2019 tax brackets federal married

|

Tax Tables 2019 Edition

15 avr 2019 · TAX ON SOCIAL SECURITY BENEFITS: INCOME BRACKETS Single head of household qualifying widow(er) married filing separately and living apart |

What is the lowest tax bracket for a married couple?

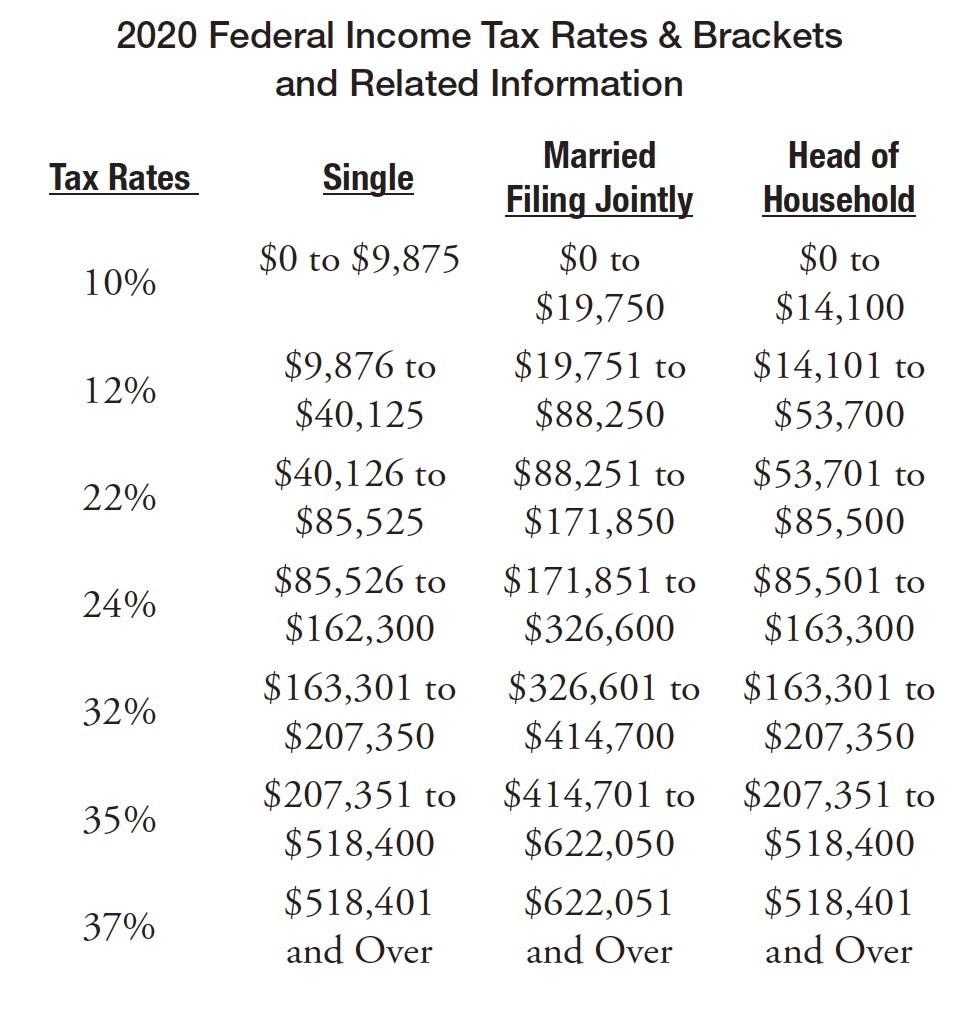

Marginal rates: For tax year 2024, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

The lowest rate is 10% for incomes of single individuals with incomes of $11,600 or less ($23,200 for married couples filing jointly).

|

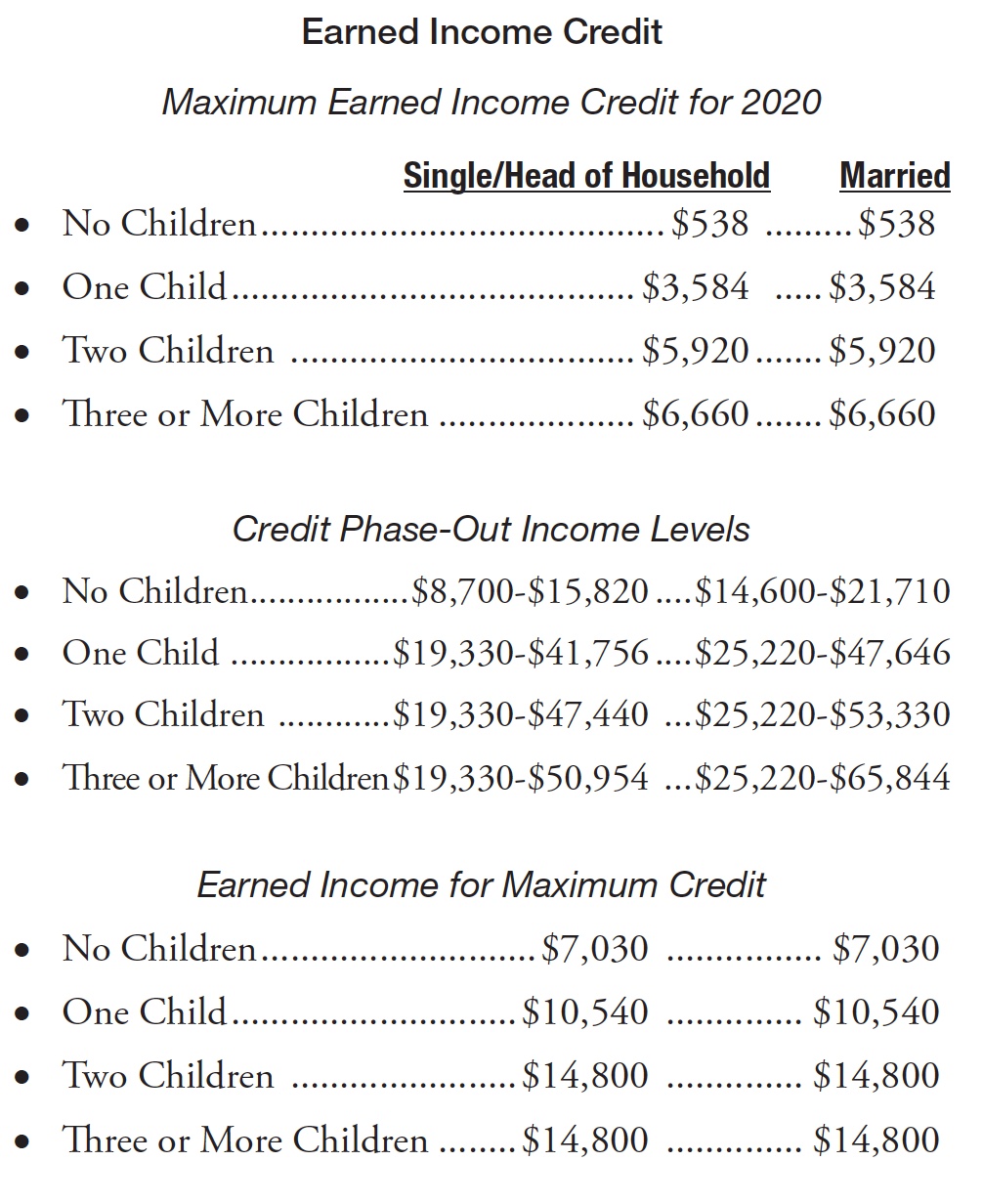

2019 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

22 ??? 2020 2019 Tax Table — Continued. If line 11b. (taxable income) is—. And you are—. At least. But less than. Single. Married filing jointly *. |

|

2019 Publication 15

17 ??? 2018 2019 Percentage Method Tables and Wage Bracket Ta- bles for Income Tax ... recognized for federal tax purposes if the marriage is rec-. |

|

2019 Publication 15-A

20 ??? 2018 2019 Formula Tables for Percentage Method Withholding; ... recognized for federal tax purposes if the marriage is rec- ognized by the state ... |

|

2019 Instruction 1040

8 ??? 2020 84 85 |

|

2021 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

16 ??? 2021 2021 Tax Table — Continued. If line 15. (taxable income) is—. And you are—. At least. But less than. Single. Married filing jointly *. |

|

2019 Publication 17

17 ???? 2020 2019 Tax Rate Schedules . ... rules for filing a federal income tax return. ... You were married filing a separate return |

|

2019 I-111 Form 1 Instructions - Wisconsin Income Tax

31 ??? 2019 This rate reduction is built into the tax table on pages. 51-56. Business Moving Expenses – The subtraction taken on your federal return for ... |

|

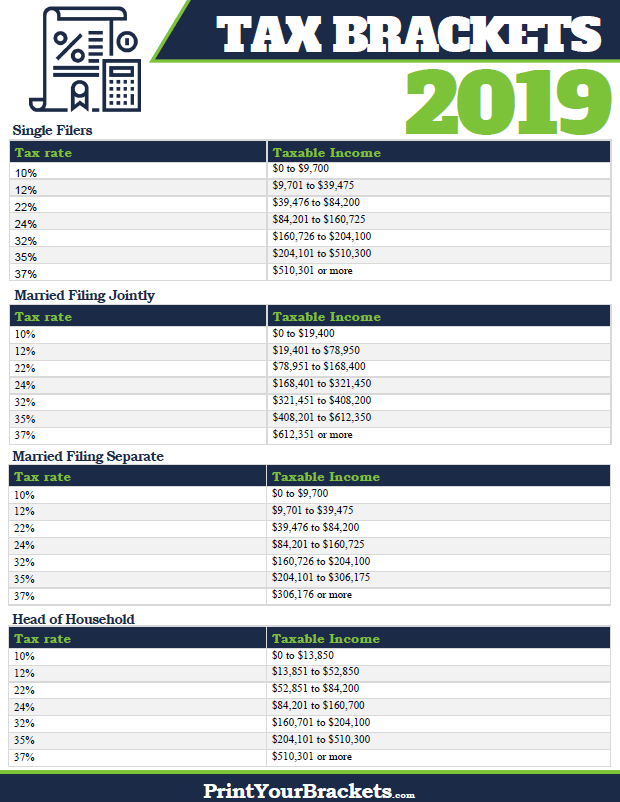

2019 Tax Brackets

16 ??? 2019 $510300. TABLE 2. Married Individuals Filing Joint Returns |

|

Withholding Tax Facts 2019

TAX RATE SCHEDULE I. (For taxpayers filing as Single Married Filing Separately |

|

2019 Tax Brackets - Tax Foundation

16 avr 2019 · at the federal, state, and local In 2019, the income limits for all tax brackets and all filers will be adjusted for inflation taxable income of $510,300 and higher for single filers and $612,350 and higher for married couples |

|

Tax Tables - Internal Revenue Service

16 sept 2020 · See the instructions for line 16 to see if you must use the Tax Table below to figure your tax At Least But Less Than Single Married filing |

|

Tax Tables 2019 Edition - Morgan Stanley

26 tax rate applies to income below: $97,400 $194,800 28 tax rate applies to income over: 3 8 tax on the lesser of: (1) Net Investment Income, or (2) MAGI in excess of $200,000 for single filers or head of households, $250,000 for married couples filing jointly, and $125,000 for married couples filing separately |

|

United States: Key 2018 and 2019 federal tax rates and limits - PwC

18 mar 2019 · MFJ means married filing jointly • MFS means married filing separately • HOH means head of household This compilation is intended to serve |

|

2019 tax rates, schedules, and contribution limits - Aquila Group of

Federal taxable income Federal tax bracket Tax-free yield 1 50 2 00 2 50 3 00 Taxable equivalent yield Married, filing jointly $0-19,400 10 00 |

|

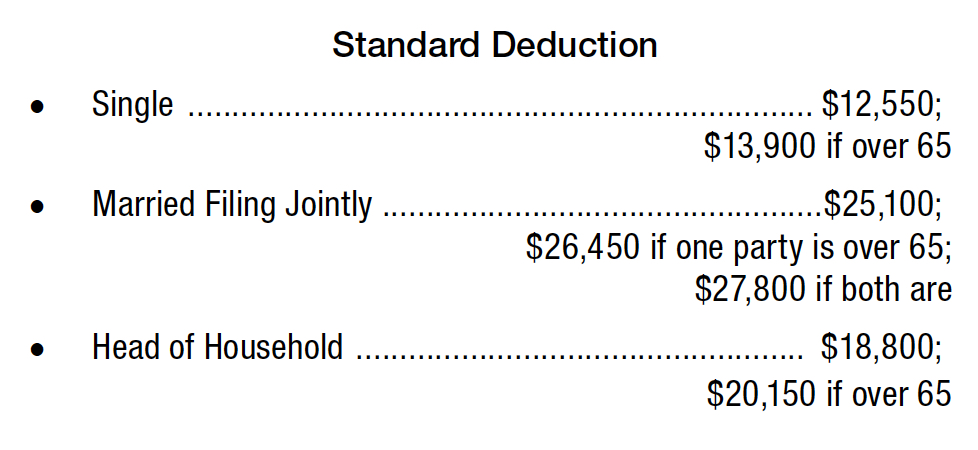

Federal Individual Income Tax Brackets, Standard Deduction, and

16 fév 2021 · This report tracks changes in federal individual income tax brackets, the Personal Exemption Phaseout Thresholds, and Statutory Marginal Tax Rates, 2019 $12,400 for single filers and married persons filing separately, |

|

2019 Tax Pocket Guide

2 Rate for taxpayers in the top income tax bracket (Middle income Alternative Minimum Tax AMT Exemptions 2019 2018 Married, filing jointly $ 111,700 For tax years beginning after 12/31/17, the C Corporation Federal tax rate is a flat |

|

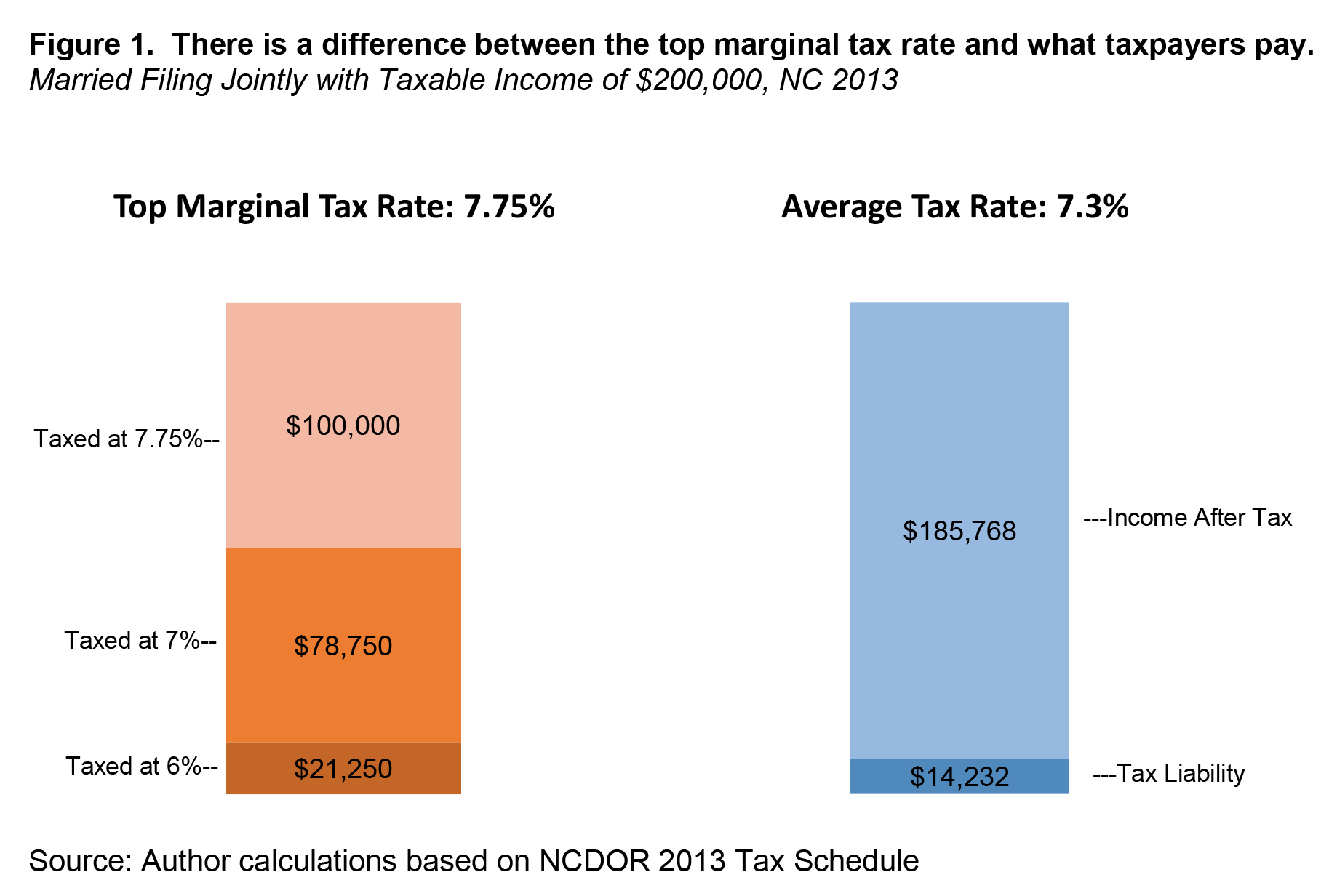

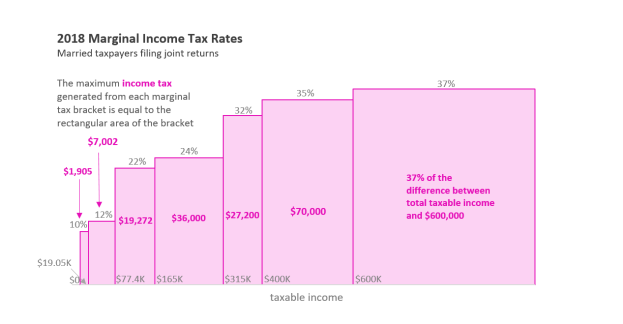

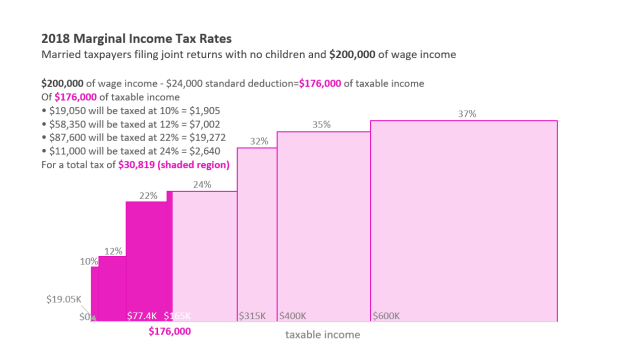

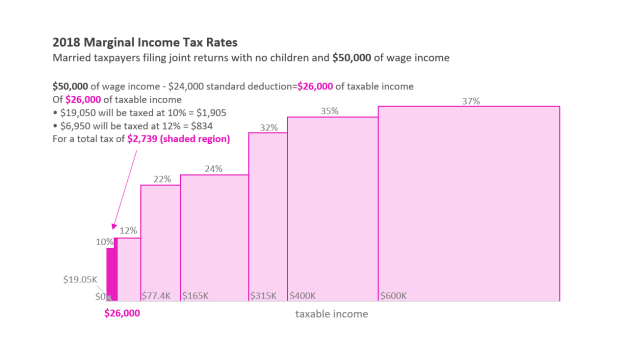

How do federal income tax rates work? - Tax Policy Center

A The federal individual income tax has seven tax rates that rise with income heads of household and to married individuals filing separate returns A separate Statistics “Historical Individual Income Tax Parameters: 1913 to 2019 ” |

|

TAX RATES AND USEFUL TABLES 2019 UPDATE

1 jan 2020 · Table 1—Section 1(j)(2)(A)—Married Individuals Filing Joint Returns and 2019 TAX RATE SCHEDULES Applicable Federal Rates |