claiming an italian state pension

|

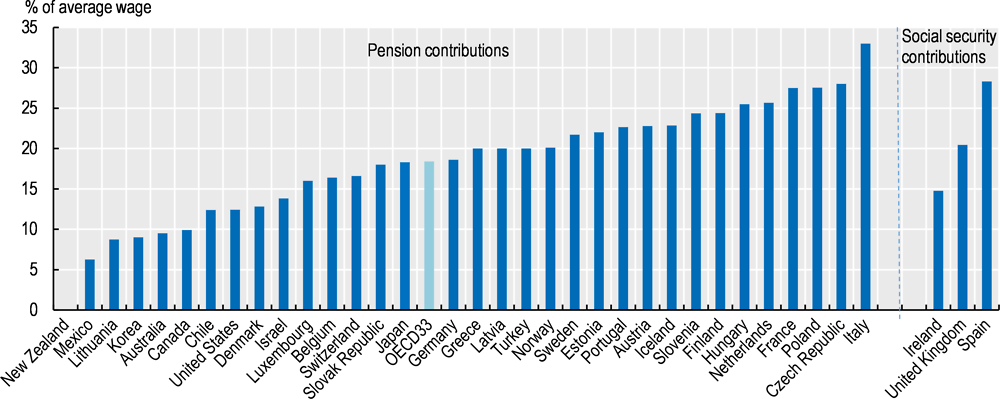

Italy: Pension system in 2018

Individuals without a contributory pension benefit can claim a means-tested tax-exempted social assistance benefit from the age of 65 years: the assegno |

How do I claim my Italian pension?

Your pension claim is submitted online to the relevant social security institution, from whose website you can download the forms to be filled in.

Electronic submission requires a second level SPID (Public Digital Identity System) or a CIE (Electronic Identity Card) or a CNS (National Service Card) log in.❖ In Italy, the pension system is structured on the basis of the "pay-as-you-go" scheme.

That means that the contributions that workers and companies pay to the social security bodies are used to pay the pensions of those who are now retired.

Can you claim pension from 2 countries?

You need to claim your pension from each country separately.

Check with the pension service for the country where you've lived or worked to find out how to make a claim.

How much is the Italian pension?

For 2023, the standard payment (website in Italian) is €503.27, paid 13 times a year.

Italy also has a couple of other schemes which allow some workers to retire early.

The early retirement allowance (Anticipo pensionistico – APE Sociale) is available to workers over 63.

Employees

Those legally working in Italy are entitled to the same benefits provided by Italian social security institutions as Italian workers. Employers are responsible for registering their staff with the INPS. The employee's contributions are made directly from the gross salary each month. Contribution rates and benefit entitlements vary depending on the

The Self-Employed

After registering their business with the Italian Chamber of Commerce (Registro delle Imprese presso la Camera di Commercio), self-employed people must register in person with Social Security (INPS). 1. Business registration information Contributions are based on the prior year's income, or for new businesses, an estimated minimum income. Quarterly

Reciprocal Agreements

Social security contributions paid over a period in another EU country can count towards benefits paid out in Italy. 1. For links to social security agencies throughout the world: INPS website(in Italian) angloinfo.com

Non-Eu Countries with Reciprocal Social Security Agreements

Italy has bi-lateral conventions with many non-EU countries, which enables citizens of those countries to claim benefits in Italy. 1. For a list of countries with bi-lateral agreements and information(in Italian) angloinfo.com

Sickness Benefits

The INPS pays up to 50 percent of a worker's average daily wage for absences from work due to sickness. This allowance is payable from the fourth day of illness for a maximum period of 180 days in a calendar year. Contract workers are paid based on their contributions made over the previous 12 month period, and are only paid for days on which they

Maternity, Paternity and Parental Benefits

Employed, contract, and self-employed persons are eligible for maternity leave, though self-employed and contract workers must meet contribution and income criteria. Expectant mothers are entitled to paid leave for two months before the birth and three months after the birth. The benefit is 80 percent of the employed mother's average daily salary (

Retirement Benefits

From 2019, the legal retirement age in Italy became 67 years old for men and women. Both must have contributed for at least 20 years. In some cases early-retirement is possible. 1. For more visit the Europa website's page onItaly - Old age benefits 1. For a detailed English-language report from the Organisation for Economic Co-operation and Develop

Disability and Survivor Benefits

Workers may receive a disability pension if deemed by an INPS physician to be unable to work. The worker must have paid social security contributions for at least five years, three of which must have been in the five years prior to the application for disability. This disability pension is not permanent - disability status can be changed at any tim

|

Italy: Pension system in 2020

Individuals without a contributory pension benefit can claim a means-tested tax-exempted social assistance benefit called the assegno sociale (old age social |

|

Italy: Pension system in 2018

Individuals without a contributory pension benefit can claim a means-tested tax-exempted social assistance benefit from the age of 65 years: the assegno sociale |

|

Your social security rights in Italy

INPGI: National Institute for Italian Journalists' Social Security (with legal The retired person must submit a claim along with a pension claim or ... |

|

Foreign pensions and annuities myTax 2021 Foreign pensions and

1 juin 2021 British pensions. Dutch pensions. German pensions. Italian pensions. Pensions from another country. Foreign income tax offset. You may claim ... |

|

Technical Explanation: US-Italy Income Tax Treaty 1999

References are made to the Convention between the United States and Italy for Article 18 (Pensions Etc.) deal with child support and alimony payments |

|

Convention between the government of the United States of America

United States of America and the Government of the Italian. Republic for the avoidance of double paragraphs 5 and 6 of Article 18 (Pensions Etc.) |

|

Mixed Claims Commission (Italy-Venezuela)

Whereas certain differences have arisen between Italy and the United States of Venezuela in connection with the Italian claims against the Venezuelan. |

|

1 TARGETING WELFARE IN A “SOFT” STATE Italys winding road to

earnings and - until the 1995 reform - they could claim a pension equal to 70% of Italian welfare state provides disproportionate benefits for old age ... |

|

DEPARTMENT OF THE TREASURY TECHNICAL EXPLANATION

References are made to the Convention between the United States and Italy for the U.S. residents for U.S. tax purposes may not claim a benefit for the ... |

|

CONVENTION BETWEEN THE GOVERNMENT OF THE UNITED

or Italy respectively on receipt of a claim by the recipient to have the tax credit pension shall be taxable only in the other Contracting State if the ... |

|

Italy: Pension system in 2018 - OECDorg

Individuals without a contributory pension benefit can claim a means-tested tax-exempted social assistance benefit from the age of 65 years: the assegno sociale (old age social allowance) In 2018 this age increased to 66 years and seven months and the entitlement age will increase in line with life expectancy |

|

Italy: Pension system in 2016 - OECD

Individuals without a contributory pension benefit can claim a means-tested tax- exempted social assistance benefit from the age of 65 years: the assegno sociale ( |

|

Pensions at a Glance 2019

Still, for new labour market entrants, claiming a pension with actuarial adjustments of benefits will be possible in Italy from age 68 with 20 years of contributions |

|

Brexit and State Pensions - UK Parliament

28 déc 2020 · Entitlement to the UK State Pension is based on an individual's UK National Insurance live in the EU, EEA or Switzerland and you can still claim your UK State Denmark, Finland, France, Germany, Iceland, Ireland, Italy, |

|

Social Security and Retirement in Italy - CORE

the private sector can claim early retirement benefits at any age if thirty-five reform of the Italian social security system) is analyzed at the steady state 30 |

|

How to Claim Your Pension from Abroad - Julkari

Claim a pension from abroad: the Finnish Centre for Pensions at your Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, the United States |

|

Recent pension reforms - OECD iLibrary

United Kingdom to 90 or more in Austria, Italy, Luxembourg, Portugal and Turkey at United States, a 5-year career break does not influence pension benefits, retirement age from 60 to 62; participants can delay claiming benefits up to 20 |

|

Pension Incomes in the European Union - IZA - Institute of Labor

Wealth (SHIW95) made available by the Bank of Italy; and the Family Expenditure Survey State pension incomes in 1998 in four EU countries: some key figures and claim that the reform agenda that is currently promoted by international |