2019 suta tax rate michigan

|

STATE UNEMPLOYMENT INSURANCE

The measures in this report describe the 2019 tax rate year amounts for each state MICHIGAN 2019 STATE TAX FEATURES STATE TAX LEVELS DISTRIBUTION OF WAGES |

What is the SUTA rate in Michigan?

Michigan.

Michigan's 2023 SUTA rates range from 0.6% to 10.3%, with the wage base holding at $9,500.What is the SUTA tax in the US?

SUTA stands for the State Unemployment Tax Act.

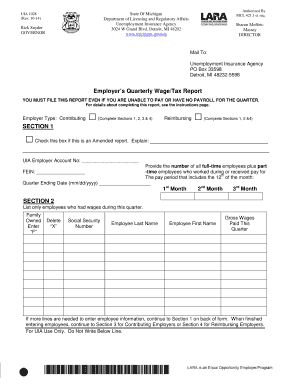

The SUTA tax is a required payroll tax that all employers must pay, and the money goes into the state unemployment fund.A contributing employer files a tax report with the UIA at the end of each calendar quarter, and pays a state unemployment tax on the first $9,500.00 of wages paid to each worker performing covered services in a calendar year.

The amount of the tax is determined by the employer's state unemployment tax rate.

How much is unemployment in Michigan?

You can only get 20 weeks of unemployment benefits in a benefit year.

The maximum amount of unemployment is $362 a week.

The weeks you get benefits are called benefit weeks.

The number of benefit weeks you get depends on your total base period wages and your weekly benefit amount.

|

Michigan Economic Update - July 2019

29 août 2019 Office of Revenue and Tax Analysis. Michigan Department of Treasury ... state unemployment rates through July 2019 ranged. |

|

Michigan Economic Update - April 2019

3 avr. 2019 Office of Revenue and Tax Analysis ... In April 2019 the Michigan unemployment rate rose 0.1 of a percentage point to 4.1 percent. In April. |

|

THE MICHIGAN SINGLE

20 mai 2022 Office of Revenue and Tax Analysis ... The Michigan unemployment rate fell from 10.0 percent in 2020 to 5.9 percent in 2021. |

|

Michigan Economic Update - April 2019

3 avr. 2019 Office of Revenue and Tax Analysis ... In April 2019 Michigan's unemployment rate was down 0.2 of a percentage point from a year ago. The. |

|

Obligation Assessment

On June 27th 2012 the Unemployment Insurance Agency |

|

Revenue Source and Distribution - April 2019

4 avr. 2019 The current tax rate is. 6%. NET BUSINESS TAXES. Includes revenue from the Single Business Tax (SBT) Michigan Business Tax. |

|

2019 Instructions for Form 940

19 nov. 2019 employer must pay additional federal unemployment tax when filing its Form 940. ... be reduced based on the credit reduction rate for the. |

|

Michigan Economic Update - April 2020

3 juin 2020 Office of Revenue and Tax Analysis ... percent lower than actual 2019 Michigan ... 2019. 2020. Michigan and U.S. Unemployment Rates. |

|

TAXPAYERS GUIDE TAXPAYERS GUIDE

1 janv. 2022 For the 2021 income tax returns the individual income tax rate for Michigan taxpayers is. 4.25 percent |

|

Michigan Economic Update Office of Revenue and Tax Analysis

3 déc. 2021 2019. 2020. 2021. Michigan and U.S. Unemployment Rates. January 2013 to October 2021. Three-Month Average. Michigan 5.7%. United States 4.9%. |

|

Obligation Assessment - State of Michigan

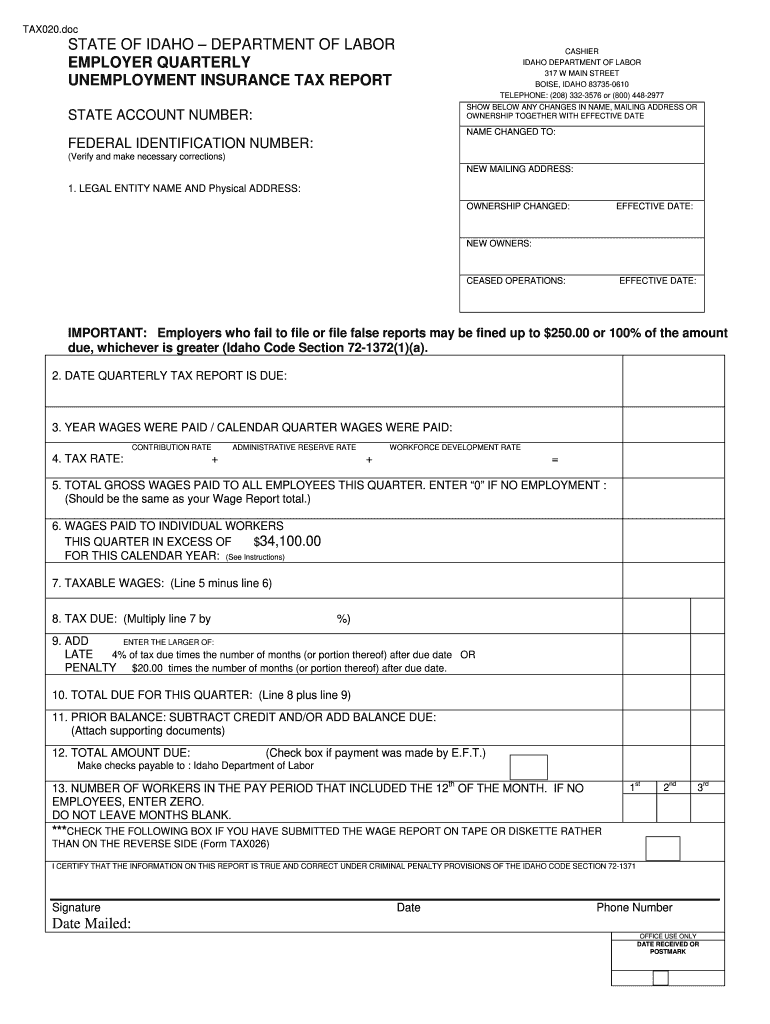

On June 27th 2012, the Unemployment Insurance Agency, in partnership with the (2019 tax rate X OA ratio) + (base assessment ÷ taxable wage base) |

|

UIA 1020 - State of Michigan

Tax Rate 9 Tax Due 10 Prior Account Balance As of 11 Amount Enclosed BE MADE PAYABLE TO: State of Michigan – Unemployment Insurance Agency |

|

State Unemployment Insurance Taxable Wage Bases 2016-2019

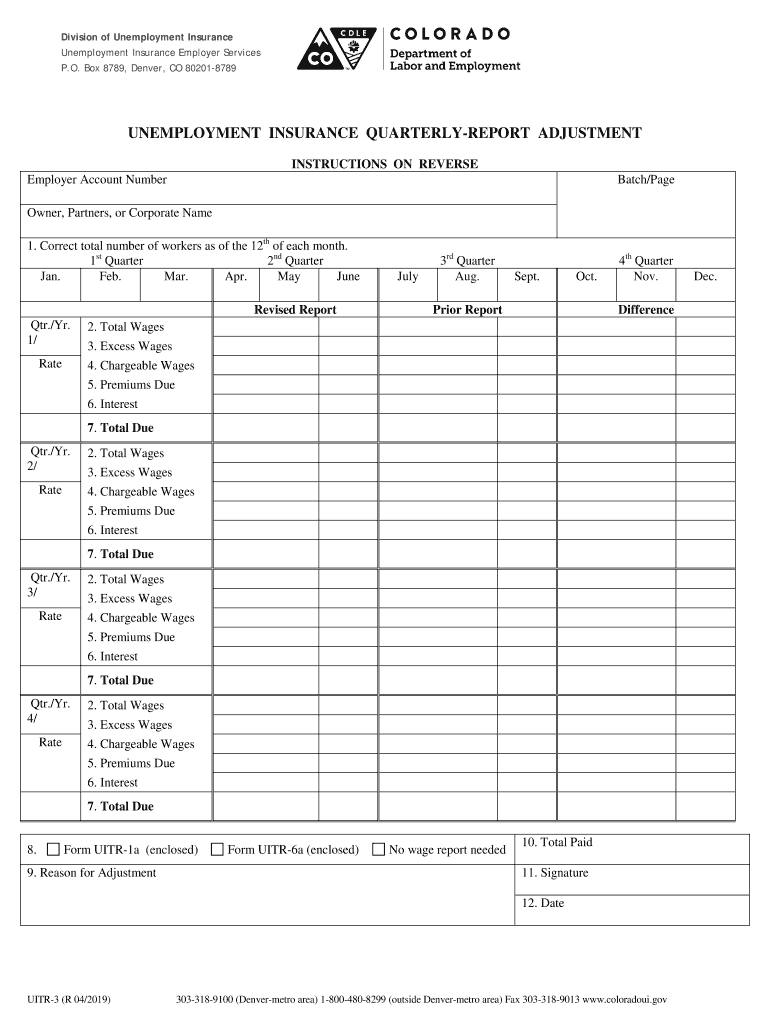

2019 WAGE BASE 2018 WAGE BASE 2017 WAGE BASE 2016 15,000 15,000 15,000 15,000 Michigan *9,500 *9,500 *9,500 Minnesota 32,000 32,000 **Rhode Island – $24,500 for employers in the highest UI tax rate group |

| [PDF] State Unemployment Tax Rates, 2017 - Tax Policy Centerwww.taxpolicycenter.org › file › download10 fév. 2017 · State Unemployment Tax Rates, 2017. State. Wages Subject to. Tax ... .doleta. gov/unemploy/content/sigpros/2010-2019/January2017.pdf');">PDF |

State Unemployment Tax Rates, 2017 - Tax Policy Center

10 fév 2017 · State Unemployment Tax Rates, 2017 State Wages Subject to Tax doleta gov/unemploy/content/sigpros/2010-2019/January2017 pdf 2 construction employers); ME (predetermined yield); MI (construction employers |

|

The cost of layoffs in Unemployment Insurance taxes - Bureau of

In each U S state and jurisdiction, UI tax rates are assigned to employers on a California Unemployment Insurance tax schedule, 2018 Michigan Benefit ratio 3,679 123 33 Minnesota Benefit ratio 7,357 184 25 Labor, March 2019) |

|

Michigan Employment Security Act - Michigan Legislature - State of

this act reference is made to the "Michigan unemployment compensation act" or to the "unemployment penalty taxes and solvency taxes to repay those advances and the interest on those advances 2019-3, compiled at MCL 125 1998 employer or claimant, respectively, an amount equal to the representation fees |

|

A Comparative Analysis of Unemployment Insurance Financing

Application of Experience Rating Methods to Employer UI Tax Rates 24 Rates in Michigan and Pennsylvania are mainly based on benefit ratios, but both states also use tax schedule (Schedule E) for each year between 2011 and 2019 |

|

Instructions for Form 940 - Internal Revenue Service

23 sept 2020 · employer must pay additional federal unemployment tax when filing its Form 940 tax will be reduced based on the credit reduction rate for the USVI farmworkers during any calendar quarter in 2019 or 2020? • Did you employ Massachusetts, Michigan, New Hampshire, New Jersey, New York, North |

|

Instructions for Schedule H (Form 1040) - Internal Revenue Service

1 fév 2021 · You need to pay federal unemployment tax if you paid total cash wages of $1,000 or more in any calendar quarter of 2019 or 2020 to household employees See the ty tax rate is 6 2 each for the employee and employer, un- OH Wisconsin WI District of Columbia DC Michigan MI Oklahoma OK |