401k and roth ira contribution limits 2020

Key takeaways

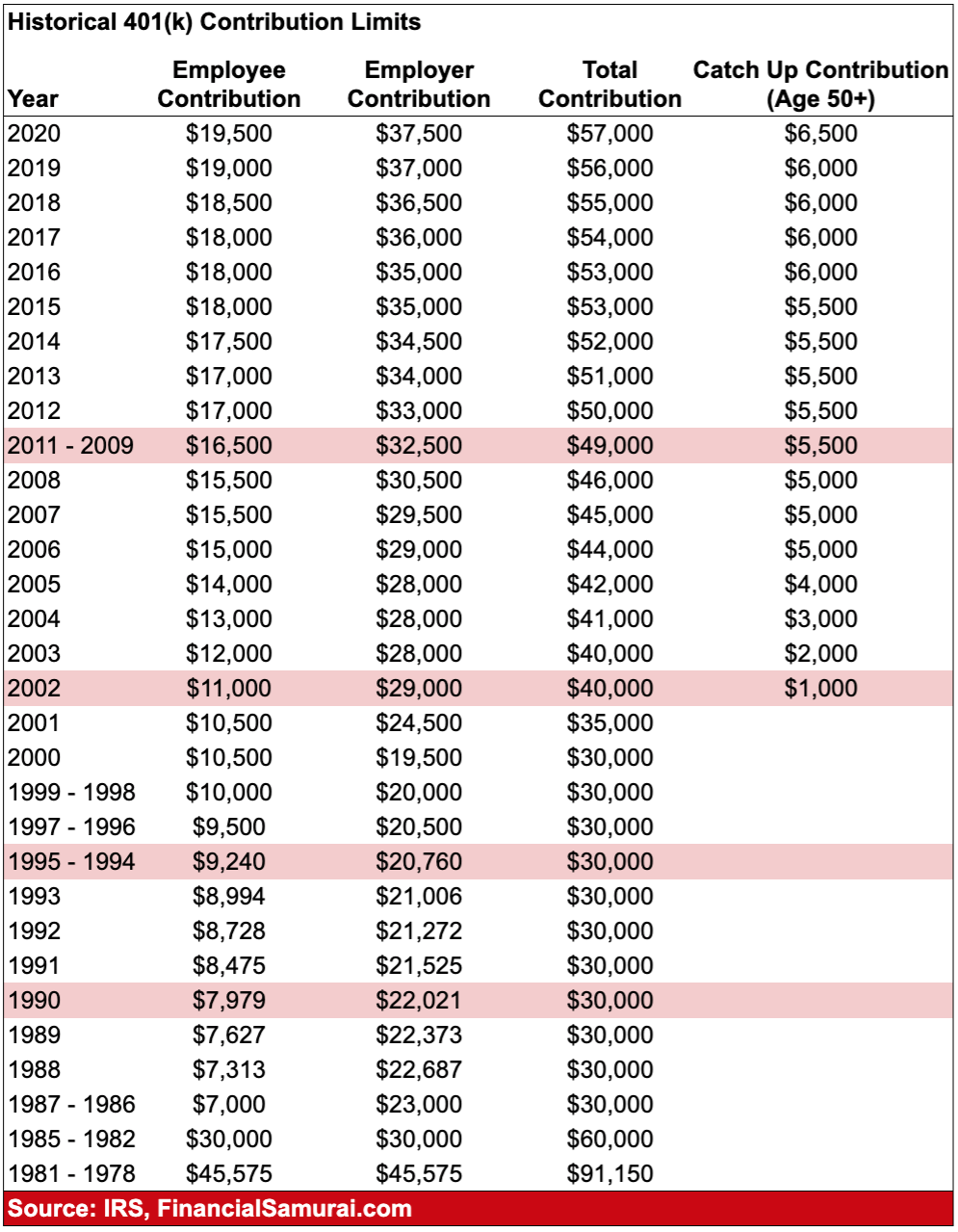

The IRS sets the maximum that you and your employer can contribute to your 401(k) each year.

In 2023, the most you can contribute to a Roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $22,500.

In 2024, this rises to $23,000.

Can I max out 401k and Roth 401k in same year?

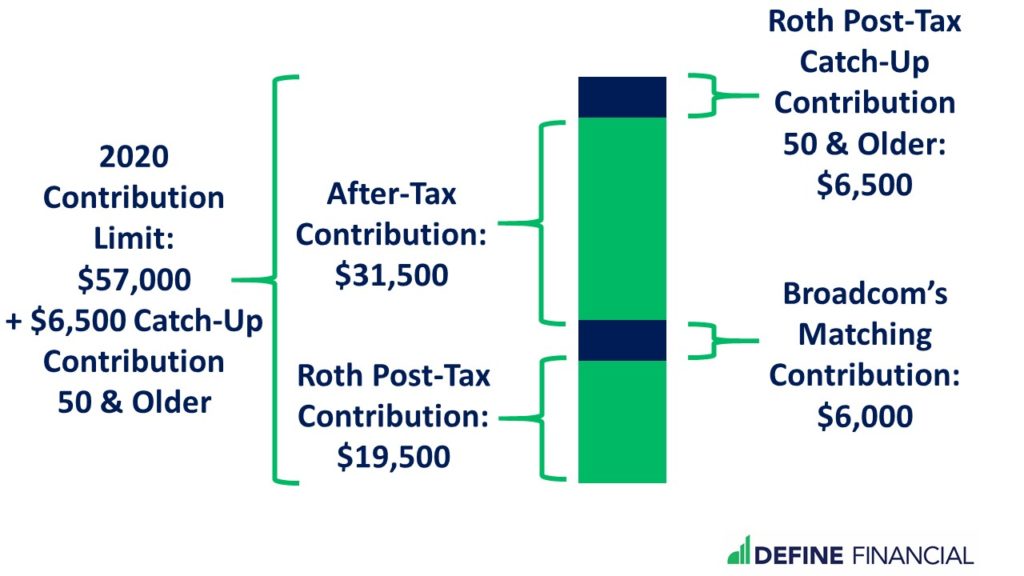

You can split your annual elective deferrals between designated Roth contributions and traditional pre-tax contributions, but your combined contributions can't exceed the deferral limit - $22,500 in 2023; $20,500 in 2022; $19,500 in 2021 ($30,000 in 2023; $27,000 in 2022; $26,000 in 2021 if you're eligible for catch-up 21 sept. 2023

Can I contribute to both a 401k and a Roth 401 K?

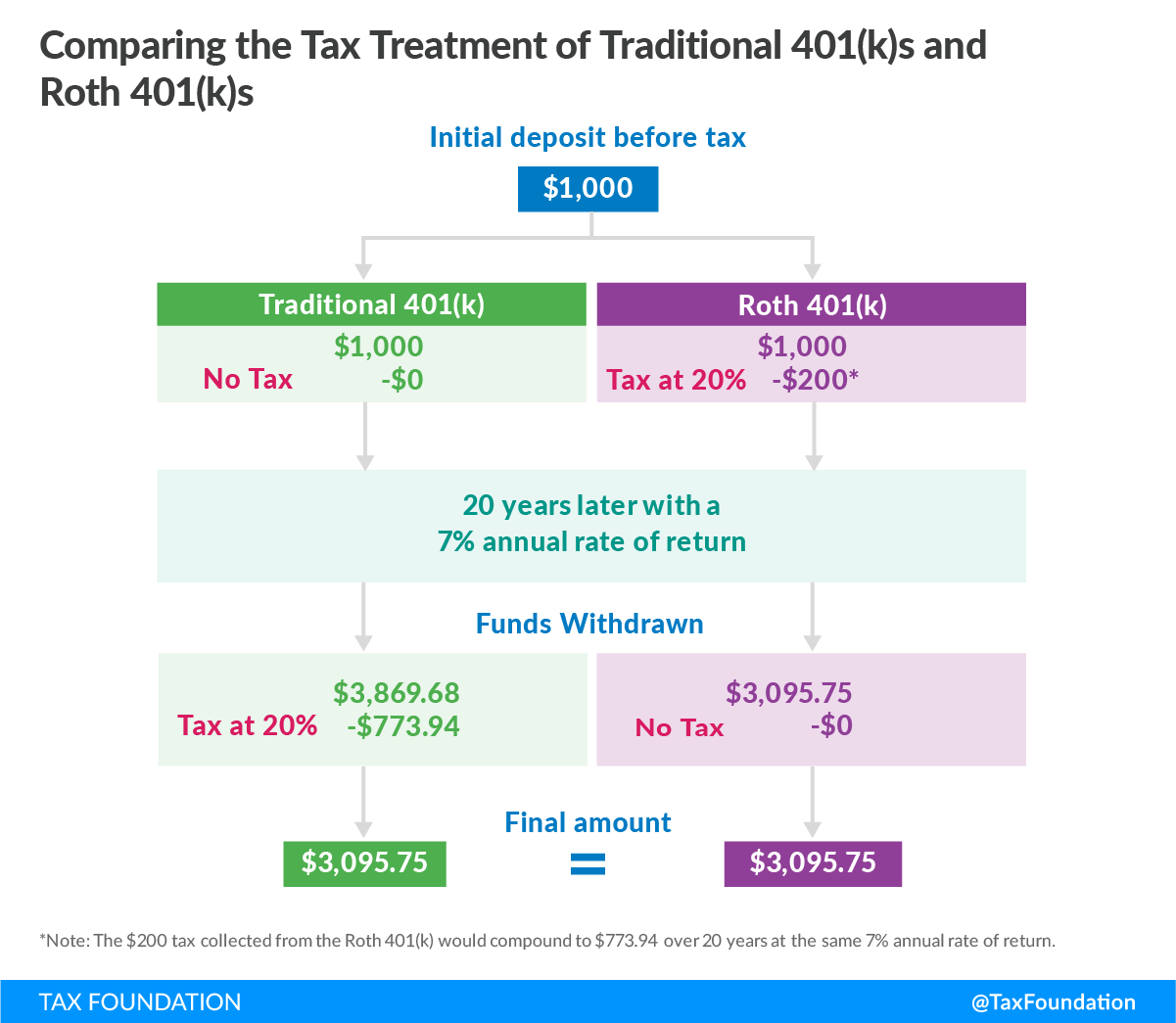

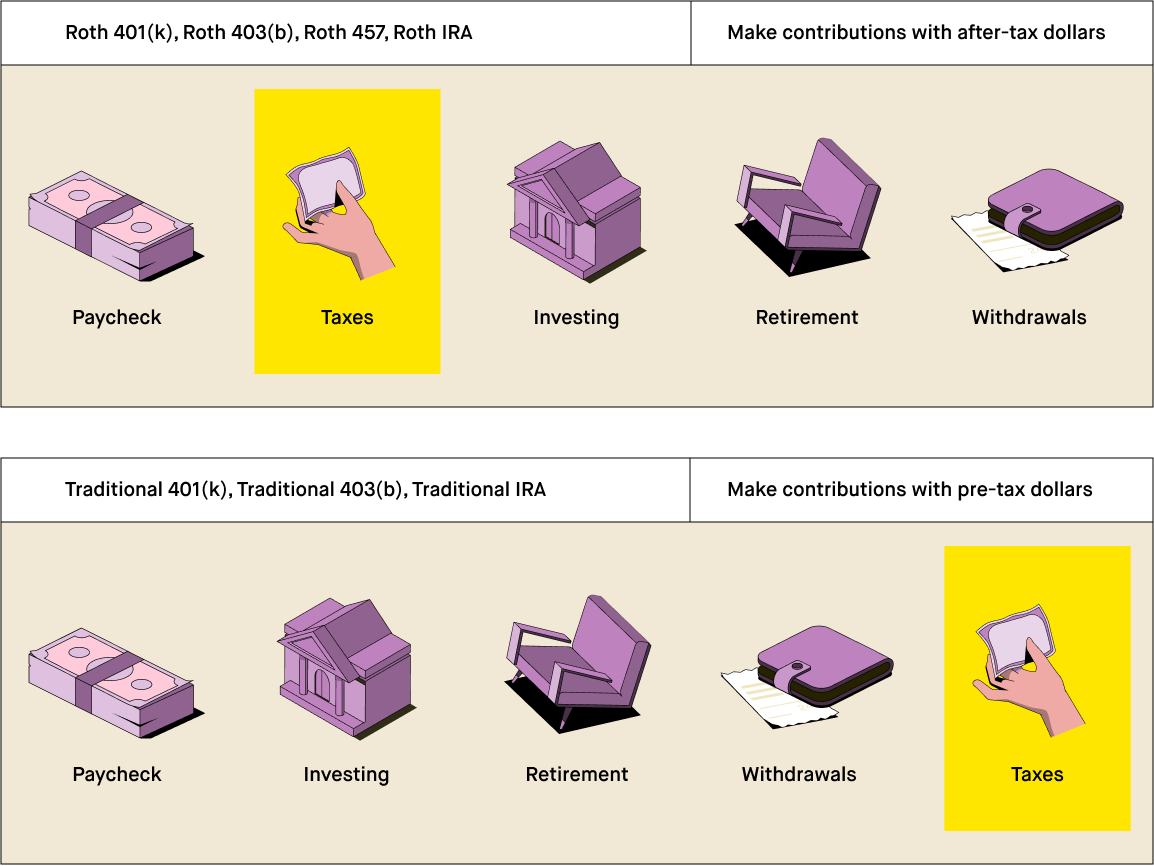

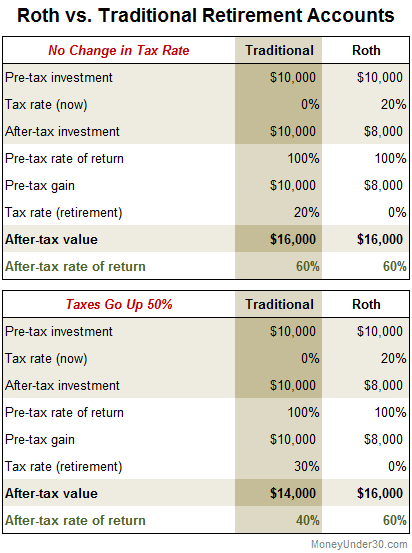

Choosing a Roth 401(k) or a traditional 401(k) might not be an either-or decision.

If your employer offers both, you can contribute to a Roth 401(k) and a traditional 401(k).

However, keep in mind that your annual contribution limit would apply across both accounts.

What is the maximum 401k contribution to a Roth IRA?

Highlights of changes for 2024.

The contribution limit for employees who participate in 401(k), 403(b), and most 457 plans, as well as the federal government's Thrift Savings Plan is increased to $23,000, up from $22,500.

The limit on annual contributions to an IRA increased to $7,000, up from $6,500.

|

Form 8880 Credit for Qualified Retirement Savings Contributions

Traditional and Roth IRA contributions and ABLE account contributions by the Elective deferrals to a 401(k) or other qualified employer plan |

|

2021 Publication 560

The limit on annual benefits for a participant in a defined benefit plan is $230000 SIMPLE. IRA and. SIMPLE. 401(k). Salary reduction contributions: 30. |

|

2021 Publication 590-A

18 févr. 2022 $196000 for 2020) but less than $208 |

|

2021 Instructions for Form 5329

1 sept. 2021 Roth IRA) and you meet an exception to ... contribution limit or you had a tax due ... 33 |

|

2021 Instructions for Form 8606

10 janv. 2022 qualified disaster distributions for 2020 ... contribute to a Roth IRA for 2021 only if ... limit applies to traditional IRAs and Roth. |

|

2021 Instructions for Form 5329

1 sept. 2021 Roth IRA) and you meet an exception to ... contribution limit or you had a tax due ... 33 |

|

2022 Instructions for Forms 1099-R and 5498

These earnings could be subject to the 10% early distribution tax under section 72(t). If a rollover contribution is made to a traditional or Roth IRA that is |

|

2021 Limitations Adjusted as Provided in Section 415(d) etc

1 janv. 2021 The adjusted gross income limitation under § 408A(c)(3)(B)(ii)(I) for determining the maximum Roth IRA contribution for married taxpayers filing ... |

|

Publication 4530 (Rev. 7-2021)

Designated Roth Accounts under a 401(k) 403(b) or governmental 457(b) plan even if your income is too high to be able to contribute to a Roth IRA. |

|

2020 Limitations Adjusted as Provided in Section 415(d) etc.

The limitation for defined contribution plans under section 415(c)(1)(A) is determining the maximum Roth IRA contribution for married taxpayers filing a. |

|

2020/2021 dollar limitations for retirement plans - RBC Wealth

The limits for 2021, as well as the 2020 limits, are as follows: 2020/2021 dollar limitations for retirement plans Account Types 2020 Limit 2021 Limit IRA Traditional and Roth IRA contribution limit $6,000 Profit Sharing, 401(k), SEP and |

|

Comparison Charts 2019-2020 IRA Contributions Limits for IRAs

SEP IRA Contribution Limits 2020 2021 Individual 401(k) Plan and Individual Roth 401(k) 2020 2021 *The employer can contribute up to the smaller of 25 |

|

Is a Roth 401(k) - The Standard

A Roth IRA account balance cannot be rolled over to a traditional, pre-tax In addition, Roth 401(k) accounts are subject to the contribution limits of traditional |

|

2020 Publication 590-A - Internal Revenue Service

26 fév 2021 · The 2019 traditional and Roth IRA contribution deadline was extended to July 15 , 2020 Modified AGI limit for traditional IRA contributions For |

|

How High Earners Can Maximize Their Retirement Savings

Retirement Plan Contribution Limits for 401(k), 403(b), and most Limits for 2020 ordinary income tax on the amount you convert into the Roth IRA, but |

|

Retirement Plan Contributions at-a-glance, 2020 - Wells Fargo

Retirement Plan Contributions At-a-Glance, 2020 such as a 401(k), 403(b), SEP IRA, or SIMPLE IRA is an easy way Roth IRA contribution phase-out limits |

|

IRA and Retirement Plan Limits for 2021 - Smith Moore

9 nov 2020 · Many IRA and retirement plan limits are indexed for inflation each year You can contribute to both a traditional IRA and a Roth IRA in 2021, $198,000 and $208,000 (up from $196,000 and $206,000 in 2020), and maximum amount you can contribute (your "elective deferrals") to a 401(k) plan remains |

|

2020 Retirement Plan Contribution Limits - AWS

Roth IRA Phase-Out Limits for Contributions IRA and Roth IRA Contribution Limits This chart For 2020, retirement account owners can purchase a QLAC 2020 13,500 3,000 16,500 Employee Salary Deferral Limits for 401(k)s 403( b)s |

/401k-contribution-limits-rules-2388221_FINAL-43f987109dd24e6a9d37c24fe2c0a08f.gif)