401k contribution limits 2020 self employed

A regular contribution is the annual contribution you're allowed to make to a traditional or Roth IRA: up to $6,000 for 2020-2021, $7,000 if you're 50 or older (see IRA Contribution Limits for details).

Do employee contributions count towards 401k limit?

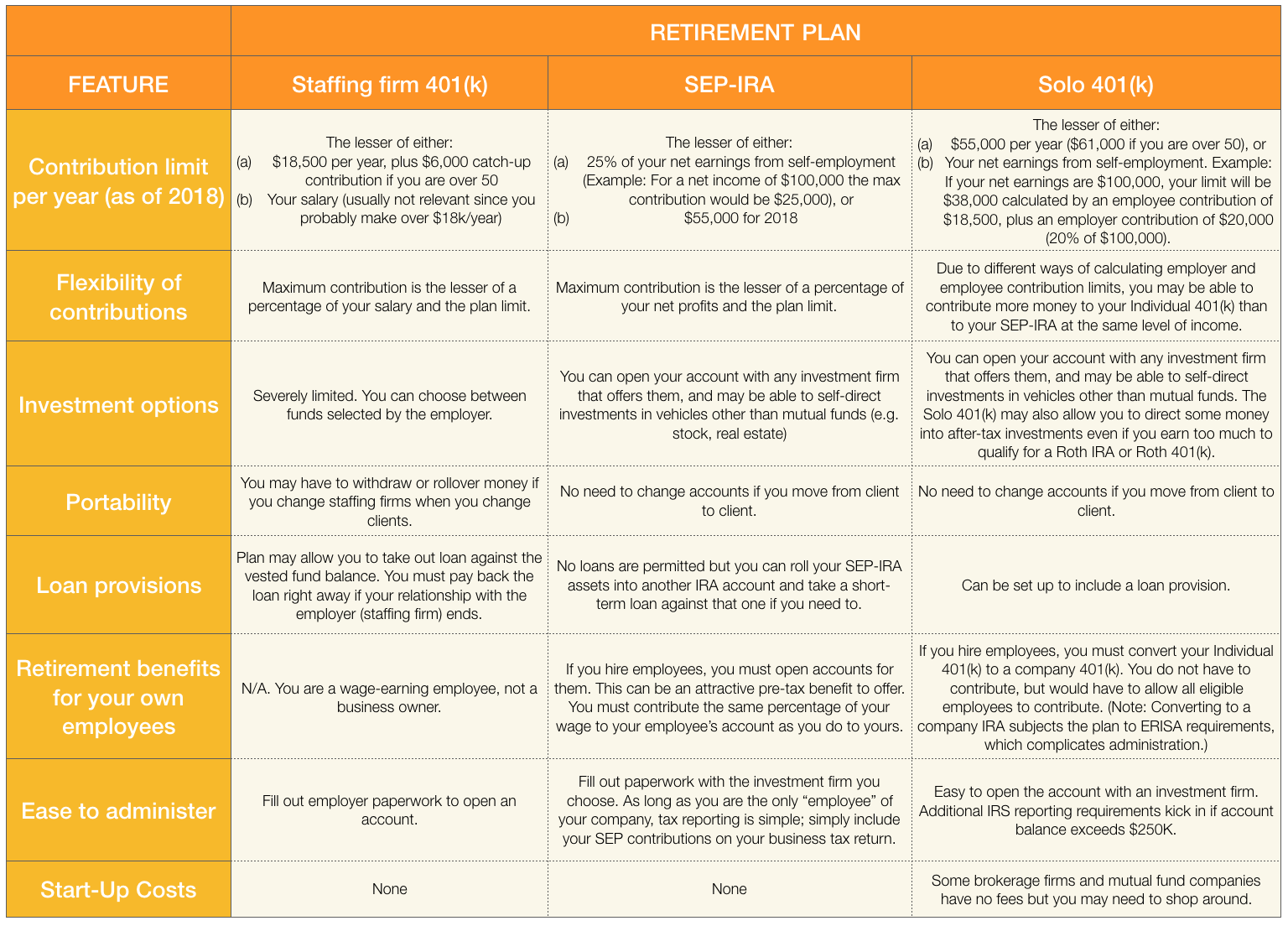

Many people wonder if employer matching counts towards their 401(k) limit, and the answer is yes and no.

The 401(k) limit applies to the employee's sole contributions, but there is also a limit on the combined employee and employer contributions.

What is the maximum employer contribution 25%?

In addition to this, you can contribute 25% of your self-employment income or compensation as an employer contribution -- up to an overall maximum of $69,000 (or $76,500 for those over 50) in 2024.

The limits in 2023 were $66,000 (or $73,500 for those older than 50).

|

2021 Publication 560

Defined contribution limits for 2021 and set up for yourself and each eligible employee. SIMPLE plans. ... the SIMPLE IRA plan and the SIMPLE 401(k). |

|

THE FIDELITY SELF-EMPLOYED 401(K) CONTRIBUTION

If you are self-employed the worksheet on the other side of this page may help you to calculate your retirement plan contributions.* However |

|

Fidelity

Refer to Fidelity.com/smallbusiness for applicable limits. • Contributions will be deposited in each participant's core account. Participants can place a trade |

|

Solo 401k Deep Dive: 2021 Contributions Guide for S-corporations

Employee Contribution (Salary Deferrals). ? The limit is 100% of your w-2 wages from your self-employed business NOT TO EXCEED/UP TO $19500 for 2020 (plus |

|

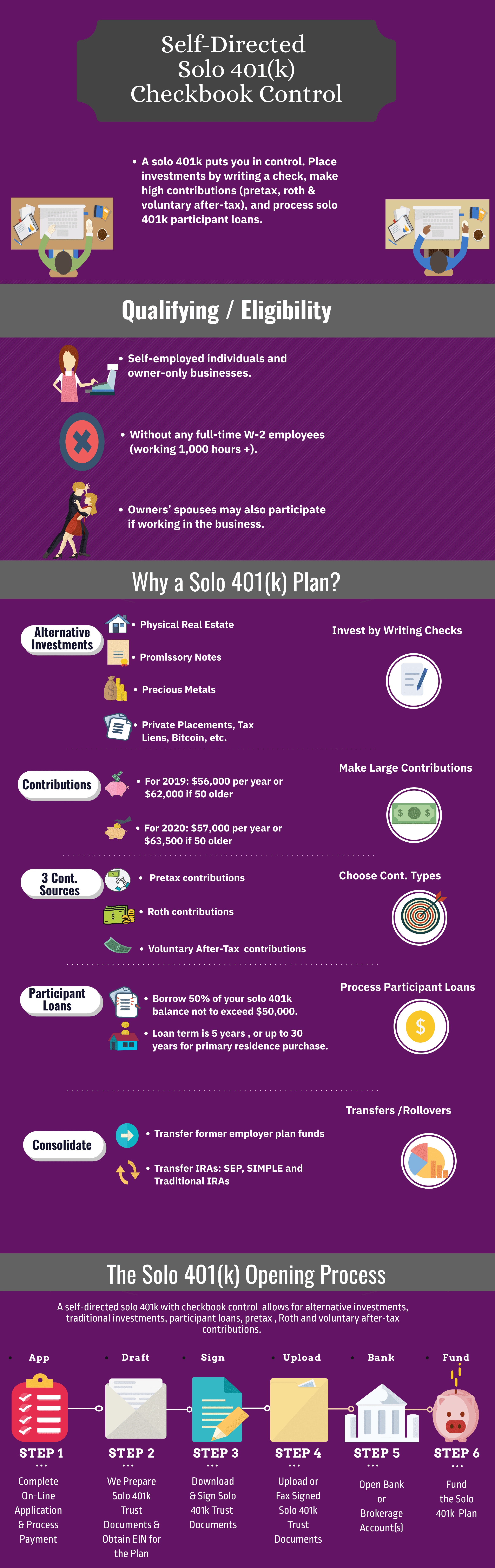

Self-Directed Solo 401k Deep Dive: Contributions Guide 2020

Basic Factors - How Much Can I Contribute? ? The Solo 401k contribution limits are based on the following factors: ? Your Self-Employment Income. ? Your Age. |

|

Publication 525 Taxable and Nontaxable Income

13 janv. 2022 after December 31 2020 |

|

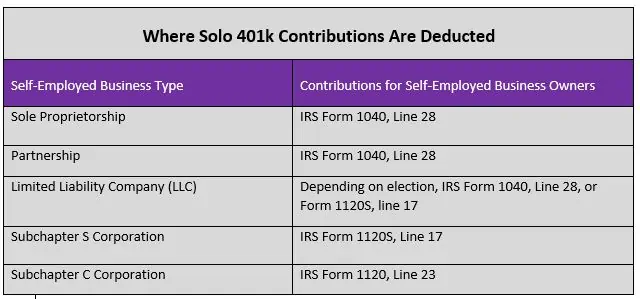

Avoiding Incorrect Self-Employed Retirement Deductions

The deduction is the total plan contributions you can subtract from gross income on your federal income tax return. Limits apply to the amount deductible. You |

|

Self-Directed Solo 401k Deep Dive: Contributions Guide 2020

Roth – How much can I contribute? ? Employee Contribution (Salary Deferrals). ? 100% of the Employee contributions (subject to the limits – |

|

Self-Directed Solo 401k Deep Dive: Contributions Guide 2020

Step 1 - Calculate Self-Employment. Compensation. Page 8. Overall Limit. Page 9. Contribution Types. Page 10. Pre-Tax (Employee) – How much can I contribute? ? |

|

Individual 401(k) Plan

contractor earning self-employment income. In these and similar work The Individual 401(k) Plan is appropriate ... 2020 annual limit of $57000. |

|

2020 Publication 560 - Internal Revenue Service

1 mar 2021 · Defined contribution limits for 2020 and 2021 set up for yourself and each eligible employee the SIMPLE IRA plan and the SIMPLE 401(k) |

|

Invesco Solo 401(k)® With designated Roth contributions

plans below Annual contribution limits for 2020 ($) Compensation (earned income for the self-employed)1 Invesco Solo 401(k)2 SIMPLE IRA2 SEP Plan2 |

|

The 2020–2021 chart: Retirement plan options for a self-employed

options for a self-employed individual with no Owner-only 401(k) Defined Often allows for a larger contribution (2020 limit) and $13,500 per year (2021 |

|

Individual 401(k) - Merrill Lynch

specifically for the self-employed, owner and spouse businesses, High contribution limits • Contributions to your 401(k) account are made up of your pre -tax salary contributions up to $19,500 in 2020, in any combination of pre-tax or Roth |

|

Retirement Plan Benefit and Contribution Limits for 2020

The Internal Revenue Service has announced the contribution limits and thresholds for retirement plans for the Tax 2020 2019 2018 401(k), 403(b), 457(b) or SAR-SEP maximum salary deferral $19,500 $19,000 (20 if self- employed |

|

2020 RETIREMENT PLAN COMPARISONS - Beene Garter

Traditional 401(k) Safe Harbor 401(k) SH with QACA* Cross-tested 403(b) Cash Balance Key and benefit limits than defined contribution plans Employee Eligibility Requirements (including self-employed) Any employer with one |

|

Individual 401(k) Plan - Morgan Stanley

The Individual 401(k) Plan is appropriate for businesses that income tax return, or for self-employed individuals, on 2020 annual limit of $57,000 – On top of |

|

2020 Retirement Plans Quick Reference Guide - Morgan Stanley

MONEY PURCHASE 401(k)1 DEFINED BENEFIT Annual deductible contribution limit: Employer 20 of net earnings from self-employment or $57,000 for |

|

Schwab Individual 401(k) - Charles Schwab

Annual profit-sharing contributions of up to 20 of your net self-employment deferral of up to $19,000 for 2019 tax year and $19,500 for 2020 tax year, for |