2015 second lowest cost silver plan

|

Second Lowest Cost Silver Plan Technical FAQs

Dec 16 2016 · The Second Lowest Cost Silver Plan (SLCSP) is used along with income and family size to calculate a household’s premium tax credit which is available to eligible individuals and families who enroll in Marketplace coverage |

|

2015 Monthly Premiums for Second Lowest Cost Silver Plans

2015 Monthly Premiums for Second Lowest Cost Silver Plans (SLCSPs) By Coverage Family Type The Child Only Monthly Premium Amount is the cost per child up to 3 children for children who have not yet turned 21 If only one child is in the coverage household use the listed Monthly Premium Amount |

|

2015 “Second Lowest Cost Silver Plan” Costs

2015 “Second Lowest Cost Silver Plan” Costs Under the Affordable Care Act premium tax credits are designed to help low and middle-income households to afford comprehensive insurance through DC Health Link The credit covers the portion of the premium of a health insurance Benchmark Plan which exceeds a percentage of the household’s income |

What is a second-lowest cost silver plan (slcsp)?

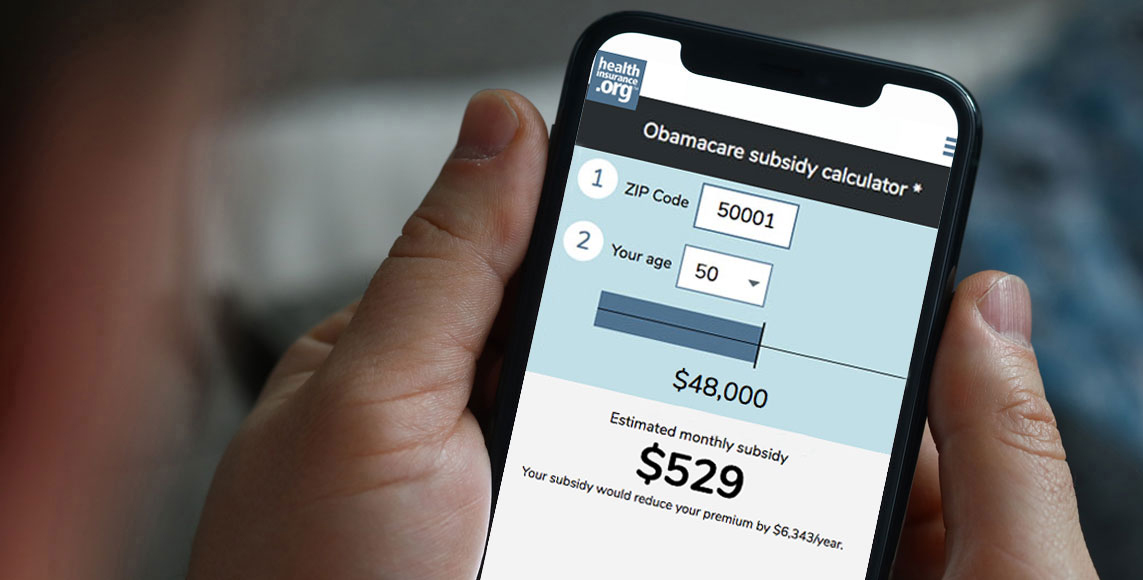

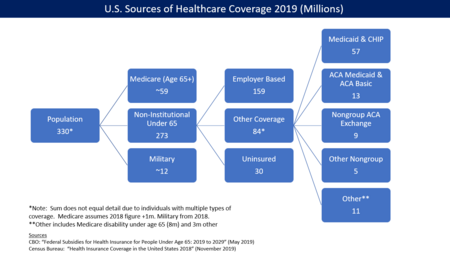

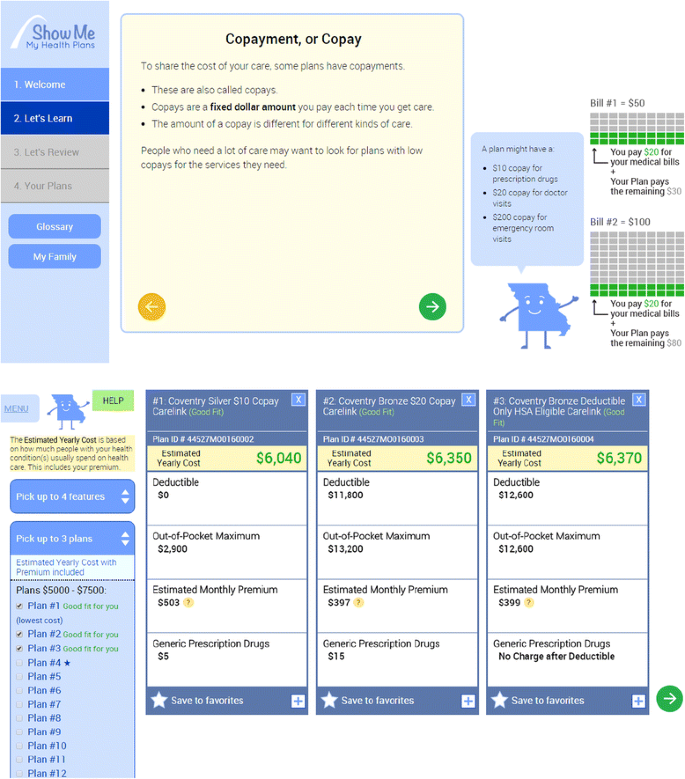

3. The second-lowest cost silver plan (SLCSP) is a type of health plan offered on the health insurance marketplace. Health plans are categorized from Bronze to Platinum. If you cannot afford the premium — the monthly base price — of a health insurance plan, you may qualify for a subsidy to help reduce the costs.

How do I get my second lowest cost silver plan tax credit?

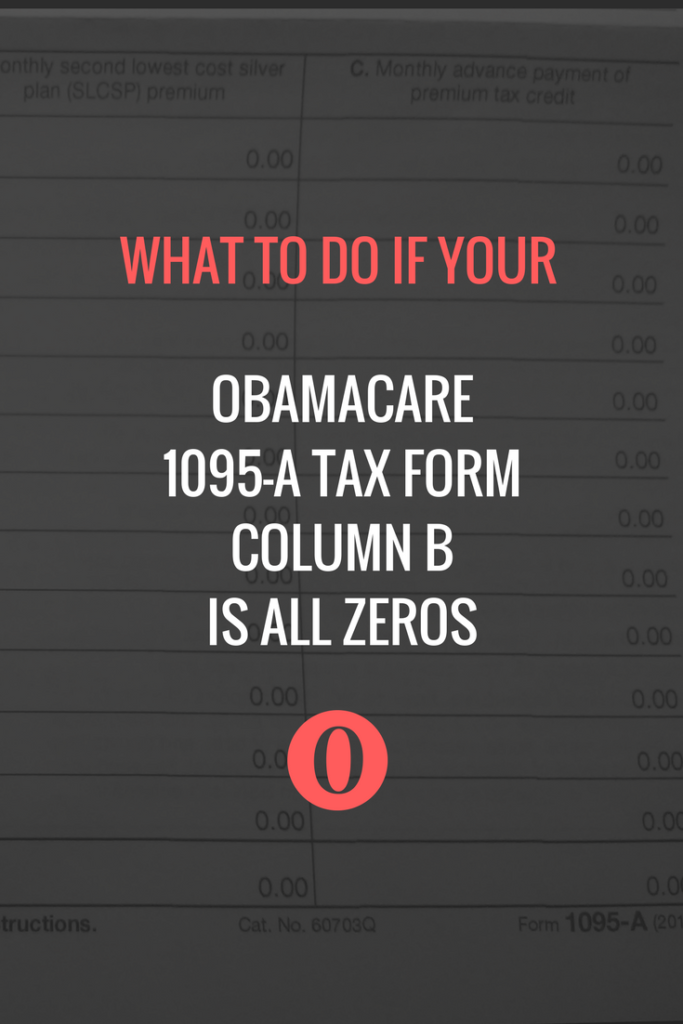

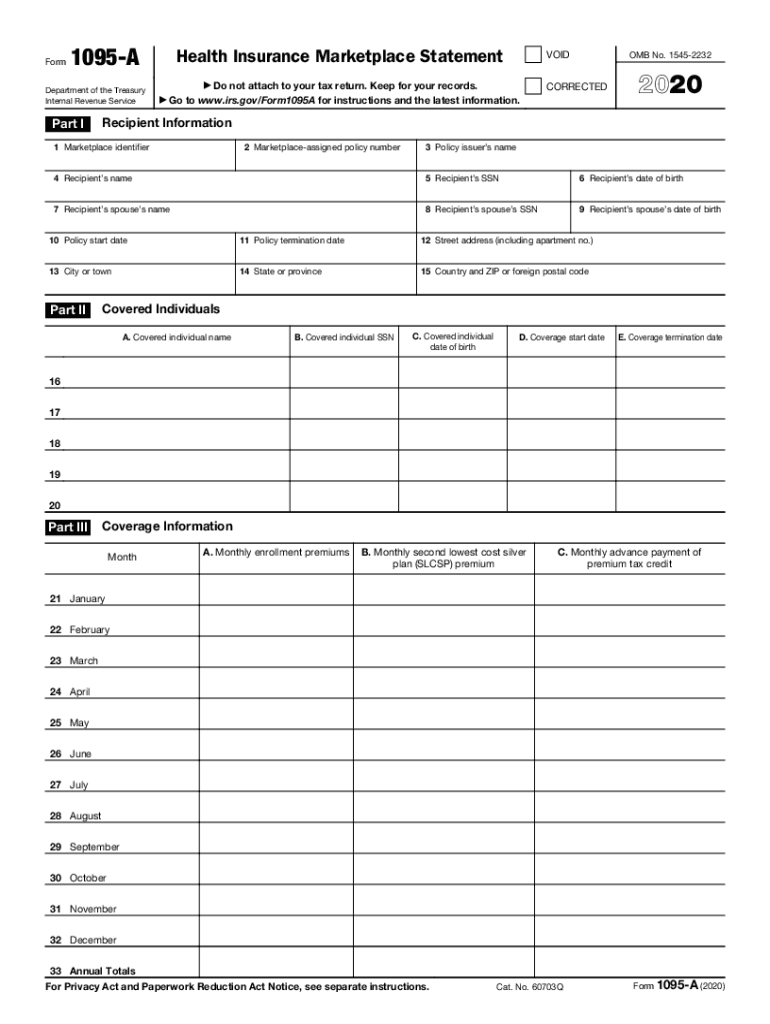

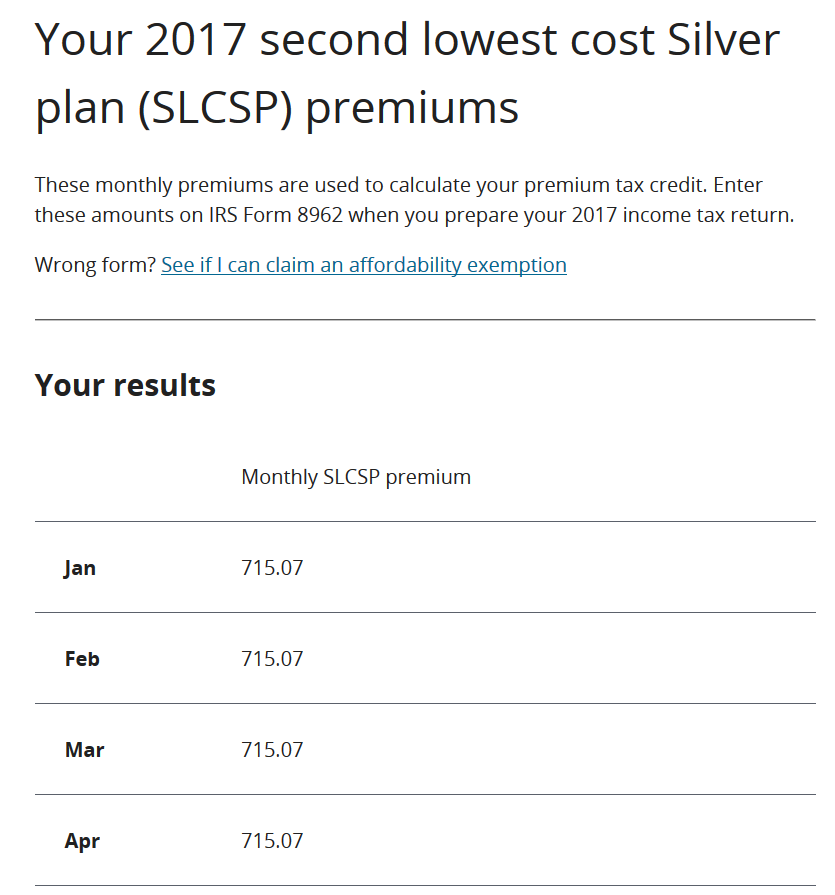

You need to know your second lowest cost Silver plan (SLCSP) premium to figure out your final premium tax credit. In most cases, you’ll find your SLCSP premium on Form 1095-A. The Marketplace sends Form 1095-A to you early in the year after someone in your household had a Marketplace health plan. You can also use our tax tool to get your SLCSP.

How are silver plans compared?

Silver plans are compared in terms of EHB premiums to determine which plan is the second lowest cost silver plan, and the premium tax credit is no greater than the difference between EHB premium of the SLCSP and the taxpayer’s contribution amount.

Which silver plan has the second lowest cost?

This will determine which silver plan is available to you and your family with the second lowest cost. The Premium Tax Credit, used to offset the cost of premiums and make health insurance more affordable for taxpayers, uses the Second Lowest Cost Silver Plan as a base.

Second Lowest Cost Silver Plans and Lowest Cost Bronze Plans Explained

The Second Lowest Cost Silver Plan (SLCSP) is a plan on each state’s Marketplace used to determine cost assistance for ObamaCare. Likewise, the Lowest Cost Bronze Planin each state’s marketplace is used to determine affordability. This page covers everything you need to know about Second Lowest Cost Silver Plans and Lowest Cost Bronze Plans. This p

Second Lowest Cost Tax Tools For Assistance and Affordability

To complete Form 8965 or Form 8962when you file your federal tax return, you may be asked for information about Marketplace health plans that were available to you in the year in which you had coverage. Thus, you may need to know the cost of premiums for the second lowest cost Silver plan (SLCSP) or the lowest cost Bronze plan. Use the following li

Second Lowest Cost Silver Plan and Lowest Cost Bronze Plan FAQ

Below is some important information on how these plans are used to determine cost assistance and affordability. 1. The Second Lowest Cost Silver Plan (SLCSP) in your state’s marketplace is used as the “baseline” plan for determining cost assistance. So for instance, if you qualified to have your tax credits capped at 9.5% of your household income,

Second Lowest Cost Silver Plan Tax Tool

To determine your final premium tax credit for the year, you need to know the premium for the second lowest cost Silver plan (SLCSP) that was available to you in that year. You’ll enter this information on Form 8962—Premium Tax Credit. SLCSP Tax Tool from HealthCare.Gov: FIND SILVER PLAN PREMIUM See if you need to use this tool to find your second

Lowest Cost Bronze Plan Tax Tool

To claim the exemption because Marketplace coverage was considered unaffordable for you in a given year, you’ll need to know the premium for the lowest cost Bronze plan available to you. To do this, you’ll use the lowest cost bronze plan tax tool below. You’ll use this information to complete Form 8965—Health Coverage Exemptions. 1. You don’t need

Second Lowest Cost Sliver Plan and 8962

To determine your final premium tax credit for the year in question, you need to know the premium for the second lowest cost Silver plan (SLCSP) that was available to you. You’ll enter this information on Form 8962—Premium Tax Credit. obamacarefacts.com

Second Lowest Cost Sliver Plan and 1095

You need to use this tool if the Form 1095-A you get from the Marketplace doesn’t include information about your second lowest cost Silver plan (SLCSP), or if the information is outdated. This could happen if: 1. You had a change in your household that you didn’t report to the Marketplace — like having a baby, moving to a new home, or a family memb

Lowest Cost Bronze Plan and 8965

You may need to use both the second lowest cost silver plan tool and the lowest cost bronze plan tool if you’re claiming a health coverage exemption because Marketplace coverage was considered unaffordable for you. NOTE: From 2019 forward the fee for not having coverage is reduced to $0 in most states. obamacarefacts.com

|

2015 “Second Lowest Cost Silver Plan” Costs

2015 “Second Lowest Cost Silver Plan” Costs. Under the Affordable Care Act premium tax credits are designed to help low and middle-income. |

|

2015 Monthly Premiums for Second Lowest Cost Silver Plans

2015 Monthly Premiums for Second Lowest Cost Silver Plans (SLCSPs). By Coverage Family Type. * The Child Only Monthly Premium Amount is the cost per child |

|

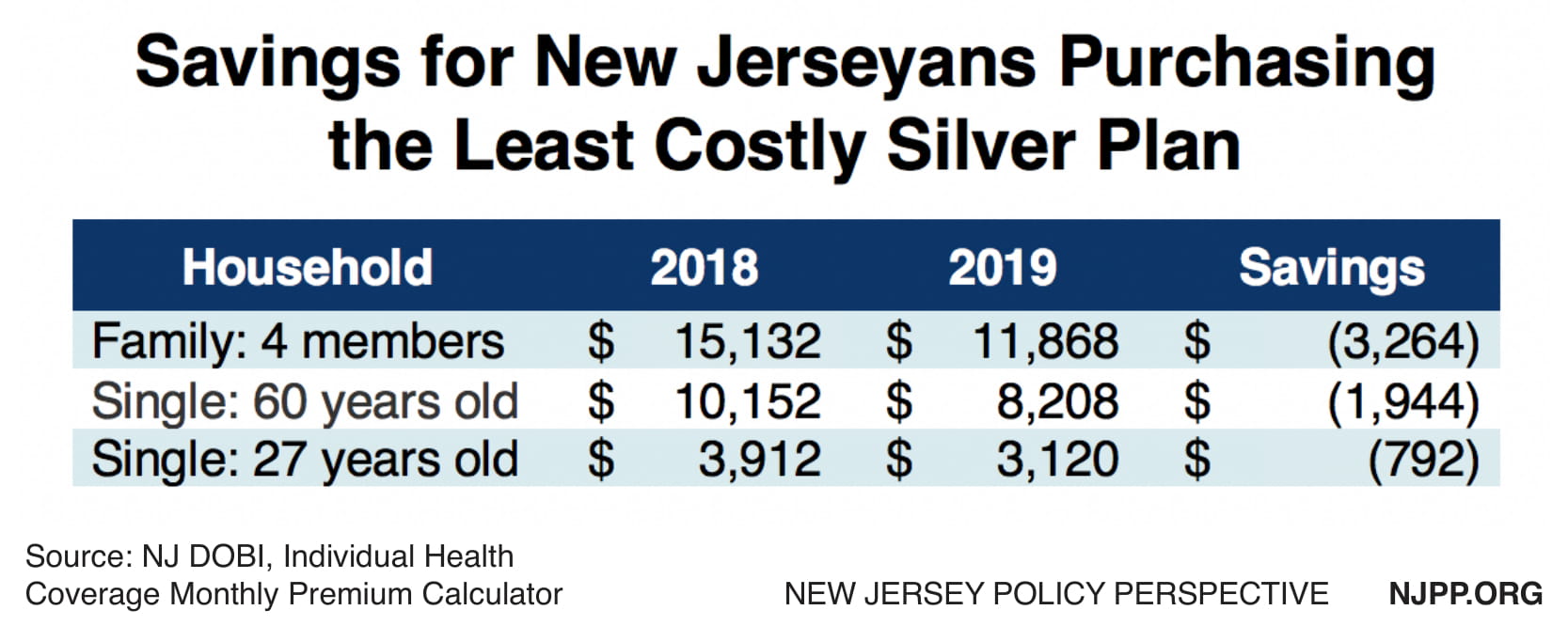

RESEARCH BRIEF

30 oct. 2015 Services “Health Insurance Marketplaces 2015 Open Enrollment Period: ... announced the premium of the second-lowest cost silver plan will ... |

|

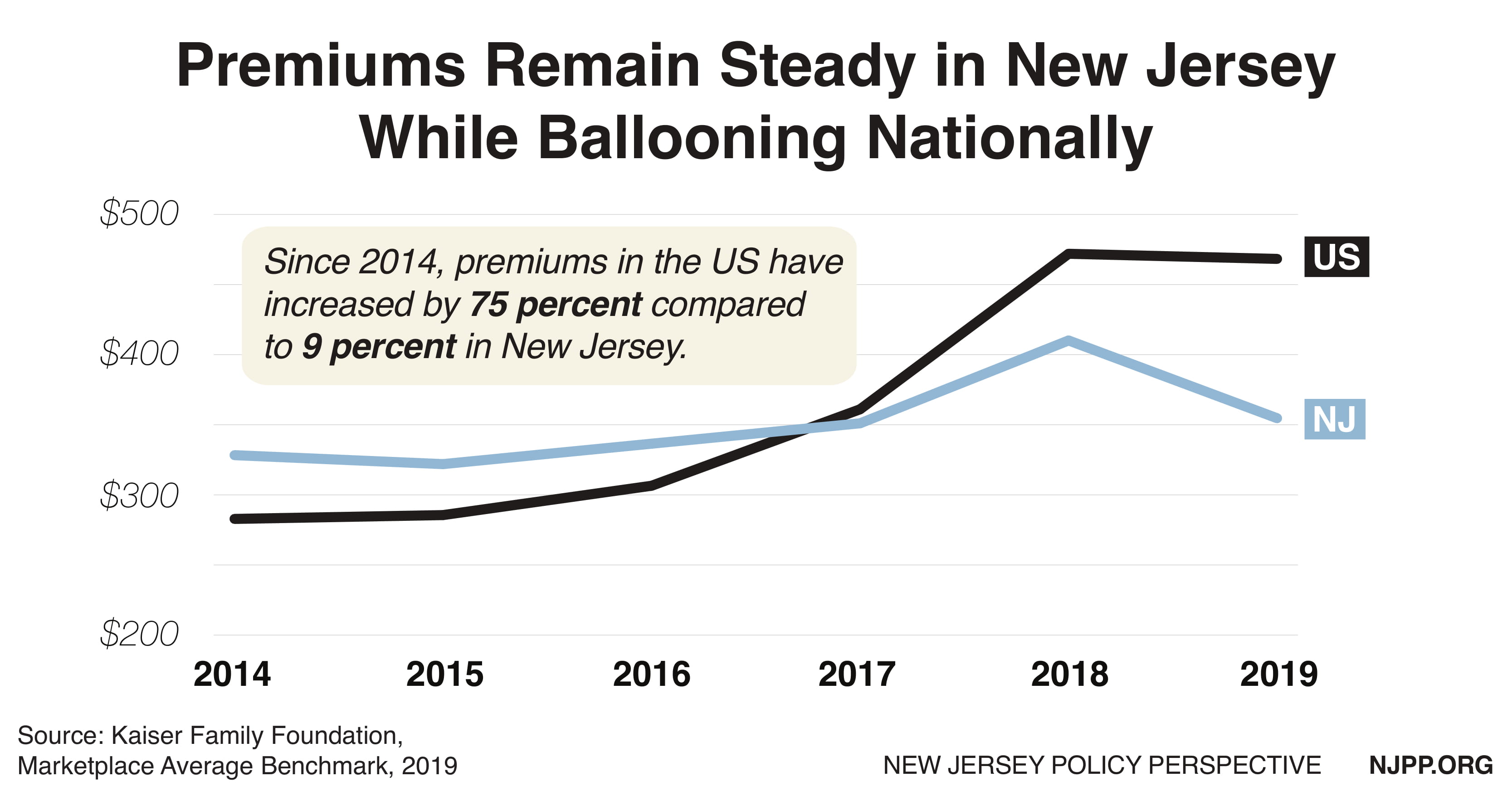

Marketplace Premium Changes Throughout the United States 2014

second-lowest-cost silver plans are the most popular.8. The lowest-cost silver plan in 2014 however |

|

Analysis of 2015 Premium Changes in the Affordable Care Acts

The second-lowest-cost silver plan is the benchmark for tax credits provided to In preparation for open enrollment for coverage in 2015 – which begins ... |

|

Premium Tax Credits: Answers to Frequently Asked Questions

How Much Help Will People Get? To calculate the premium tax credit the marketplace will start by identifying the second- lowest cost silver plan that that |

|

[ TEXT HERE ]

28 oct. 2015 Marketplaces (the 2015 plan year) for those consumers who had selected ... premiums for the second-lowest cost silver plan (also called the ... |

|

Marketplace Plan Choice: How Important Is Price? An Analysis of

26 mars 2016 In California the marketplace insurers with the lowest 2015 ... second-lowest-cost silver plan insurer in the region |

|

Insurer Competition In Federally Run Marketplaces Is Associated

the second-lowest-cost silver plan in a rating ar- did insurers newly entering the market in 2015 ... changes from 2014 to 2015 in the monthly plan. |

|

What Explains the 21 Percent Increase in 2017 Marketplace

5 janv. 2017 Lowest - and Second – Lowest-Cost Silver Plan Premium Level and 2016-2017 and. 2015-2017 Percentage Change in Lowest-Cost-Silver Premium ... |

|

2015 “Second Lowest Cost Silver Plan” Costs - DC Health Link

forms › 2 PDF |

|

2015 Monthly Premiums for Second Lowest Cost Silver Plans

nthly Premiums for Second Lowest Cost Silver Plans (SLCSPs), By Coverage Family Type |

|

Frequently Asked Questions about the Second Lowest Cost

|

|

Second Lowest Cost Silver Plan Technical FAQs - CMS

The Second Lowest Cost Silver Plan (SLCSP) is used along with income and family |

|

Health Insurance Marketplace 2015: Average - ASPE

of the second-lowest cost silver plan with respect to the applicable taxpayer and the |

|

Calculation of the Federal Advance Premium Tax Credit

ond-lowest cost silver plan in Dane County costs $383 04 per month for a 40-year-old in 2019 at a particular point in time by the federal Exchange County 2014 2015 2016 |

|

Second Lowest Cost Silver Plan - Wisconsin Office of the

PressReleasesPDF |

|

Premium Tax Credits: Answers to Frequently Asked Questions

cost silver plan that that is available to each member of the The benchmark plan is the second lowest silver plan that is in February 2015, it turns out that their income was a |

|

Second lowest cost silver - Mngov

mnsure-stat › assetsPDF |

.jpg)