2019 tax brackets married filing jointly calculator

If you make $130,000 a year living in the region of New York, USA, you will be taxed $39,805.

That means that your net pay will be $90,196 per year, or $7,516 per month.

Your average tax rate is 30.6% and your marginal tax rate is 39.5%.

|

2019 Form W-4

flat amount or percentage of wages. You can also use the calculator at www.irs.gov/W4App to determine your tax withholding more accurately. Consider. |

|

2019 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

22 jan. 2020 2019 Tax Table — Continued. If line 11b. (taxable income) is—. And you are—. At least. But less than. Single. Married filing jointly *. |

|

2021 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

16 déc. 2021 2021 Tax Table — Continued. If line 15. (taxable income) is—. And you are—. At least. But less than. Single. Married filing jointly *. |

|

2022 Publication 15-T

13 déc. 2021 the STANDARD Withholding Rate Schedules in the 2022. Percentage Method Tables ... IRS.gov/ITWA to help you figure federal income tax with-. |

|

2019 Publication 15

17 déc. 2018 security tax rate is 6.2% each for the employee and em- ... tax withholding. Notice 2018-92. 2018-51 I.R.B. 1038 |

|

2019 Form W-4P

You can also use the calculator at www.irs.gov/W4App to determine your tax withholding federal income tax withheld at the 2019 default rate (married. |

|

2021 Publication 915

6 jan. 2022 taxable. See IRS Pub. 501 Dependents |

|

2019 Publication 915

10 jan. 2020 If you are married and file a joint return for 2019 you ... These forms will also show the tax rate and the amount of. |

|

Table A - Personal Exemptions for 2019 Taxable Year Tax

Connecticut 2019 Income Tax Calculator. Married Filing Jointly or. Qualifying Widow(er) ... Enter amount from Table C 3% Tax Rate Phase?Out Add?Back. |

|

Tax Tables - Internal Revenue Service

16 sept 2020 · Tax Table below to figure your tax At Least But Less Than Single Married filing jointly* Married filing sepa- rately Head of a house- hold |

|

2016 Instruction 1040 - TAX TABLE - Internal Revenue Service

Department of the Treasury Internal Revenue Service IRS gov This booklet Tax Table CAUTION See the instructions for line 44 to see if you must use the 2,019 17,900 17,950 2,225 1,793 2,225 2,026 17,950 18,000 2,233 1,798 |

|

Table A - Personal Exemptions for 2019 Taxable Year Tax - CTgov

Connecticut 2019 Income Tax Calculator Visit the DRS Married Filing Jointly or Enter amount from Table C, 3 Tax Rate Phase‑Out Add‑Back If zero, enter |

|

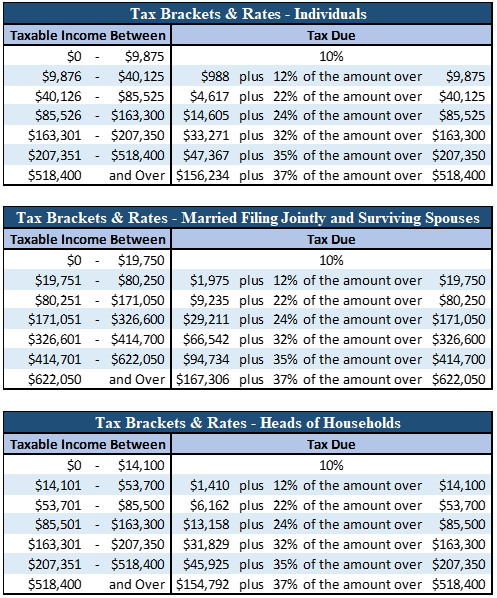

How do federal income tax rates work? - Tax Policy Center

The rates apply to taxable income—adjusted gross income minus either the standard deduction or allowable itemized deductions Income up to the standard |

|

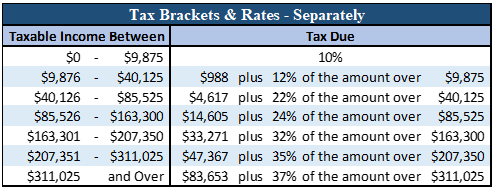

INDIVIDUAL TAX RATE TABLE 2018

As of January 14, 2019 Your tax rate is just one part of your overall tax picture If your filing status is Married Filing Jointly (MFJ) or Qualifying Widow(er): |

|

Federal Income Tax Brackets and Maximum Tax Rates: 1950-1980

Tax Brackets and Maximum Tax Rates: 1950-1980 Individual Income Tax Parameter, Married Filing Jointly 1950 1960 1970 1980 Taxable Income Rate |

|

How to Prepare for Tax Season

Tax Year 2019 2020 Single $12,200 $12,400 Married filing jointly Once the calculator generates the estimated taxes, which you'll either owe or be |

|

Form W-4 (2019)

compares to your projected total tax for 2019 If you use the calculator, you don't need to calculator at www irs gov/W4App to make sure you have enough Note: If married filing separately, check "Married, but withhold at higher Single rate " |

|

California Guideline Child Support Calculator User Guide - CA Child

(LCSA) and the LCSA used the California Child Support Guideline Calculator between Married Filing Jointly (not with other parent) Use this status if the parents are The following table provides information about the checkboxes you should 2019 Spousal support paid to another spouse or partner is tax deductible to |

|

2020 tax planning tables - Wells Fargo Advisors

31 déc 2019 · File 2019 federal individual income tax return (or make payment with extension) 2020 income tax rate schedules* Married taxpayer fling |