credit enhancement models

|

Review of ADBs Credit Enhancement Operations

ADB's business model as a financial institution is based on borrowing from capital markets and making loans Accordingly ADB has little inherent operational |

|

Credit Enhancement Facilities

This section describes the internal and external credit enhancements found in most series of securitized credit card receivables INTERNAL CREDIT ENHANCEMENT |

|

Credit Enhancement for Green Projects

This paper seeks to identify review and understand credit-enhancement schemes provided by multilateral development banks and international financial |

|

CREDIT ENHANCEMENT PRACTICES

✓Financial instrument designed to lower repayment risk of debt and security instruments ✓Its main objective is to improve the credit profile of borrowers |

What are the different types of credit enhancements?

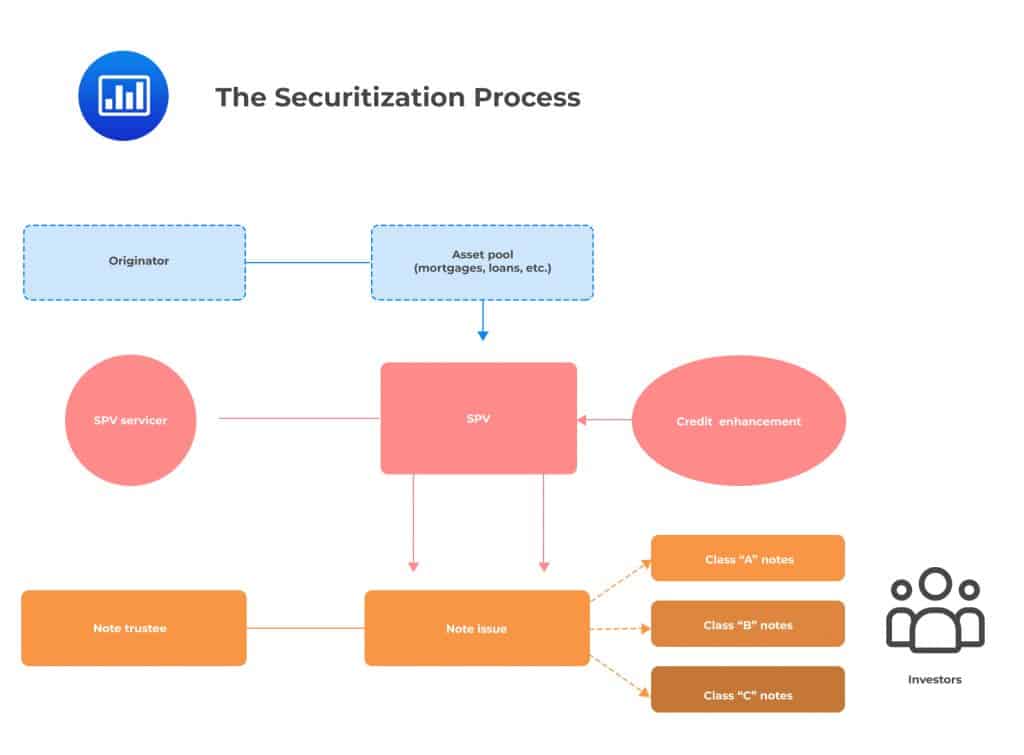

Credit enhancements provided by the cash flows generated by the underlying receivables and the securitization structure include excess spread, spread accounts, subordinated classes, and over- collateralization.

internal credit enhancement is overcollateralization.

This form enhances credit for a pass-through by establishing a pool of assets with a greater principal amount than the principal amount of the pool of mortgage loans.

How is credit enhancement calculated?

The credit enhancement obligation is calculated so that the total credit enhancement amount plus the first loss account is sufficient to bring the total loss reserves for the master commitment to achieve an Acquired Member Assets (AMA) investment grade. 19 Over time, this credit enhancement obligation is recalculated.

What is credit enhancement in CLO?

Credit Enhancement: CLOs are structured with tranches with different levels of credit risk.

This credit enhancement can provide additional protection to investors in the senior tranches against losses due to defaults in the underlying loans.

- Loan Loss Reserves. Loan loss reserves (LLRs) provide partial risk coverage to lenders—meaning that the reserve will cover a pre-specified amount of loan losses.

- Interest Rate Buy-Downs.

- Loan Guarantees.

- Loan Loss Insurance.

- Debt Service Reserves.

- Subordinated / Senior Capital.

|

The Role of Bank Credit Enhancements in Securitization

25 juil. 2012 enhancements.2 Credit enhancements are protection in the ... Enhancements in models 1 and 3 is likely due to the omitted. |

|

FHLBank Use of Models and Methodologies for Internal

25 avr. 2018 The AMA rule requires that a Bank shall use an appropriate model and methodology for estimating the amount of credit enhancement for an asset or ... |

|

Implementation of the Credit Enhancement for Charter School

Two Grantees are using this model of service in which they make loans directly to charter schools and also provide credit enhancements for loans made by. |

|

An outline guide to Project Bonds Credit Enhancement and the

21 déc. 2012 Bond Initiative and Project Bonds Credit Enhancement (PBCE) will work. ... risks and benefits of each financing option (shadow modelling). |

|

Financial Analysis Techniques for Infrastructure Projects

Role of the financial model in PPPs. • Credit enhancements for project finance. Risk Analysis in Project Finance. • Key elements of risk management. |

|

Report Highlights: Implementation of the Credit Enhancement for

The Credit Enhancement for Charter School Facilities Program was established in What is the relative efficiency of the models of service being used by ... |

|

Technical Line: Lessee model comes together as leases project

9 avr. 2018 5.1.1 Impact of collateral credit enhancements ... loss model and replace the IAS 39 Financial Instruments: Recognition and. |

|

Developments in credit risk management across sectors: current

bond obligation or from the risk of a guarantor |

|

ASSET-BACKED SECURITIES CASH FLOW MODEL

Initial credit enhancement is often brought in the form of overcollateralisation or a reserve fund. Both are generally funded by a subordinated loan or junior |

|

Too Interconnected To Fail: Financial Contagion and Systemic Risk

Model of CDS and Other Credit Enhancement. Obligations of US Banks. Prof. Sheri Markose Economics (ACE) for financial network modeling for systemic risk. |

|

CREDIT ENHANCEMENT PRACTICES - GFDRR

✓The customary use of credit enhancement in development finance is providing partial credit guarantees to qualifying borrowers against the risks associated |

|

Credit Enhancement for Green Projects - International Institute for

Credit-enhancement schemes respond to the demand to mitigate the risks of the project and attract further financing and investment to the project It is an external mechanism that seeks to increase the credit rating/credit worthiness of the financeable aspects of an infrastructure project |

|

Securitization Structured finance solutions - Deloitte

credit enhancement involves third-party guarantees such examine each form of credit enhancement prior to issuance models reflecting maturity and issuer |

|

Credit Enhancement: The Missing Link in Infrastructure Finance

Credit Enhancement: The Missing Link in Infrastructure Finance William Streeter, Hastings Introduction Infrastructure projects are viewed as long-term assets in |

|

Enhancement of a credit rating tool for Company X - Theseus

24 mar 2020 · Bankruptcy prediction models were chosen as an additional method for a more accu- rate analysis of the financial data The chosen model was |

|

Evaluation Boosting ADBs Mobilization Capacity: The Role of Credit

Credit Enhancement Products Reference A financial instrument that provides credit enhancement risk models that are based on risks, historical loss |

|

Introductory Guide to Infrastructure Guarantee Products from

other credit-enhancement instruments, such as A/B loans, equity participation MDBs' business models that “require” a conservative accounting treatment of |

|

The Role of Credit Rating Agencies in Structured Finance - IOSCO

ratings were based on incorrect information and faulty or dated models is run to determine the credit enhancement required for a AAA rating This test might |

|

UK RMBS Methodology And Assumptions

"Guidelines For The Use Of Automated Valuation Models For U K RMBS 'AAA' credit enhancement anchor in the U K RMBS criteria differs from the anchors |