expected return formula

|

What is the Expected Return on a Stock?

Third the formula makes specific |

|

Forecasting Investment Returns and Expected Return Assumptions

27 févr. 2019 Topic 15: Fixed income return expectations: direct calculation or implicit determination based on modeled interest rates. Page 5. Page 5 |

|

A New Formula for the Expected Excess Return of the Market

27 sept. 2019 In our formula each risk-neutral return central moment contributes to the expected excess return and is representable in terms of known option ... |

| What is the Expected Return on a Stock? |

|

Chapter 1 The Constant Expected Return Model

Here. ˆ ? is a random variable. Definition 5 Let {r1 |

|

A Simple Formula for the Expected Rate of Return of an Option over

The market price of the call at all times through expiration is set equal to the value it would have according to the Black-Scholes formula for European options |

|

Chapter 1 Portfolio Theory with Matrix Algebra

7 août 2013 expected returns and variances becomes cumbersome. The use of matrix (lin- ... The matrix algebra formulas are easy to translate. |

|

Chapter

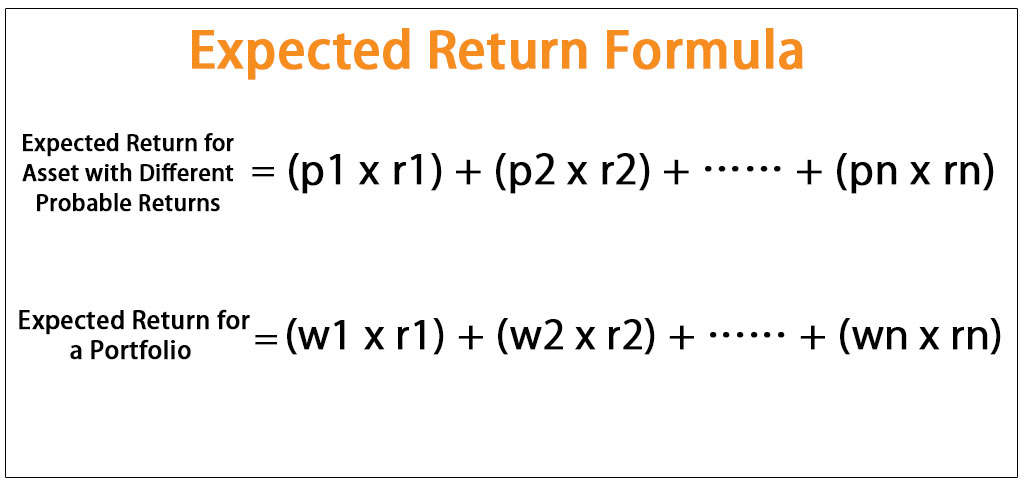

Expected Returns I. • Expected return is the “weighted average” return on a risky asset |

|

Hewlett Foundation

Because grants do not earn returns. Acumen Fund accounts for the sunk costs of the grant and admin- istration in the denominator of the expected return formula |

|

Market-Expected Return on Investment: Bridging Accounting and

14 avr. 2021 By definition the PVGO is $802.2 |

|

3 Basics of Portfolio Theory - University of Scranton

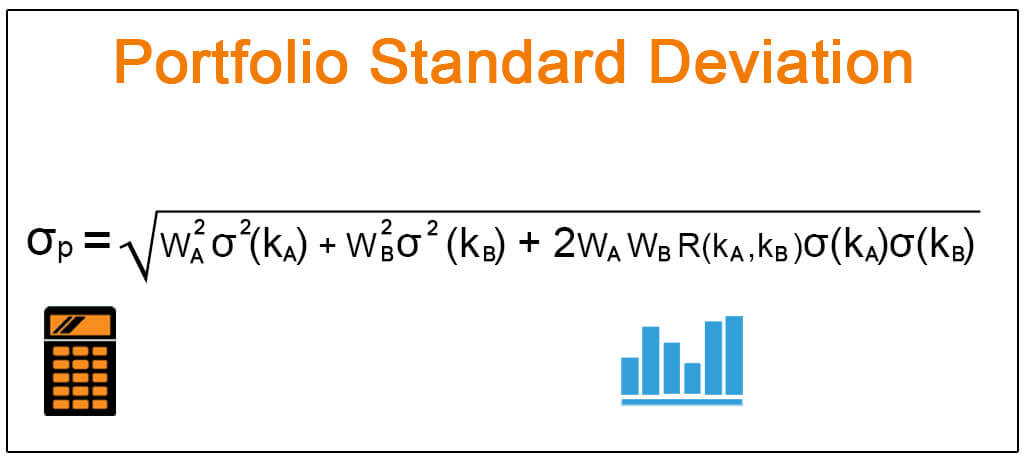

The expected return of the portfolio is still the weighted average of the expected returns of the individual securities We may express it as E(R p) = w 1 E(R 1) + w 2 E(R 2) + w 3 E(R 3) Likewise we may construct the expression for the ? of a three-security portfolio First |

|

Financial Modeling: CAPM & WACC - CLDP

%20WACC |

|

How to Calculate Expected Rate of Return SoFi

• Total Return = expected return + unexpected return • Unexpected return = systematic portion + unsystematic portion • Therefore total return can be expressed as follows: • Total Return = expected return + systematic portion + unsystematic portion |

|

Mean-Variance Optimization and the CAPM - Columbia University

any expected return This was the cental insight of Markowitz who (in his framework) recognized that investors seek to minimize variance for a given level of expected return or equivalently they seek to maximize expected return for a given constraint on variance Before formulating and solving the mean variance problem consider Figure 1 below |

|

Risk-Neutral Probabilities - New York University

Expected Returns with RN Probs • Note that we can rearrange the risk-neutral pricing equation price = discounted “expected” payoff as • I e “expected” return = the riskless rate (Here return is un-annualized ) • Thus with the risk-neutral probabilities all assets have the same expected return--equal to the riskless rate |

|

Searches related to expected return formula filetype:pdf

We can think of returns as being decomposed into expected returns and unexpected returns More formally: R t = E t?1 (R t) + e t (1) where R t is return in period t E t?1 (R t) is expected return at t conditional on information available at t-1 e t is unexpected return |

What is your expected rate of return?

- The expected rate of return is the return on investment that an investor anticipates receiving. It is calculated by estimating the probability of a full range of returns on an investment, with the probabilities summing to 100%.

What does expected rate of return mean?

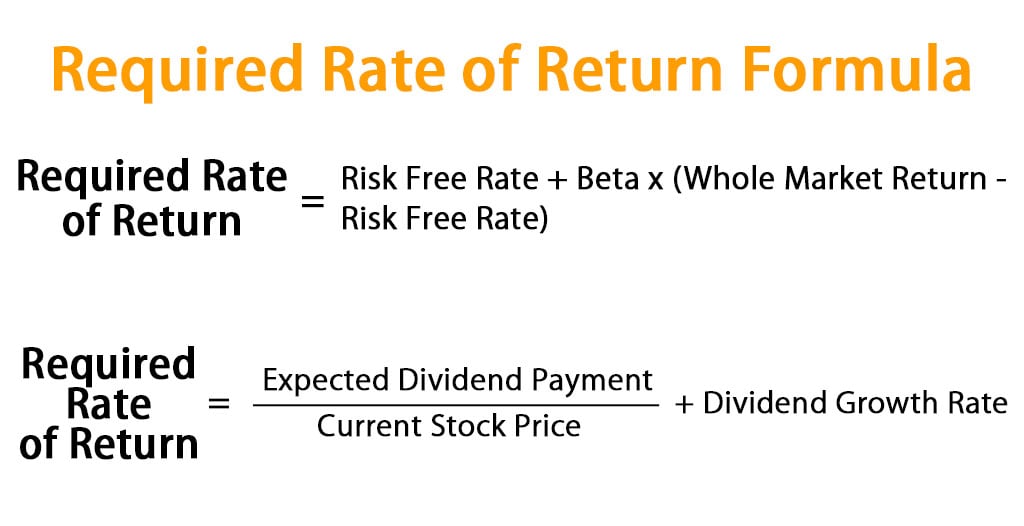

- The expected rate of return is the return that the investor expects to receive once the investment is made. The expected rate of return can be calculated by using a financial model such as the Capita Asset Pricing Model (CAPM), where proxies are used to calculate the return that can be expected from an investment.

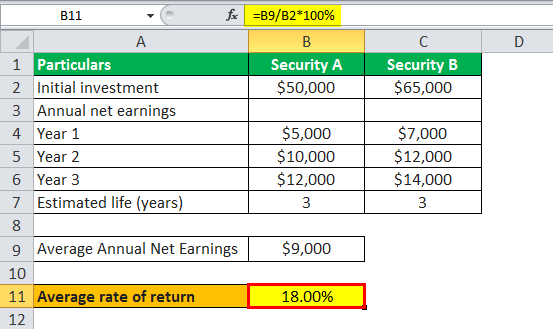

What is the required rate of return Formula?

- Required Rate of Return Formula. The core required rate of return formula is: Required rate of return = Risk-Free rate + Risk Coefficient(Expected Return – Risk-Free rate) Required Rate of Return Calculation. The calculations appear more complicated than they actually are. Using the formula above. See how we calculated it below:

What is expected rate of return equation?

- The formula of expected return for an Investment with various probable returns can be calculated as a weighted average of all possible returns which is represented as below, r i = Rate of return with different probability.

|

What is the Expected Return on a Stock?

Third, the formula makes specific, quantitative predictions about the relationship between expected returns and the three measures of risk-neutral variance; it does |

|

Expected return - Chapter

This formula is not as difficult as it appears This formula says is to add up the squared deviations of each return from its expected return after it has been multiplied by the probability of observing a particular economic state (denoted by “s”) The standard deviation is simply the square root of the variance |

|

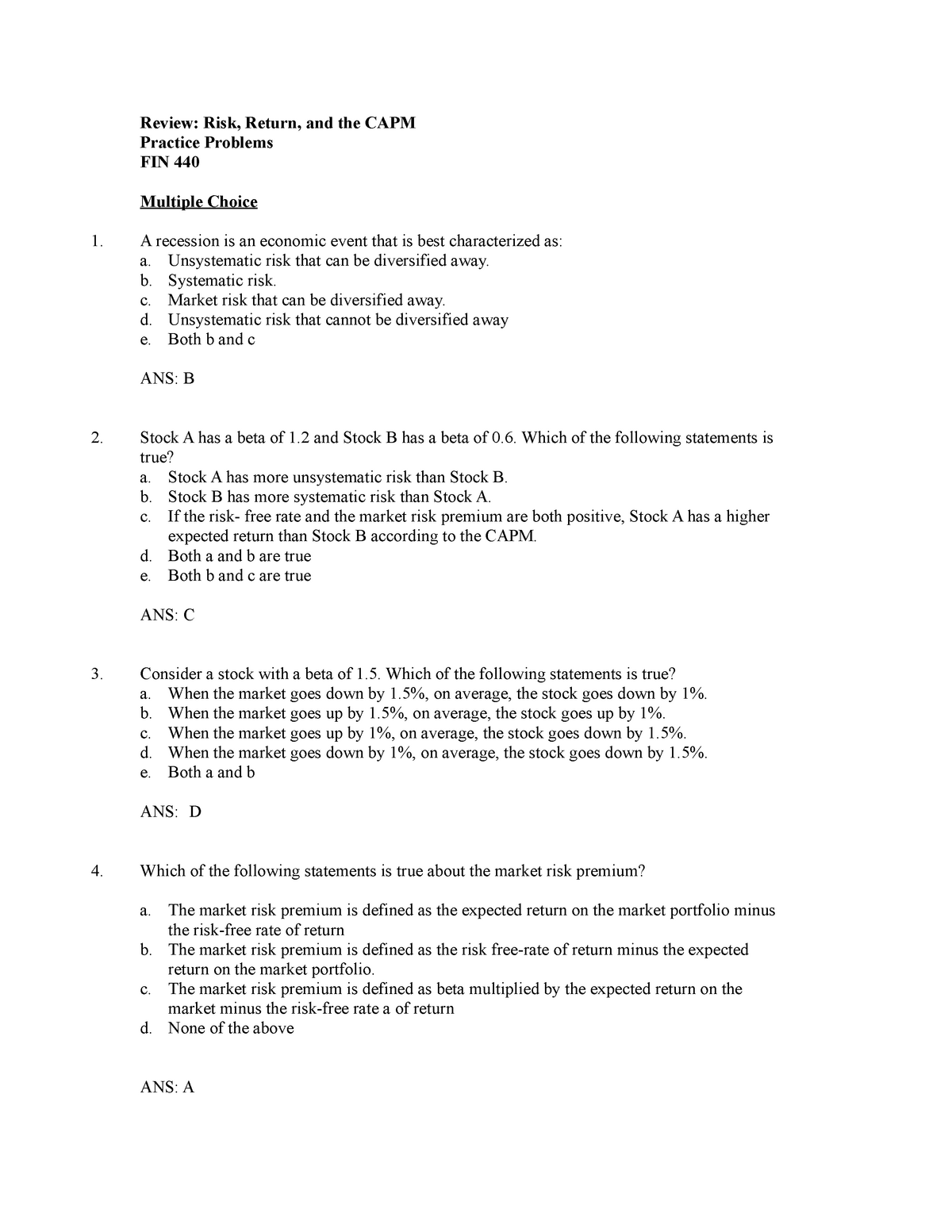

Chapter 11 Expected Returns Variance and Standard Deviation

Compute the expected portfolio return using the same formula as for an individual asset • Compute the portfolio variance and standard deviation using the same |

|

What is the Expected Return on a Stock? - personallseacuk

We derive a formula for a stock's expected return in excess of the market: Et Ri,t+ 1 − Rm,t+1 Rf,t+1 = 1 2 ( SVIX2 i,t − SVIX 2 t ) SVIX indices are similar to |

|

3 Basics of Portfolio Theory

Develop the basic formulas for two-, three-, and n-security portfolios 3 1 investment is uncertain, one should look at the expected return of a portfolio The |

|

EXPECTED RETURN, REALIZED RETURN AND - NYU Stern

Since one does not expect correlation between the riskless rate and the surprises this is equivalent to the procedure just described 15 The definition of the term |

|

Calculating expected return on investment using Capital Asset

An alternative to overcome this issue is to compute the duration of the cash flows, and use the corresponding rate for calculation Fundamentally, for an investment |

|

CHAPTER 7

Expected stock returns using the probabilistic approach Expected stock returns Create a formula for the expected return for Petrochemical The formula is: |

/expectedreturncorrected-e0e026cf96334027b60d468d7fc59866.jpg)