401k contribution limits 2020 profit sharing

|

UNDERSTANDING 401(K) AND PROFIT SHARING PLANS

For 2016 the individual maximum contribution limit for employees applied to all defined contribution plans is 100 of compensation or $53000 whichever is |

|

Profit Sharing Plans for Small Businesses US Department of Labor

Unless it includes a 401(k) cash or deferred feature a profit sharing plan does not usually allow employees to contribute If you want to include employee |

Calculation Detail—Integration Method

Under the Integration method, a Base Percentage is applied to total compensation, and an Excess Percentage is applied to compensation over the Integration Level.

The disparity is the difference between these two percentages.

Can you make a profit-sharing contribution to a solo 401k?

As the employer, you can make an additional profit-sharing contribution of up to 25% of your compensation or net self-employment income, which is your net profit less half your self-employment tax and the plan contributions you made for yourself.

Does 401k contribution limit include employer match?

The short and simple answer is, they don't.

Matching contributions made by employers do not count toward your maximum contribution limit.

Can profit-sharing be added to 401k?

You can do both matching and profit-sharing in your 401(k) plan.

Should you? That is up to you, your financial team, and your employees' wants and needs.

|

Profit Sharing Plans for Small Businesses - US Department of Labor

A profit sharing plan allows you to decide (within limits) from year to year If you want to include employee contributions see 401(k) Plans for Small. |

|

2021 Publication 560

Defined contribution limits for 2021 and stead of setting up a profit-sharing or money purchase plan ... the SIMPLE IRA plan and the SIMPLE 401(k) plan. |

|

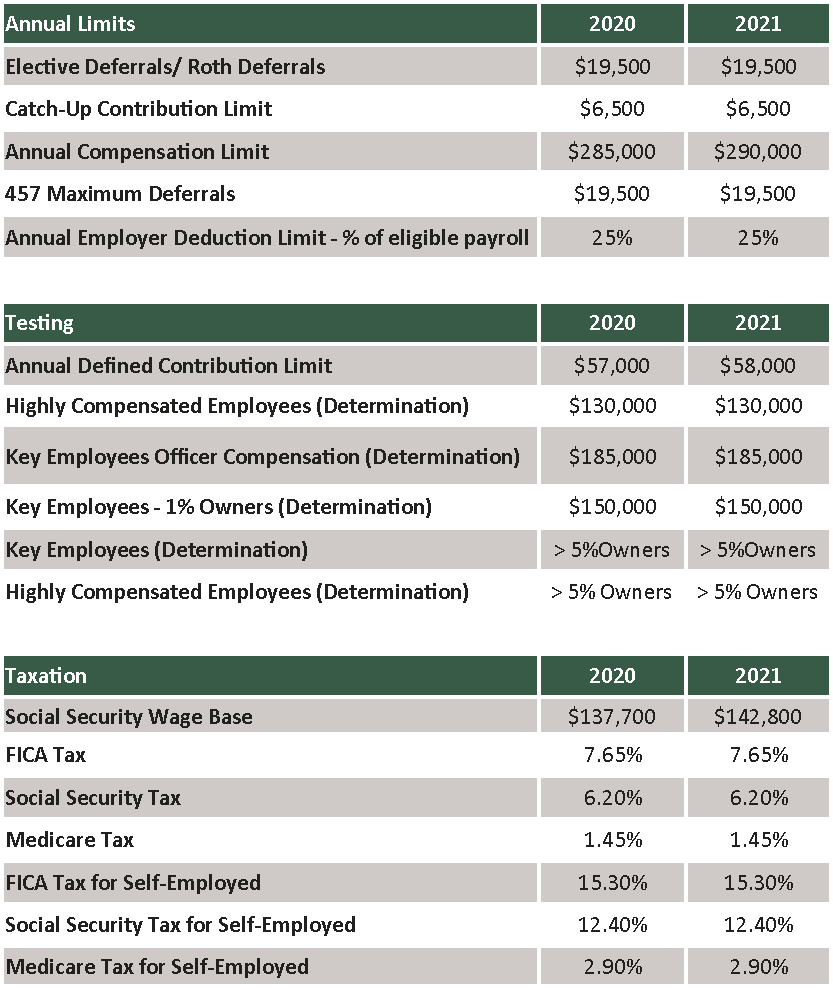

2021/2022 dollar limitations for retirement plans

Catch-up limit for individuals age 50 and older. $6500. $6 |

|

Profit Sharing Plans for Small Businesses

A profit sharing plan allows you to decide (within limits) from year to year If you want to include employee contributions see 401(k) Plans for Small. |

|

401(k) 403(b) and Profit-Sharing Plan 2021 Contribution Limits

Plan 2021 Contribution Limits. Deferral limits for 401(k) and. 403(b) plans ($19500 in 2020) ... to a defined contribution plan (profit-sharing plan or. |

|

THE FIDELITY SELF-EMPLOYED 401(K) CONTRIBUTION

Your maximum annual deductible contribution for profit sharing is 25% of additional contribution up to the limits outlined on this worksheet. |

|

2020 Limitations Adjusted as Provided in Section 415(d) etc.

Notice 2021-61. Section 415 of the Internal Revenue Code (“Code”) provides for dollar limitations on benefits and contributions under qualified retirement |

|

Fidelity

Use this form to submit contribution deposits to your Fidelity 401(k) and/or Employer Profit Sharing Contributions. ... limits are not exceeded. |

|

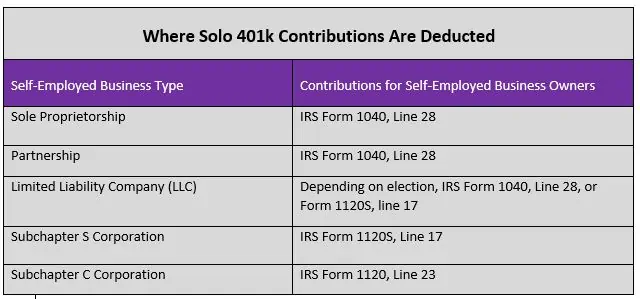

Solo 401k Deep Dive: 2021 Contributions Guide for S-corporations

Employer Contribution (Profit-Sharing) 2020 (For 2021 the contribution limit increased to ... “day job” 401k plan) UNLESS such contributions. |

|

2020 Contribution Limits - 401(k) PROFIT SHARING & CASH

2020 Contribution Limits. 401(k) PROFIT SHARING & CASH BALANCE PLANS. *401(k): $19500; $6 |

|

2020/2021 dollar limitations for retirement plans - RBC Wealth

Defined contribution limit (415(c) limit) $57,000 $58,000 Profit Sharing, 401(k), SEP and Money Purchase Pension Employee annual compensation limit |

|

Owner-only 401(k) profit sharing plans Owner-only 401(k) profit

2020 RBC Wealth Management, a division of RBC Capital Markets, LLC, Member contribution limits, don't come close 401(k) profit sharing plan also |

|

Employer-Sponsored Retirement Plans Contribution and Benefit Limits

2020 Employer-Sponsored Retirement Plans Maximum Contribution and Benefit The Annual Addition Limit for 401(k), Individual 401(k), profit-sharing and |

|

401(k), 403(b) and Profit-Sharing Plan 2020 Contribution Limits

$57,000 ($63,500 including catch-up contributions) for 2020 |

|

THE FIDELITY SELF-EMPLOYED 401(K) CONTRIBUTION

Your maximum annual deductible contribution for profit sharing is 25 of Total profit sharing and salary deferral contributions may not exceed $57,000 for 2020 and additional contribution up to the limits outlined on this worksheet |

|

2020 Contribution Limits - Kravitz Cash Balance Design

2020 Contribution Limits 401(k) PROFIT SHARING CASH BALANCE PLANS * 401(k): $19,500; $6,500 catch-up; $37,500 profit sharing ** Assuming 45 tax |

|

General Overview 401(k) PROFIT SHARING PLAN - Nicholas

A profit sharing 401(k) plan allows contributions through three different over 5 owner, compensation over $130,000 in 2020 (may limit to top 20 ), or a |

|

Retirement Plan Benefit and Contribution Limits for 2020

The Internal Revenue Service has announced the contribution limits and thresholds for retirement plans for the Tax 2020 2019 2018 401(k), 403(b), 457(b) or SAR-SEP maximum salary deferral $19,500 SEP-IRA and Profit Sharing Plan |

|

2020 Contribution Limits - FuturePlan

2020 FuturePlan, an Ascensus company, and/or its respective affiliates All rights reserved Age 401(k) with Profit Sharing* Cash Balance Total Tax Savings |

/what-is-a-safe-harbor-401-k-2894205-Final21-5c87e407c9e77c0001f2ad14.png)