANDARD DEDUCTION space on Parts 3 4 |

|

2018 Publication 501

31 Dec 2018 use the 2018 Standard Deduction Tables near ... deduction for taxpayers who are blind or age 65 ... tus for 2018 and 2019. |

|

Publication 501: Dependents, Standard Deduction, and Filing

1040-SR is higher for 2020 than it was for 2019 deduction for taxpayers who are blind or age 65 or older, as standard deduction available to dependents In |

|

Publication 554 - Internal Revenue Service

14 jan 2021 · standard deduction amount has been increased for all fil- ers The amounts age 65 at the end of the year if your 65th birthday is on or before January from filing jointly in 2019 to single in 2020 because of the death of your |

|

2019 Individual Income Tax Return Single/Married - Missouri

5 Missouri standard deduction or itemized deductions If age 65 or older, blind, or claimed as a dependent, see federal return or page 6 |

|

Tax Tables 2019 Edition - Morgan Stanley

15 jan 2019 · Blind or over 65 and unmarried and not a surviving spouse *For taxable years beginning in 2019, the standard deduction amount under |

|

Standard Deduction Worksheet for Dependents (2019) - TheTaxBook

Do not use this chart if someone can claim the taxpayer, or spouse if filing jointly, as a dependent Instead, use the worksheet above __ Taxpayer was born before |

|

2019 Nebraska - Nebraska Department of Revenue - Nebraskagov

31 déc 2019 · of the Nebraska standard deduction or federal itemized deductions, filing separately, the additional amounts for spouse 65 and over and |

|

FastTaxFacts - CalCPA

2019 2019 Federal California Standard Deductions Single $ 12,200 Additional for Age 65 and Older or Beginning of Itemized Deduction Phase-out |

|

2019 Publication OR-17, Oregon Individual - State of Oregon

20 avr 2020 · Enter the Oregon standard 5 $ ______ deduction for a single person: • Basic standard deduction: $2,270 • Age 65 or older, or blind: $3,470 |

|

2020 tax guide - TIAA

After subtracting applicable standard or itemized deductions from adjusted gross Please note: In 2020, the additional standard deduction amount for those age 65 or over is $1,300, For 2020, as in 2019 and 2018, there is no limitation on |

![Income Tax Calculator For FY 2018-19 [AY 2019-20] - Excel Download Income Tax Calculator For FY 2018-19 [AY 2019-20] - Excel Download](https://www.doughroller.net/wp-content/uploads/2019/10/federal-income-tax-brackets-deductions-and-exemption-limits.jpg)

![Income Tax Calculator For FY 2019-20 [AY 2020-21] - Excel Download Income Tax Calculator For FY 2019-20 [AY 2020-21] - Excel Download](https://www.efile.com/efile-images/tax-deduction-share.jpg)