colorado 2019 tax filing deadline

|

2019 Amended Individual Income Return Instructions

January 1 through December 31 2019 Tax due paid without billing or paid within 30 days of billing: 6 Tax due paid after 30 days of billing: 9 File this return and pay electronically at Colorado gov/RevenueOnline or if you cannot make checks payable to: Colorado Department of Revenue DR 0104X (10/15/19) COLORADO DEPARTMENT OF REVENUE |

When should I file my Colorado income tax return?

Once you have paid at least 90% of your income tax liability by April 15th, you will have until October 16th to file your Colorado Income Tax Return ( DR 0104 ). If you expect to get a refund this year, but do not make the filing deadline, you can still file your state income tax on or before October 16th.

What is the Colorado income tax extension?

LAKEWOOD, March 18, 2021 – The Colorado Department of Revenue announced today that it will extend the individual income tax payment and filing deadline by 32 days to May 17, 2021 , without penalties and interest, regardless of the amount owed. This extension will be similar to the Internal Revenue Service (IRS) extension.

When is the 2019 tax return deadline?

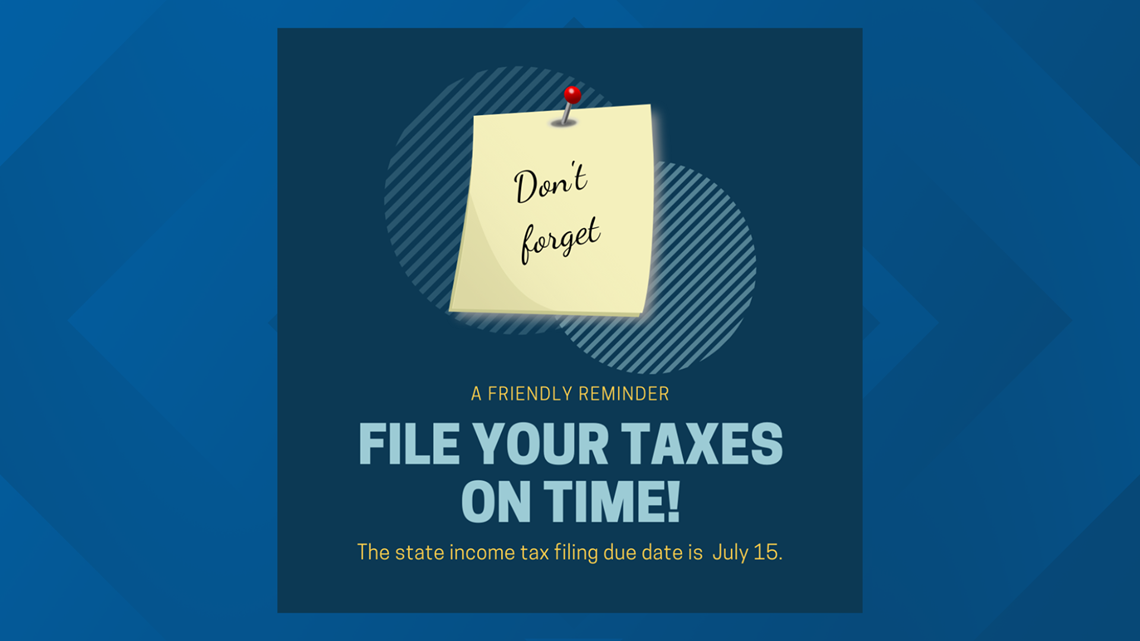

The IRS extended the deadline for 2019 tax returns to July 17, 2023. Taxpayers usually have three years to file and claim their tax refunds. The three-year deadline for filing 2019 returns to claim a refund was in 2022, but the IRS postponed the deadline to July 17, 2023, due to the COVID-19 pandemic.

When is the tax filing deadline for 2020?

The federal tax filing deadline was extended to July 15 because of the coronavirus pandemic. But not all states have followed suit. Earlier this month, Treasury Secretary Steve Mnuchin announced on Twitter that the federal income tax filing deadline for 2020 would be pushed to July 15.

Select A Tax Type

Excise TaxesFuel Tax & International Fuel Tax Agreement (IFTA)Income TaxMarijuana Taxes tax.colorado.gov

Excise Taxes

Cigarette Tax Return (E-File Only(opens in new window))Tobacco Products Tax Return (E-File Only(opens in new window))Nicotine Products Tax Return (E-File Only(opens in new window))Monthly Report of Excise Tax for Alcohol Beverages (Form DR 0442(opens in new window)) tax.colorado.gov

Fuel Tax & International Fuel Tax Agreement

International Fuel Tax Agreement (IFTA) Tax Report (Form DR 0122(opens in new window))Fuel Distributor Tax Return (E-File Only(opens in new window))Environmental Response Surcharge, PFAS Fee, LPG & NG Inspection Fee (E-File Only(opens in new window))Refund Claim for Exempt Use of Fuel (Form DR 7118(opens in new window)) tax.colorado.gov

Income Tax

Individual Income Tax 1. Individual Income Tax Return Filing (Form DR 0104(opens in new window)) 1.1. Annual - Return due April 15th of the following year (under an extension, October 15th) 2. Individual Income Tax Payment (Form DR 0104 or DR 0900(opens in new window)) 2.1. Annual - Payment due on April 15th of following year 3. Individual Income Tax Estimated Payments (DR 0104EP(opens in new window)) 3.1. Quarterly - April 15, June 15, September 15, and January 15 3.2. Annual - January 15 Business Income Tax 1. C Corporation Income Tax Return Filing (Form DR 0112(opens in new window)) 1.1. Annual - April 15th of the following year or the 15th day of the fourth month following the close of the fiscal year 2. C Corporation Income Tax Payment (Form DR 0112 or DR 0900C(opens in new window)) 2.1. Annual - Payment due on April 15th of following year or the 15th day of the fourth month following the close of the fiscal year 3. C Corporation Income Tax Estimated Payments (Form DR 0112EP(opens in new wind

Marijuana Taxes

Marijuana Excise Tax Return (E-File Only(opens in new window))Retail Marijuana Sales Tax Return (E-File Only(opens in new window))Sales Tax Return for Sales Tax on Medical Marijuana (Form DR 0100(opens in new window))Sales Tax Return for Sales Tax on Items Sold By Retail Marijuana Stores (Form DR 0100(opens in new window) - for sales of products that are not retail marijuana or retail marijuana-infused) tax.colorado.gov

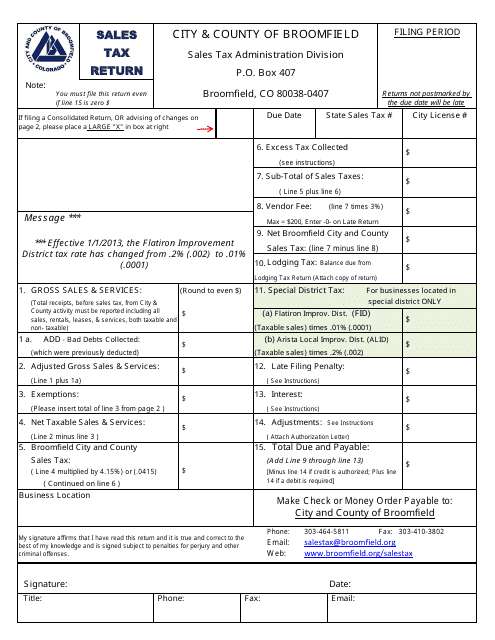

Sales & Use Taxes

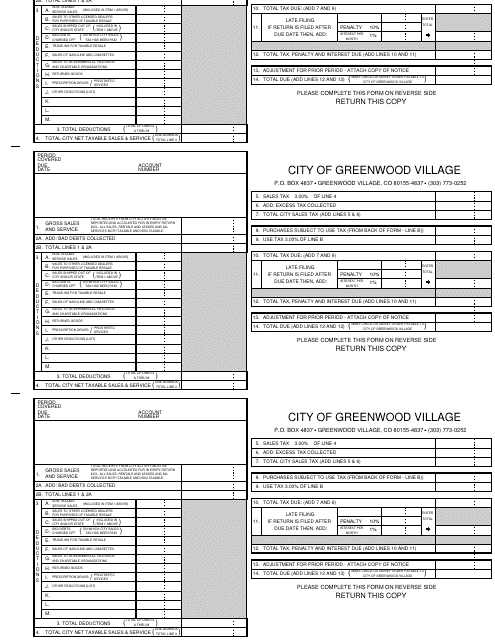

Retail Sales Tax 1. State & State-Administered Sales Tax Return (Form DR 0100(opens in new window)) 1.1. Monthly - 20th day of the month following the filing period end date 1.2. Quarterly - 20th day of the month following the filing period end date 1.3. Annual - 20th day of the month following the filing period end date 1.4. Seasonal - 20th day of the month following the filing period end date 2. Sales Tax Return for Occasional Sales (Form DR 0154(opens in new window)) 2.1. Casual - 20th day of the month fol

Local Jurisdiction Sales Tax

County Lodging Tax Return (Form DR 1485(opens in new window))Local Marketing District Tax Return (Form DR 1490(opens in new window)) tax.colorado.gov

Severance Tax

Oil & Gas Severance Tax Return (Form DR 0021(opens in new window))Metallic Minerals Severance Tax Return (Form DR 0020A(opens in new window))Coal Severance Tax Return (Form DR 0020C(opens in new window))Molybdenum Ore Severance Tax Return (Form DR 0022(opens in new window)) tax.colorado.gov

Specialized Business Fees

Prepaid Wireless Charge Return (Form DR 0526(opens in new window))Annual Report for Public Utility Administration Fee (Form DR 0525(opens in new window))Vehicle Daily Rental Fee (Form DR 1777(opens in new window)) tax.colorado.gov

Withholding Tax & Wage Withholding

Withholding Tax Return (Form DR 1094 for W-2 or DR 1107 for 1099(opens in new window))Withholding Statement (W-2 or 1099)Gaming Withholding Tax Return (Form DR 1091(opens in new window))Gaming Withholding Statement (W-2G) tax.colorado.gov

|

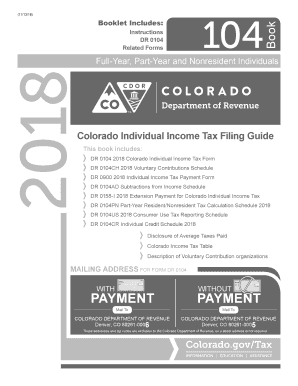

2019 Extension Payment for Colorado Individual Income Tax

Apr 15 2020 If you are traveling or residing outside the United States on. April 15 |

|

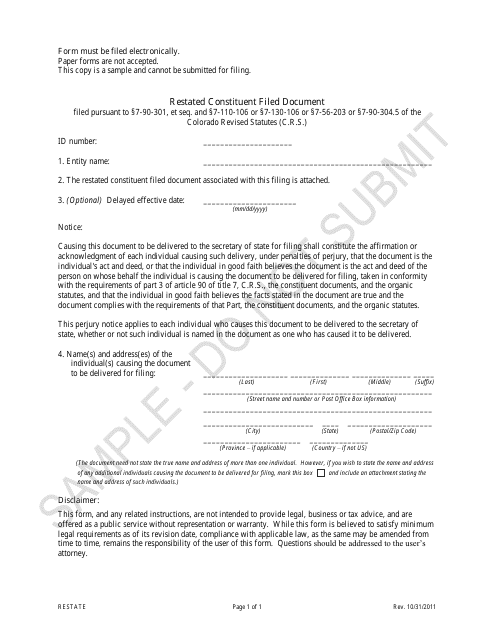

2019 Amended Individual Income Return Instructions

Use the DR 0104X Amended Colorado Income Tax Return |

|

PAYMENT PAYMENT

Oct 22 2019 DR 0158-N Automatic Filing Extension for Composite Nonresident. Income Tax Return. DR 0106 2019 Colorado Partnership and S corporation and ... |

|

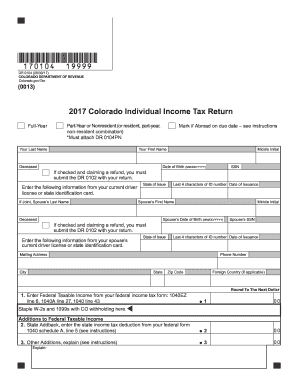

2019 Colorado Individual Income Tax Return

Oct 7 2019 2019 Colorado Individual Income Tax Return ... Mark if Abroad on due date – see instructions ... Spouse's Date of Birth (MM/DD/YYYY). |

|

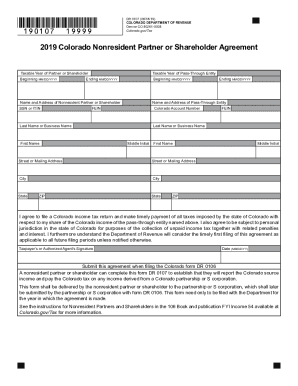

Instructions

Enter the beginning and ending dates of the tax agree with the amounts shown on the company's 2019 Federal/Colorado income tax returns and that said. |

|

PAYMENT PAYMENT

Nov 13 2018 Colorado Individual Income Tax Filing Guide. PAYMENT. WITHOUT ... your return |

|

PAYMENT PAYMENT

Nov 8 2019 DR 0112 2019 Colorado C Corporation Income Tax Return ... unable to file by your prescribed due date |

|

2019 Colorado C Corporation Income Tax Return

Oct 28 2019 2019 Colorado C Corporation Income Tax Return. Do not submit federal return |

|

2018 Extension Payment for Colorado Individual Income Tax

Apr 15 2019 If you are traveling or residing outside the United States on. April 15 |

|

Instructions

303-866-3889 or see our File > Fiduciary Income Tax information at Colorado.gov/Tax. Line Instructions. Tax Year Enter the beginning and ending dates of the |

|

Extension of Time for Filing a Colorado C Corporation Income Tax

Colorado gov/Tax Return the DR 0158-C with check or money order payable to the Colorado Department of Revenue, unable to file by your prescribed due date, you may file to file your return, or until October 15, 2019 for traditional |

|

State Tax Filing Guidance for Coronavirus Pandemic - AICPA

20 mai 2020 · U S states are providing tax filing and payment due date relief for individuals and CO – “In June and July 2020, Colorado enacted legislation |

|

COVID-19: Updated State and Local Tax Due Date Relief - Deloitte

20 mai 2020 · Colorado Indirect Tax Pursuant to an executive order, retailers that are required to file a sales tax return and remit by April 20 may do so by |

|

BDO SALT_COVID-19 State Tax Deadlines

23 mar 2020 · Order extend the deadline to file tax returns, file reports, and make Link: https:// www colorado gov/pacific/tax/2019-income-tax-deadline- |

|

State and Local Tax Extensions in response to COVID - assetskpmg

10 avr 2020 · income tax filing due date is also extended from April 15, 2020, to July Any pass-through entity required to file a 2019 composite income tax The income tax payment deadline has been extended for all Colorado taxpayers |

|

State Tax Filing Guidance for Coronavirus Pandemic Updated: 3/23

23 mar 2020 · all Colorado individuals and business taxpayers normally due April 15 moved the deadline for 2019 federal tax returns to July 15, 2020 |

|

Code of Colorado Regulations

of the due date of that return or, (b) in a notice of final determination The servicemember makes this election on their Colorado income tax return (2) For income tax years beginning on and after January 1, 2019, a credit equal to 50 of |