30 year mortgage rates refinance chart

What is a rate and term refinance?

Rate-and-term refinance. Allows you to lower your interest rate and/or change your loan term. For example, you might want to refinance your 30-year mortgage with a 5% interest rate into a 15-year mortgage with a 3% rate. This will lower your total interest costs and help you pay off the mortgage faster. Cash-out refinance.

What are the different types of mortgage refinance options?

The three most common types of mortgage refinance options are: Rate-and-term refinance. Allows you to lower your interest rate and/or change your loan term. For example, you might want to refinance your 30-year mortgage with a 5% interest rate into a 15-year mortgage with a 3% rate.

What is the average annual percentage rate for a mortgage refinance?

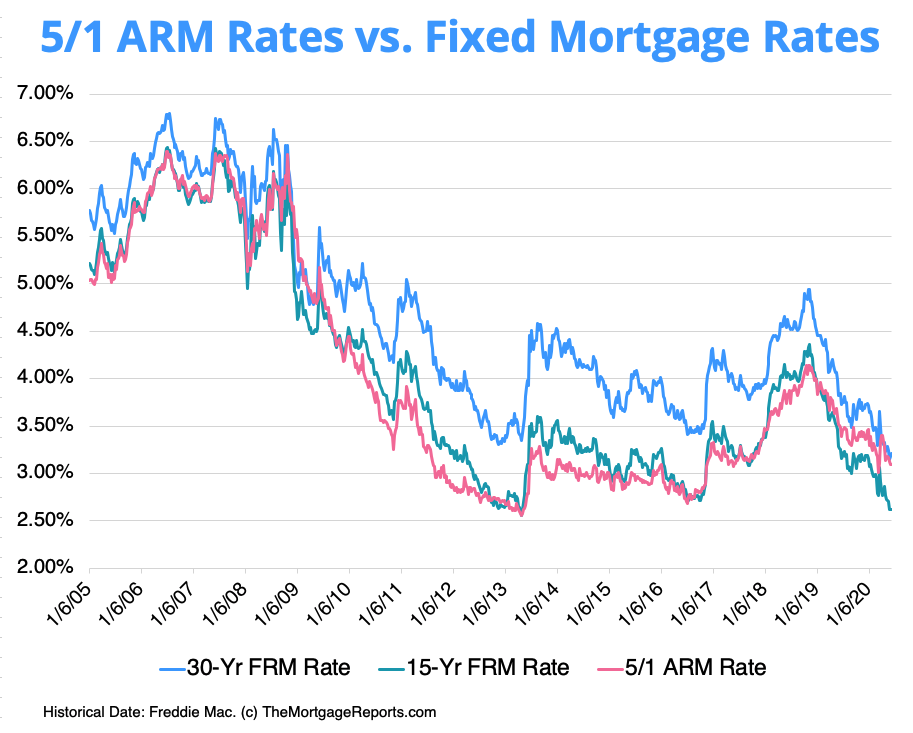

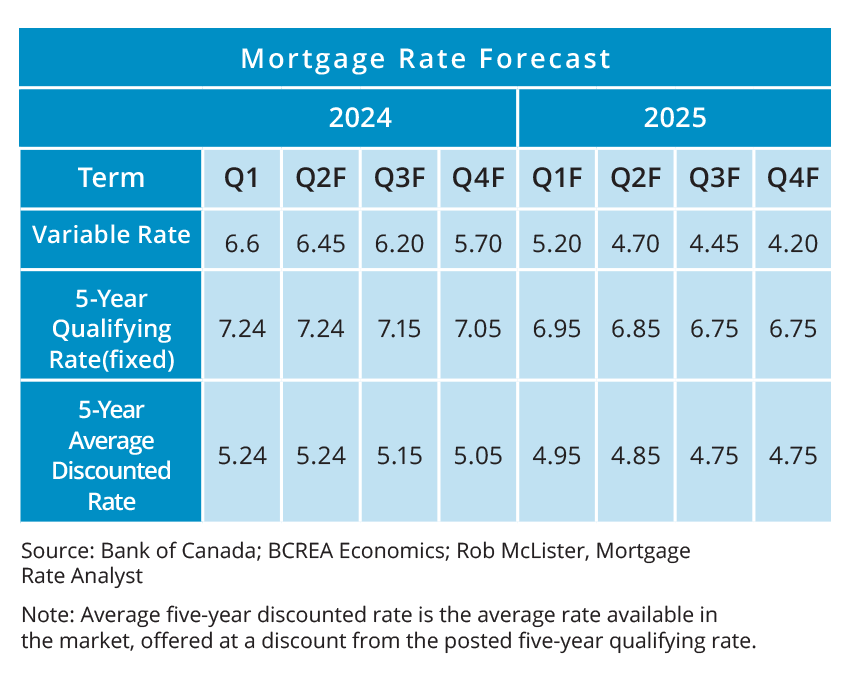

Here are the average annual percentage rates (APR) on 30- and 15-year fixed mortgage refinances and 5/1 ARM refinances: The average APR for a 30-year fixed refinance loan increased to 7.46% from 7.41% yesterday. This time last week, the 30-year fixed APR was 7.18%. Meanwhile, the average APR on a 15-year fixed refinance mortgage is 6.60%.

What is the average APR for a 30-year fixed mortgage?

The average APR for a 30-year fixed refinance loan increased to 7.46% from 7.41% yesterday. This time last week, the 30-year fixed APR was 7.18%. Meanwhile, the average APR on a 15-year fixed refinance mortgage is 6.60%. This same time last week, the 15-year fixed-rate mortgage APR was 6.29%.

Raise Your Credit Score

If your credit score is below 760, then you might not qualify for the very best rate lenders offer. That doesn’t mean you can’t get a lower rate than what you currently have, but there is room to improve your score and boost your savings. Before you apply for a mortgage refinance,check your credit score andget a copy of your credit report. If you f

Shop Around For The Best Rate

The second step in ensuring you get the best rateavailable to you is to shop around. Make sure you compare the APR between lenders, not just the rate. The APR is the all-in total of your mortgage costs, which can vary by lender, and will include your closing costs if rolled into your loan. You should compare offers from at least three lenders befor

Keep Your Loan-To-Value Ratio Low

Finally, the lower your loan-to-value (LTV) ratiois, the lower your interest rate will be. If you don’t have to take cash out of your home when you refinance, you might want to avoid doing so as that will bump up your LTV and likely result in a higher interest rate. The loan-to-value ratio measures the amount of financing used to buy a home relativ

|

Chart of the Week - Jan 28 2022 Mortgage Applications Since 2020

28-Jan-2022 With mortgage rates increasing steadily lately refinance applications have fallen. The 30?year fixed rate averaged 3.30. |

|

Introducing the U.S. Residential Mortgage Rate Lock Index Series

18-Oct-2021 counterpart (ICE U.S. Conforming 30-Year Fixed Refinance Mortgage Rate Lock Index). Chart 2. 30-Year Conforming Rates: Refi vs Purchase. |

|

Housing Finance At A Glance: A Monthly Chartbook

more charts to highlight a specific mortgage market HARP-eligible borrowers to consider refinancing. ... Fixed-rate 30-year mortgage. Fixed-rate 15-year ... |

|

Housing Finance At A Glance: A Monthly Chartbook February 2021

01-Feb-2021 The 30-year fixed-rate mortgage continues to remain the bedrock of the ... month-to-month variation the refinance share (bottom chart) has. |

|

US Economic Indicators: Mortgage Applications & Mortgage Rates

3 days ago * Average conventional 30-year commitment rate. Weekly data thru December 2003 daily thereafter. Source: FHLMC Primary Mortgage Market Survey. |

|

FANNIE MAE AND FREDDIE MAC SINGLE-FAMILY GUARANTEE

The average guarantee fee in 2017 on 30-year fixed rate loans fell by 1 basis 3 Prior-year data in the text and subsequent tables and charts may not be ... |

|

Mortgage Refinancing and the Concentration of Mortgage Coupons

between market interest rates and refinancing activity is apparent in Chart 1 which plots the average contract rate for new thirty-year fixed rate |

|

Housing Finance At A Glance: A Monthly Chartbook January 2022

01-Jan-2022 Cash-out Refinance Share of All Originations. 10. Total Home Equity Cashed Out ... Change in the Components of the 30-Year Fixed Rate. |

|

Prepayment Monitoring Report - First Quarter 2021

Chart 4 illustrates the spread between the weighted average loan rates (WACs) in mortgage pools to the coupon on the MBS backed by that pool for 30-year MBS |

|

Why Mortgage Backed Securities Are Negatively Convexed When

When interest rates go up fixed maturity bond prices go down and vice Everyone who has purchased a home using a 30-year mortgage knows that. |

|

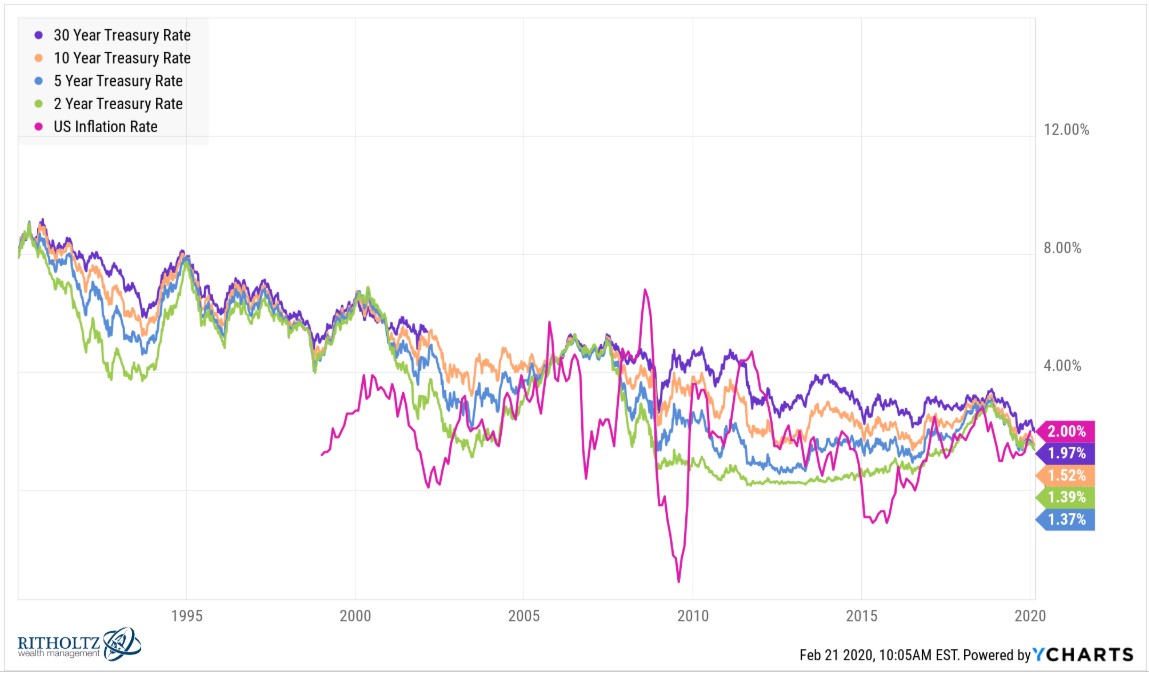

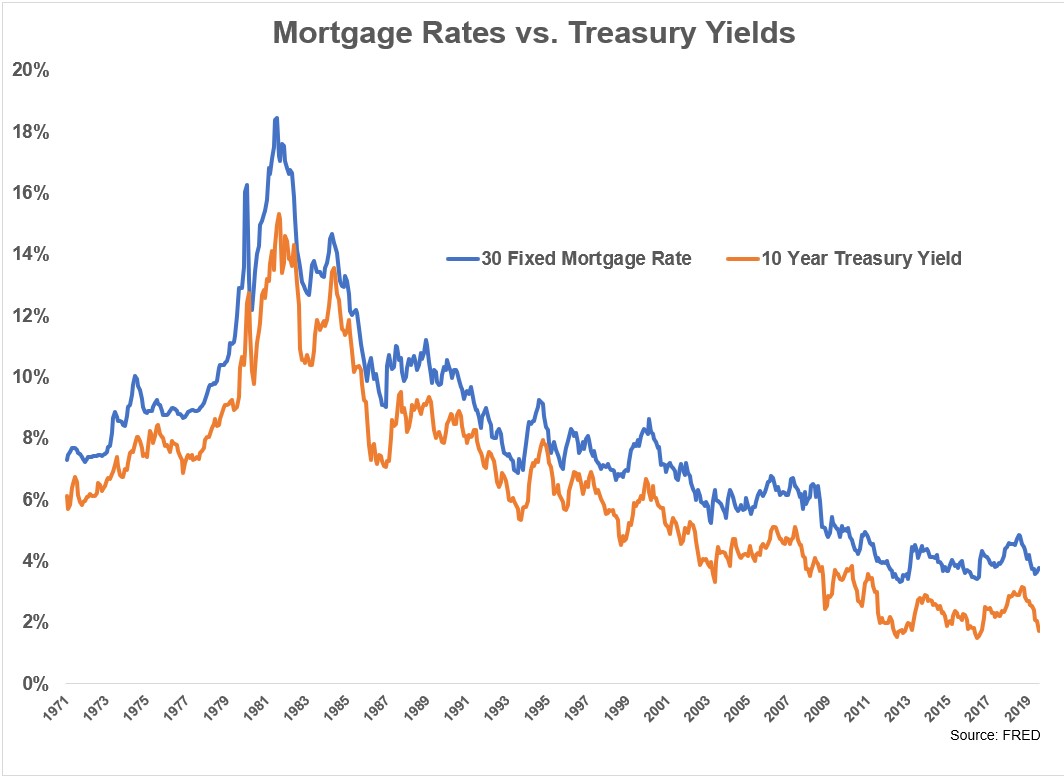

Chart of the Week - March 6, 2020 30-Year Fixed Mortgage versus

6 mar 2020 · Given the further drop in Treasury rates this week, we expect refinance activity will increase even more until fears subside and rates stabilize |

|

Chart of the Week - March 13, 2020 Refinance Index and 30 Yr

13 mar 2020 · Source: MBA Weekly Applications Survey Treasury rates and mortgage rates have fallen to historic lows, driven down by the market turmoil |

|

BECU Mortgage Rates

BECU Mortgage Rates 03/26/2021 Products Rate/Term Refinance 740+ N/A VA 30 Year Fixed 2 875 0 000 Rate Schedule Effective: 30 Year Fixed |

|

Interest Rates for the 30-Year Fixed Rate Mortgages Originating in

20 fév 2020 · Interest Rates for 30-Year Fixed Rate Mortgages Originated in 2018: To calculate the statistics shown in the tables, OCE began with the 2018 agency HMDA dataset refinance mortgages—had more than 2 4 million loans |

|

Mortgage Refinancing and the Concentration of Mortgage - CORE

between market interest rates and refinancing activity is apparent in Chart 1, which plots the average contract rate for new thirty-year fixed rate mortgages |

|

Mortgage loan rate - American Airlines Federal Credit Union

19 mar 2021 · Adjustment Schedule Loan Amount Discount Points Rate APR* First Time Homebuyer 5/1 ARM (30 yr) Fixed for 5 years, then adjusts |

|

Mortgage Refinancing in 2001 and Early 2002 - Federal Reserve

Chart 1 Refinancing activity and mortgage rates, 1993-2001 [graph plotting two lines: thirty-year fixed rate and refinance originations In the beginning of 1993, |

|

Quick View Loan Chart - Small Business Administration

working capital; refinance debt for compelling equipment) is 5-10 years; real estate is 25 years Loans less than 7 years: $0 - $25,000 Prime + Fixed Rate: |

|

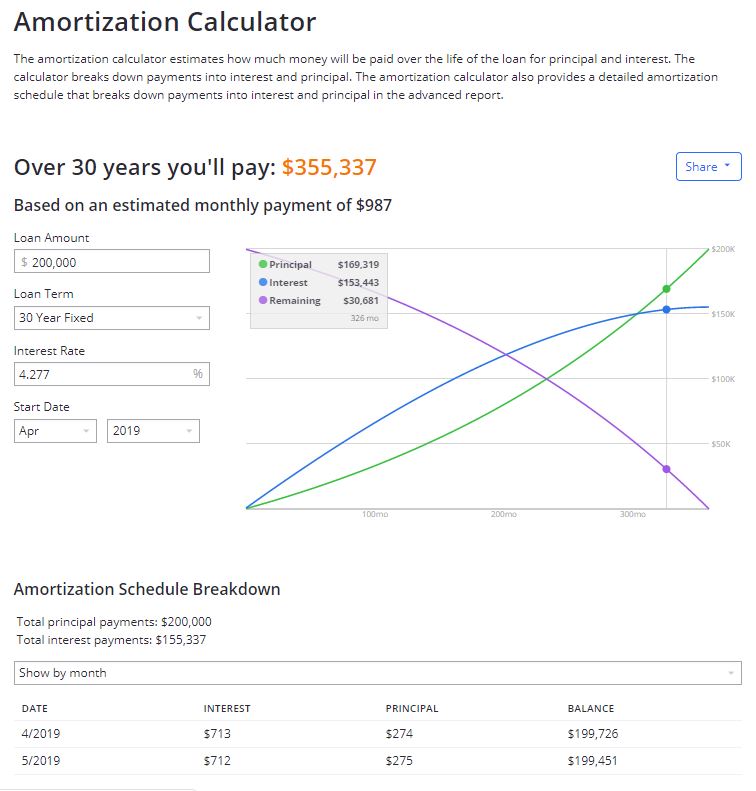

Refinancing During A Pandemic - Los Angeles County Department

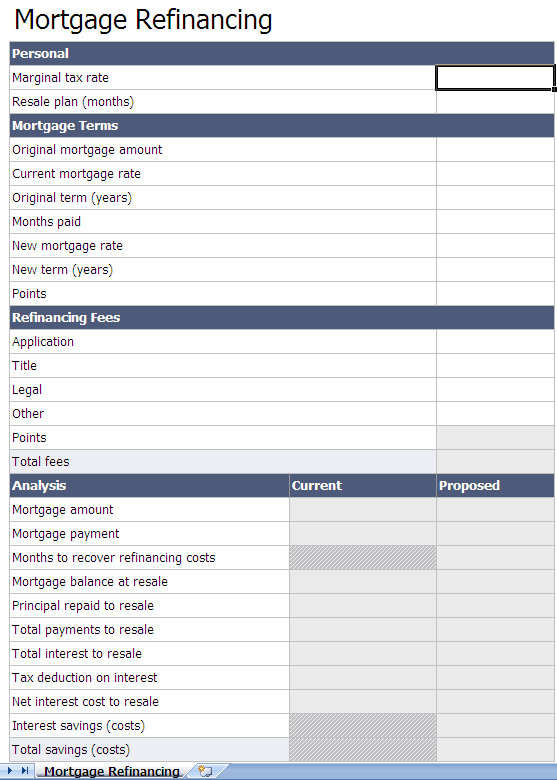

2 nov 2020 · Mortgage Calculator Using an online mortgage calculator, enter: 1 The amount of your loan 2 The term (30-year note) 3 The interest rate |