2019 tax calculator 1099

How much is self employment tax in Florida?

There Is No Florida Self-Employment Tax

As of April 2022, the federal self-employment tax rate is 15.3% of your net earnings (earnings minus business expenses).

This tax comprises a 12.4% Social Security tax and a 2.9% Medicare tax.How much is self employment tax in Texas?

As a self employed individual, you don't have an employer to withhold taxes and make payments on your behalf, which means you need to pay Texas self employment tax.

That amount is a total of 15.3%, with 12.4% of it dedicated to Social Security and 2.9% dedicated to Medicare.How much is 1099 tax in California?

The California self employment tax rate for 2022 is 15.3%.

As previously discussed, this includes your Social Security and Medicare taxes.

Those who are self employed need to cover the entire 15.3% of these taxes in addition to paying the normal income tax rates.A self employed individual must pay Ohio self employment tax, since they don't have an employer to withhold those federal payments on their behalf.

The Ohio self employment tax totals 15.3%, with 12.4% covering Social Security and 2.9% going to Medicare.

|

2021 Publication 915

Jan 6 2022 have received a Form SSA-1099 |

|

Instructions for Form 1099-Q (Rev. November 2019)

Nov 7 2019 Form 1099-Q. (Rev. November 2019). Payments From Qualified Education Programs (Under Sections 529 and 530). Department of the Treasury. |

|

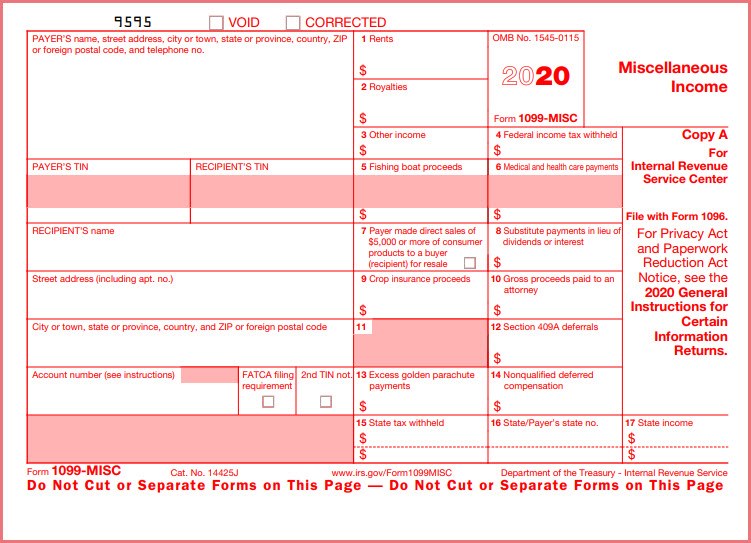

2019 Instructions for Form 1099-MISC

Nov 19 2018 You also must file Form 1099-MISC for each person from whom you have withheld any federal income tax (report in box 4) under the backup ... |

|

2019 Instruction 1040

Jan 8 2020 For information about any additional changes to the 2019 tax law or any ... enrolled you should have received Form(s) 1099-H showing the ... |

|

2019 Instruction 1040 TAX AND EARNED INCOME CREDIT TABLES

Jan 22 2020 2019. Tax Table. CAUTION ! See the instructions for line 12a to see if you must use the. Tax Table below to figure ... 1 |

|

Form 8919 Uncollected Social Security and Medicare Tax on Wages

G I filed Form SS-8 with the IRS and haven't received a reply. H I received a Form W-2 and a Form 1099-MISC and/or 1099-NEC from this firm for 2021. The amount |

|

2022 Form 1040-ES

Jan 24 2022 Use Form 1040-ES to figure and pay your estimated tax for 2022. Estimated tax is the method ... You can use the Tax Withholding Estimator at. |

|

2020 Pennsylvania Personal Income Tax Return Instructions (PA-40

are now required under Act 13 of 2019 to provide their PTIN on the PA-. 40 return. update your address; calculate penalty and interest; pay tax due by. |

|

Instructions for Forms 1099-INT and 1099-OID (Rev. January 2022)

tax-exempt stated interest in boxes 8 and 9 on Form 1099-INT. Exceptions to reporting. information necessary to calculate OID but has been unsuccessful. |

|

Tax Tables - Internal Revenue Service

16 sept 2020 · Example Mr and Mrs Brown are filing a joint return Their taxable income on Form 1040, line 15, is $25,300 First, they find the |

|

Publication 915 - Internal Revenue Service

26 jan 2021 · This publication explains the federal income tax rules for have received a Form SSA-1099, Social Security Benefit Example In 2019, you received $3,000 in social se- Automatic calculation of taxable social security ben- |

|

2019 Tax Guide - Morgan Stanley

securities), Form 1099-B will show any gain or loss from the sale using the To calculate your Morgan Stanley is pleased to provide you with the 2019 Tax |

|

2019 Individual Income Tax Return Single/Married - Missouri

in 2019 First Name Suffix Spouse's Last Name Spouse's First Name M I Missouri tax withheld from Form(s) W-2 and 1099 00 Tax Calculation Worksheet |

|

Revenue Information Bulletin No 19-006 January 11, 2019

11 jan 2019 · updated calculation method for preparing Form 1099‐G, Certain This allows the IRS to ensure that all items subject to tax are properly |

|

Individual Income Tax Booklet 2019 - NDgov

benefits reported on a Form RRB-1099 was prior to 2019 starting with the 2021 tax year for farm income (on Schedule ND-1FA) to calculate your tax? |

|

Results of the 2019 Filing Season - Treasury Department

22 jan 2020 · IRS updated the tax withholding estimator to provide a step-by-step tool to As of May 2, 2019, the IRS received 35 2 million Forms 1099-MISC |

|

2019 Nebraska - Nebraska Department of Revenue - Nebraskagov

31 déc 2019 · Tax Calculation Schedule or Tax Table, must be used without adjustment a Statement of Nebraska Tax Credit, Form 1099 BFC, from the |

|

2019 MAINE Individual Income Tax Booklet - Mainegov

after January 1, 2019, the calculation used to report unpaid use tax on the Maine schedule or worksheet, send 1099 forms only if there is State of Maine |

|

California Guideline Child Support Calculator User Guide - CA Child

(LCSA) and the LCSA used the California Child Support Guideline Calculator between Information from paycheck stubs, 1099s, or tax returns about income or 2019 This field will treat spousal support received as non-taxable income for |