2019 federal tax brackets calculator

Does Texas have state income tax?

Texas does not have an individual income tax.

Texas does not have a corporate income tax but does levy a gross receipts tax.

Texas has a 6.25 percent state sales tax rate, a max local sales tax rate of 2.00 percent, and an average combined state and local sales tax rate of 8.20 percent.The state income tax rates range from 1.4% to 10.75%, and the sales tax rate is 6.625%.

New Jersey offers tax deductions and credits to reduce your tax liability, including deductions for medical, alimony, and self-employed health insurance expenses.

Does Washington have income tax?

No income tax in Washington state

Washington state does not have a personal or corporate income tax.

However, people or businesses that engage in business in Washington are subject to business and occupation (B&O) and/or public utility tax.

|

2019 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

22 janv. 2020 FreeFile is the fast safe |

|

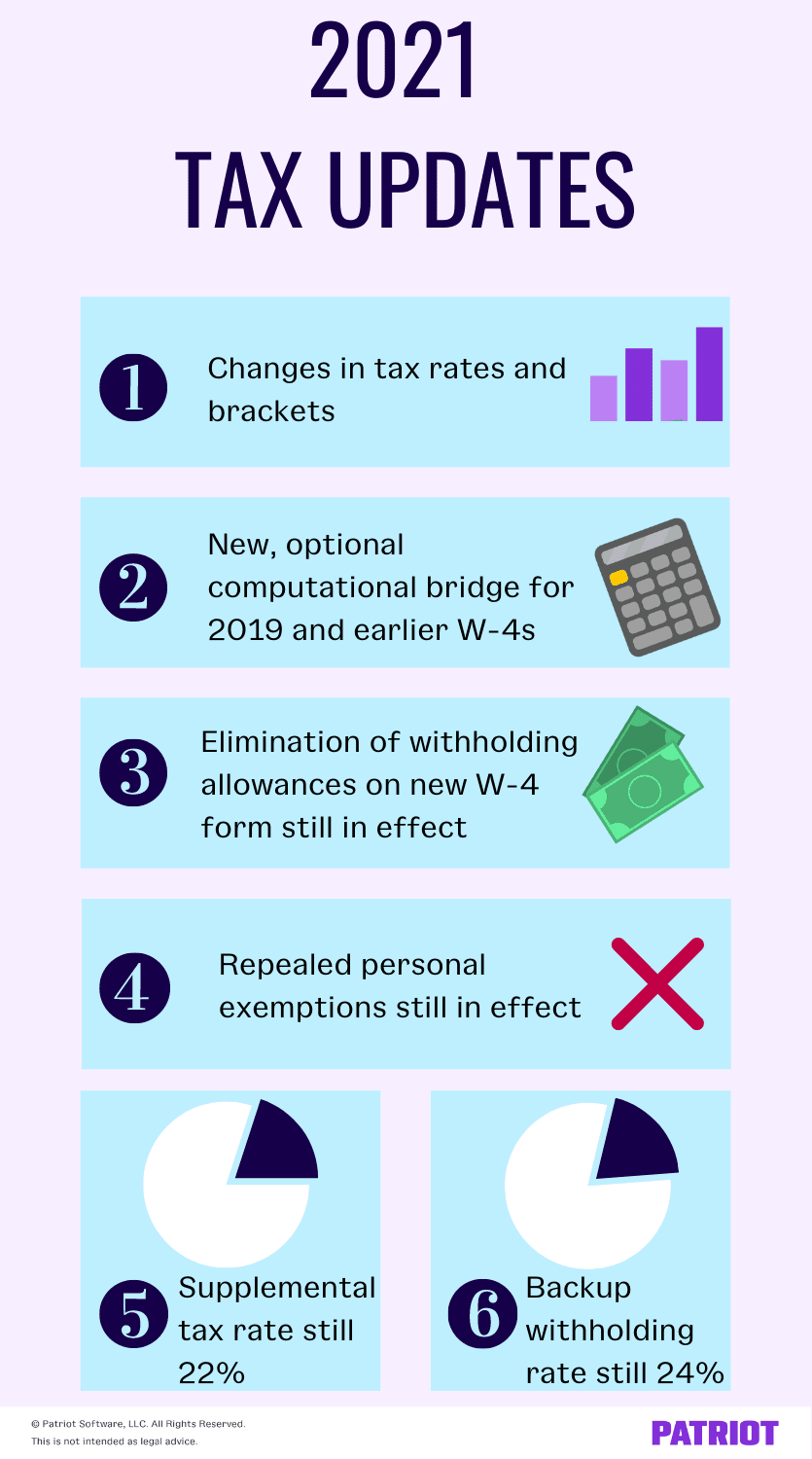

2019 Form W-4

federal income tax withheld because you had no tax liability and compares to your projected total tax for. 2019. If you use the calculator |

|

2019 Publication 15

17 déc. 2018 2019 Percentage Method Tables and Wage Bracket Ta- bles for Income Tax Withholding; see section 17. 2019 federal income tax withholding. |

|

2021 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

16 déc. 2021 Go to IRS.gov/Payments. NOTE: THIS BOOKLET DOES NOT. CONTAIN ANY TAX FORMS. Department of the Treasury Internal Revenue Service www.irs. |

|

2019 Instruction 1040

8 janv. 2020 Department of the Treasury Internal Revenue Service www.irs.gov ... For information about any additional changes to the 2019 tax law or any ... |

|

2021 Publication 915

6 janv. 2022 This publication explains the federal income tax rules for ... Student loan interest (for 2020 2019 |

|

Federal Percentage Method of Withholding 2019

31 déc. 2019 Procedures used to calculate federal taxes withheld*:. 1. Obtain the employee's gross wage for the payroll period. |

|

2019 Publication 15-A

20 déc. 2018 2019 Formula Tables for Percentage Method Withholding;. Wage Bracket Percentage Method Tables; Combined. Federal Income Tax Employee Social ... |

|

2022 Publication 15-T

13 déc. 2021 withholding is used to figure federal income tax withhold- ... zero allowances on a 2019 or earlier Form W-4. Exemption from withholding. |

|

2019 Tax Brackets - Tax Foundation

16 avr 2019 · income tax brackets or have reduced value from credits and The IRS used to use the Consumer Price Index (CPI) to calculate the past year's |

|

2020 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

16 sept 2020 · FreeFile is the fast, safe, and free way to prepare and e-file your taxes See IRS gov/FreeFile Pay Online It's fast, simple, and secure |

|

2019 Form W-4 - Internal Revenue Service

federal income tax withheld because you had no tax compares to your projected total tax for 2019 If you use the calculator, you don't need to complete any of |

|

2019 Tax Calculation Schedule - CTgov

Form CT-1040 TCS 2019 Tax Calculation Schedule TIP Calculate your tax instantly online using the Connecticut 2019 Income Tax Calculator Visit the DRS |

|

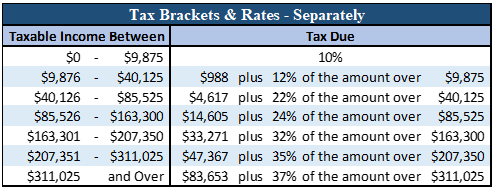

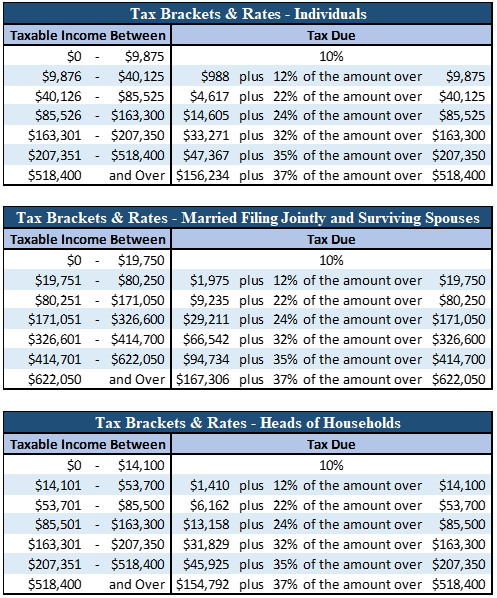

How do federal income tax rates work? - Tax Policy Center

The federal individual income tax has seven tax rates ranging from 10 percent to 37 percent (table 1) The rates apply to taxable income—adjusted gross income |

|

Calculating the tax you may owe on your COVID-19 benefits - CIBC

however, income tax is not withheld from the benefits at the time they are paid qualify, you must have had (self-)employment income of at least $5,000 in 2019 or in Here's how to calculate how much tax you'll owe on your CERB payments |

|

COMPUTING STATE INDIVIDUAL INCOME TAX - Louisiana

COMPUTING STATE INDIVIDUAL INCOME TAX ON RESIDENT LOUISIANA RETURNS To compute Louisiana tax, you need the Louisiana taxable income, the filing taxable income for every exemption over 8, and calculate the tax using 8 |

|

1 2018 IRS Federal Tax Withholding Calculator - Paul Hastings LLP

The IRS has published this tax calculator to help you: ▫ Many of those changes won't be visible to you until early 2019 when you file your 2018 tax return December 2017 and your 2017 tax return, including Schedule A if you itemize |

|

Personal income tax rates - OECDorg

In Tables 4 and 5, taxes include payroll taxes of 6 9 per cent for the year 2019 of gross These formulae are used directly to calculate the income tax of single |

|

California Guideline Child Support Calculator User Guide - CA Child

(LCSA) and the LCSA used the California Child Support Guideline Calculator between June 23, 2008 and July 11, 2008 to calculate Federal Income Taxes |