2019 standard deduction irs

|

2019 Instruction 1040

8 jan 2020 · Have any deductions to claim such as student loan interest deduction self-employment tax or educator expenses Can claim a refundable credit |

|

2019 Publication 17

17 juil 2020 · The simplified worksheet for figuring your qualified business income deduction is now Form 8995 Qualified Business Income Deduction |

|

2019 Publication 501

13 jan 2020 · This section also discusses the standard deduction for taxpayers who are blind or age 65 or older as well as special rules that limit the |

|

2019 Publication 929

20 mar 2020 · For married taxpayers who are age 65 or over or blind the standard deduction is increased an additional amount of $1300 ($1650 if head of |

|

2021 Publication 501

28 Jan 2022 IRS.gov/Vietnamese (Ti?ng Vi?t) ... filing requirements and the standard deduction) ... Your spouse died in 2019 or 2020 and you. |

|

2019 Publication 501

13 Jan 2020 Standard deduction increased. The stand- ard deduction for taxpayers who don't itemize their deductions on Schedule A of Form 1040 or. 1040-SR ... |

|

2019 Publication 554

27 Dec 2019 For 2019 the standard deduction amount has been increased for all fil- ... need to file a federal income tax return for 2019 |

|

2021 Instructions for Form 4684

See Qualified disaster losses and Increased standard deduction reporting later. See also IRS.gov/DisasterTaxRelief for date-specific declarations associated |

|

2019 Instruction 1040

8 Jan 2020 increased standard deduction. • Election to use your 2018 earned income to figure your 2019 earned in- come credit. See the instructions for. |

|

Section 111.—Recovery of Tax Benefit Items 26 CFR 1.111-1

2019-11. ISSUE. If a taxpayer received a tax benefit from deducting state and local taxes for 2018 in lieu of using their standard deduction of $12000. |

|

2021 Schedule A (Form 1040)

Internal Revenue Service (99). Itemized Deductions. ? Go to www.irs.gov/ScheduleA for instructions and the latest information. ? Attach to Form 1040 or |

|

2019 Standard Mileage Rates Notice 2019-02 SECTION 1

Thus the business standard mileage rate provided in this notice cannot be used to claim an itemized deduction for unreimbursed employee travel expenses during |

|

2021 Publication 587

Certain expenses are deductible to the extent they would have been deductible as an itemized deduction on your Schedule A or if claiming the standard deduction |

|

Publication 501: Dependents, Standard Deduction, and Filing

1040-SR is higher for 2020 than it was for 2019 The amount standard deduction available to dependents In addition, this the Internal Revenue Service, Tax Forms and Publications, 1111 filing requirements and the standard deduction) |

|

US Tax Return for Seniors Filing Status Standard Deduction

Form 1040-SR Department of the Treasury—Internal Revenue Service U S Tax 12 Standard deduction or itemized deductions (from Schedule A) 12 13 2020 estimated tax payments and amount applied from 2019 return 26 27 |

|

2019 Instruction 1040 - Internal Revenue Service

8 jan 2020 · Form 1040 Standard deduction amount in- creased For 2019, the standard deduc- tion amount has been increased for all filers The amounts |

|

2020 Instruction 1040 - Internal Revenue Service

9 fév 2021 · Outlays for Fiscal Year 2019 106 deduction, self-employment tax, or educator expenses Can claim Standard deduction amount in- |

|

Publication 5307 (Rev 6-2020) - Internal Revenue Service

Changes to Standard Deduction Limit on overall itemized deductions suspended The standard deduction for each filing status for tax year 2019 is: Single |

|

Standard Deduction (continued)

Standard Deduction Worksheet for Dependents Use this worksheet only if someone else can claim you (or your spouse if filing jointly) as a dependent Blind is |

|

2019 Publication 929 - Internal Revenue Service

20 mar 2020 · Due to the increase in the standard deduction and re- duced usage of itemized deductions, if you are employed, you may want to consider |

|

Revenue Procedure 2019-44 - Internal Revenue Service

16 Standard Deduction 63 01 Section 3201 of the Taxpayer First Act of 2019, Pub L 116-25 For taxable years beginning in 2020, the standard deduction |

|

2020 Publication 17 - Internal Revenue Service

11 fév 2021 · explain the standard deduction, the kinds of and AGI from your originally filed 2019 federal 2019 income tax return, you can request a tran- |

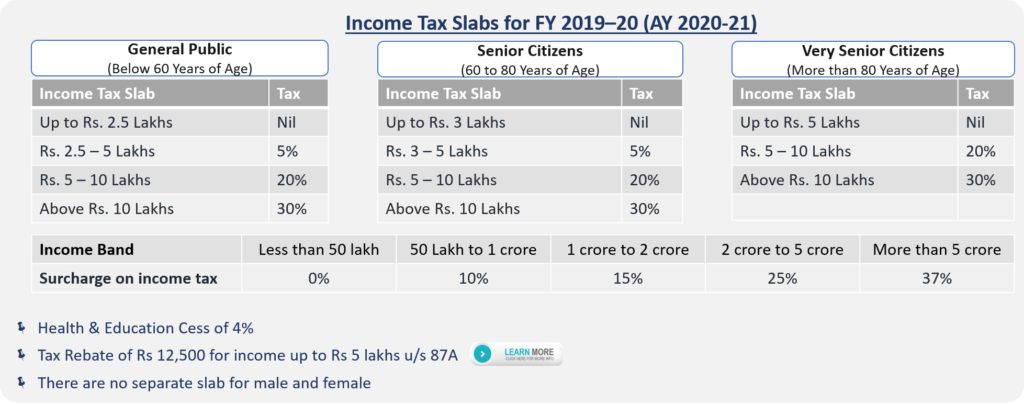

![Income Tax Calculator For FY 2019-20 [AY 2020-21] - Excel Download Income Tax Calculator For FY 2019-20 [AY 2020-21] - Excel Download](https://www.efile.com/efile-images/standard-deductions.png)