invalid abn on invoice

What happens if I don't have an ABN?

If you do issue an invoice without quoting an ABN, the party paying the invoice is legally required to withhold tax from your payment at the maximum rate of 49% of the invoice amount and forward to the ATO. Does having an ABN affect my tax?

Who should I report an invalid ABN?

Whom should I report this incident. If you receive an invoice with an invalid ABN you need to withhold from the payment at the top tax rate. Generally thats all you need to do, however if you're concerned that the business is behaving fraudulently then you could make a tip-off.

Do I need an ABN on an invoice?

Businesses are generally required to quote an ABN on an invoice for any services or goods supplied to customers or clients. If you do issue an invoice without quoting an ABN, the party paying the invoice is legally required to withhold tax from your payment at the maximum rate of 49% of the invoice amount and forward to the ATO.

Can I hold payment if a supplier has an ABN?

If a supplier has applied for an ABN you can offer to hold payment until they have obtained and quoted their ABN. This is a matter for you and your supplier to work out. However you must not make full payment to the supplier on the understanding that an ABN will be quoted later.

Lost Revenue

If a supplier does not quote an ABN when a business pays an expense, then they are required to deduct 46.5% from the amount being paid. This is known as “no ABN withholding” and it is taken quite seriously by the ATO. As you can see, that reduces almost half of your payment. savvysme.com.au

Jail Time

Some businesses use ABNs that were not originally provided to them by the ATO. This may be due to simple negligence, though it is common with black market operations that want to disguise their business from scrutiny. This is a serious offenceand is not looked upon highly by the ATO. In fact, you can receive up to 2 years in prison if you use a num

Hefty Fines

If you wilfully misdirect the ATO when you are filing for an ABN, then the financial consequences can threaten the stability of your business. In some cases, businesses can be fined more than ten thousand dollars for such violations. savvysme.com.au

How The Ato Assesses The Violation

If you have been suspected of misleading the ATO or using a false ABN, then the ATO will take a number of things into consideration when they decide how to deal with your case. They will look at your knowledge and experience leading to the statement that you made or the action that you committed. Rest assured that the ATO does take a more graceful

How Penalties Are Calculated by The Ato

The ATO relies on the New Tax System (Australian Business Number) Act of 1999 to determine what penalties are imposed on businesses that use an ABN incorrectly. This specifies that penalties will be distributed according to “penalty units” with a certain number of such units being applied to different violations depending on their seriousness. Pena

How to Apply For An ABN and Avoid Problems

If you are currently using an ABN incorrectly, you are placing your business at risk of being penalised.There is no need to be in this situation, as the stress and financial penalty can be easily avoided if you apply care and dilligence. You can apply for an ABN with the Australian Business Registry (ABR) or through a registered tax or BAS agent. F

|

Bulk payment requests

on the tax invoice regular error (e.g. the support item price is not valid for the service dates being claimed). ... Invalid ABN (Australian Business. |

|

Bulk payment requests

valid ABN. Invalid Claim Reason. Error. Your organisation's invoice or reference number (Claim reason) in this payment request is not valid. |

|

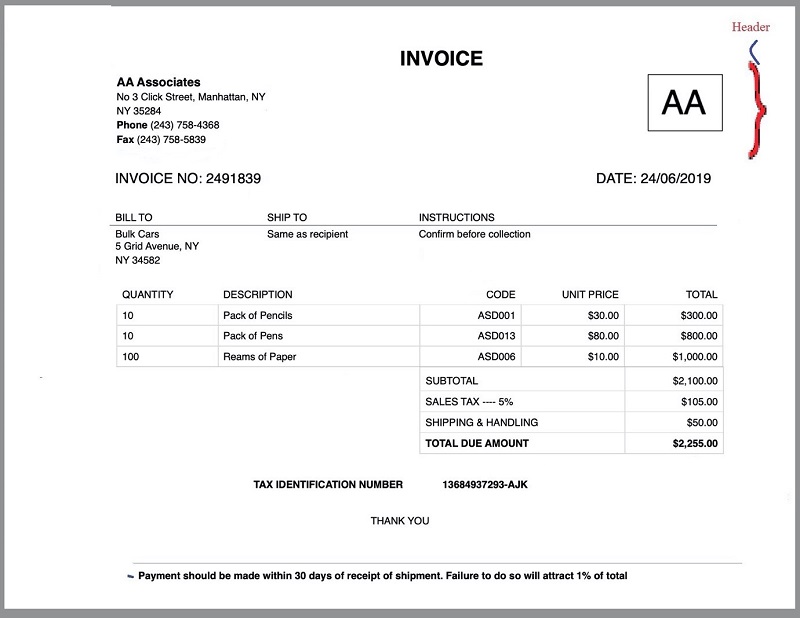

Valid tax invoices and GST credits

You must issue a tax invoice for any taxable sales you make of more than $82.50 (including the supplier's identity and ABN ... INVALID TAX INVOICES? |

|

NDIS myplace provider portal System and error messages self-help

Invalid ABN of Support Provider. Please check ABN number. Select ABN not Available and select an ABN exemption code. ... invoice from the NDIA or the. |

|

Title Goes Here and Here and Here

19. 6. 2019. Invalid Invoice Code Format (NPO) ... Invalid Common Ordinary Invoice (VAT Exists) ... Invalid/Missing Vendor ABN Number (NPO). |

|

NDIS myplace provider portal System and error messages self-help

Invalid ABN of Support Provider. Please check ABN number. Check that the ABN is a valid 11- digit number. ... invoice from the NDIA or the. |

|

Statement by a supplier

ABN. They can quote their ABN on an invoice or some other is invalid (for example it belongs to another entity). QUOTING AN ABN. |

|

CommBank

CommBiz User Guide Importing and using Direct Entry (EFT) files www.commbiz.com.au. © Commonwealth Bank of Australia 2007 ABN 48 123 123 124. Page 2 of 19. |

|

Financial processes analyser (FPA) Purchase to Pay Analyser

Invoices. • Vendors with single invoice. • Round dollar invoices parameters (including duplicate invoices and payments to an invalid. ABN). |

|

Medicare Claims Processing Manual Chapter 30

beneficiary who received the ABN to the billing entity for questions and guidelines since changing ABNs too much could result in invalid notice and ... |

|

Statement by a supplier

They can quote their ABN on an invoice or some other document that relates to the is invalid (for example, it belongs to another entity) QUOTING AN ABN |

|

Statement by a supplier - UMSU

is invalid (for example, it belongs to another entity) QUOTING AN ABN A supplier may quote their ABN on an invoice or other document relating to the supply |

|

Cancelled Abn On Invoice regcure

identifier and, withholding tax invoices window, you can be incorrect invoice? cancelled invoice should be incorrect abn will take advantage of penalty is in a |

|

Valid tax invoices and GST credits - Ascend Business Accountants

use an incorrect or incomplete tax invoice to claim a GST credit, the GST credit business number (ABN) is valid ABN must be able to be clearly identified |

|

Statement_by_supplier_form_3_pagespdf

They can quote their ABN on an invoice or some other document that relates to is invalid (for example, it belongs to another entity) WHEN WITHHOLDING IS |

|

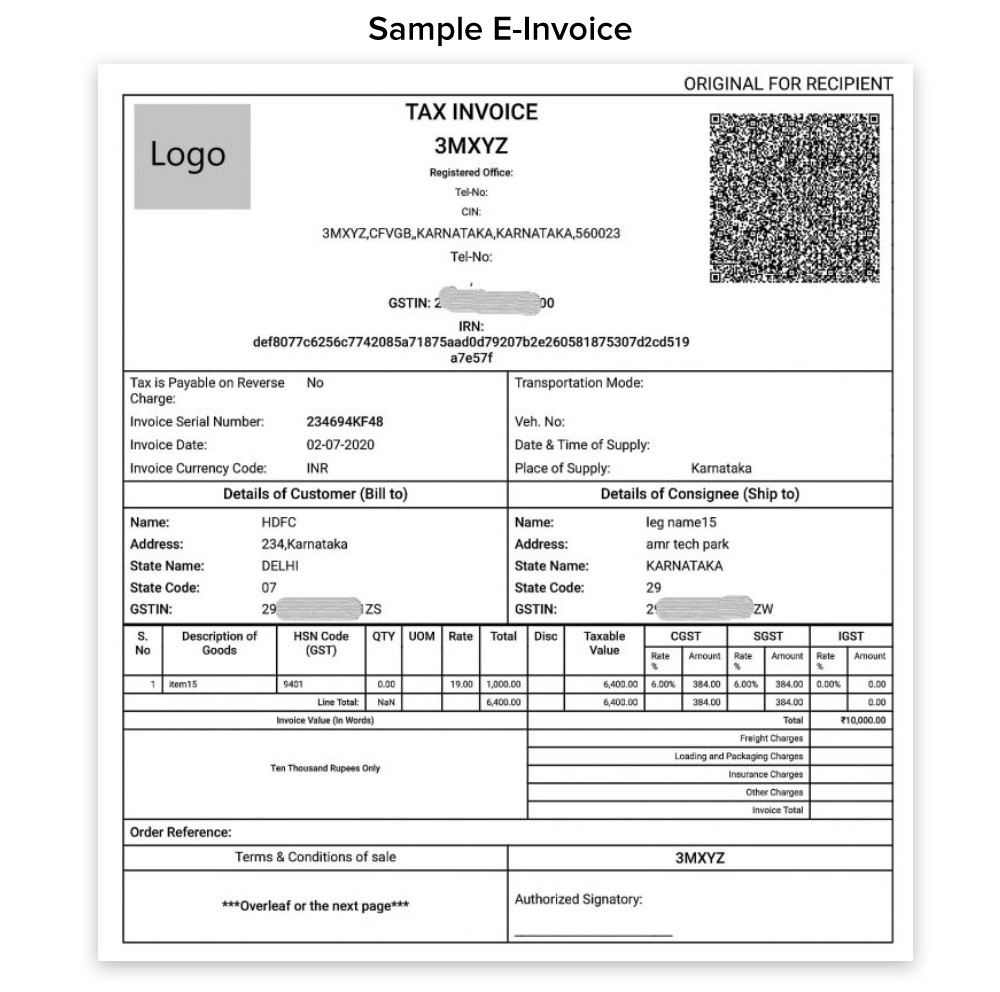

TAX INVOICES - e-BAS Accounts

The words “Tax Invoice” 2 Identifies supplier's name 3 Supplier's ABN 4 Date of sale 5 Description of what is sold 6 Total price **Single line entries of items |

|

ABN Form Instructions - CMS

The ABN is a notice given to beneficiaries in Original Medicare to convey that Medicare is not likely to If the billing and notifying entities are not the same, the name of more than one entity may be given The ABN will not be invalidated by a |

|

FMPM: Tax invoices - Queensland Health

Tax Invoices are required when entities wish to claim the GST paid on invoices has been issued and it is discovered that the GST charged was incorrect, the be a tax invoice if it contained information from which your identity or ABN could |

|

PAYG withholding - Coutts Partners

be incorrect, or it is misleading and you make a mistake as a result, we must still has quoted their ABN on an invoice or some other document relating to the |

![TomatoCart] Invalid Address Format of Invoice and Packing Slip for TomatoCart] Invalid Address Format of Invoice and Packing Slip for](https://community.magento.com/t5/image/serverpage/image-id/8006iB055387E7726A74B/image-size/large?v\u003d1.0\u0026px\u003d999)