2019 standard deduction married filing separately

How does standard deduction work?

You should itemize deductions on Schedule A (Form 1040), Itemized Deductions if the total amount of your allowable itemized deductions is greater than your standard deduction or if you must itemize deductions because you can't use the standard deduction.

What is the threshold for married filing separately?

The standard deduction is a specific dollar amount that reduces the amount of income on which you're taxed.

Your standard deduction consists of the sum of the basic standard deduction and any additional standard deduction amounts for age and/or blindness.Can married filing separate take the standard deduction?

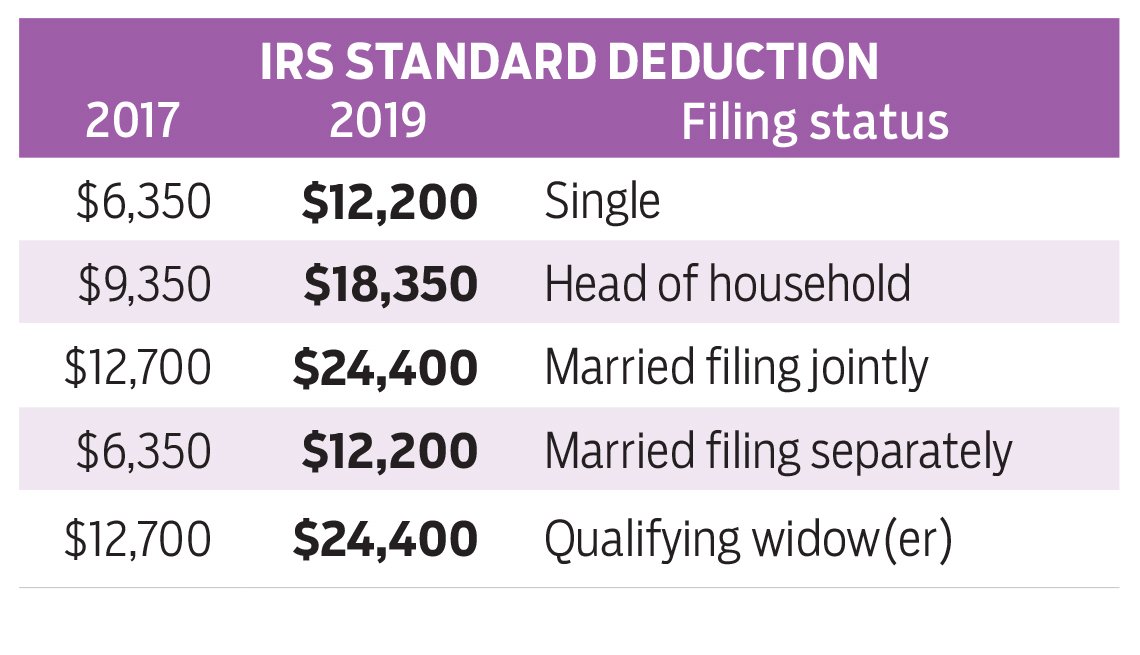

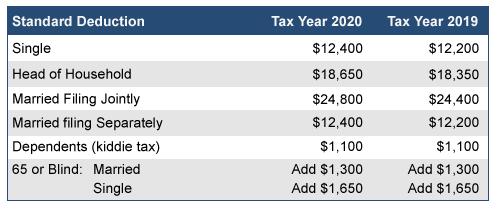

The 2023 standard deduction is $13,850 for single filers and those married filing separately, $27,700 for those married filing jointly, and $20,800 for heads of household.

It is claimed on tax returns filed by April 2024. $13,850. $13,850.11 jan. 2024

|

2021 Publication 501

Jan 28 2022 can use the 2021 Standard Deduction Tables ... under Married Filing Separately |

|

2019 Publication 554

Dec 27 2019 For 2019 |

|

2019 Publication 501

Jan 13 2020 can use the 2019 Standard Deduction Tables ... standard deduction available to dependents. In ... under Married Filing Separately |

|

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

Dec 31 2019 2019 Standard Deduction Table . ... (or total gross income of a married couple) during 2019 was: Single. Under 65. $11 |

|

Form 1040 - 2021

Married filing separately (MFS) Standard. Deduction. Someone can claim: You as a dependent ... c Prior year (2019) earned income . |

|

2019 Instruction 1040

Jan 8 2020 For 2019 |

|

2021 Form 1040-SR

Filing. Status. Check only one box. Single. Married filing jointly. Married filing separately Standard. Deduction. Someone can claim: You as a dependent. |

|

2021 Publication 504

Jan 31 2022 file a return |

|

2021 Instruction 1040

Dec 21 2021 ARP expanded the child and dependent ... Don't file the Standard Deduction ... You may elect to use your 2019 earned income to fig-. |

|

Instructions for Form IT-201 Full-Year Resident Income Tax Return

If you claimed the standard deduction on your federal return mark an X in the No box. Item C. If you can be claimed as a dependent on another taxpayer's. |

|

Publication 501: Dependents, Standard Deduction, and Filing

1040-SR is higher for 2020 than it was for 2019 The amount married filing a separate return and you lived with your spouse at any time during 2020, or (b) tax-exempt interest is more than $25,000 ($32,000 if married filing jointly) If (a) or |

|

Tax Tables 2019 Edition - Morgan Stanley

15 jan 2019 · jointly, and $125,000 for married couples filing separately *For taxable years beginning in 2019, the standard deduction amount under |

|

Standard Deduction Worksheet for Dependents (2019) - TheTaxBook

Do not use this chart if someone can claim the taxpayer, or spouse if filing jointly, as a dependent Instead, use the worksheet above __ Taxpayer was born before |

|

State Individual Income Tax Rates and Brackets for 2019 - eFilecom

Married Filing Jointly Standard Deduction Personal Exemption State Rates Brackets Rates Brackets Single Couple Single Couple Dependent Ala 2 00 |

|

2019 Individual Income Tax Return Single/Married - Missouri

5 Missouri standard deduction or itemized deductions If age 65 or older, blind, or claimed as a dependent, see federal return or page 6 |

|

2019 Tax Brackets - Tax Foundation

16 avr 2019 · The standard deduction for single filers will increase by $200 and by $400 for married couples filing jointly (Table 4) The personal exemption |

|

State Individual Income Tax Rates and Brackets for 2019

7 jui 2019 · tax rates, brackets, standard deductions, and personal exemptions for both Rates Brackets Single Couple Single Couple Dependent Ala |

|

2020 Federal Tax Information

2019 Standard deduction for single individuals $12,400 $12,200 Standard deduction for joint MFS = Married Filing Separately; ET = Estates and Trusts |

|

2020 Nebraska Individual Income Tax Booklet

The deduction is limited to $5,000 for married filing separate returns and $10,000 110 of the tax shown on your 2019 return if AGI on the return was more than of the Federal Form 1040 or 1040-SR, or the Nebraska standard deduction |

|

Itemized Deductions - Kansas Legislature

24 jan 2019 · 2019 100 allowed on Fed 2020 Real Estate Tax and Personal The higher federal standard deduction will lead fewer taxpayers to claim itemized For example: A married couple who in the past had $15,000 of Kansas |