1099 misc box 7 codes

|

2023 Instructions for Forms 1099-R and 5498

23 fév 2023 · Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities Use Code 4 for reporting death benefits paid to a survivor |

Is 1099 R Box 7 Code 4 taxable?

When a taxpayer receives a distribution from an inherited IRA, they should receive from the financial instruction a 1099-R, with a Distribution Code of '4' in Box 7.

This gross distribution is usually fully taxable to the beneficiary/taxpayer unless the deceased owner had made non-deductible contributions to the IRA.Code "P" indicates that the taxpayer contributed more than allowed to a 401k, IRA, etc. through payroll withholding.

Excess contributions must be included as income for the year in which the contributions were made.

What is distribution code 7 on a 1099?

Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), or section 403(b) plan, if the employee/taxpayer is at least age 59 1/2; (b) for a Roth IRA conversion if the participant is at least age 59 1/2; and (c) to report a distribution from a life insurance, annuity, or

|

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

31 janv. 2022 Section references are to the Internal Revenue Code unless otherwise noted. ... Form 1099-NEC or box 7 on Form 1099-MISC to report any. |

|

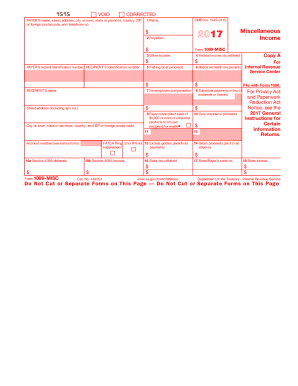

Form 1099-MISC (Rev. January 2022)

City or town state or province |

|

2017 Instructions for Form 1099-MISC

20 oct. 2016 Section references are to the Internal Revenue Code unless otherwise noted. Future Developments ... reportable in box 7 of Form 1099-MISC. |

|

2021 Instructions for Forms 1099-MISC and 1099-NEC

17 nov. 2020 Section references are to the Internal Revenue Code unless otherwise noted. ... Form 1099-NEC or box 7 on Form 1099-MISC to report any. |

|

2019 Instructions for Form 1099-MISC

19 nov. 2018 Section references are to the Internal Revenue Code unless otherwise noted. ... reportable in box 7 of Form 1099-MISC under section. |

|

Instructions for Forms 1099-MISC and 1099-NEC (Rev. January 2022)

30 sept. 2021 Section references are to the Internal Revenue Code unless otherwise noted. ... You may either file Form 1099-MISC (box 7) or Form. |

|

2022 Instructions for Forms 1099-R and 5498

Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities. Use Code 4 for for Forms 1099-MISC and 1099-NEC for more information. |

|

2013 Instructions for Form 1099-MISC

14 févr. 2013 Section references are to the Internal Revenue Code unless otherwise noted. ... business are reportable in box 7 of Form 1099-MISC. |

|

2016 Form 1099-MISC

City or town state or province |

|

2020 Form 1099-MISC

City or town state or province |

|

2020 Instructions for Forms 1099-R and 5498 - Internal Revenue

14 fév 2020 · Use Code 7 in box 7 for reporting military pensions or survivor benefit annuities Use Code 4 for reporting death benefits paid to a survivor beneficiary on a separate Form 1099-R Do not combine with any other codes |

|

2020 Instructions for Forms 1099-MISC and 1099-NEC - Internal

6 déc 2019 · Internal Revenue Service Section references are to the Internal Revenue Code unless Payer made direct sales of $5,000 or more (checkbox) in box 7 File Form 1099-MISC, Miscellaneous Income, for each person in the |

|

1099-R - Internal Revenue Service

www irs gov/Form1099R insurance contracts, etc , are reported to recipients on Form 1099-R Qualified your loan is taxable, code L will be shown in box 7 |

|

Pension - The Pension Specialists

Forms 1099-R and 5498 in mid-April These instructions Code 2 in box 7 if the individual is under age 59 1/2, 1099-MISC (excluding fishing boat pro- ceeds) |

|

FAQ - Retiree 1099 Forms - CT State Comptroller - CTgov

22 jan 2021 · A: To request a replacement 1099-MISC form, contact the Office of the Note your Box 7 Distribution code will be marked as a '3' if you are a |

|

IP 2010(11), Forms 1099-R, 1099-MISC and W-2G - CTgov

the associated informational returns; 1099-MISC, 1099- R or W-2G's There are tax forms you are filing from the drop down box 3 Select File 5 N/A Enter blanks Control Code 21-27 Blank 7 Enter blanks 28 Test File 1 DRS does not |

|

IRS Reporting Procedures for Tax Year 1999 - Bradford Scott Data

They also must have the 1099-MISC check-box checked in the Use Code 7: (a) for a normal distribution from a plan, including a traditional IRA, section 401(k), |

|

Understanding your IRS Form 1099-R - PERS

understanding of IRS Form 1099-R, important sections of Distribution code(s) 7 5 2a Acct No Account Number To help you prepare your taxes, this box |

|

W-2/1099 Reporting Instructions and Specifications Handbook for

Correcting Amounts and Distribution Code on 1099-R Nonemployee compensation was previously located in Box 7 of the 1099-MISC form and is |