compare mortgage rates and closing costs

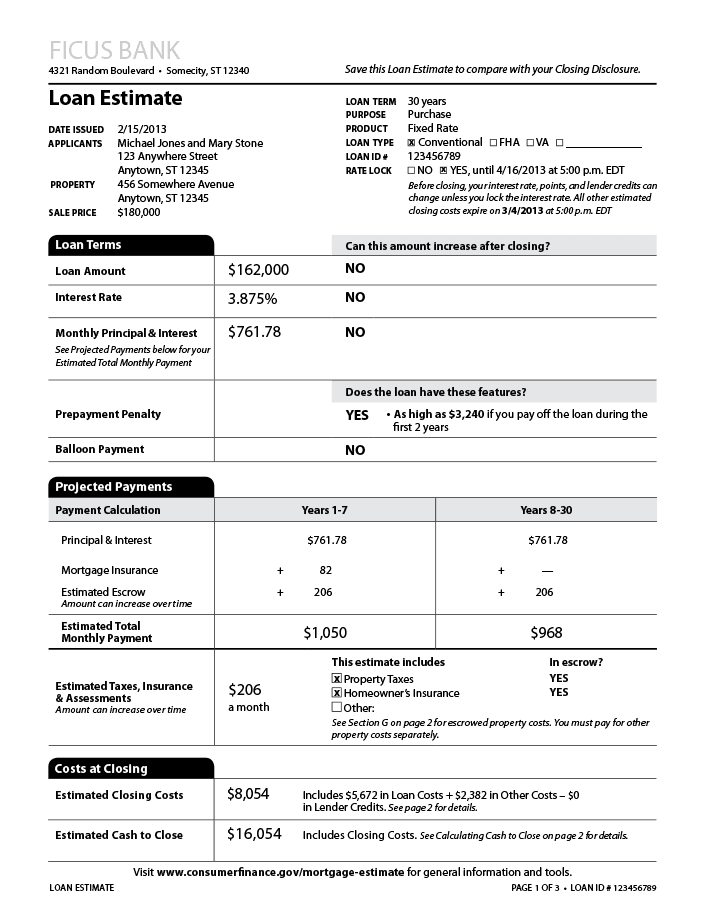

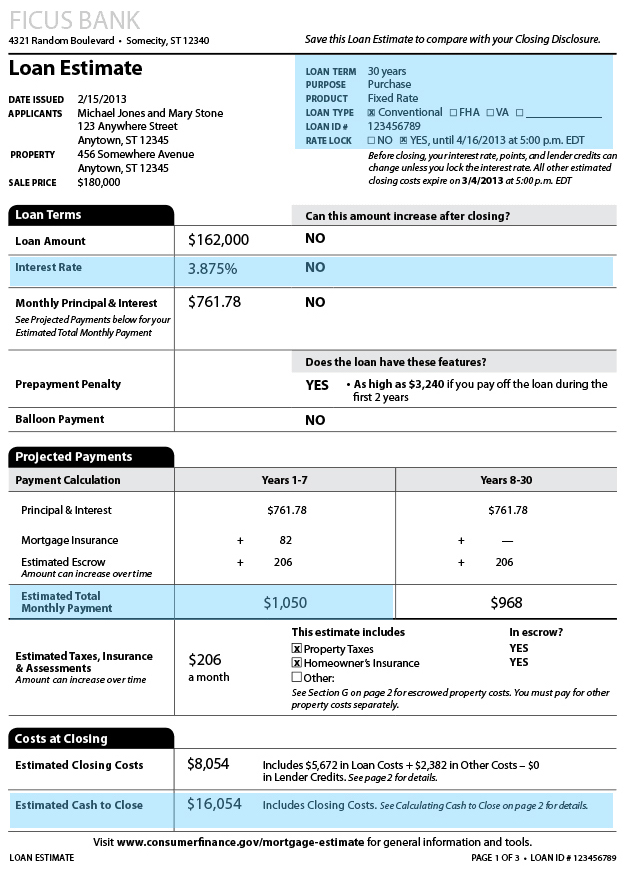

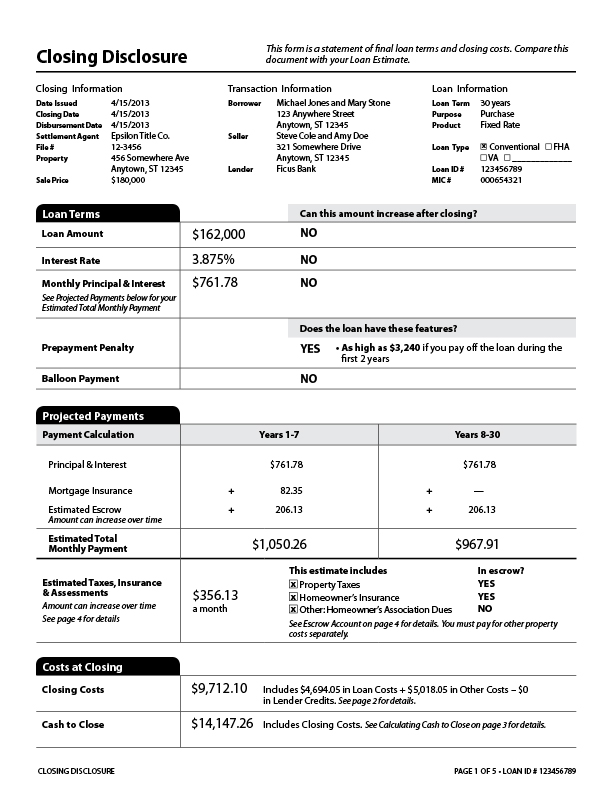

What is a loan estimate & Closing Disclosure?

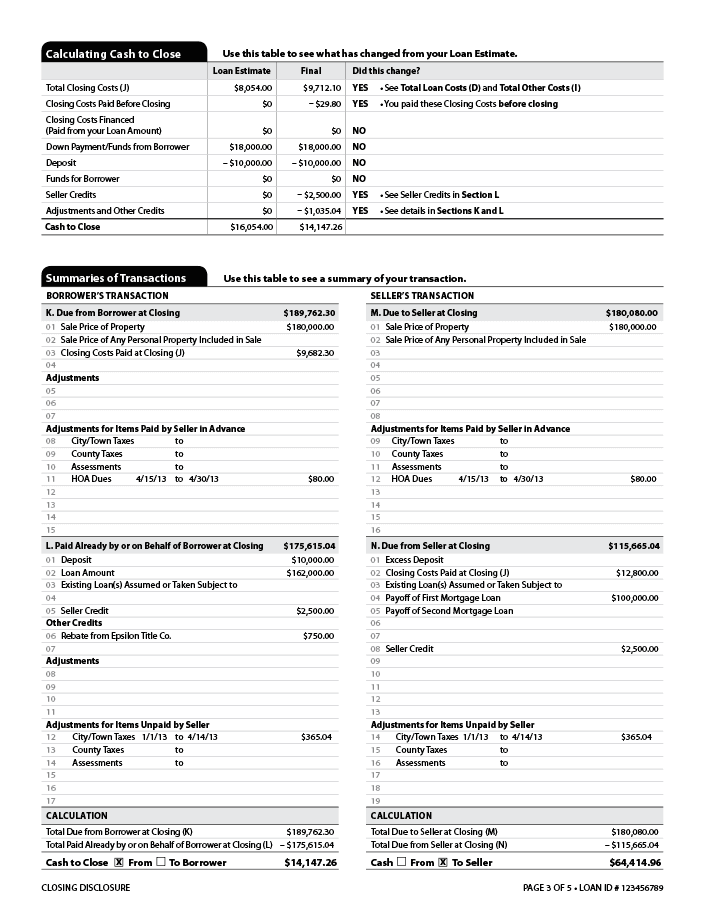

The Loan Estimate provides details about your loan, including the projected monthly mortgage payment and estimated closing costs. A lender must provide a Loan Estimate within three business days after you apply for a mortgage. The Closing Disclosure, which has the final numbers, is delivered three days before closing.

How much do mortgage closing costs cost?

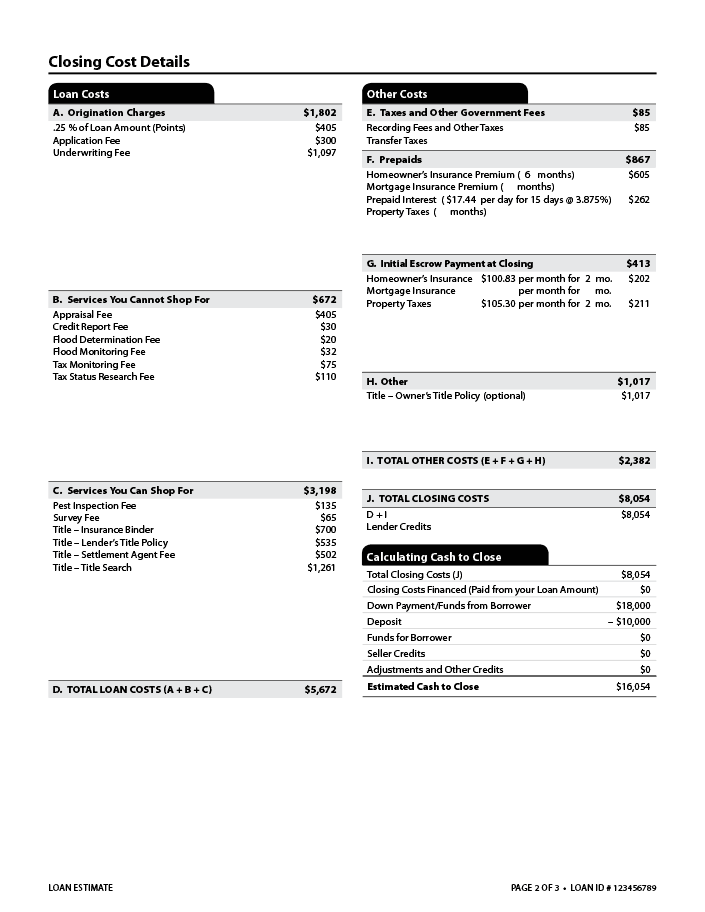

Closing costs are usually 2% to 5% of the loan amount. If no loan is involved, the percentage may be as low as 1%. Paying mortgage discount points to lower your rate can be another significant, yet optional cost. If you pay one point or 1% of the loan amount, you can potentially lower your rate by 0.25 percentage points.

Who pays closing costs?

Both buyers and sellers pay closing costs, but not equally. Here’s who pays what. Homebuyers and sellers are both responsible for some form of closing costs. Closing costs are a big part of getting a mortgage or refinancing your home loan. Bankrate has compiled closing cost resources to help you navigate the homebuying process.

How much does a home loan cost?

Cost estimate: About 1% of the loan amount. Government-backed mortgages have upfront fees that are paid at closing if they're not rolled into the loan. FHA loans require an upfront mortgage insurance premium. Cost: 1.75% of the loan amount. USDA loans have an upfront guarantee fee. Cost: 1% of the loan amount. VA loans have a funding fee.

Application Fee

Some lenders charge an application fee to process your loan request. This fee varies by lender but can be up to $500. This may be a separate fee or used as a deposit to be applied to other closing costs later. rocketmortgage.com

Appraisal

Your lender will order an appraisalthrough a third-party appraisal management company that’ll send a professional appraiser to take a look at your home and determine how much your property is worth. They’ll do some basic safety checking to make sure the property is move-in ready. Appraisals are important because they set the value of the property,

Attorney Fees

In some states, you can’t close on a housing loan without an attorney. Attorney fees cover the cost of having a real estate attorneycoordinate your closing and draw up paperwork for your title transfer. Real estate attorney charges depend on your state and local rates. rocketmortgage.com

Closing Fee

Your closing fee goes to the escrow company or attorney who conducts your closing meeting. In some states, an attorney must sign off on every closing. These costs vary depending on your state and whether an attorney must attend your closing. rocketmortgage.com

Courier Fee

Courier fees cover the cost of transporting mortgage documents. Expect to pay around $30 in courier fees if your lender charges them. rocketmortgage.com

Credit Reporting Fee

Credit reporting fees cover the cost of pulling your credit report and looking at your credit score. Most credit reporting fees are between $10 and $100. rocketmortgage.com

Discount Points

Lenders allow you to pay money upfront on your loan to reduce your interest rate by buying discount points(essentially, buying down your rate to save money in interest over time). One discount point equals 1% of your loan amount. For example, if you get a mortgage for $100,000, one point will cost you $1,000. For a $200,000 loan, a point costs $2,0

Escrow Funds

Sometimes referred to as reserve fees or prepaids, escrowfunds hold reserved money for property taxes, homeowners insurance premiums and mortgage insurance. Your lender keeps your escrow funds in a special account and uses them to make payments on your behalf as part of your regular mortgage payment. At closing, your lender might require you to put

FHA Mortgage Insurance

With an FHA loan, you’ll need to pay a mortgage insurance premiumupfront at closing. The current MIP rate is 1.75% of your base loan amount. For example, if you borrow $100,000 to buy your home, your MIP due at closing is $1,750. This upfront payment is separate from your monthly MIP, which ranges from 0.15% to 0.75% of your loan value. rocketmortgage.com

Flood Certification

You will likely need to pay $15 – $25 for a flood certification. This money goes to the Federal Emergency Management Agency, which uses the data to plan for emergencies and target high-risk zones. This closing cost only applies if you’re buying a house in a flood zone. rocketmortgage.com

|

Looking for the best mortgage: shop, compare, negotiate - HUD

Some common fees associated with a home loan closing are listed on the Mortgage Shopping Worksheet in this brochure Down Payments and Private Mortgage |

|

The Smart Consumers Guide to Lowering Your Closing Costs

This is true of every mortgage lender or broker to whom you apply for a loan You can use the GFEs to compare lenders' rates, terms and fees, and then choose |

|

MORTGAGE COMPARISON - HubSpot

Each pre-approval may look a little different, so reach out to your loan officer to support you in making compare some of the major components of your pre- approval Interest Rate Annual Percentage Rate Points Estimated Closing Costs |

|

Your home loan toolkit: A step-by-step guide - govconsumerfinance

Look closely at your total fees, interest rate, and monthly payment when comparing options Ask about loan programs such as: ▫ Conventional loans that may offer |

|

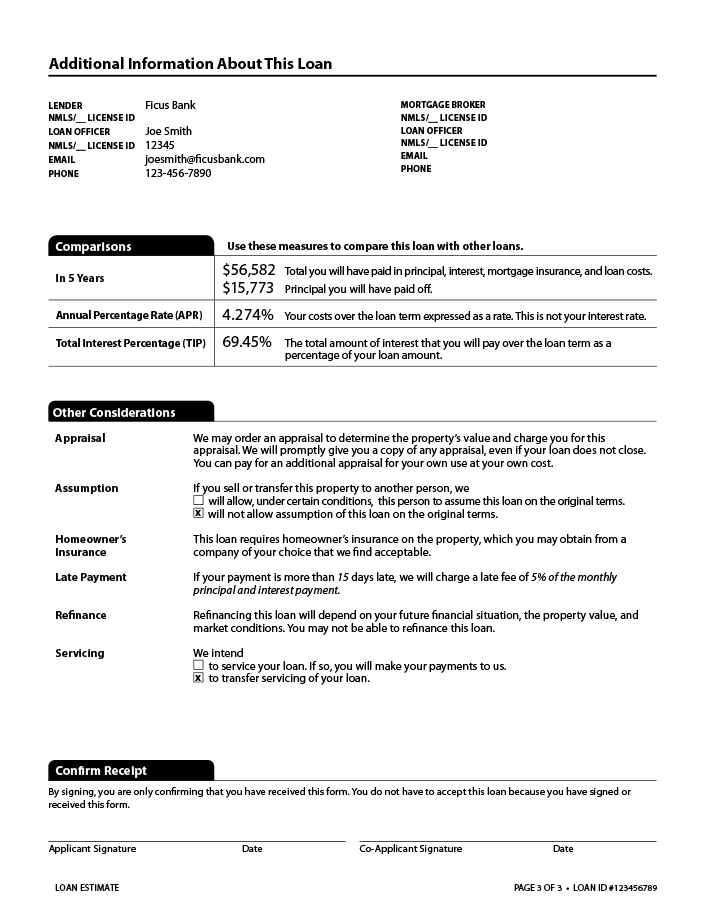

Loan Estimate - govconsumerfinancefiles

change unless you lock the interest rate All other estimated closing costs expire on Save this Loan Estimate to compare with your Closing Disclosure PAGE 1 |

|

Mortgage Shopping Worksheet - Consumerftcgov

Type of Mortgage: fixed-rate, adjustable-rate, conventional, some typical fees you may see on loan documents Application fee or Loan processing fee |

|

Ally Mortgage Playbook

Rate Mortgages (ARM) that have varying terms up to 30 years After identifying which type of loan is best, remember to compare interest rates and closing costs, |

|

HOW WILL I KNOW WHAT FEES AND CLOSING COSTS WILL BE

or all of the closing fees for the buyer There are certain closing costs and fees that are customary for a buyer or seller to pay For example, on a VA Loan it is |

|

Model Specifications For Analyzing And Comparing Reverse - AARP

comparing reverse mortgage costs and benefits The unusual structure of these loans and the variety of features among competing loan products make it difficult |

/what-is-a-fixed-rate-mortgage-3305929-Final2-3c46c75609a940939cca58b8e47f669f.png)