1099 misc box 3 h&r block

What is box 3 on 1099 div?

Box 3.

Shows a return of capital.

To the extent of your cost (or other basis) in the stock, the distribution reduces your basis and is not taxable.

Any amount received in excess of your basis is taxable to you as capital gain.Other Income includes any taxable income for which there is not a specific line identified on Form 1040.

This income is reported on Form 1040, Schedule1.

|

H&R Block® Refund Bonus Program Terms and Conditions

16 oct. 2021 special bonus to you we'll add an extra 3% to the amount of your Gift Card. ... a Form 1099-MISC (Miscellaneous Income) for tax year 2022. |

|

Instructions for Form 1099-DIV (Rev. January 2022)

securities see the instructions for box 8 under Specific Instructions for Forms 1099-MISC and 1099-NEC. ... IRS.gov/irb/2006-03_IRB#NOT-2006-3. |

|

Instructions for Form 1099-G (Rev. January 2022)

1099-G for each person from whom you have withheld any federal income tax (report in box 4) under ... incentives may be reportable on Form 1099-MISC |

|

Instructions for Forms 1099-INT and 1099-OID (Rev. January 2022)

File Form 1099-INT Interest Income |

|

2022 Instructions for Form 1099-B

Also you must check the QOF box in box 3 for all Form 1099-MISC |

|

Publication 525 Taxable and Nontaxable Income

13 janv. 2022 for taxable years ending after 3/27/2020. (See ... able fringe benefits in box 1 of Form W-2 as wa- ... you in box 3 of Form 1099-MISC. |

|

AIRBNB HOST REPORTING GUIDE

Regardless of whether you receive a Form 1099-K the rental income you earned Airbnb's partnership with H&R Block does not constitute an endorsement. |

|

2020 Pennsylvania Personal Income Tax Return Instructions (PA-40

1099-R 1099-MISC |

|

UNDERSTANDING YOUR FORM 1099 CONSOLIDATED TAX

1099-MISC: MISCELLANEOUS INCOME Line 3: Other Income – This line can include payments ... H&R Block® is a leading tax-preparation software product. |

|

2022 Instructions for Forms 1099-SA and 5498-SA

See the instructions for boxes 1 through 3 later. In addition |

|

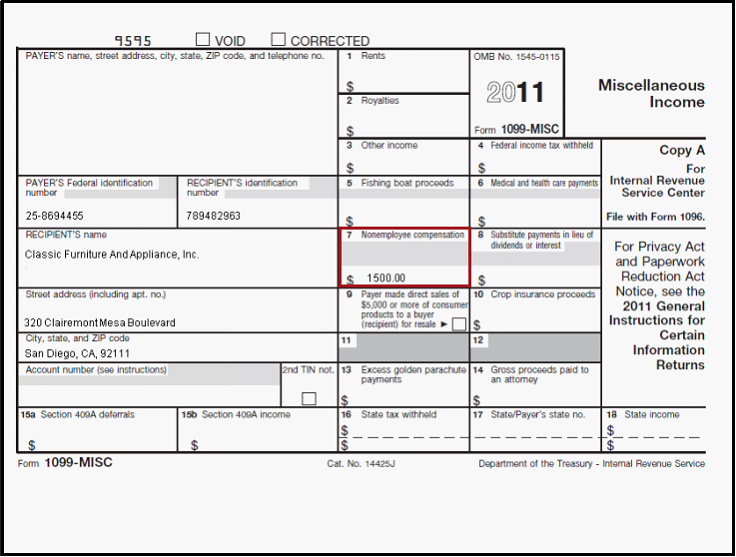

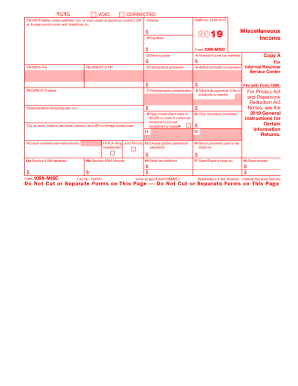

2020 Instructions for Forms 1099-MISC and 1099-NEC - Internal

6 déc 2019 · for Form 1099-MISC File Form 1099-MISC, Miscellaneous Income, for each contract to an individual, partnership, or estate (box 3); 5 Any fishing H-2A visa agricultural worker who did not give you a valid TIN You must |

|

1099-M Box Descriptions

Enter other income of $600 or more required to be reported on Form 1099-MISC that is not reportable in one of the other boxes on the form Enter in box 3: |

:max_bytes(150000):strip_icc()/Form1099-NEC-46cc30fa3f2646d8be4987b14d4aa5d4.png)