401k contribution limits 2020 over 50

How much can you contribute to a 401(k) after age 50?

Some plans, however, will also allow employees to make additional after-tax—but non-Roth—contributions to a traditional 401 (k) once the 2020 participant contribution limit of $19,500 (or $26,000 after age 50) is exceeded, up to the "all sources" contribution limit of $57,000 (or $63,500 after age 50).

How much can you contribute to a 401(k) in 2023?

In addition, the amount of your compensation that can be taken into account when determining employer and employee contributions is limited to $330,000 for 2023; $305,000 for 2022; $290,000 in 2021 ($285,000 in 2020). Learn the contribution limits for your 401 (k) and Profit-Sharing retirement plans.

What if Joe Saver has only one 401(k) plan in 2020?

Example: If Joe Saver, who’s over 50, has only one employer in 2020 and participates in that employer’s 401 (k) plan, the plan would have to permit catch-up contributions before he could defer the maximum of $26,000 for 2020 (the $19,500 regular limit for 2020 plus the $6,500 catch-up limit for 2020).

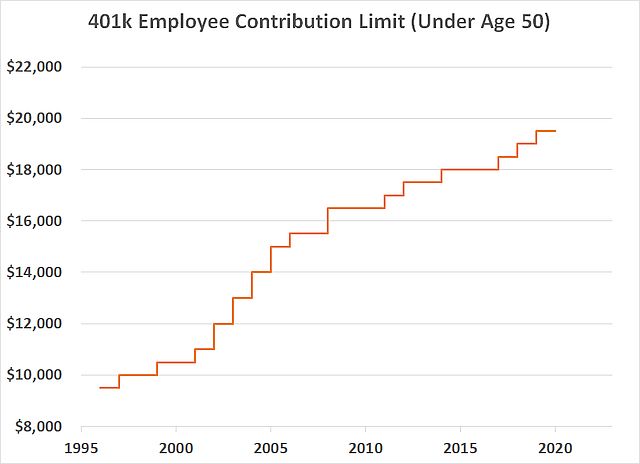

How much will a 401(k) contribution increase in 2020?

E mployee 401 (k) contributions for 2020 can increase by $500 to $19,500, while the combined employer and employee contribution limit rises by $1,000 to $57,000, the IRS announced on Nov. 6, 2019. For participants ages 50 and over, the additional "catch-up" contribution limit will rise to $6,500, up by $500.

Two Annual Limits Apply to Contributions

A limit on employee elective salary deferrals. Salary deferrals are contributions an employee makes, in lieu of salary, to certain retirement plans:An overall limit on contributions to a participant’s account. The limit applies to the total of: irs.gov

Deferral Limits For 401(k) Plans

The limit on employee elective deferrals (for traditional and safe harbor plans)is: 1. $23,000 ($22,500 in 2023, $20,500 in 2022, $19,500 in 2021 and 2020; and $19,000 in 2019), subject to cost-of-livingadjustments Generally, you aggregate all elective deferrals you made to all plans in which you participate to determine if you have exceeded these

Deferral Limits For A Simple 401(k) Plan

The limit on employee elective deferrals to a SIMPLE 401(k) plan is: 1. $16,000 ($15,500 in 2023, $14,000 in 2022, $13,500 in 2021 and 2020; and $13,000 in 2019) 2. This amount may be increased in future years for cost-of-livingPDFadjustments irs.gov

Plan-Based Restrictions on Elective Deferrals

Your plan's terms may impose a lower limit on elective deferralsIf you are a manager, owner, or highly compensated employee, your plan might need to limit your deferrals to pass nondiscrimination tests irs.gov

Catch-Up Contributions For Those Age 50 and Over

If permitted by the 401(k) plan, participants age 50 or over at the end of the calendar year can also make catch-up contributions. You may contribute additional elective salary deferrals of: 1. $7,500 in 2023 and 2024, $6,500 in 2022, 2021 and 2020 and $6,000 in 2019 - 2015 to traditional and safe harbor 401(k) plans 2. $3,500 in 2023 and 2024, $3,

Catch-Ups For Participants in Plans of Unrelated Employers

If you participate in plans of different employers, you can treat amounts as catch-up contributions regardless of whether the individual plans permit those contributions. In this case, it is up to you to monitor your deferrals to make sure that they do not exceed the applicable limits. Example: If Joe Saver, who’s over 50, has only one employer in

Treatment of Excess Deferrals

You have an excess deferralif the total of your elective deferrals to all plans is more than the deferral limit for the year. Notify your plan administrator before April 15 of the following year that you would like the excess deferral amount, adjusted for earnings, to be distributed to you from the plan. The April 15 date is not tied to the due dat

Overall Limit on Contributions

Total annual contributions (annual additions) to all of your accounts in plans maintained by one employer (and any related employer) are limited. The limit applies to the total of: 1. elective deferrals (but not catch-up contributions) 2. employer matching contributions 3. employer nonelective contributions 4. allocations of forfeitures The annual

Compensation Limit For Contributions

Remember that annual contributions to all of your accounts maintained by one employer (and any related employer) - this includes elective deferrals, employee contributions, employer matching and discretionary contributions and allocations of forfeitures, to your accounts, but not including catch-up contributions - may not exceed the lesser of 100%

Additional Resources

401(k) plansContribution limits if you're in more than one planWhen compensation exceeds the annual limits- deferrals and matching401(k) plan catch-up contribution eligibility irs.gov

|

2020 Limitations Adjusted as Provided in Section 415(d) etc.

The limitation for defined contribution plans under section 415(c)(1)(A) is section 408(p) for individuals aged 50 or over remains unchanged at $6500. |

|

2021 Publication 560

The limit on annual benefits for a participant in a 401(k). Salary reduction contributions: 30 days after the end of the month for ... age 50 or over. |

|

2021 Limitations Adjusted as Provided in Section 415(d) etc

1 janv. 2021 participant's compensation limitation as adjusted through 2020 |

|

Guidance for Coronavirus-Related Distributions and Loans from

281 (2020) (CARES Act) for qualified individuals and eligible retirement generally is includible in income over a 3-year period and |

|

WASHINGTON The Internal Revenue Service today announced cost

1 janv. 2020 for catch-up contributions to an applicable employer plan described in § 401(k)(11) or. § 408(p) for individuals aged 50 or over remains ... |

|

401(k) contribution limit increases to $19500 for 2020; catch-up limit

6 nov. 2019 The catch-up contribution limit for employees aged 50 and over who participate in these plans is increased from. $6000 to $6 |

|

Solo 401k Deep Dive: 2021 Contributions Guide for S-corporations

limit of $57000 or $63 |

|

401(k) Plans for Small Businesses - US Department of Labor

All 401(k) plans may allow catch-up contributions of $6500 for 2020 and for 2021 for employees age. 50 and over. Page 8. U.S. DEPARTMENT OF LABOR. 6. Vesting. |

|

Know your 2020 PRAP Contribution Limits

For 2020 there is a combined limit of $19 |

|

Benefit Reminders for 2020

1 janv. 2020 The limit on contributions to a 403(b)/401(k) plan for 2020 is $19500. If you are over the age of 50 |

|

2020/2021 dollar limitations for retirement plans - RBC Wealth

The limits for 2021, as well as the 2020 limits, are as follows: 2020/2021 dollar Traditional and Roth IRA contribution limit $6,000 $6,000 Catch-up limit for individuals age 50 and older $1,000 $58,000 Profit Sharing, 401(k), SEP and Maximum Social Security benefit at social security full retirement age $3,011 |

|

2020 Contribution and Benefit Limits

Limits stated above are subject to the provisions of the plan 2020 2019 401(k ), 457 and 403(b) maximum annual elective deferral limit aged 50 or over |

|

Employer-Sponsored Retirement Plans Contribution and Benefit Limits

2020 Employer-Sponsored Retirement Plans Maximum Contribution and Participants must aggregate all 401(k) and 403(b) plan contributions from all plans SIMPLE IRA Catch-Up Contribution Limit: Participants who are age 50 or over in |

|

IRS Contribution Limits for 2020

If you are at least 50 years old by the end of this year, you are eligible to contribute up to an additional $6,500 over the Annual Employee Deferral Limit to both the 457 and the 401(k) Plans If you have not made the maximum contribution in prior years, you may be eligible for the Special 457 Catch-Up contribution |

|

Regulatory limits for 2020 - Vanguard Institutional

The 2020 plan limits for SIMPLE 401(k)/IRA plans are $13,500 for deferrals Catch-up contribution limit for employees 50 and older in 401(k), 403(b), and 457 plans Return of excess contributions and earnings that are taxable in the year of |

|

THE FIDELITY SELF-EMPLOYED 401(K) CONTRIBUTION

Over △ Calculating Your Maximum Plan Year Contribution If you are self- employed, the worksheet on the 2021 ($63,500 if age 50 or older in 2020 and $64,500 for 2021) additional contribution up to the limits outlined on this worksheet |

|

New Estimates of the Future Path of 401(k) Assets - Federal

value of 401(k) assets as a percent of GDP over this period We conclude percent of private retirement saving contributions were to employer plans; 64 percent of these in a 401(k) plan But over 50 percent of the C25 cohort, which increased contribution limits very substantially and now future increases are indexed to |

|

401(k) contribution limit increases to $19,500 for 2020; catch-up limit

6 nov 2019 · government's Thrift Savings Plan is increased from $19,000 to $19,500 The catch-up contribution limit for employees aged 50 and over who |