put call parity proof

|

4 MATH3733

4 2 Proof of put and call parity: Arbitrage reasoning Let us explain the formula for put call parity using the arbitrage arguments What- ever the put and |

|

Chapter 7 Put-call parity estimates for American options bounds on

Because the price of the American option is greater than its payoff the option will sooner be sold than exercised at time 0 Similar inequalities hold for t |

|

Handout 20: Arbitrage Proofs for Put-Call Parity and Minimum Value

Construct an arbitrage by buying the “cheap” call at $12 and selling the “expen- sive” put at $5 Recall that long a call and short a put both profit when S |

|

Lecture 6 Put-call parity: The general case

So far we have looked at put-call parity for non-dividend-paying assets Now we will use a similar approach to obtain put-call parity for stocks that pay |

|

Lecture 7

Proof of Put-Call Parity The value of European put option can be found as P0 Proof of Put-Call Parity Now we assume that P0 < C0 − S0 + Ee−rT We set |

|

Put-Call Parity (Castelli 1877)

17 mar 2010 · A European put on a non-dividend-paying stock may be worth less than its intrinsic value (p 161) Lemma 2 For European puts P ≥ max(PV(X) − |

|

Put-call parity

Proof Consider the portfolio consisting of buying one share of stock and a K–strike put for one share; selling a K–strike call for one share; |

|

Put-Call Parity

See text for proof Early exercise may be optimal for American futures options even if the underlying asset generates no payouts Theorem 16 American futures |

How do you derive the put-call parity relationship?

The formula for put call parity is c + k = f +p, meaning the call price plus the strike price of both options is equal to the futures price plus the put price.

What is put-call parity with with example?

Well, if you had invested in the asset at the spot price of $100 and it ended at $110, and you had to pay back the strike price at maturity from the amount you borrowed which would be $100, the net amount would be $10.

We see that these two portfolios both net to positive $10 and the put-call parity holds.What is the call put parity condition?

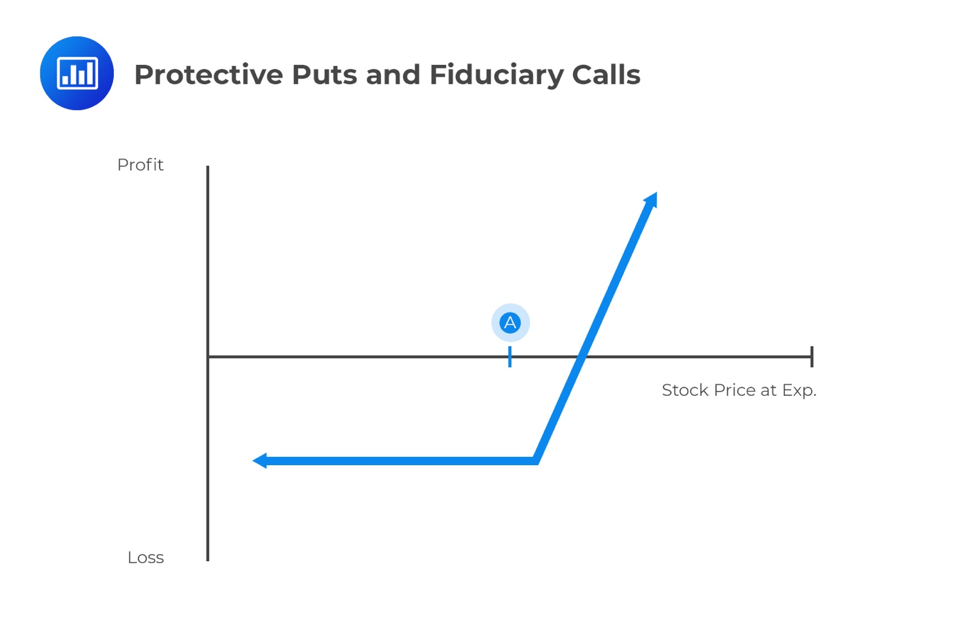

Put-call parity states that the simultaneous purchase and sale of a European call and put option of the same class (same underlying asset, strike price, and expiration date) is identical to buying the underlying asset right now.

The inverse of this relationship would also be true.- In financial mathematics, the put–call parity defines a relationship between the price of a European call option and European put option, both with the identical strike price and expiry, namely that a portfolio of a long call option and a short put option is equivalent to (and hence has the same value as) a single

|

4 MATH3733

Suppose the interest rate is 6% while the quoted price of the put option is indeed $8. 4.2 Proof of put and call parity: Arbitrage reasoning. |

|

Handout 20: Arbitrage Proofs for Put-Call Parity and Minimum Value

I. Put-Call Parity. Put-call parity states that. C = S ? Ee?rT + P. (1). To prove this statement assume that it doesn't hold and show that it is possible. |

|

Manual for SOA Exam FM/CAS Exam 2.

(Put–call parity formula) For a stock which does not pay any dividends Chapter 7. Derivatives markets. Section 7.6. Put–call parity. Proof. |

|

Chapter 6 Arbitrage Relationships for Call and Put Options

Proof: To prove this result we must show that for a stock that pays no dividends over the lifetime of the option the value of a call option unexercised is |

|

Option Put-Call Parity Relations When the Underlying Security Pays

Proof of the above relation can be found in most textbooks on options. The put-call parity relation for European-style options states. |

|

THE BLACK-SCHOLES MODEL AND EXTENSIONS Contents 1

22 août 2010 Finally we will prove put-call parity in order to price European put options |

|

Put-call parity for exotic european options

The result rests on a reasonable generalization of the concepts of put and call. The proof is based on the fundamental theorem of arbitrage pricing and. |

|

Lecture 7

Upper and Lower Bounds on Put Options. 2. Proof of Put-Call Parity by No-Arbitrage Principle. 3. Example on Arbitrage Opportunity. |

|

Lecture 6 Put-call parity: The general case

Now we will use a similar approach to obtain put-call parity for stocks that pay either discrete dividends |

|

Put-Call Parity and the Law

CARDOZO LAW REVIEW. [Vol. 24:1. B. An Intuitive Proof of the Put-Call Parity Theorem33. The put-call parity theorem states that the payoff from a. |

|

Lecture 6 Put-call parity: The general case - UT Math

Now we will use a similar approach to obtain put-call parity for stocks that pay either discrete dividends or a continuous dividend stream |

|

(PDF) Put-Call Parity - ResearchGate

Abstract Put–call parity is a fundamental relationship connecting European calls puts and forward contracts together Keywords: option synthetics; option |

|

Put-Call Parity (Castelli 1877)

17 mar 2010 · The Proof (continued) • At expiration if the stock price S? ? X the put will be worth X ? S? and the call will expire worthless |

|

Arbitrage Proofs for Put-Call Parity and Minimum Value (Optional)

We prove the statement by contradiction as before Assume C = $1 i e calls are selling at their intrinsic value and below their minimum value (they do not |

|

4 MATH3733

Suppose the interest rate is 6 while the quoted price of the put option is indeed $8 4 2 Proof of put and call parity: Arbitrage reasoning |

|

Put-call parity - Manual for SOA Exam FM/CAS Exam 2

Put–call parity Proof Consider the portfolio consisting of buying one share of stock and a K–strike put for one share; selling a K–strike call for one |

|

Option Put-Call Parity Relations When the Underlying Security Pays

The original put-call parity relations are derived under the premise that the underlying security does not pay dividends before the expiration of the options |

|

Lecture 7 - The University of Manchester

Proof of Put-Call Parity by No-Arbitrage Principle 3 Example on Arbitrage Opportunity Sergei Fedotov (University of Manchester) |

|

Chapter 7 Put-call parity estimates for American options bounds on

American put-call parity estimates For a stock paying no dividends the price of Amer- ican call and put options both with the same strike price K and |

|

Put-Call Parity in Equity Options Markets: Recent Evidence

26 mar 2019 · In a study of the Israeli stock options market Nissim and Tchahi [6] find evidence that violations of put-call parity are frequent and may |

What is put-call parity principle?

. This equation establishes a relationship between the price of a call and put option which have the same underlying asset.

Why does put-call parity not hold for American options?

. This is because American options have the liability of early exercise; hence they are not held until expiration.

Why are calls cheaper than puts?

. Puts (options to sell at a set price) generally command higher prices than calls (options to buy at a set price).

. One driver of the difference in price results from volatility skew, the difference between implied volatility for out-of-the-money, in-the-money, and at-the-money options.

What is a put vs call?

. Think of a call option as a down payment on a future purchase.

. Options involve risks and are not suitable for everyone.

. Options trading can be speculative in nature and carry a substantial risk of loss.

|

4 MATH3733

Hence, it must be exactly the same as if it were invested into a bank account with the interest rate r, that is, K = exp(r(T − t))(Pt − Ct + St) Otherwise an arbitrage opportunity would arise So, we come to the put and call parity formula: P − C + S = exp(−r(T − t))K |

|

Arbitrage Proofs for Put-Call Parity and Minimum - Wharton Finance

To prove this statement, assume that it doesn't hold and show that it is possible to make riskless profits We will use numbers for concreteness Assume S = $110 |

|

Option Put-Call Parity Relations When the - University of Miami

The option put-call parity condition quantifies the relations among the price of a call option, the price of an otherwise identical put option, the price of the underlying |

|

Basic Financial Derivatives - UiO

Proof We will compare two strategies Both having the same final payoff of S (T) at (Put-call parity estimates) The price of American call and put options, |

|

Chapter 6 Arbitrage Relationships for Call and Put Options

To derive boundary prices for call and put option prices from arbitrage arguments ; • To explain when Proof: Consider two portfolios, A and B A contains one European call option and X European Put-Call Parity Equations with Dividends |

|

Put/Call Options - TAMU Math

This relation is referred to as Put Call Parity C − P = S − PV(X), where PV(X) denotes the present value of the strike price X, which is to be paid at expiration As |

|

1 American Options

The Call Option: 1 CA (0) ≥ (S (0) − K)+ Proof: (1) CA (0) ≥ 0 (optionality); (2) If CA Put-call parity for American options on an non-dividend-paying stock: |

|

Deriving Put-Call Parity

19 mar 2007 · The put-call parity relationship comes nicely from some simple but clever steps The analysis begins with following true expression: (ST − K)+ |

|

Lecture 6 Put-call parity: The general case - UT Math

Now, we will use a similar approach to obtain put-call parity for stocks that pay either discrete dividends, or a continuous dividend stream Let Portfolio A consist |

![PDF] Put-call parity violations and return predictability PDF] Put-call parity violations and return predictability](https://0.academia-photos.com/attachment_thumbnails/34525317/mini_magick20180816-25659-pcjatj.png?1534461208)

![PDF] Put-call parity violations and return predictability PDF] Put-call parity violations and return predictability](https://d3i71xaburhd42.cloudfront.net/b6523c1f18936f4d3a5b568232be244d4334d2fc/32-Table3-1.png)

![PDF] Put-call parity violations and return predictability PDF] Put-call parity violations and return predictability](https://i1.rgstatic.net/publication/45863711_P_NP_Proof/links/5d1cd82392851cf44062afa4/largepreview.png)

![PDF] Put-call parity violations and return predictability PDF] Put-call parity violations and return predictability](https://i1.rgstatic.net/publication/319377140_A_TeXas_Style_Introduction_to_Proof/links/59a74f740f7e9b41b789238a/largepreview.png)

/tungsten-toned-view-of-a-suspended-balance-scale-stk20156bid-574e56955f9b5851659acfe3.jpg)